Acquisitions drive diversified growth at Fairpoint

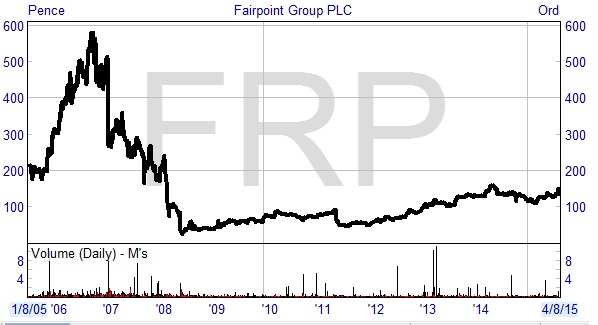

When markets are not at rock bottom it can be difficult to find value shares. Value shares with growth prospects are even harder to find in any market. Add in a decent dividend yield and you have the holy trinity of attractive investment characteristics. Despite a few caveats, AIM listed Fairpoint Group (FRP) looks to meet all these criteria.

The Business

Fairpoint Group, previously known as Debt Free Direct until January 2008, has a long history on AIM, having listed at the end of 2002. Initially a debt solutions business, as it stands today the company is one of the UK’s leading providers of consumer professional services, operating across four divisions:

– Individual Voluntary Arrangements (IVAs) – The Debt Free Direct Limited and Clear Start UK businesses earn fees by offering consumers in financial difficulties a managed payment plan, providing both interest and capital forgiveness. Fee paying IVAs under management at the end of 2014 were 17,628.

– Debt Management Plans (DMPs) – The Lawrence Charlton business provides a service which is like an IVA but more suitable for consumers who can fully repay their debts if provided with interest relief. After three acquisitions, DMPs under management increased by 62% to 25,462 in 2014.

– Claims Management – mainly earns income through payment protection insurance (PPI) reclaim activity.

– Legal Services – provides a range of consumer focused legal services, such as family, personal injury, travel law and clinical negligence.

Fairpoint initially concentrated on providing advice to financially stressed consumers. However, since the financial crisis of 2007-09 and the associated lessening of credit, falling levels of consumer debt and record low interest rates, the sector has suffered a decline. CEO Chris Moat, previously Managing Director of Direct Line, joined the company in May 2008 to drive a new strategy focussed on diversifying income streams into new sectors. Notably, since last year the strategy has seen a move into the growing consumer legal services market.

Growth by acquisition

The most significant deal of recent times was the June 2014 acquisition of Simpson Millar LLP Solicitors, Fairpoint’s first acquisition in the consumer legal services sector. Leeds based Simpson Millar was founded over 150 years ago, with its business mainly coming from the areas of family law, personal injury and clinical negligence. Fairpoint bought the business for an initial £9 million in cash and shares (at 141p per share), with potential earn-outs of up to £6 million payable according to financial targets being met.

Simpson Millar saw turnover grow by 40% over 2009 to 2013 and in the year to June 2013 posted revenues of £16.9 million. In effect the deal increased the size of the Fairpoint business by 60% (measured by turnover) on an annualised basis and was expected to be immediately earnings enhancing on an adjusted basis. Crucially in a people business, Simpson Millar was bought with the intention of continuing to be run by its current management team. In this vein the potential earn outs have been constructed to incentivise the owners, with further consideration payable 50% in cash and in 50% in Fairpoint shares.

The legal services business was further added to in July 2014 via a smaller deal. Fairpoint bought £1.2 million revenue business Foster and Partners, a Bristol based law practice specialising in family law, for up to £0.4 million.

Recent trading

Results for the year to December 2014 showed revenues up by 35% at £38.3 million as Simpson Millar made a maiden contribution. Adjusted for amortisation and exceptional items, pre-tax profits were up by 15% at £9.3 million. After the £2.5 million of exceptional costs net, operating cashflow was strong at £5.7 million. Due to the good performance, Fairpoint increased the total dividend for the year by 7% to 6.4p per share.

Earlier this week Fairpoint revealed that trading for the six months to June 2015 was “materially ahead” of the same period last year and in line with expectations. Growth was mainly driven by the contribution from Simpson Millar, which was said to have performed “well” compared to its prior year, with the business now being the largest source of group income. Net debt as at 30th June was £5.2 million, down from £7.6 million six months earlier, as strong cash generation continued.

