Why you need to understand decentralised finance

By Martyn Holman and Ellen Logan

What is DeFi?

Cryptocurrency has now been around for some time and has more than permeated the general consciousness. Stories of its wild volatility and overnight millionaires abound. But at its heart, cryptocurrency’s promise is to make money and payments universally accessible. Decentralised Finance (DeFi) builds on this, aiming to provide a global, open alternative to every financial service used today.

DeFi is an ecosystem of applications and protocols built on blockchains which support smart contracts, primarily the Ethereum blockchain. They provide the same services as classical finance, namely borrowing, lending, and saving. The difference is that they aim to do this in a “decentralised” manner, meaning there is no middle-man — no banks taking a cut of returns and no central point of failure where the whole system could fail.

DeFi apps and protocols can be broadly categorised as either being lending protocols, aggregators, decentralised exchanges (DEXs) or decentralised oracles. Some of them are decentralised autonomous organisations (DAOs) which give users of the protocol the ability to change it by voting with the tokens given to them by the protocol. Universal access is provided and controlled by “smart contracts” (or dapps) that can execute automatically when certain conditions are met. Smart contracts can be programmed with sophisticated functionality allowing complex functions to be managed in the absence of a central, trusted counterparty. For example, automated loans negotiated directly between two strangers in different parts of the world, without a bank in the middle.

The operations of DeFi businesses are not managed by an institution and its employees — instead the rules are written in code – the “smart contract”. Once the smart contract is deployed to the blockchain, DeFi dapps can run themselves with little to no human intervention and hence have ultimate scalability. The code is open source and fully transparent on the blockchain for anyone to audit. This builds a different kind of trust with users, because anyone has the opportunity to understand the contract’s functionality or find bugs.

Unlike finance today, there are no gatekeepers or accounts. Users interact directly with smart contracts from their crypto wallets. Anyone can create DeFi apps, and anyone can use them – they are truly “permissionless” to create, “permissionless” to participate. New DeFi applications can be built or composedby combining existing DeFi protocols like Lego pieces — e.g. stablecoins, decentralised exchanges, and prediction markets can be combined to form entirely new applications and are therefore totally interoperable. All (pseudonymous) transaction activity is also public for anyone to view. Dapps are global from day one with access to the same DeFi services and networks globally.

Somewhat counterintuitively – given the global, open sourced nature of the technology used to build DeFi – there is a regionality to protocol development and user bases in DeFi. Regional approaches to the regulation of the space may emerge, although the expectation from the community is that, in time, a cooperative international body will be created to regulate the DeFi space.

Leading protocols

Stablecoin and Decentralised Reserve Bank: MakerDAO

Maker is a stablecoin project where each stablecoin (called DAI) is pegged to the US Dollar and is backed by collateral in the form of crypto. Stablecoins offer the programmability of crypto without the downside of volatility that you see with “traditional” cryptocurrencies like Bitcoin or Ethereum.

Individuals can pledge crypto and borrow DAI, with DAI being the ‘working capital’ for the DeFi market, with >100 integrations into products. Thus, an individual maintains their capital exposure in crypto, whilst receiving the utility of an asset-backed stablecoin. Currently, therefore, this operates more like a margin product with collateral usually exceeding the value of the loan – for the customer it is about creating utility, but maintaining exposure to the pledged asset.

Maker aspires to be a decentralised reserve bank. Individuals who hold a separate but related token, MKR, can vote on important decisions like the Stability Fee (similar to how the Federal Reserve’s Federal Open Market Committee votes on the Fed Funds rate).

Borrow and Lend: Compound

Compound is a blockchain-based borrowing and lending dapp. Individuals can choose to lend crypto and earn interest, or deposit crypto to the Compound smart contract as collateral and borrow against it.

The Compound contract automatically matches borrowers and lenders, and adjusts interest rates dynamically based on supply and demand. Other popular borrow/lend dapps are Dharma and dYdX. Aggregators like LoanScan track borrow/lend interest rates across the various dapps, so you can shop around for the best rates.

