Games Workshop – Dungeons, Dragons and Dividends

While doing research for my article in this month’s Master Investor Magazine (Small Caps in the Song of Buffett) there were some companies I had to reject, as they didn’t meet all of the investment guru’s buying criteria. To re-cap, Buffet likes companies with a wide “economic moat” – a situation which helps them to deliver a consistent high return on capital/equity, strong cashflow and create shareholder value over the long term.

One company, Games Workshop (GAW), certainly meets the first two criteria but has a somewhat erratic trading record. For this reason I did not include the company as one that Buffett might want to invest in. Nevertheless, the business retains an interesting investment case.

The Business

Games Workshop was founded in the 1970s by a trio of fantasy gaming fanatics who originally sold wooden board games from their house in West London. It got its first big break when it obtained the UK distribution rights to US role playing game Dungeons and Dragons and then opened its first shop to capitalise on the growing popularity of the genre. In the late 1980s the business then founded Citadel Miniatures, which produced the metal miniatures used in its games.

As of today Games Workshop still operates in the same wider industry but has a very niche focus on designing, manufacturing and selling fantasy miniatures for use in its range of role playing tabletop wargames. The business attracts a hardcore of hobbyists (mainly teenage boys and male adults) who can be collectors and/or gameplayers, dedicated to buying, painting and building up fantasy armies.

The company’s major brands are the fantasy game Warhammer: Age of Sigmar, futuristic version Warhammer 40,000 and licenced games based on the Lord of the Rings and Hobbit fantasy worlds. Supporting the core games and miniatures are a range of in game scenery, painting accessories and guides, rulebooks, novels and promotional magazine White Dwarf. Games Workshop also has a visitor and events centre, Warhammer World, at its headquarters in Nottingham.

Income is generated via four different channels.

Retail – at the end of November last year Games Workshop had 430 physical stores around the world, with key territories being the UK, North America and Europe. These are actually loss making (£1 million in the last financial year) but as well as selling products are important for attracting new customers to the hobby, providing demonstrations and keeping current collectors hooked.

Trade – sells to independent retailers around the world and includes the magazine newsstand business and distributor sales from publishing business Black Library.

Mail order – sales through the firm’s own websites and external affiliates.

Royalties – income is also earned from selling licences to third parties for use of the firm’s brand and trademarks, mainly for use in computer, mobile and non-digital games.

Erratic trading but cashflow and balance sheet in good ‘elf

Between 2002 and 2004 Games Workshop enjoyed a bumper trading period as it benefited from increased sales of its Lord of the Rings products, which was driven by the popularity of the film trilogy and associated TV advertising. This was, by the company’s own admission, somewhat of a “bubble”.

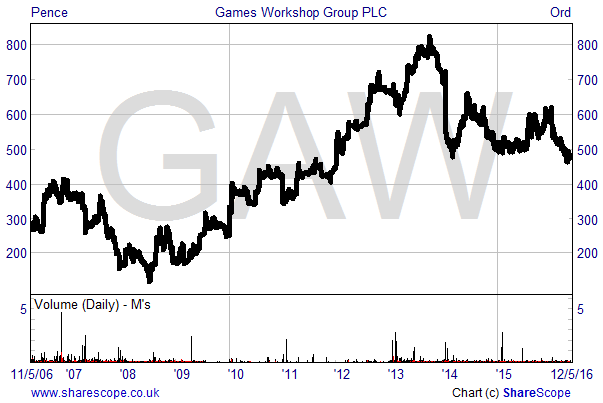

As the chart below shows, trading in the past decade has been inconsistent, with 2007 showing losses on the back of a restructuring and slowing sales, before an improvement in the next two years. Since 2010 revenues and profits have been up and down from year to year but net operating cashflow has been more consistent, averaging £23.8 million over the past six years.

More recent trading has been disappointing, with the interims to 29th November 2015 reporting revenues down by 2% at £55.3 million after adverse currency movements hit the numbers. Nevertheless, revenues did grow by 0.7% on a constant currency basis and, boosted by a more than doubling of royalty income, pre-tax profits for the period were flat at £6.3 million. Cashflow remained strong, with the net inflow from operations up by 18% at £7.7 million. This helped to finance a 20p dividend for the half year, with net cash at the period end standing at £7.78 million.

However, the markets were more focussed on the outlook statement which confirmed that sales in the key December period were below expectations across the whole business. As a result pre-tax profits for the full year to May are not expected to exceed £16 million, down from £16.6 million in the previous year.

Shares worth Goblin’ up?

Games Workshop shareholders have had a miserable 2016, with the shares having fallen by 23% in the year to date, from 621p to the current 478p, although 20p of this can be attributed to the dividend payment. Such levels have not been seen for over four years, with the company now capitalised at £153.5 million.

The forecast price earnings multiple for the current year to end May is around 12.7 times, falling to 11.3 times for 2017. These ratings are low by historic standards and do not look too demanding given the firm’s strong brands, loyal customer base and the consistently strong cashflow performance.

But the real attraction here is the dividend payment.

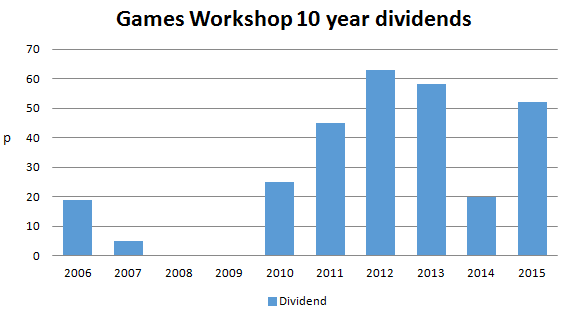

Games Workshop has a rather unique policy towards the distribution of cash to shareholders, with the dividend payment not being based on earnings but on cash deemed to be “truly surplus” to the business. As such, payments have been consistently erratic – if such a term exists (see chart below). Assuming that this year’s total distribution of 40p per share is maintained, and it looks like it could be assuming trading does not take a turn for the worse, the yield on offer is a chunky 8.36%.

While a maintained payment for 2017 would only just be covered by forecast earnings, this is not a huge concern given the strong balance sheet and that net cashflow from operations has consistently been higher than statutory earnings. Discounting a 40p payment into perpetuity by a reasonable 5% discount rate would thus suggest a fair value target for Games Workshop of 800p per share, implying 67% upside from current levels.

The shares will not be for everybody however. Games Workshop operates in a very niche sector and has what can be described as a stubborn strategy and attitude towards running the business. The latest annual report clearly states the strategy – “to make the best fantasy miniatures in the world and sell them globally at a profit and it intends doing so forever.” Acquisitions are not on the cards and management have historically been reluctant to try out new ideas which diversify away from the core fantasy games business. But with excellent income on offer and recovery potential in the core business Games Workshop looks like a relatively low risk portfolio addition.

Comments (0)