Fast growing small caps to beat the autumn blues – MAGAZINE EXCLUSIVEMAGAZINE EXCLUSIVE

MAGAZINE ARTICLE

This article first appeared in Issue 44 of Master Investor Magazine.

Click here to download the article as a printer-friendly PDF

Get this article and many more – for free! |

While most equity investors have felt some pain over the past month, it’s not been a good October for small cap fans in particular. Demonstrating this, after reaching a near 11 year high in September, the FTSE AIM All Share index has since shed around 12% of its value, putting it in negative territory for the year. Small cap investors have also had to put up with several instances of corporate jiggery-pokery, including the high profile financial collapse of cake business Patisserie Holdings (LON:CAKE) and questionable accounting at gas and electricity supplier Yu Group (LON:YU.).

Nevertheless, a clutch of small caps are still delivering strong growth in earnings amidst the market malaise. Here are three such companies which have recently posted strong numbers and, in my opinion, look worth considering for inclusion in a growth portfolio.

PELATRO

One company which has been ticking along nicely over the past year or so, but seems to be off the radar of investors, is marketing software specialist Pelatro (LON:PTRO). The business was founded in 2013 with the objective of offering specialised software to telecoms companies (telcos) to help them develop “precision” marketing campaigns. Pelatro does this through its flagship platform mViva, which uses big data analytics and artificial intelligence to process and analyse data from phone subscribers and reveal patterns, trends and key behavioural traits.

Telcos use this data to develop marketing campaigns focussed on each individual subscriber (hence the term “precision”), helping them to offer products and deals that are more relevant and personalised to them. This is important in improving customer retention rates and increasing average revenues per user in a market which is maturing and seeing high levels of customer “churn”. Pelatro claims that its clients have experienced an increase of up to 5% of annual incremental revenue per end user through the upselling of products using its services – that’s a big number when applied to millions of subscribers.

After listing on AIM in December 2017, raising £3.8 million for the company at 62.5p per share, in July this year Pelatro completed a major transaction, acquiring the business and certain assets of Danateq for an initial payment of $7 million. Like Pelatro, Danateq uses data analytics to provide campaign management solutions to telcos but also offers additional complementary products. Following the acquisition, the business now offers a suite of products branded as the mViva Multichannel Marketing Hub consisting of the mViva Contextual Marketing Solution, mViva Loyalty Management Solution, mViva Intelligent Notification Manager and mViva Emergency Credit Solution.

As well as providing new products to sell to its existing customers, the Danateq acquisition doubled the number of subscribers on the company’s platforms from 160 million to 325 million and the number of customers from 8 to 12. In line with its international focussed growth strategy, the deal gave Pelatro immediate entry into Central Europe and is expected to help accelerate entry into Western Europe over the next 18-24 months, to add to its existing presence in Latin America, Africa and Asia. To finance the initial consideration, £6 million was raised in a placing at 73p per share, with up to $5 million also due if profit targets are hit. The acquisition is expected to be immediately earnings enhancing.

Traction with telcos

While still small in size, Pelatro has grown quickly from a standing start. From 2015 to 2017 revenues grew almost tenfold to $3.15 million, with pre-tax profits soaring from just $30,000 to $1.1 million. As you can see from those figures, this is a highly profitable operation, with gross margins being around 75%. The record performance in 2017 was driven by four new customer wins for mViva during the year, with current customers now including the likes of Robi Axiata, Smart Dialog, Bahamas Telecom and Inwi.

Things have got more exciting following the year end, with April seeing the company win its largest ever contract. The deal, worth $1.7 million, is with a Central Asian subsidiary of an un-named Western European telco, which has more than 6 million customers. Pelatro will implement mViva for the client and will also guide the telco in setting up a customer value management department, with the majority of fees expected to be recognised this year. This is a crucial win for the company as it has found that once it makes an initial sale into a new telco group, it finds it easier to sell mViva products to other group subsidiaries.