Automated Token Exchange: Uniswap

Uniswap is a cryptocurrency exchange run entirely on smart contracts. It allows users to trade popular tokens directly from any crypto wallet. This differs from an exchange like Coinbase, which stores crypto and holds the associated private keys for safekeeping (and which requires you to sign for an individual account).

Uniswap uses an innovative mechanism known as Automated Market Making to automatically settle trades near the market price. In addition to trading, any user can become a liquidity provider, by supplying crypto to the Uniswap contract and earning a share of the exchange fees. This is called “pooling”.

Other popular Decentralised Exchange platforms (DEXes) include: AirSwap, Bancor, Kyber, IDEX, Paradexand Radar Relay and 0x.

Prediction Markets: Augur

Augur is a decentralised prediction market protocol. Users vote on the outcome of events with a value attached to the vote – rather like a betting market. Bets are placed using DAI stablecoin.

Prediction market platforms like Augur and Guesser are nascent outside of sports betting. Augur is the software which governs market creation and payout rules. There are a number of VC backed ‘second layer’ startups building user interfaces to run on top of the Augur protocol.

Insurance: Nexus Mutual

Many of today’s DeFi “loans” are overcollateralised (more like a margin product) and hence inherently safe due to the buffer. But the black swan for DeFi is smart contract vulnerabilities. If a hacker finds and exploits a bug in the open source code for a dapp, millions of dollars could be drained in an instant.

Nexus Mutual is an insurance mutual owned by the token holders (NXM), offering protection against smart contract vulnerabilities. Members select which protocols they want to buy cover for and can also stake their NXM tokens against protocols in return for a share of the premiums paid for that protection. Staking is knowledge-based – staking against a protocol risks loss in the event of a breach and payout on that protocol.

Where members stake their NXM is how the risk level of a specific protocol is determined (similar to a pools bet). The more NXM that is staked against a specific protocol the cheaper it is for other members to buy cover. Certain events could trigger a payout, members have the final say through a vote.

The Market Opportunity

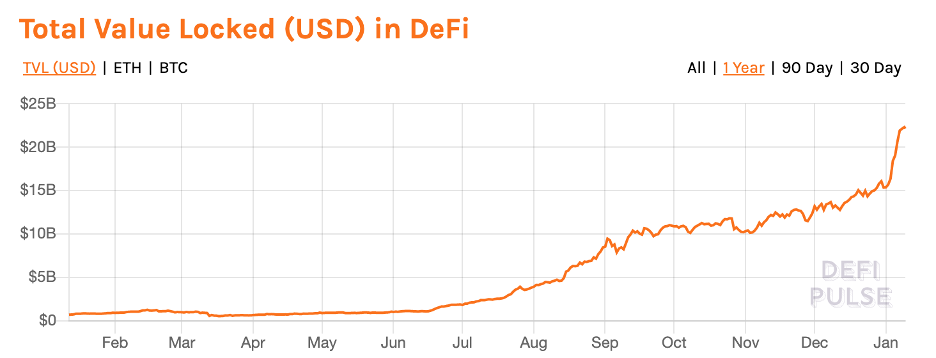

In 2020, the DeFi user base grew 11x[1] and the TVL (Total Value Locked) in DeFi protocols increased by over 2,000%, closing the year at around $15bn[2] (and since accelerating to $22bn as of early Jan-21). Current positive crypto price trends, the growing universe of DeFi applications and ongoing low interest rate environments in the traditional finance world are expected to support this momentum with both new and more-seasoned crypto investors moving into the space.

