ASOS – Still in Fashion?

There are three ways to make money from investing in shares: capital gains, dividends and perks. The latter are never more than modest and are becoming increasingly rare these days. Dividends can provide a useful stream of income, but they are unlikely to make you rich. Capital gains, however, are the raison d’être for most equity investors given that, in a theoretical sense, they can be unlimited.

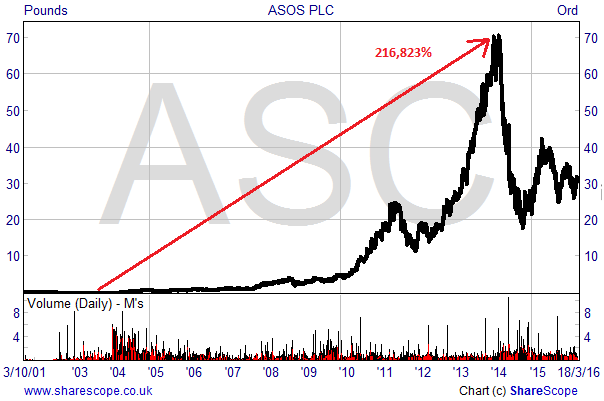

One company which has delivered capital gains beyond the dreams of many is the stock market darling ASOS (ASC). Investors who bought shares in the internet fashion retailer at the low of 3.25p in August 2003, and sold at the peak of £70.50 in February 2014, would have made a return of 216,823%! That’s a compound annual return of 108%. Or in other words, an investment of just £470 made at the bottom and sold at the top would have been turned into just over a million pounds.

But ASOS is no longer the glamour stock of years gone by. Hit by a series of profit warnings, slowing growth, negative currency movements, and a fire at its main warehouse, the shares have collapsed over the past two years. Now trading at less than half of their all-time high, are the shares worth buying back into?

The Rise and Rise of ASOS

ASOS was launched in 2000 under the name of asSeenonScreen, an online retailer of products which had been seen on film or TV and used or worn by celebrities. As it stands today the company has grown and developed into one of the world’s largest and most well known fashion brands, making over £1 billion in revenues for the first time in the last financial year. Its strategy is to become the “number 1 online fashion destination for 20-somethings.”And it’s not doing badly on achieving that goal.

Offering the latest clothing, apparel and accessories from nine local language websites, ASOS currently attracts 114 million visitors a month who can choose from over 80,000 branded and own-brand products. As at the end of 2015 the firm had 10.7 million customers who had shopped on one of its websites in the previous 12 months. At around 46% of total retail sales the UK is the firm’s largest market, with the EU and US being second and third respectively. Orders are delivered from fulfilment centres around the world including in the US, Europe and China and from the firm’s flagship warehouse in Barnsley, South Yorkshire.

The company’s success can be attributed to a number of factors…

Being in the right place at the right time in the early 2000s, when e-commerce was in its infancy, was certainly a good start. But a shrewd management team (led by founder Nick Robertson), have been completely committed to growth, both in the UK and abroad, forsaking dividends in exchange for further investment in the business. Expansion overseas has been particularly well executed, with a focus on local branding, combined with sharp marketing, opening up huge new markets.

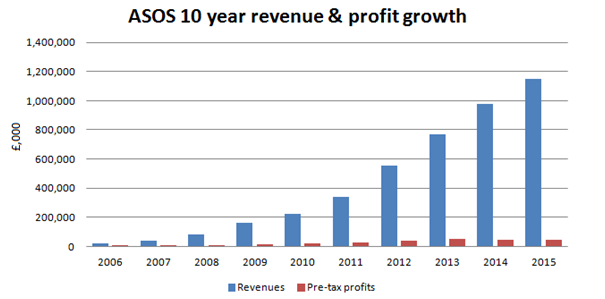

The overall result is that ASOS has increased revenues by a compound annual rate (CAGR) of 50% over the past 10 financial years, to reach £1.15 billion in 2015. Over the same period pre-tax profits rose by a CAGR of 42%. All of this has been achieved without the company opening a (permanent) physical store, although ASOS has briefly sold its products in “pop up” shops and in collaboration with other retailers.

