AIM to bounce back

Richard Gill, CFA, looks atthree AIM 100 companies which he believes look like they are ready to bounce back.

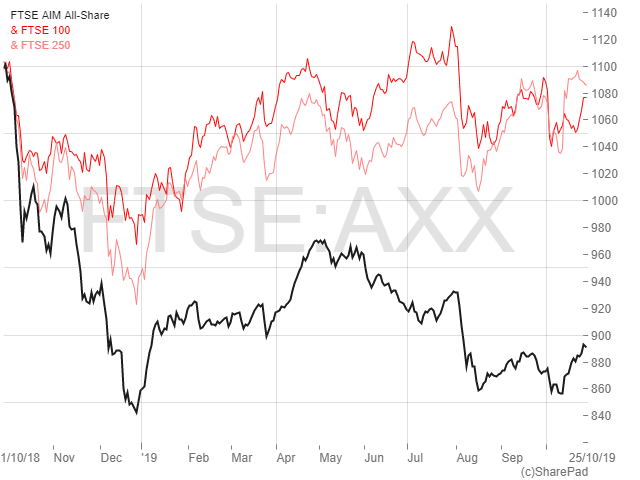

Just over one year on from the market crash in the final quarter of 2018, most share fans are unfortunately still licking their wounds. Investors across the whole spectrum of UK-listed stocks were hit by the ‘flash crash’, with the FTSE 100 losing 10.2% between 1 October and the end of the year. The FTSE 250 lost 14.2% and the AIM All Share dropped by 22.1%. While the larger caps have almost made back all of their losses as I write, small caps remain well and truly in the doldrums.

AIM performance vs FTSE 100 and FTSE 250 since 1 October 2018. Source: SharePad

Particularly notable about the small-cap share plummet is that the traditionally stalwart AIM 100 index constituents have led the fall. The index is down by 22.7% since last year, compared to the AIM All Share which is down by 19.1%, following some markedly bad performances from AIM’s billion-pound businesses.

Asos (LONASC), for example, has lost 38% of its value since the start of Q1 2018 as investors became concerned with growth rates and failed to maintain the online retailer’s high rating. Fellow highly rated stock Fevertree (LON:FEVR) has fallen by 43%, with investors again concerned about slowing growth at the tonic maker and the high price of the shares. Former market darlings Accesso Technology (LON:ACSO) and Blue Prism (LON:PRSM) are down by 79% and 63% respectively, with beleaguered litigation-finance firm Burford Capital (LON:BUR) losing 58% after a hatchet job from US short-seller Muddy Waters.

As in any bear market, some companies can be caught up in the malaise despite continuing to trade well and have good growth prospects. Here are three AIM 100 companies which I believe look like they are ready to bounce back.

REDDE

Companies which offer a dividend yield of around 5-6% or higher should always be scrutinised carefully, to avoid the infamous ’dividend trap’. This is a situation where an investment may look attractive due to the high income on offer but in the background there could a whole of host of problems such as poor operational performance, a declining industry or an unsustainable level of payouts.

An example of a classic dividend trap was HMV, back in 2011, when the yield on offer had risen to 11%. However, dragged down by debt and its failure to catch on to the digital-music trend, the company went bust in January 2013. Not all high yielding stocks are dividend traps however, with this next company having a deliberate policy to make large payouts.

On the road

Founded in 1992 as Helphire but rebranded in 2014, Redde (LON:REDD) is a market-leading provider of a range of accident management, incident management and legal services, which works with insurance companies, insurance brokers, motor dealerships and large, national, fleet owners. The company delivers accident-management services to motorists, helping them remain mobile until their vehicles are repaired, and also providing legal services ensuring motorists are compensated for their injuries and losses. Ancillary legal services provided also include wills and probate; family law; clinical negligence; and employer and public-liability law advice.

Under long-standing chief executive Martin Ward, the business has grown well since the rebrand, with revenues trebling to £590 million between 2014 and 2019, and earnings up from 7.47p to 13.44p per share. The last financial year was a good one for the company financially. It grew pre-tax profits adjusted for non-cash and exceptional items by 7.1% to £49.3 million. Operational highlights for the period included a 9.4% growth in credit-hire cases and a 5.2% increase in number of repair cases.

In the Redde

Redde shares weathered the October 2018 small-cap sell-off reasonably well but unfortunately there was some bad news in March this year. The company revealed that its hire-and-repair contract with a large insurer it had worked with for 10 years had not been renewed. As a result, consensus operating-profit forecasts for the year to June 2020 were expected to be hit to the tune of £4.7 million. The share price pretty much halved to a low of 90p on the back of this news, which seemed a massive overreaction, given that the shortfall amounted to around only 9% of profit forecasts for the year.

Redde is experiencing strong momentum elsewhere however, with a number of new contracts won in other areas of the business since March, as well as a contract renewal with a major insurer, all of which have contributed to confidence in the company meeting revised market expectations.