Results for the six months to June 2018 showed a continuation of the growth trends, with revenues up by 53% at $2.38 million and pre-tax profits up by 24% at $1.2 million. More recently, in October the company announced that it has been selected by industry giant Telenor to supply its Loyalty Management Solution to the operations of Telenor globally. Danateq had already been supplying its Contextual Marketing Platform to three Telenor companies and this agreement has been expanded to include the loyalty product. Pelatro is now presenting to several of Telenor’s operating companies a view to implementing and supporting this offering.

Dial in the profits

Trading in Pelatro shares has been somewhat subdued since IPO, with them hitting a high of 89.5p in early January before falling to the current 69p. At that price the company is capitalised at £22.4 million. House broker FinnCap is currently looking for 15.4 cents of earnings in 2019, which at current exchange rates equates to c.12p per share. That puts the shares on a forward earnings multiple of just 5.75 times.

While Pelatro is a small business, it is growing fast and, in my opinion, the current valuation looks too low. With net cash of $1.6 million as at 30th June this year, the balance sheet looks reasonably strong, although trade receivables are a concern, with the $2.68 million at the period end representing more than six months worth of historic revenues. It’s also worth noting that the company capitalises large amounts of its development expenditure, a perfectly acceptable method of accounting but one which is not as conservative as it could be. Nevertheless, FinnCap has a target price of 115p, which implies 67% upside from the current price.