The fall

While top line growth continued in 2014, the year could be described as ASOS’s “annus horribilis. In March that year the shares plunged following a shock profits warning, caused by slowing UK growth and increased investment in China squeezing margins. June saw a further warning, with negative currency movements and more promotional activity further reducing earnings guidance. If that wasn’t bad enough, a fire later in the month at the firm’s Barnsley warehouse caused further disruption and losses – although ASOS was fully insured for loss of stock and business interruption.

The overall effect of the above events was to reduce pre-tax profits by 14% to £46.9 million for the year to August 2014. The combination of bad news sent the shares down by 75% from peak to trough during the calendar year, ASOS being hit particularly hard given the very high valuation the market attributed to it.

On the up again?

After the challenges of 2014, the following year was a better one for ASOS. For 2015 revenues surpassed £1 billion for the first time (as long promised by the company) and profits began to grow again – albeit by only 1% as further investment was put into infrastructure and staff.

The focus on growth continues, and this financial year around £80 million is being spent on capex. This will mainly be IT infrastructure but also warehousing, including the EuroHub 2 in Berlin which is expected to be operationally live in early 2017. With net cash of £119 million as at 31st August and having consistently delivered strong operational cashflow, ASOS looks well financed to fund its expansion.

More recently, a Christmas trading update released in mid-January did little to reinvigorate investors, although it did contain some pretty decent numbers. Overall, group revenues grew by an impressive 27% in the four months to December, with a 25% rise in UK retail sales being complemented by a 20% uplift in international sales – although the latter was reduced from 28% by negative currency movements.

Are the shares back in fashion?

While shares in ASOS have pulled back sharply, the market is still rating the company highly. Consensus forecasts for earnings in the region of 54p for the current year to August put the shares on a multiple of 59 times. The multiple falls to 44 times for 2017 on the back of forecasts for 72p of earnings. For a growth stock like ASOS the price to earnings growth (PEG) multiple seems appropriate and for 2017 the figure is 1.3 times – above the level of 1 which is generally considered to be fair value.

But let’s take a longer-term approach…

ASOS is currently investing in its infrastructure and international warehousing in order to hit a “staging post” of £2.5 billion in sales in the medium term – with 2020 being hinted at as the target year. This implies revenue growth of around 17% per annum up until 2020, which looks achievable given historic growth rates and the capital investments being made.

An EBIT margin of around 6% is also in sight, suggesting pre-tax profits of £150 million for 2020. On a tax charge of 20% that equates to earnings of around 144p per share and an earnings multiple of 22 times.

In my opinion that valuation, which you will remember is five years out, does not factor in any bad news. What is clear is that investors are still pricing in a lot of growth which simply hasn’t happened yet. For that reason I would not buy into ASOS at the present time.

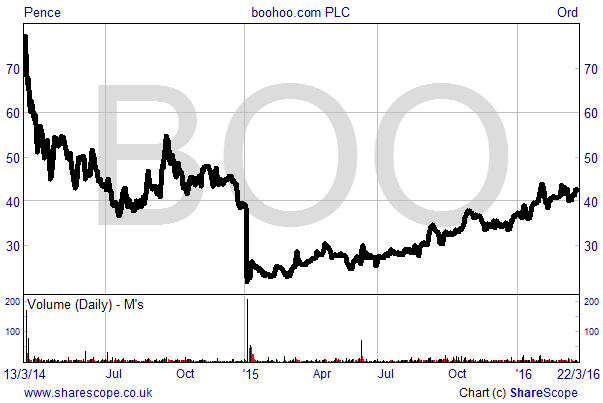

Investors who are dedicated followers of the online fashion sector might want to take a closer look at new kid on the block Boohoo.com (BOO). It trades on a much more reasonable current year earnings multiple of around 30 times and on a PEG of around 1, while also having around 12.5% of its market cap covered by cash.

Comments (0)