Paint the town Redde

Redde shares have recovered from their recent lows to currently trade at 114.8p, capitalising the company at £352 million. At the current price, if the annual dividend payout of 11.65p per share is maintained then the yield on offer is a stonking 10.1%.That’s the highest of any AIM 100 company. So the question here is, is the dividend likely to be maintained and is it sustainable?

Firstly, it is important to note that the high payout is deliberate, with Redde having a ’full distribution’ dividend policy. This means it gives away pretty much all of its annual profits to shareholders. The last set of results stated that Redde,“…intends to at least maintain the absolute dividend amount”. With current market-consensus forecasts for 2020 looking for 13.3p of earnings, that does look likely, absent any more nasty surprises.

The sustainability question should also consider the balance sheet, which looks sound in my opinion. Redde had net debt of £34.7 million as at 30 June 2019 (cash of £11.9 million), with this mainly made up of obligations under finance leases which the company takes out to rent vehicles. However, interest on these was just £1.2 million last year, well covered by EBITDA of almost £55 million. The company also had minimal capex expenses of £3.75 million last year. In addition, the company has a £50 million, five-year, committed, revolving capital facility with HSBC, along with a £5 million overdraft.

As well as the high dividend yield, Redde shares look cheap on an earnings basis, trading on a multiple of 8.6 times 2020 forecasts. One caveat to be wary of however is that the administrator of Woodford Investment Management, Link Fund Solutions, has a near 20% holding in Redde. While this is expected to be sold off, other institutions, including Société Générale, have recently been increasing their stake.

RENEW HOLDINGS

Hofstadter’s Law, which is concerned with estimating how long it will take to complete a large task, states: “It always takes longer than you expect, even when you take into account Hofstadter’s Law.” This is especially the case with large infrastructure projects, with many running over time and budget due to their huge complexity. Crossrail was supposed to be ready for the Olympics, wasn’t it? And Virgin Galactic seems to have been promising that its space-tourism flights are two-three years away, every year for the past 15 years. One company which helps to support large infrastructure projects, however, is performing a lot more reliably.

Renew Holdings (LON:RNWH) is an engineering-services group which supports a range of UK infrastructure assets through its various subsidiaries. The core engineering-services division, which accounts for over 90% of revenues, focuses on energy, environmental and infrastructure markets, providing services such as asset maintenance, civil engineering and installation.These markets provide a good degree of visibility as they are largely governed by regulationand benefit from non-discretionary spend, with long-term visibility of committed funding. Another of its divisions, specialist building, focuses on refurbishment projects in the high-quality, residential market in London and the Home Counties.

The group was significantly expanded last year following the £80 million acquisition of specialist, independent rail contractor QTS Group. Based in Scotland, and with eight operational bases across the UK, QTS has a long-standing relationship with Network Rail, operating under long-term framework contracts. In the year to March 2018 it made revenues of around £70 million and adjusted operating profits of £9.2 million, with the deal expected to be materially earnings enhancing.

Renewed profits

Like most firms in the industry, Renew had a tough time following the 2009 recession. But since bottoming out in July that year the shares have increased fourteen fold. Revenues have increased from £316.6 million in 2009 to £541.5 million in the last financial year, with operating profits up from £4.6 million to £31.1 million. The numbers have been driven by an increasing focus on the engineering-services businesses, along with a strategy to acquire complementary companies.

The most recent numbers, covering the six months to March 2019, reported a record set of figures, which in part were boosted by a first full H1 contribution from QTS. Revenues for the half year grew by an impressive 15% to £301 million, with adjusted operating profits advancing by 39% to £18.4 million. Notable was an improvement in the operating margin from 5% to 6.1%, crucial in an industry which traditionally has slim pickings. Operating highlights included a 4% increase in the overall group order book to £580 million and significant new framework contracts being secured in the energy and infrastructure industries.

At the beginning of October, Renew announced a positive trading update, confirming that results for the year to 30 September 2019 would be in line with market expectations, reflecting the full-year contribution from QTS. Engineering services expects to report good organic growth and a strong order book reflecting its focus on long-term framework contracts, with net debt expected to be between £10-£11 million at the period end.

On track for growth

Sentiment with regard to companies in the engineering and contracting services sector remains relatively low following the demise of Carillion last year. That may go some way to explain why Renew trades on a multiple of just over nine times consensus earnings forecastsfor the current financial year. With a dividend of around 12p being pencilled in, the yield of 3.2% is reasonable.

Overall, I believe that the shares look like a good bet, with management being a particularly good asset here. What’s more, the business is strongly cash generative, with a £16.6 million inflow from operations in 2018, and the current order book represents just over a year’s worth of historic revenues. Notable growth opportunities come from Network Rail’s current Control Period 6 (CP6) five-year financial period, which has had £48 billion allocated to its budget, with an increase of around 25% in planned spending on operations, maintenance, support and renewals activities, compared to CP5.

Renew shares have slipped a few percent since the October trading update, which seems unfair given that it was in line and there were no negative points. In September this year, analysts at Peel Hunt initiated coverage on the shares and slapped on a 500p target price, implying upside potential of 33%. Top management seems to agree with that view, with the chief executive, chief financial officer and another director recently splashing out a combined £50,000 on buying the shares.

