3 small cap clean energy stocks to clean up with

Richard Gill, CFA, looks at three London-listed small caps which he believes could provide both a cleaner future and a bigger bank balance in the coming years.

Just a few weeks ago, outgoing prime minister, Theresa May, laid out plans for the UK government to set a net zero greenhouse-gas emissions target in law. Amending the Climate Change Act 2008, the new proposal is for the country to eradicate its net contribution to climate change by 2050, building on the current target to reduce emissions by at least 80% by 2050, relative to 1990 levels. While some, mainly environmental-interest groups, have said that the target is not ambitious enough, this makes the UK the first major world economy to set such a goal.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

The low-carbon sector is already big business in the UK, with an estimated 400,000 people employed in the sector and its supply chains. Low-carbon technology and clean energy are estimated to contribute a chunky £44.5 billion to the economy every year. And recent months and years have seen significant progress towards its further decarbonisation.

In 2018 for example, the country secured more than half its electricity from low-carbon sources, with its carbon intensity having fallen by 53.1% in just five years (see chart). In May this year, a new record was set for the number of days without burning any coalsince the Edison Electric Light Company opened the world’s first public coal-power station in London in 1882. The record was set at just over two weeks, and with coal-fired power generation expected to be phased out by 2025, many more records look set to be broken.

As with any industry which is experiencing a positive change in regulation, this provides opportunities not only for jobs, but also for investors. There is no defined ’green stocks’ sector in London, but some of the related subsectors in the market include alternative electricity; alternative fuels; renewable- energy equipment; and waste and disposal services, along with a handful of renewables-focused investment funds.

Historically, so-called green stocks have not been the best performing for investors, with many companies struggling with technology issues, difficulties in commercialisation and the ongoing need for cash. While these problems remain for many London-listed green stocks, it does seem that we are finally reaching a turning point where some serious money could be made. Below are three London- listed small caps which I believe could provide both a cleaner future and a bigger bank balance in the coming years.

GOOD ENERGY

Good Energy (LON:GOOD) was co-founded in 1999 by chief executive, Juliet Davenport (who has since been awarded an OBE for services to renewables), with a mission to tackle climate change by generating and investing in renewable energy. The business is one of the foremost renewable-energy-generation-and-supply companies in the country, sourcing energy from its own generation assets along with independent, UK-based renewable generators.

At the end of 2018, the company owned and operated eight renewable-energy facilities across the UK that deliver wholly renewable electricity to the UK electricity grid. There were six solar sites and two wind farms, with a total of 47.5MW of installed capacity in the continuing generation portfolio. However, the portfolio has been subject to various disposals over the years and no further generation assets are being developed. The firm’s flagship asset is the Delabole wind farm in Cornwall, which was the first such commercial farm in the UK and operates four turbines with an installed capacity of 8.2MW.

The core of the business is the supply of electricity and gas to domestic and business customers, with 259,863 customers being on the books at the end of 2018 −split 53% domestic/47% business. Electricity is sourced 100% from renewable sources, either from the company’s own assets, from other UK-based renewable-power producers or the open market. Gas is sourced from wholesale markets −obviously not from a renewable source, but is referred to as carbon neutral. This is because the gas contains 6% biomethane −gas produced in the UK from food waste. Emissions from the rest of the gas its customers use is balanced through supporting verified carbon-reduction schemes in Malawi, Vietnam and Nepal.

Alongside this, Good Energy makes money from providing administration services to so-called micro-generators under the Feed in Tariff (FIT) scheme. As at the end of December 2018, the firm worked with 152,244 customers, with revenue earned from regulator Ofgem for administering the scheme. The FIT scheme closed on 1 April this year for new entrants, but Good Energy will continue to serve its existing customers, who remain eligible for the scheme for up to 20 years (25 years in some cases).

Good trading

Over the past five years revenues have consistently grown at Good Energy, more than doubling from £57.6 million in 2014 to £116.9 million in 2018. As the chart below shows, however, profits have been more erratic, with the figures often boosted by booking in profits from asset sales. In 2018, pre-tax profits rose by 214% to £2.3 million, but the real highlight of the numbers was a £14 million net cash inflow from operations. This resulted from much-improved working capital, following the resolution of billing issues, along with the adding back of non-cash depreciation. This helped net debt fall by 23% to £40.9 million, with the company having taken on significant borrowings to develop its generation assets.