Elsewhere, the IVA business saw further declines as the wider sector continued to fall. Fairpoint did not give any specific figures but said that it continues to focus on delivering good margins, cash generation and not writing uneconomic business. In Debt Management Plans revenues were broadly flat, which was put down to the lack of acquisition activity compared to the previous year. Finally, in Claims Management trading was broadly in line with last year, with growth being seen from in-house claims management services offset by a fall in IVA related claims activity.

Another big deal

Alongside the trading statement, Fairpoint announced further progress on its strategic plan. In a deal which has many similarities with that of Simpson Millar, the group has bought consumer legal services business Colemans for an initial £9 million in cash and shares (with a potential £7 million earn-out).

Colemans specialises in personal injury, conveyancing and travel law, having three offices in Manchester, Surrey and London. In the financial year to April 2015 the business made revenues of £19 million and pre-tax profits of £2.3 million. The deal again significantly increases the size of the Fairpoint Group, with scale efficiencies also expected to be realised. Like the Simpson Millar deal, key management are staying and Colemans is expected to be immediately earnings enhancing on an adjusted basis, although there will be £1 million of associated legal, professional and integration costs.

After the Simpson Millar acquisition Fairpoint increased its borrowing facilities to £20 million and this was further increased following the Colemans deal to £25 million (via a five year facility).

Risks & Opportunities

I like the income diversification strategy that Fairpoint has put in place in recent years, which has reduced reliance on the more mature and declining IVA business. Consumer legal services is a fragmented market, estimated to be worth around £10 billion per annum, and expected to provide the main growth opportunities over the next few years. The plan is to create a top 5 UK consumer legal services business, which implies a revenue base of £60 million. On a pro-forma basis, legal services is expected to represent 62% of total group revenues following the Colemans acquisition, which should help the company to be viewed by the market as a growth stock again.

Of course, any strategy based on growth by acquisition – especially in legal services where key fee earners can leave – has its own risks. However, Fairpoint management look to be doing a good job so far. Simpkins Millar has been performing well under the group, and at 6 times historic adjusted EBITDA the initial consideration looks like a good price. Even better, the initial consideration for Colemans was at a price of just 3.6 times historic estimated EBITDA. I like the way that management have been incentivised with earn-outs in both cash and shares over the coming years. Also, it has been specifically stated that the potential earn-out consideration for Colemans is expected to be self-funding, thus significantly de-risking the deal.

A risk also related to the acquisition strategy is the firm’s increasing levels of borrowings – following the Colemans deal net debt is expected to be £13.2 million. The position should be comfortable however. Interest paid in 2014 was covered almost 8 times by cash from operations and despite the rise in debt Fairpoint also has additional cashflow from Colemans available to pay interest.

Elsewhere, there are of course risks associated with legislation & regulation – for example IVAs are delivered under the regulation of the Insolvency Act and the Financial Conduct Authority (FCA) assumed responsibility for the regulation of the debt management sector in April 2014. The IVA market continues to decline, although we note that with an interest rate rise looking ever closer, the sector has the potential to pick up in the medium term.

Assessment

The investment case here is based upon Fairpoint successfully executing its acquisition strategy, keeping debt manageable and maintaining the profitability of the declining debt management businesses. If all these are achieved then there looks to be significant upside, even given the recent rise in the share price.

Given the recent deals I believe that earnings of 20p per share look entirely possible for the next financial year. On a PE ratio of 10 times, which does not seem unfair, an 18 month price target of 200p looks achievable, implying 29% upside from the current 155p. Further upside potential comes from longer term growth (broker Shore Capital sees the possibility for earnings of 26p per share by 2018). The shares also look good value compared to certain peers. For example, business recovery firm Begbies Traynor trades on a multiple of 14.6 times current year consensus forecasts despite having lower profit margins and similar levels of debt to Fairpoint.

With a dividend in the range of 7p also looking likely for the 2016 financial year, a yield of 4.5% is highly attractive. The payment is well covered by earnings, there looks to be scope for increases, and it is one of the highest on offer on the whole of the AIM market.

For those investors who like to follow momentum strategies, I note that the shares have recently hit a 52 week high. Also, followers of institutional investors should note that this week Henderson Global Investors increased its stake from 4.82% to 5.81% and that Gervais Williams’ Miton Asset Management has a 25.47% stake in the company.

Comments (0)