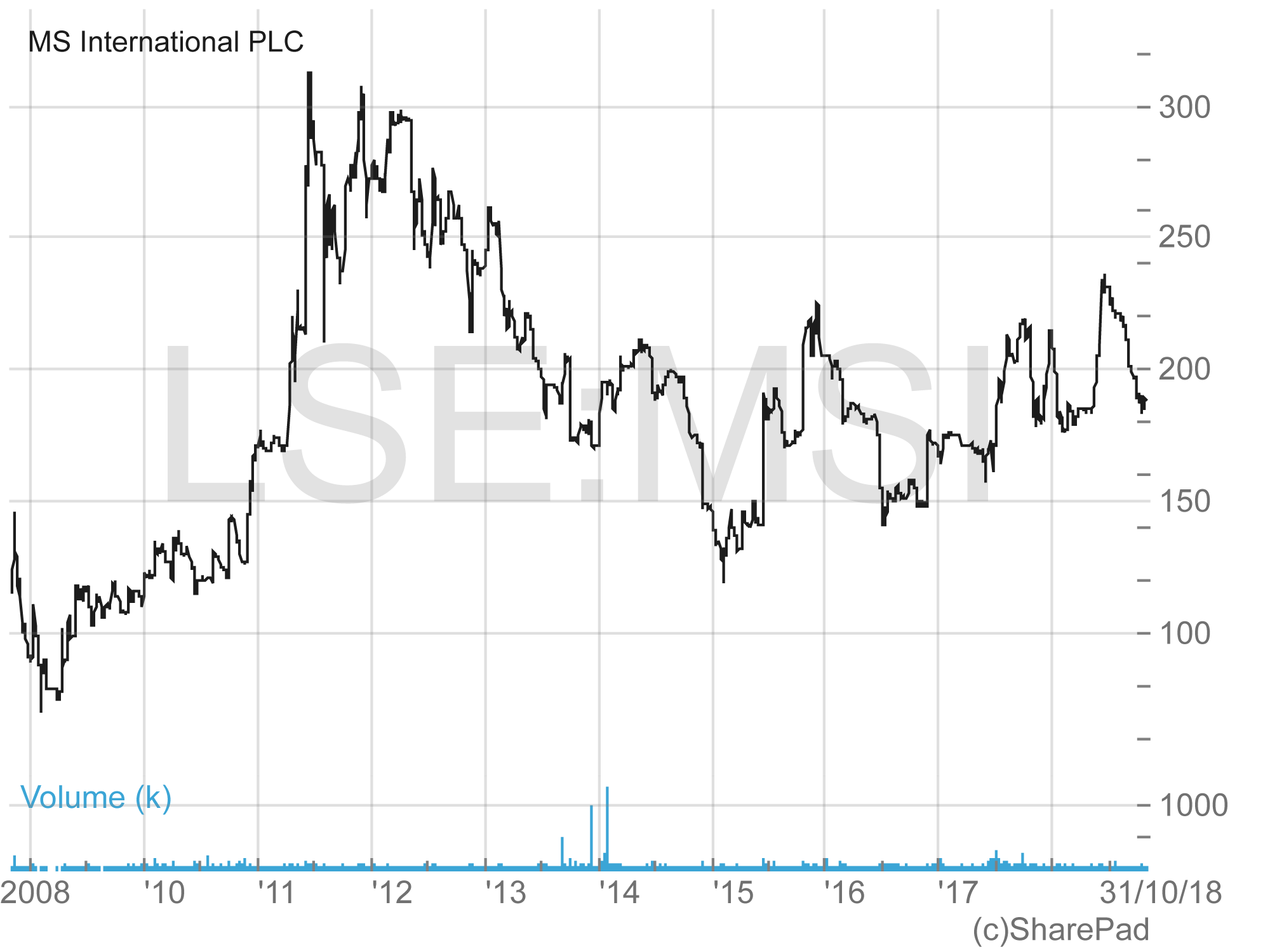

MS INTERNATIONAL

At first glance MS International (LON:MSI) looks to be a bit of a dull business. The company is very slow on the newsflow front (typically only releasing interim and full year results), does little on the PR front, has a quiet bulletin board and a corporate website that looks like it was designed in 1998. But take a look at the numbers and things get a bit more exciting.

Dealing in Donny

With a head office in Doncaster and operations in Brazil, Germany, Poland, The Netherlands and US, MS International is a unique business, operating across the four divisions of Defence, Forgings, Petrol Station Superstructures and Petrol Station Branding. The company was previously listed on the Main Market of the LSE but moved to AIM in 2013 following a review of its needs. Executive Chairman Michael Bell is the majority shareholder, with a 29.3% stake, and has been with the company since 1972.

Defence is the largest division by revenues, making up around a third of sales last year. Based in Norwich, MSI-Defence Systems specialises in gunnery weapon systems through to navigational plotting tables, tactical shelters and underwater systems, being a major supplier of equipment to the UK Royal Navy and over 40 other navies worldwide. The Forgings division is unsurprisingly engaged in the manufacture of forgings, with Doncaster based subsidiary MSI Quality Forgings forging steels ranging from carbon, low alloy, stainless, duplex, super duplex and super alloys. Other subsidiaries specialise in the manufacture of fork-arms for the fork lift truck, construction, agricultural and quarrying equipment industries.

Elsewhere, the Petrol Station Superstructures division is engaged in the design, manufacture, construction, branding, maintenance and restyling of petrol station superstructures. These include structures such as convenience stores, canopies, retail, food & refreshment outlets and car wash buildings, with the company’s operational centres being in the UK, Poland and Netherlands. Finally, the Petrol Station Branding division is engaged in the design and installation of the complete appearance of petrol stations. Services include the conception, production, supply, installation and fitting of all established advertising and operating products for the gas station sector, with customers including the likes of Avia, BP, ESSO, Shell and Texaco.

Defence up, petrol down

In June MSI released some cracking numbers for the financial year to 28th April 2018, with total group revenues for the period up by 26% to £68.1 million. With margins relatively flat and costs controlled well, the operational gearing kicked in and sent pre-tax profits up by 165% to £4.04 million. Earnings more than doubled to 20.5p, growing slightly less than pre-tax profits due to a higher effective tax charge. Net cash at the period end was a chunky £15.87 million and while there was no debt there was a modest pension liability of £6.42 million.

Across the divisions, Defence had a good year, with profits up by 43% at £2.6 million after a good year for export sales and new product offerings. Forgings was the only division in the red but it cut losses by 26% to £0.54 million following the first phase of full production from a new facility in the US. Trading was tough in Petrol Station Superstructures, with the division just about breaking even after posting a £0.96 million profit in the previous year. This was a result of major customers accelerating the divestment of their company owned stations. However, Petrol Station Branding posted a profit of £2.17 million, from a loss of £0.29 million, following strong demand for station rebranding.

