Time to Sell the European Yield Madness

At a time when investors need to pay European corporations for the privilege of lending them money, the degree of financial madness should have reached level 100. Governments around the world excused themselves from leading their own sluggish economies towards healthier states and central banks surpassed all known boundaries in replacing them on such a task. In the end, the results are poor while the distortions are the greatest. Central banks are now lacking options, in particular in continental Europe and in the UK, and it won’t take much time until they realise there’s nothing more they can do to interest rates and assets to help the economy. With a Swiss 30-year government bond now yielding -0.061%, it is time to sell this madness and expect an inversion.

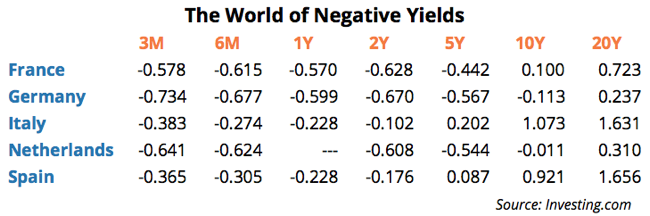

It is with pain that I look at the table reproduced below and think about the future of pensions, savers, investors, and society at large.

All those negative yields mean that we are expected to teach our children that for each £1 they earn they should spend £1.20, because any pence they save would be worth less and less as time goes by. In such a society, people don’t put aside part of production to build a better future. By the contrary, they consume more than they produce in the expectation they will have more in the future. But that is nonsense, because if they don’t put aside anything they just can’t have more in the future, which clearly shows how incongruent it is to have negative yields. But, central banks believe that, because of deflation, the only way to improve our economies is by means of cutting interest rates to negative levels, in order to reduce the real interest investors face.

As I mentioned many times in my past blogs, this view ignores the fact that investment doesn’t depend only on interest rates but also on expected demand and other conditions, which remain poor. At this point, every time a central bank cuts rates and extends asset purchase programmes, it creates some level of initial enthusiasm among investors, but scares businesses and households, as they interpret such action as a lack of trust on the economy and its future outcome. After all, the accommodative policy contributes to further depress demand, as the negative effect on expectations outpaces the positive effect in interest rates.

Limited Remaining Options

The world is imprisoned in a liquidity trap fuelled by very low interest rates, where available options are scarce. At this point, the only way of surpassing the remaining monetary policy boundaries is by means of suppressing physical currency, setting an expiry date on it, or finding an even more radical approach. Because of the radically involved, I believe that governments will now get the lead and take this opportunity to raise debt at record low interest to propel growth. For more on this topic, please take a look at “The End of Austerity” in the last issue of Master Investor Magazine (pg. 10-15).

Today was the time for the ECB to move on and feed the market with some extra dovish signs regarding the future. Investors were anxiously waiting for an extension in asset purchases both in amount and in time, but Mario Draghi under-delivered on that goal. He may eventually tweak the current programme by the next committee meeting, but he would most likely stand as quiet as possible. Don’t blame him! What can he do? Really, what can he do?

The ECB has been creating huge distortions in bond markets and is quickly approaching the end of the eligible-to-purchase-bond queue. The pool of available bonds is drying quickly: the central bank is approaching a few country quotas, two-thirds of German bonds are no longer eligible because they’re offering a yield below the ECB’s deposit rate of -0.40%, and 30% of Eurozone bonds are also no longer eligible. These constraints led the ECB into the world of corporate bond purchases in May, as the bank appended a plan to purchase investment-grade (non-bank) bonds to its existing asset purchase programme. But, just a few months after starting the programme, the distortions and limitations are already visible. Sanofi and Henkel just issued bonds promising investors to pay them less than they’re lending to these companies. While some corporate bonds were already showing negative yields, these were the first to hit them in the primary market.

Replacing Monetary Policy

The ECB has been purchasing, on average, €60 billion per month of government bonds, under its public sector purchase programme, now accumulating €995 billion in purchases to date. The corporate sector purchase programme has just started and accumulates just €20 billion in assets.

With all the limitations in place, what can the ECB do? One option would be to remove or expand the lower bound of -0.40%, eventually further cutting its deposit rate to expand the range of eligible assets. But such measure would have a great impact in short-term yields again, further deteriorating the banking sector prospects, as they are just unable to pass these negative rates to customers. Another option would be to just expand the asset purchases programme in time and amount but, as mentioned above, such measure would most likely fall short of its intentions if not accompanied with an extension of eligible assets, as there are not much remaining eligible assets. Then comes the option of expanding eligible assets to foreign bonds and eventually equities, but such alternative would certainly lead to much political scrutiny and eventually to fierce external opposition. No matter which option is chosen, it always comes severely flawed and limited, which acts as further evidence that the only remaining reliable alternative is that of giving fiscal policy more weight over time.

