Friday’s Master Investor Market Report

– The FTSE 100 fell 48.72 points to 6,810.72 points.

– The FTSE 250 slipped 157.40 points to 17,933.02.

– The FTSE All Share dropped 26.91 points to 3,713.48 points.

– The FTSE AIM All Share finished the day down by 1.32 points at 776.01 points.

The Greek Government is facing difficulties from within after it moved to delay a €300 million (£218.5 million) debt repayment that was due today. The country has announced that it will bundle all the payments owed to the IMF into a single transfer at the end of the month. Reports suggest that the organisation put forward this option and other Eurozone countries have not publicly objected at this time. However, more left-wing members of the governing Syriza Party are less sympathetic to Greece’s negotiating strategy, with some suggesting that any and all concessions should be off the table and that the alternative would be to call another set of elections. Finance Minister Yanis Varoufakis told Reuters yesterday that he saw no reason for such a move.

The United States economy added 280,000 jobs during May, but the unemployment rate rose to 5.5% from last month’s low of 5.4%. The rate rise was due to an increase in labour force participation, which suggests that previously discouraged individuals are once again actively looking for jobs, and has been framed as a positive sign for future growth. However, many predict that the rate of improvement will slow down this year relative to the rate at the end of 2014, with Ethan Harris from Bank of America Merrill Lynch saying that “we are not going to add 280,000 jobs a month but I certainly think that we are capable of adding 225,000 to 250,000 jobs per month through the rest of 2015”.

Oil prices rose today after the Organisation of Petroleum Exporting Countries said that the bloc’s output would remain steady at 30 million barrels a day.

Pub landlord and brewer Fuller, Smith & Turner (FSTA) saw revenues jump 12% to £321.5 million driven by strong demand, acquisitions and new pub openings. Beer and cider volumes rose by 4% and like for like pub and hotel sales grew by 6.3%. Shares in the company bubbled up to 1,100p, a rise of 41p despite an apparent downturn in the opening weeks of its 2015 financial year.

Sovereign Mines of Africa (SMA) plummeted by 47.92% to 0.25p as the firm issued a stark warning about its future prospects. The company struggled to find a partner for its flagship Mandiana project during 2014 and the ebola outbreak made the region less conducive to exploration. Losses for the year quadrupled to £3.8 million and no revenues were earned.

Shares in drug researcher 4D Pharma (DDDD) fell 100p today to 865p after the company published its maiden final results. 4D lost £2.38 million before tax during 2014 as it worked to bring a number of products to clinical trials in 2015. Since being admitted to AIM in February, the share price has grown by over 400%.

Solo Oil (SOLO) climbed by 0.01p to 0.54p after the announcement of positive news from Schlumberger regarding reserves at the Horse Hill project, which suggests there are 271 million barrels of oil in the Jurassic section. This estimate is significantly higher than a previous estimate made by the NUTECH consultancy. UK Oil & Gas (UKOG) also holds a stake in the project and saw its shares rise by 0.13p to 2.78p.

Shares in Union Jack Oil (UJO) climbed by 2.2% to 0.23p after the company agreed terms to buy an additional 10% stake in the PEDL180 License in Lincolnshire from Celtique Energie Petroleum for a nominal fee. Union Jack now owns 20% of the prospect, which is expected to begin production in the first quarter of next year.

Halfords (HFD) profits raced forward 11.4% to £81.1 million during the year ended 27th May as better customer service and improved cycling ranges helped push the firm’s revenues above £1 billion a year ahead of plan. All areas except car enhancement saw sales growth above 5%. Hargreaves Lansdown Equity Strategist Keith Bowman noted that “investments in staff training, revamped stores and enhanced product availability all look to be paying off, whilst a change of leadership made at its Autocentres business is showing early promise”. Halfords shares climbed by 3.5p to 488p.

Broadcasting outfit UTV (UTV) has agreed the sale of its Liverpool-based Juice FM station to Global Radio Holdings for a £10 million cash consideration. The station recorded revenues of £2.2 million in 2014 and earned pre-tax profits of £4.8 million. UTV is continuing to review its remaining radio stations and shares in the company closed today at 162p, a 3p rise.

Monday’s news today

IDOX (IDOX) will publish interim results and Falkland Islands Holding (FKH) will release its finals.

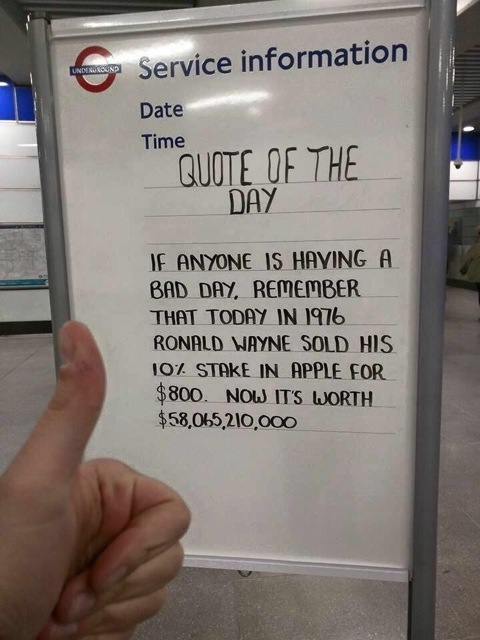

Quote of the day

Comments (0)