Value and Income

Shares in MSI spiked in value to a c. five-year high of 236.25p following the release of the full year results in June, but since then have dwindled to 188.5p. That capitalises the company at just £31.6 million, with the enterprise value being just £15.9 million if we strip out the net cash on the balance sheet as at 28th April. The shares, therefore, trade on a historic price to earnings multiple of just 9.3 times, falling to 4.7 times on an ex-cash basis.

If last year’s dividend of 8.25p per share is maintained then the shares also offer an attractive yield of 4.4%. That looks likely given the current net cash position, dividend cover of almost 2.5 times and historic free cash flow yield of 5.9%.

Unsurprisingly, there are no forecasts in the market for MSI, so investors will have to wait until around late November/early December for the interim results to see how trading is progressing. The only clue we have so far is from the full year results when the company commented, “…we are continuing to move the business forward on an upward trajectory and are well positioned to support and develop opportunities…” Despite the lack of detail here, I believe that the current valuation provides a significant margin of safety for investors.

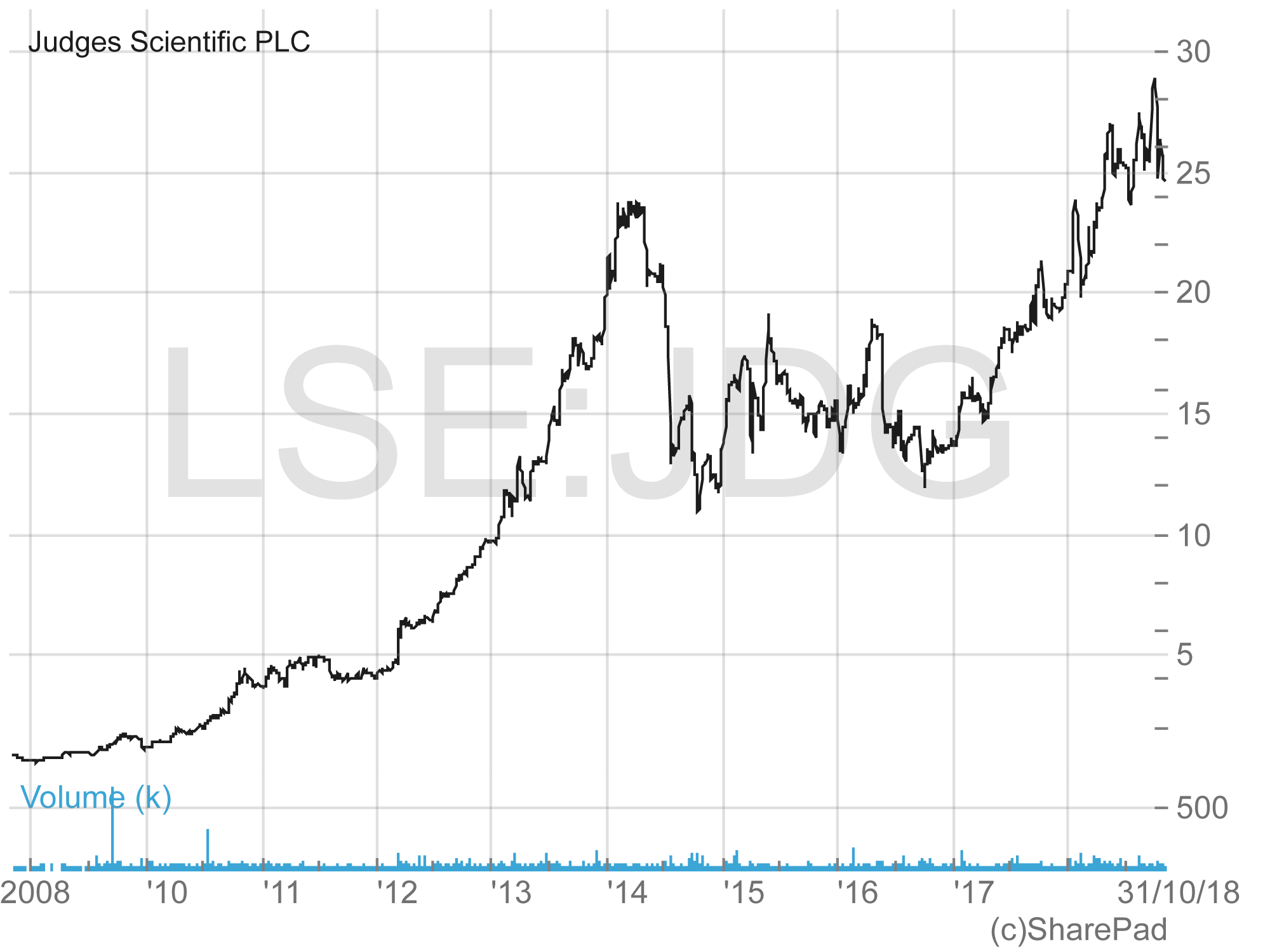

JUDGES SCIENTIFIC

One company that has delivered strong returns for investors over the past ten years or so is scientific instrument business investor Judges Scientific (LON:JDG). From the 2009 nadir of 59.5p, the shares have since surged by over 4,000%, with decent dividends also having been paid along the way.

Judges’ current business model is focussed on a “buy and build” strategy, looking at acquiring growing companies in the area of scientific instruments. A turning point in the company’s history was in April 2005, when the business was re-admitted to AIM following the acquisition of fire testing equipment business Fire Testing Technology. This was the beginning of a strategy focussed on taking advantage of positive long-term trends in a sector which is being driven by worldwide investment in higher education and a optimisation across science and industry.

As of today the company consists of 16 businesses, primarily UK-based, with products sold worldwide to a range of niche markets including higher education, scientific communities, manufacturers and regulatory authorities. The strategy is focussed on selectively acquiring businesses that generate sustainable profits and cash, with support and advice being provided to their management teams.