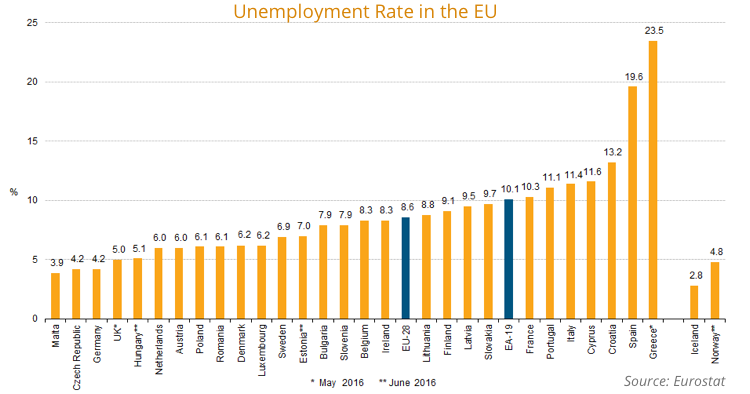

A pause in austerity in Europe would boost demand and confidence levels, which is needed for businesses to start investing again and consumers to save less. At the same time, it is becoming obvious that Europe faces a problem of diversity that just can’t be solved with one-size-fits-all policies. The average numbers for GDP and unemployment hide a huge diversity among member states, which requires an adjustment tool to compensate the lack of monetary tools. While further integration is the only way to reduce part of this problem, fiscal policy may help deal with different business cycle needs for different member states, replacing the one-size-fits-all monetary solutions.

The need for further intervention in the European economy is reflected in the current numbers for GDP growth and core inflation, with the first now at 1.6% YoY and the second hovering around 0.8%. But, the need for fiscal policy becomes more evident when we detail the numbers by member state. Behind a 1.6% average growth lies a growth of 3.7% in Slovakia and 3.2% in Spain, but -0.9% in Greece. In terms of unemployment, the reality is even worse, with the rate being as low as 3.9% in Malta and as high as 23.5% in Greece. With such a wide range, no one can put the full adjustment burden in unified monetary policy and painful long-term structural reforms. At this pace, and taking Greece as an example, there’s no long-term.

Opposing the Madness

I believe that the most important point from today’s ECB meeting is the recognition of policy exhaustion (even though Draghi doesn’t want investors to perceive that). There’s always something the central bank can do, but that specific something is just becoming too costly for the benefits it can bring. More than anything the ECB will try to delay any decision and kick the can down the road waiting for the FED to tighten and for European governments to start doing something. Governments that once supported austerity are somewhat weakened today, in particular after Brexit, and they will start supporting the ECB in reaching its inflation goal, sooner rather than later.

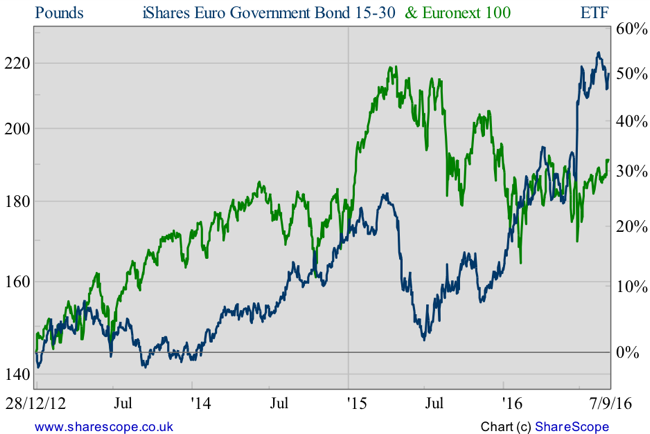

With all the above in mind, its seems to me that it doesn’t make any sense to purchase a 10-year German bond yielding -0.113% or even a 20-year Italian bond yielding 1.631%. Those are huge bets against the ECB reaching its inflation targets. As I believe inflation will start rising very soon, the only available bet in sovereign bonds is to sell the longer maturities. As it sometimes may be nearly impossible to short sovereign bonds, a way of doing this is through a short position in the iShares Euro Government 15-30Yr ETF (LON:IBGL). This ETF targets sovereign bonds in the 15-30y interval and has a weighted average maturity of 22 years. It is exactly the long-term part of the yield curve that I believe is severely distorted and represents the most risks to long positions. I believe that over the next year or so, these long-term yields will have to rise substantially and then prices are expected to decline. This favours a short position in the above ETF.

Comments (0)