Cheap FTSE Stocks For 2023

With global markets declining and most defensive stocks overvalued, it’s hard to find cheap stocks inside the Consumer Staples, Utilities and Health Care industries. At offering the peace of mind investors are looking for during troubled times, these stocks have been in high demand. In my view, 2023 will be another tough year. The Federal Reserve plans to raise interest rates above 5% and both the European Central Bank and the Bank of England have a long way to go. A global recession seems imminent, and the current market downtrend will unlikely revert during the first months of 2023. Yet, there is always value in a market that has been battered down over the year. We just have to look for it.

What I propose our readers is to dig inside market indices to find the cheapest stocks. Those that, even if the broad market declines further, are better positioned for a recovery and for which investors are not overpaying. We can’t guess the market’s bottom, but many stocks are already trading at tempting prices. Despite this year’s downtrend, the S&P 500 is up 43% for the last five years. This contrasts with the FTSE 350, which is down 4% in the same period. The chart below shows that the FTSE 350 struggled to recover after the pandemic crash with the same strength as the S&P 500 did. But, UK stocks also escaped this year’s capitulation, ending the year flat while US stocks are down 20%. Overall, UK stocks are trading at more appealing prices than US stocks. With the help of a few financial ratios and a screener, we can find the best value for 2023.

Dealing with gearing and lack of momentum

I’m going to implement my strategy in the FTSE 350 universe. What I need is a few ratios that can capture value (measure cheapness) and some others that filter out potential financial trouble. I start my screener using Interest Cover to filter out potential financial trouble that often comes with downturns. I discard all companies with an Interest Cover below three. The lower the level, the higher the likelihood of a company having difficulties to honour their financial expenses.

Some businesses with stable revenues and profits may operate well with high gearing and then show a lower Interest Cover without it being a problem. Even so, I’m being cautious here. This filter eliminates 26 stocks from my list. Out of curiosity, at the top of the list lie many Consumer Discretionary stocks, mainly from the Travel and Leisure sector. The list includes easyJet, Whitbread, JD Wetherspoon and Playtech. The average net debt to Enterprise Value of these 26 stocks is 44%. I’m happy to discard them at this point in the business cycle, even if missing some upside potential.

To avoid being caught in a cold streak, I also filter out stocks that declined more than 15% relative to the FTSE 350 during the last month. While a value strategy requires time and patience for stock prices to turn around, it’s easier if we avoid the unloved ones to start with. Once again, the exclusion list is filled with Consumer Discretionary stocks, including Moonpig Group, Currys and easyJet at top spots. During periods of high inflation, consumers first cut on their discretionary expenses. With inflation still hovering around in 2023, these companies may continue to suffer.