Some of the key companies in the Judges’ portfolio include: Armfield, which designs and manufactures equipment for engineering education & research and for the food, beverage, dairy, edible oil and pharmaceutical industries; Scientifica – which develops equipment for use in the neuronal electrophysiology, two-photon imaging and optogenetics markets; and GDS Instruments – a developer and manufacturer of equipment and software used for the computer controlled testing of soils and rocks.

Orders, orders

Judges has an excellent track record, having grown adjusted earnings from 28p in 2009 to 131.9p in 2018, with dividends rising from 3.7p per share to 32p over the same period. While things haven’t always gone in a straight line, with some down years (see chart), the current year to date has been a record one for the company, with revenues in the six months to June 2018 rising by 13% to £37 million. Of that, 5.7% came from organic growth – that is from businesses owned at the same time in the previous year. Organic order intake was up by 2.3% compared with H1 2017, with the order book amounting to 15 weeks’ worth of sales.

One thing to note about the P&L account is that a large percentage of sales are made overseas, with over 85% of goods being exported. Therefore, movements in exchange rates have a significant influence on the numbers. A quarter of revenues are made in euros, with around two-thirds coming in the form of US dollars. The first half of this year saw adjusted pre-tax profits rise by 50% to £6.6 million, with the figures being boosted by a weak pound. The outlook for the full year was strong, with adjusted profits and earnings expected to be ahead of previous expectations.

Courting investors

Given the company’s excellent track record, shares in Judges Scientific currently trade on a relatively high historic earnings multiple of 18.7 times. But that doesn’t look too expensive to me given the current growth profile, as demonstrated in the interims. The historic dividend yield is just 1.3% but will probably be higher this year given that the interim payment was hiked by 20% and was covered seven times by adjusted earnings.

Potential investors should be aware that sales can be affected by short-term customer spending variability, as experienced in 2016, along with the exchange rate exposure mentioned above. The balance sheet has a £2.1 million pension liability but is reasonably strong overall, with adjusted net debt of £2.2 million as at 30th June 2018. Cash balances were £14.4 million at the period end with the company having a £35 million finance facility in place to further fund its expansion.

In my view, the 14% fall in the shares since the start of October could provide a good entry point for growth hunters.

|

Comments (0)