So far, in 2019, there have been three major operational highlights. First, in March, the company acquired a 12.9% stake in Zap-Map, an app developer for Britain’s 200,000 electric vehicle (EV) drivers. This was in line with its vision to accelerate the adoption of EVs, with there being the opportunity to acquire a majority equity position in Zap-Map. Then in May, two significant financial events occurred; £3.6 million of bonds were redeemed and the company’s 5MW solar park at Brynwhilach Farm near Swansea was sold, for £5.6 million in cash.

In late June, the company announced a modestly upbeat statement covering trading since the start of the year. Continued growth was seen in both business supply and FIT administration, but the domestic supply business was held back by a warmer than seasonally normal first quarter, along with continued price competition. The overall cash position was said to be strong following cash-collection improvements and better-than-expected working-capital management, with gross debt reduced following the Brynwhilach sale and bond redemption. Overall, performance remains in line with expectations, with profits expected to be weighted towards the traditionally colder first half of the year, despite the warmer first quarter.

Good buy

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Shares in Good Energy hit an all-time low of 87.5p last November, during a period of market malaise, but have since rallied to the current 138p. Nevertheless, that remains well off highs of around 290p seen in early 2014. The shares now trade on a historic earnings multiple of 13.5 times, which looks reasonable given strong cash generation. In addition, net assets of £19.4 million provide backing to 85% of the market cap.

Good Energy also aims to deliver a progressive dividend policy, with the 2018 payment rising to 3.5p per share. This yields a reasonable 2.5% at the current share price. For shareholders who want to increase their stake in the company, and to avoid dealing commissions, there is also the option of a scrip dividend.

Of course, there are big risks associated with operating in the energy sector −not least regulation, exposure to demand based on weather conditions and price competition. Borrowings are also high at the company, but they are falling markedly and interest payments were comfortably covered by operating cash flow in 2018. Overall, with its unique selling point of supplying power from renewable sources, I believe Good Energy is a good play on the alternative-energy sector.

CERES POWER HOLDINGS

This next company is a little riskier than Good Energy, as it is currently making a loss. But with revenues more than doubling on an annual basis for the past three years, losses falling and with plenty of cash, it appears to lie in a sweet spot.

Ceres Power (LON:CWR) has been around on the markets for some time, having listed on AIM in 2004 to fund the development and commercialisation of fuel-cell technology. Its flagship product is the SteelCell, a low-cost, next-generation fuel-cell technology, which allows the efficient conversion of fuel to power in a variety of applications. Put simply, SteelCell is a perforated sheet of steel with special screen-printed ceramic layers that electrochemically convert a variety of different fuels directly into power at the point of use.

The SteelCell can generate power from conventional fuels like natural gas and from sustainable fuels like biogas, ethanol or hydrogen, significantly lowering carbon emissions and pollutants, and also offering lower running costs. It is highly efficient, with the current fifth-generation SteelCell achieving a key milestone of 60% net efficiency, which is twice that of conventional gas engines and greater than centralised megawatt-scale gas turbines. The core technology platform is protected by 50 patent families.

Ceres’ business model is based on a high-margin licence-based approach, and it partnerswith world-leading manufacturers, including Nissan, Honda and Bosch, to embed its SteelCell technology in their mass-market power products. Revenues are earned through the provision of initial engineering services, upfront licence fees and future royalties based on power production. The partnerships enable the company to scale across multiple geographies and applications such as combined heat and power for commercial and residential sectors, data-centre power and electric-vehicle range extension.

Fuelling growth

Ceres is now seeing the commercialisation of its technology advance significantly. This was highlighted in results for the six months to December 2018, which reported revenues up by 168% at £8.3 million and operating losses more than halving from £6.3 million to £3 million. Notably, gross margins soared from 46% to 82% after growth in the highly profitable licence fees. The company ended the period with £30.5 million of contracted future revenues, and is on course to more than double revenues for the fourth successive year, to more than £15 million.

Perhaps the main highlight of the period was the influx of cash raised from various sources. A total of £77.6 million was raised via share issues in the half, meaning that the company believes it is now, “…fully funded to execute its business plan” and has sufficient cash to reach cash-flow breakeven. The funding included a £9 million investment fromBosch, with the two companies also entering into a strategic collaboration to combine expertise in fuel cells, manufacturing and product development. This will provide significant staged revenues to Ceres through licensing and longer-term royalties on 5kW SteelCell stacks, as well as initial engineering services.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Another investor and partner is Weichai Power, a Chinese engine manufacturer. A recently signed collaboration between the companies includes a licence agreement including technology-transfer payments of up to £30 million and ongoing future royalties, along with a £9 million deal for the continued development of a first-range extender product for electric buses in China. Weichai increased its total equity investment in Ceres Power to £48 million during the half, taking its stake to 20%.

