Has Scientific Digital Imaging Reached an Inflection Point?

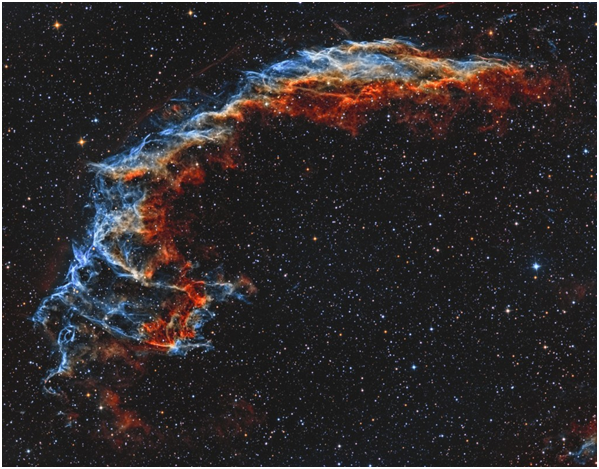

They say a picture is worth a thousand words. But this one must be worth at least a million.

This glorious image was created by technology owned by an interesting AIM listed company, Scientific Digital Imaging (SDI), which after several years of plodding along now looks like it might be about to take off.

The Business

As a group, Scientific Digital Imaging provides a range of products which use digital imaging technology for use across a number of sectors, including life sciences, healthcare, astronomy, consumer manufacturing and art conservation. The business has a history going back to 1984, having been spun out of the engineering and metallurgy departments of the University of Cambridge.

Core business Synoptics designs and manufactures instruments and systems mainly used in the life sciences, using digital imaging technologies for a range of disciplines. It operates under four main brands: Syngene, by far the largest of the brands, produces hardware and software for life scientists to image and analyse gels for DNA and protein analysis; Synbiosis produces equipment for microbiologists to automate microbial colony counting; Syncroscopy provides systems that apply digital imaging techniques to microscopes; and Synoptics Health focuses on imaging techniques within the hospital and clinical environments using the ProReveal system, which detect proteins on surgical instruments.

Elsewhere, Norwich based Artemis CCD designs and manufactures high sensitivity cameras under the Atik brand for astronomical and life science imaging, with its main market being amateur astronomy. This brand is responsible for the image at the top of the page.

Growing deal by deal

SDI has made two acquisitions during its time as a public company. The first of these was in February 2014 with the company buying Opus Instruments for £1.325 million in a mix of cash and shares. Opus manufactures the Osiris camera, a portable high resolution camera used for infrared reflectography – a technique used to look through layers of paint. The cameras have mainly been used in galleries and museums to examine works of art, helping to guide restoration work and advance art history. Opus made revenues of £293,000 and net profits of £94,000 in the year to April 2013 and sales since acquisition are said to have remained steady.

The most significant deal came last October when SDI bought Sentek Limited for £2 million in cash. Sentek operates a business different from SDI’s existing operations, focusing on the production of pH, conductivity sensors and other electrochemical sensors for water based applications. However, the deal does seem to be complementary, as Sentek sells consumables rather than equipment and software. The consumables typically have a working life of six to 12 months so need to be consistently replaced, giving a stream of repeat business.

In the year to October 2014 Sentek made revenues of £2.6 million and pre-tax profits of £0.5 million. Revenues have grown at a compound annual rate (CAGR) of 9% over the past five years, with pre-tax profits up by a CAGR of 33%. The deal is forecast to be earnings enhancing in the first full year of ownership (financial year to April 2017), with cross selling and manufacturing synergies also expected.

The deal was paid for with £0.6 million in cash, with the remaining £1.4 million financed by a new bridge loan. However, along with the acquisition came a £2.5 million placing at 8p per share which saw a number of new institutional investors come on board, as well as CEO Mike Creedon putting in £5,000. These funds have since been used to fully repay the bridge loan, for transaction costs, with the remainder being put to use as working capital for the enlarged business.

Recent trading

At first glance the historic accounts show a relatively uninspiring set of numbers. Over the past five years annual revenues have floated between around £7 million and £7.7 million, with a negligible pre-tax profit or loss being posted each year.

But interims for the six months to October showed good traction, with revenues up by 15% at £3.67 million. SDI commands high margins, with the gross margin standing at 58% for the period and an operating loss of £207,000 in the comparative period being turned into a £29,000 profit. Operating cashflow was notably good, being steady at £394,000 due to the adding back of depreciation and good working capital management.

SDI also commented that it is actively seeking further profitable scientific and technology based acquisitions.

Assessment

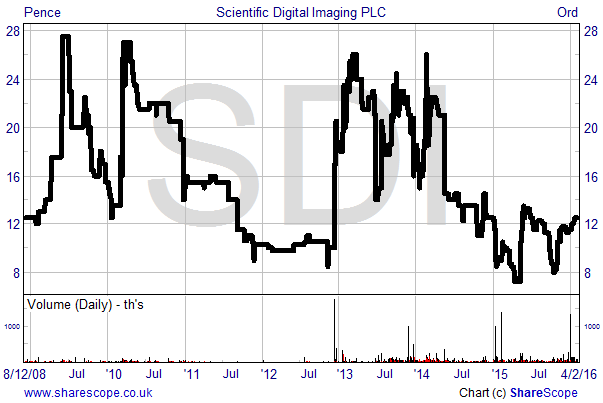

Shares in Scientific Digital Imaging currently trade at 12.25p, just below the 12.5p level they opened at on their first day of AIM dealings in December 2008. At that price the firm is capitalised at just over £8 million. And at 12p to sell and 13p to buy the spread is not as bad as it could be for such a small company.

Broker FinnCap has a 29p target price for the shares (with the caveat that it is the house broker), which implies 132% upside. The broker’s forecasts for the current year to April 2016 are for 1.7p of earnings, rising to 2.4p in 2017 as Sentek makes its first full year contribution. This puts the shares on very undemanding earnings multiples of 7.4 and 5.2 times respectively. However, there is no dividend forecast in the near future.

I note that City veteran Patrick Evershed recently increased his personal holding in the company to 3.1%, with discretionary clients of his fund management business Hargreave Hale raising their stake to above 5%. Other fund managers which have recently taken a stake – via the October placing – include Octopus (12%) and Gervais Williams’ Miton Asset Management (7.8%).

Overall, with Scientific Digital Imaging now clearly on the growth track and increasing in scale, the shares look like a good speculative play. If current market forecasts are met I believe there could be substantial returns on offer in the medium-term.

Comments (0)