This meteoric increase in participation, largely concentrated in the last six months has led to accusations of a bubble, and considerable division of opinion, even amongst those most closely attached to the industry:

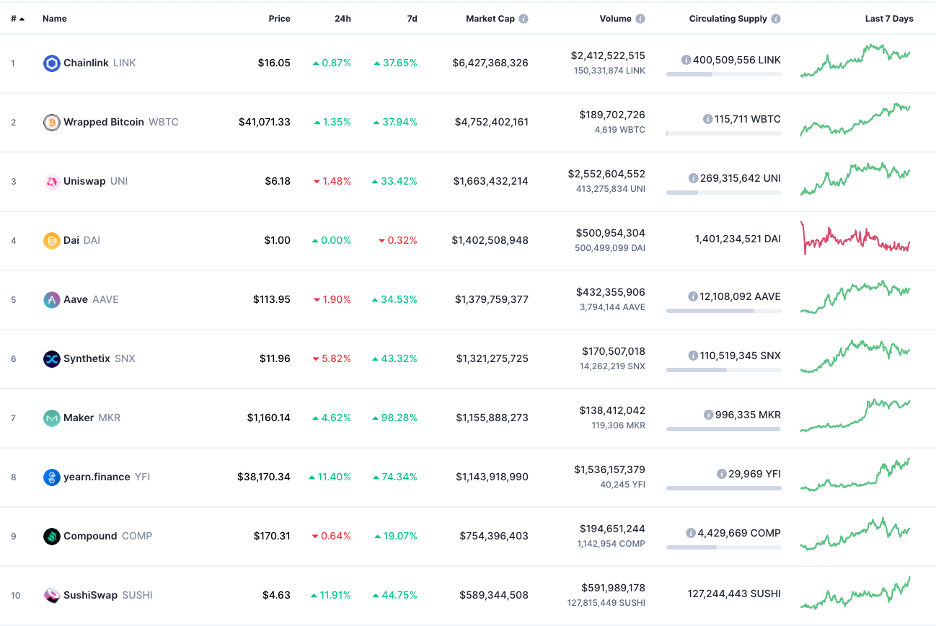

Compared to the crypto market as a whole, DeFi is small with a market cap for the leading 100 DeFi tokens around $27 billion (as at 8/01/21), or c.2% of the total market capitalisation of all cryptocurrencies[3].

Top 10 DeFi Protocols by Market Cap[4]

Investing in DeFi: The Augmentum Thesis

At Augmentum Fintech we appreciate the scale of the opportunity that DeFi is attempting to disrupt; but given the nascent nature of the space relative to more traditional fintech propositions we have built our entry investment case around a conviction thesis.

Central to this thesis is the belief that DeFi is disruptive to financial services at a fundamental level with the potential to render today’s “CeFi” institutions (incumbents and fintechs) redundant by performing their role (as trusted intermediaries) with software. As a result, DeFi is disrupting the fundamental infrastructure layer (e.g. LiBor) as opposed to the application layer (e.g. NeoBank). Furthermore, it’s Impossible for CeFi “for profit” companies to compete with the scalability of these token networks driving significant “unfair advantage”. Blockchain infrastructure is effectively reducing the cost of trust and allowing rapid scaling.

Balanced against this promise is the fact that DeFi is nascent and there are significant (known and unknown) risks associated with the space – regulation, governance, user concentration to name but a few. The reality is therefore a low probability of disruption of traditional finance, and an even lower probability of any individual protocol finding success with the DeFi ecosystem in the long term. But the potential return from a diversified portfolio is significant due to the scale of the market opportunity, and potential returns in the event of crossover success are potentially one or two orders of magnitude greater than traditional fintech. If DeFi technology does not permeate traditional finance then return potential remains attractive with capital and user inflows to the space growing at pace.

Augmentum recently announced our investment in and partnership with ParaFi, through which we gain exposure to a diversified portfolio of pioneers in the decentralised finance (DeFi) and blockchain spaces. We are excited by the potential of this new approach to finance and look forward to developing our thesis and exposure.

[3] Coin Market Cap, accessed 09/01/21

[4] Coin Market Cap, accessed 09/01/21

Comments (0)