Are These the Cheapest Stocks in London (Part 3)?

Having done a scan of all the stocks in London for this three part feature one stood out as being the cheapest, by far, in valuation terms. Chinese seafood seller Aquatic Foods Group (AFG) is trading on a PE of 0.7 times, yields 15% and has net cash of c.£40 million against a market cap of £10 million. A bonkers valuation if ever there was one.

The problem is that, with the company being based in China, the markets simply do not believe the numbers. This is given the raft of China based scandals and company suspensions which have hit AIM in recent years. The shares may be the bargain of the century but with the ”intrinsic” value potentially being zero (and the spread being a huge 89%) I turn to another stock for the final part of my analysis.

Listing on AIM in October 2014 entu (UK) is a provider of energy efficiency products and services to UK homes. The firm owns a portfolio of ten companies which provide offerings including home improvement products – mainly doors and windows, the sale of energy generation and energy saving products, the sale of insulation products, and repairs and renewals service agreement programmes. These are supported by installation services business Job Worth Doing, which provides the nationwide installation of Entu products. The firm also earns commissions on finance packages offered to customers via third-party providers.

Entu Group structure: Source: Company website

It has not been plain sailing for the company during its relatively short time on the markets.

Entu shares plunged after a profits warning in September last year caused by problems in the company’s Solar division, which provided and installed solar panels to homes. An expected upturn in trading did not materialise and the business made a loss of over £2 million for the year to October 2015 against a budgeted contribution of £1.6 million. Along with a planned reduction in feed-in tariffs by the government the decision was made to close the business. Then just before the year-end Entu completed the disposal of its loss making kitchen retail operation, Norwood Interiors, for a nominal £1.

At IPO analysts were looking for pre-tax profits of £11 million for the year to October 2015, but the figures fell well short, with just £7.5 million of profits eventually being delivered from the continuing operations.

Despite being well behind initial expectations the results themselves were solid enough, with revenues up by 7.3% at £99 million on a continuing basis and operating profits being in line with revised guidance at £8 million.

Shares worth getting Entu?

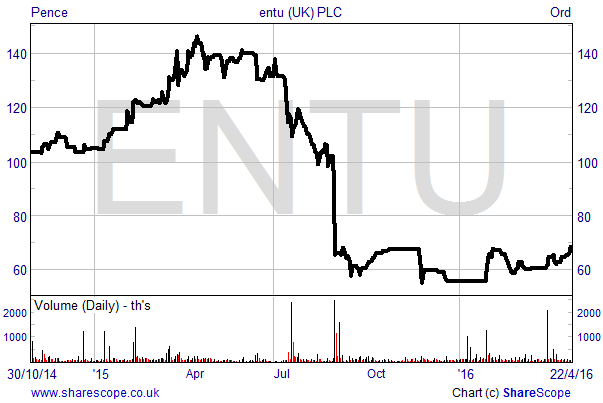

Entu shares currently trade at 68.5p, well off all time highs of 146p seen in April last year and down from the IPO price of 100p. That capitalises the company at £44.9 million. The shares have made progress in 2016, however, rising by 22% from lows of 56p seen at the start of the year.

With a historic dividend of 5.65p per share the current yield is a huge 8.24%. Such a large yield often suggests a so called “yield trap” may be present. But with dividend coverage of 1.9 times being not far off the generally considered comfortable level of 2 times the payment looks to be pretty sustainable, assuming that trading doesn’t see a substantial downturn. Adding weight to this, the balance sheet was strong as at 31st October, with £1.3 million of net cash and no debt. In addition, management said in the results that they aim to maintain the current level of dividends.

While the expectation for the current year is for results to be marginally below 2015 we are still looking at earnings of c.10p per share. That means the dividend cover becomes a little more stretched but still relatively comfortable at 1.77 times, with the PE multiple for the current year being low at 6.9 times.

For income and a potential re-rating as trading stabilises Entu shares look good value.

Comments (0)