Seeking for value

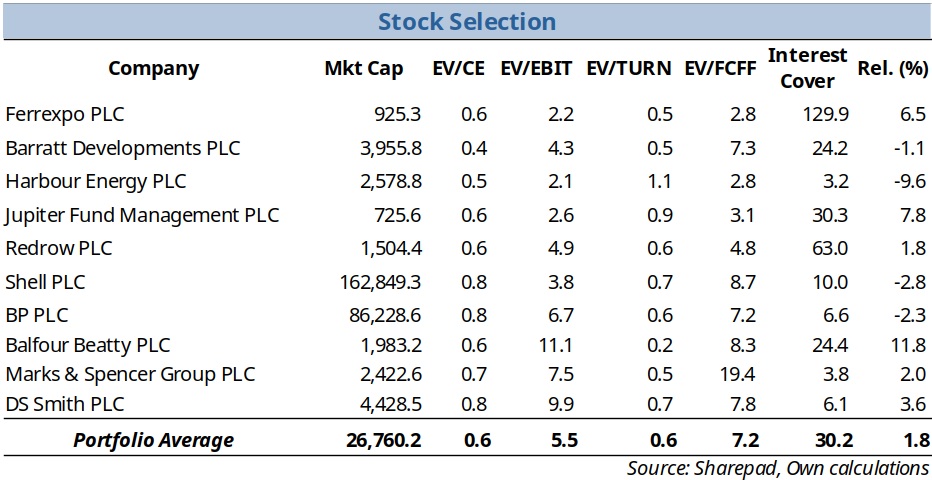

The above two filters help me discard stocks with a significant debt load and that lack momentum. Now is the time to seek for value. I use four ratios to capture it: Enterprise Value to Capital Employed (EV/CE), Enterprise Value to Free Cash Flow to the Firm (EV/FCFF), Enterprise Value to EBIT (EV/EBIT), and Enterprise Value to Turnover (EV/Turnover). My option for EV instead of share price is to avoid the distortions created by the company’s financing choice (between equity and debt). Highly geared companies look better than they should.

I use a range of ratios because each considers value from a different angle. Value comes from a company’s ability to generate profits, cash flows, sales and valuable assets. The less we pay for all of this, the better. Depending on overall economic conditions and the specific corporate circumstances, a company may rank well on one variable and poorly on another. Free cash flow, for example, may be negative due to expenses being larger than revenues, while the company ranks well on EV/Turnover and EV/EBIT. It could be because they’re investing in the business. Nothing wrong or bad about that. I prefer to give some leeway here instead of excluding a company based on a single number. At the same time, value is a relative concept. Instead of setting threshold values for the ratios, I use a ranking system based on ratings.

My system is simple. I rank companies for each ratio from highest (worst) to lowest (best), and award a rating of one to the first, two to the second, and so on until reaching the last. The last spot is awarded with the highest rating, corresponding to the best rank. I repeat the process for the other ratios and sum the ratings for each stock to extract an overall rating. The final step is ranking stocks by their overall rating, from highest to lowest. We can then easily pick as many spots as we wish.

Top 10 stock picks for 2023

My quantitative strategy selected the following stocks from the FTSE 350: Ferrexpo (LON:FXPO), Barratt Developments (LON:BDEV), Harbour Energy (LON:HBR), Jupiter Fund Management (LON:JUP), Redrow (LON:RDW), Shell (LON:SHEL), BP (LON:BP), Balfour Beatty (LON:BBY), Marks & Spencer Group (LON:MKS) and DS Smith (LON:SMDS). The final portfolio includes three companies from the Energy sector, three from Consumer Discretionary, two from Industrials, and one from Basic Materials and Financials. The final selection appears balanced, and the stocks selected have strong enough finances to deal with a potential recession while also looking cheap.

Out of curiosity, this system didn’t select any company from Consumer Staples, Utilities and Health Care, as these defensive sectors are currently expensive. From those sectors, the top spots in my list are Sainsbury (13th), Imperial Brands (25th) and Premier Foods (28th). While recession fears entice investors to purchase defensive stocks, these are so expensive that all they can offer is a high likelihood of underperformance. A better option is to discard stocks that may incur in financial trouble and then select those that appear cheap.

This is all for 2022.

I wish our readers a Happy New Year!

No, I think you’re great spot on I’m going to take note of what you said I’m going to go for

Bizarre. Investors chronicle screens, as reviewed Dec 2022 have been an absolute disaster this last year. In previous years they had done well. Screens are dead, fine if world doesn’t change. Choose and monitor yourself. Your brain has more ai than any screen or chatbot.

Screen has two selections from housebuilders. What a surprise. Clearly they have fallen 50per cent from peaks. But going forward I don’t see virtually zero per cent mortgages returning in my lifetime. They are cyclical, there will be highs and lows. No surprise there.

Big oil BP and she’ll. I prefer buying at lows of £15 for shell and selling at £25. The old adage, best cure for low oil price is a low oil price. Oil price is average at moment, big oil not spending capital to replace reserved. Big oil majors prices do not look cheap to me.

Ferrexpo, big iron works in Ukraine, with power problems, unfortunately. As much as I vote for Ukraine and its people, looks like one volatile situation to me.

Make your own selections, then you only have yourself to blame.