More recent news is that partner Miura Co., a Japanese industrial-boiler manufacturer, is launching its first fuel-cell product using the Ceres technology. The fuel-cell system is a 4.2kW combined heat and power unit, targeting the commercial building sector in Japan, one of the most advanced markets in the world for fuel cells, and a key target market for Ceres. Field trials are underway, with commercial launch to a select number of customers expected to take place from October 2019.

Power your portfolio

There is a lot going on at Ceres Power at present, but the main themes from the investment case are clear – growing revenues, solid industry partnerships and world-leading technology − all against the backdrop of rising demand for energy, and clean energy in particular. Analysts at brokerage Liberum recently initiated coverage of Ceres and set a bullish target price of 300p per share − 75% higher than the current price of 171p. Backing its views, it believes that within a decade annual revenues could exceed £150 million and earnings and free cash flow could exceed £100 million.

AQUILA EUROPEAN RENEWABLES INCOME FUND

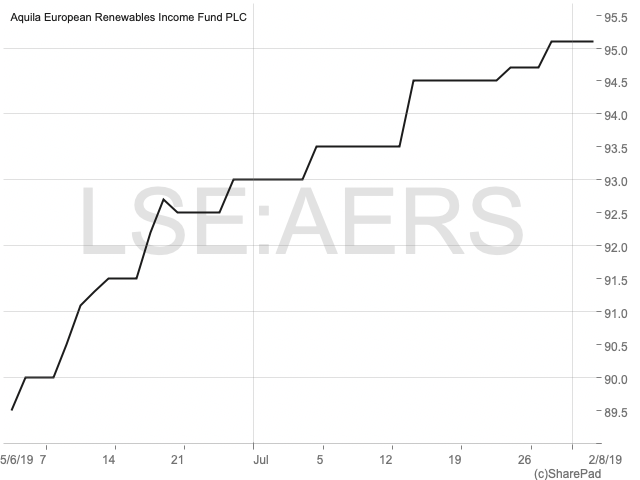

Finally, for investors looking for easy entry into a diversified portfolio of income-generating renewable assets, an interesting fund recently listed on the London markets. The Aquila European Renewables Income Fund (LON:AERS) joined the London Stock Exchange in early June, following the raising of €154.3 million at the traditional round price of €1.00 per share. While this amount was short of the initial €300 million target, it still represented one of the largest fundraises by a listed investment fund so far in 2019.

The fund has been established with a remit to invest in renewable-energy technologies across continental Europe and the Republic of Ireland in order to build up a diversified revenue stream from energy sales. Europe seems an excellent area to invest in at the moment, with the recently revised Renewable Energy Directive increasing the EU’s target for renewable-energy share to 32% in 2030, with a long-term goal of having 75% of the EU energy mix from renewable energy in 2050.

AERS was set up by Aquila Group, a German investment-management company which has around €8.2 billion of assets under management and a focus on renewable energy and other green sectors. Subsidiary Aquila Capital is the fund’s investment advisor and interestingly has agreed to use the fees due to it in the first two years to buy shares in the fund, either in the market or by the creation of new shares, depending on whether the price is at a premium or discount.

To date, the investment advisor has identified a number of potential renewable-energy infrastructure- investment targets, with the majority either held in Aquila-managed funds or pending targets for acquisition by the Aquila investment team. These include a range of solar, wind and hydro assets in various stages of operation and commissioning across a number of European countries. This focus on different generation types helps to balance cash flows, with wind power producing more electricity in the winter and solar more in summer.

Renew your portfolio

It is early days in the life of the AERS. As yet there have been no announcements regarding any investments, but we expect to hear news soon following the initial deployments of cash.

The main attraction here is income, with AERS targeting a dividend of 1.5 cents per share for 2019 as the portfolio is built up. That rises to a minimum of 4 cents in 2020 and 5 cents from then on as the portfolio reaches maturity. On top of that, the company is targeting an internal rate of return of 6% to 7.5% after fees and expenses on the issue price of €1.00over the long term, through the reinvestment of excess cash flows, asset-management initiatives and the prudent use of leverage.

Shares in the fund are currently changing hands for €1.03 (93p), slightly above the issue price so at a small premium to the cash raised at IPO. If the stated targets are met then that offers a decent income yield of 4.85% from 2021. Assuming the growth ambitions are also met, taking the mid-point, then investors are looking at a highly attractive total annual return of around 11.5%. As it is denominated in euros, the fund also provides investors with a hedge against sterling, should there be any negative post-Brexit-related currency movements.

Comments (0)