DRAPER ESPRIT

Most company TIDM (Tradable Instrument Display Mnemonic) codes are a simple abbreviation of a business’s name. BARC is used for Barclays, EXPN for Experian, GSK for GlaxoSmithKline and so on. But some companies are allocated more amusing monikers, like UFO for mining explorer Alien Metals, ZZZ for defunct temporary-accommodation provider Snoozebox, and CAKE for collapsed pastry purveyor Patisserie Valerie. Perhaps the best use of a TIDM code to describe a business is demonstrated by this next company.

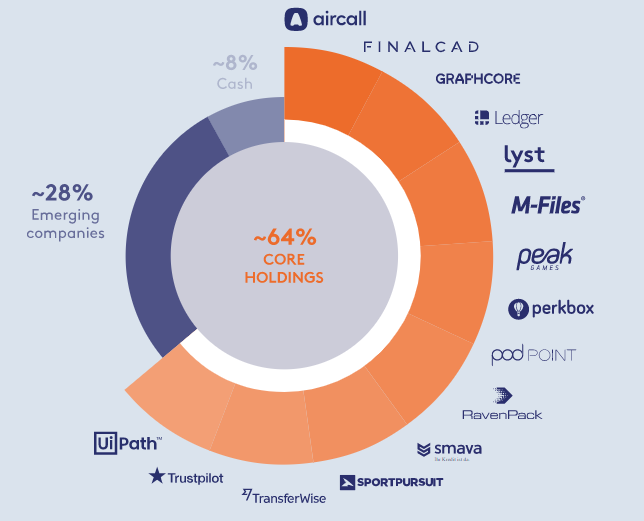

Draper Esprit (LON:GROW) is a listed venture-capital investor focused on the creation, funding and development of high-growth technology businesses, with an emphasis on digital technologies in the UK, the Republic of Ireland and Europe. As well as investing directly in companies, it also has a range of EIS and VCT funds through which it can provide capital to growth businesses. Since listing on AIM and the Euronext Growth markets in 2016 the company has, every year, exceeded its target portfolio return of 20%,successfully exiting a number of investments.

As at 31 March this year Draper Esprit’s portfolio consisted of minority stakes in 54 companies, with 15 core holdings accounting for 70% of the portfolio by value. These are growing fast, with the portfolio companies having an average turnover in excess of $142 million, up by more 45% annually from 2018 to 2019. Some of the core holdings include Ledger, a hardware security wallet for cryptocurrencies and blockchain applications; Lyst, a global fashion search-engine platform; international money transfer platform Transferwise; and review website Trustpilot.

Showing spirit

The last financial year was highly successful for Draper Esprit, with the primary portfolio value soaring in value by 144% to £594 million −a 58% increase in fair value over the 12 months to March 2019. The plc invested £226.4 million during the period, with a further £35.1 million invested by the firm’s EIS/VCT funds, funded by the plc raising £215 million and the funds £64 million. In addition, £16 million was generated via two exits, with an additional £15.3 million realised post period end – the company has now exited 18 companies since the 2016 IPO.

An AGM update in July showed further progress in the current financial year, with £22 million invested across six portfolio companies and a further £6.5 million allocated from the EIS/VCT funds in the year to date. This included a further investment of €7 million into Berlin-headquartered digital-banking company N26as part of a $170 million round. The company also invested a further £2.2 million into machine-learning business Realeyes, which measures emotions through facial-recognition technology, and €2.5 million in Aiven, a cloud-technology company developing a portfolio of database-as-a-service products.

At the end of October, there was a further positive update, reporting on progress at a trio of investee companies. Firstly, big-data analytics provider RavenPackhas raised $10 million, with the funding valuation increasing Draper Esprit’s holding by a fair value of £18.3 million to £33.9 million. Meanwhile, online marketplace Pollenhas raised $60 million in new finance, with Draper Esprit taking part in the round to the tune of £5.9 million. The company’s holding increased in value by £2.3 million to £13.2 million at the funding round’s price. Finally, Draper Esprit led a $9 million funding round into Sweepr, investing £2.7 million in the Dublin-based customer-experience platform for the ‘connected home’, which will be used to expand the workforce in the US and Europe.

Unwarranted discount

Investment companies such as Draper Esprit are valued in relation to their net assets, with the market usually applying a premium or discount depending on the characteristics of the company. With a current share price of 459p and a NAV per share of 524p as at 31 March 2019, the current discount is 12.4%. For a company with such a good track record, that discount looks a bit harsh, especially considering the further increases in value reported since the period end.

Draper Esprit has grown its NAV per share from 352p as at 30 September 2016, which is a compound growth rate of 17.25% per annum – rises in the portfolio value have been diluted by equity fundraisings. That is impressive, and with £150 million of further funds for investment, I believe shareholders are in for another successful yearin 2020. Analysts at both Numis and Peel Hunt argue that the shares should trade at a premium to NAV, with the latter having a target price of 630p. That implies upside of 37%.

Comments (0)