Three European water ETFs to hydrate your portfolio

Filipe R. Costa explores the merits of investing in clean water through thematic ETFs.

Stocks are trading at hefty valuations while governments around the world attempt to crack down on Covid-19. Many companies have been busted in the process but there is a nascent community of “Robin Hood” investors that threatens to keep all them afloat, no matter how inflated valuations look. During this madness, the best thing is to relax, drink a glass of water and wait for the next big opportunity. But wait a minute! Water! Everybody needs water! Why not consider investing in something that is and always will be in high demand? Water, pure and clean.

Thematic investing has been rising in popularity during the last three years, as investors seek out alternative ways of building portfolios. A traditional allocation between the market portfolio and the safety of bonds is efficient but boring at the same time. Investors are always looking for ways of enhancing returns above the market averages.

While beating the market systematically is an almost impossible endeavour, for those who love the thrill, there are ways of playing the game without risking too much. We can still depart from a core portfolio allocation and then reserve some cash from our active portfolio enhancement. We may then fill that part with the themes we believe will prevail over the next few years.

During 2020, the alternative energy theme has been in the spotlight. Looking at the performance of the two biggest alternative energy ETFs helps us to understand how big a theme can score in comparison to the broad market. The iShares S&P Global Clean Energy ETF (NASDAQ:ICLN) rose 140% in 2020 while the Invesco Solar ETF (NYSEARCA:TAN) rose a staggering 234%. So far, this year, alternative energy continues on a tear, but valuations are not that appealing.

Climate still dominates

The big question is what will be the prevailing theme for the near future? In a recent study reported in the FT, Cerulli, a company that undertakes research and consulting for clients such as private banks and wealth managers, claims that the climate theme will continue to be in the spotlight during 2021 but the focus will change from clean energy to water. In a survey conducted over 37 European ETF providers, more than 90% of the respondents reported an expected demand increase for water products and services. They believe that water-themed investment will be in demand from investors in the next 1-2 years. The themes following in the ranks were biotechnology and technology.

Water is a scarce resource that we underestimate because of its wide availability in urban areas of the developed world. However, the WHO estimates that half of the world’s population will be living in water-stressed areas by 2025. In 2017, 5.3 billion people used safely managed drinking-water services, but there were still 2.2 billion people without that safety (and with difficult access to water in many instances).

The world population is increasing by 80 million per year and is ever more demanding. Urban areas are growing, and resources are becoming exhausted. Water sources are increasingly polluted and endangered, requiring an ever-greater effort to clean them. At the same time, there’s an unequal distribution of water across the world. In general, the best and cleanest water sources exist in places they are in low demand. New companies under the water theme are no longer just the traditional utilities but instead technology companies providing long-term solutions to water scarcity and logistics. The theme provides a good diversification layer to a core portfolio. On the one hand, it’s a defensive play because water is an essential commodity. Demand for water is less exposed to the ups and downs of the overall economy than other products are. On the other hand, as long as water scarcity is a growing threat, demand for water-related services will be in high demand in the near future, also making the theme a growth play.

Let’s buy some water

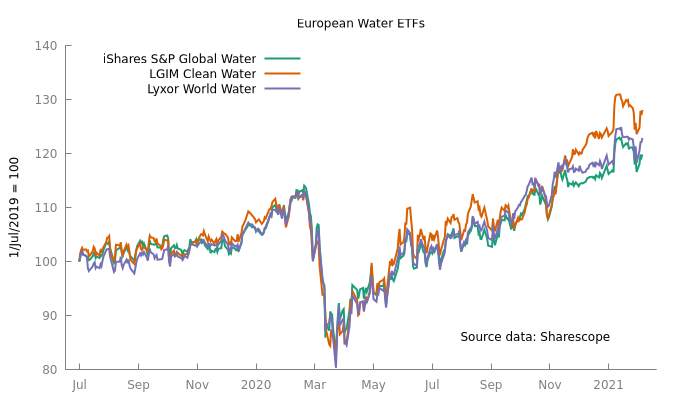

As I mentioned above, the performance of the alternative energy theme in 2020 has been stunning, flying into three-digits. These numbers have not been trailed by water ETFs, which ended 2020 with a performance in the 10% to 15% range, above the overall European market but still below the US broad market. This is a sign that the trend is still nascent, which is in general good news, as the assets of these companies are not overvalued as they are for alternative energy.

After explaining why I believe it is worth considering an investment in the water theme, it’s time to find a few investment vehicles. Because selecting single stocks from around the world is difficult and expensive from the point of view of an individual investor, particularly in a sector going through a modernisation process, I’m looking into ETFs. In the US, there are a few ETFs featuring clean water. The largest are Invesco Water Resources ETF (NASDAQ:PHO), Invesco S&P Global Water Index ETF (NYSEARCA:CGW) and First Trust ISE Water Index Fund(NYSEARCA:FIW). These ETFs have been outperforming the market over the last five years, particularly the First Solar FIW and the Invesco PHO. However, their performance is more or less in line with market performance and far away from the skyrocketing numbers secured by alternative energy ETFs. Nevertheless, the future may be favourable to these ETFs.

From the perspective of a European investor, either located in continental Europe or the UK, there are three different options. One of them was recently created (in 2019) and is more tailored to face the new challenges of the sector instead of being just a utilities fund. Let’s take a look into the three.

LGIM Clean Water UCITS ETF (LON:GLGG)

Legal & General Investment Management (LGIM) created the water ETF in July 2019 with the goal of offering something new to the market, something that goes beyond the conventional utility company. One quarter of the holdings are in utilities but half of the holdings are in technology and digital solutions. The idea is to invest not only in companies providing water as a commodity but also in companies providing efficient water solutions. GLGG (the British pound version of the index) tracks an index of international companies that are engaged in the clean water industry through the provision of technological, digital, engineering, utility and other services. In summary, the index attempts to capture the growth potential of the global clean water industry from all its angles. Unlike all other ETFs tracking this theme, GLGG is an equal-weighted fund, investing in 66 different companies in equal proportions. Twice a year the portfolio is rebalanced to keep the proportions and to consider new investments. The ETF invests worldwide, with predominance in the US, continental Europe, the UK, Japan and Hong Kong. Dividends are reinvested and the total expense ratio is 0.49%.

In 2020, GLGG rose 14.9%, which is just slightly above the rise in the MSCI World index (denominated in GBP). This ETF is very small, with less than 100 million GBP under management but it is very promising and I expect it to grow substantially.

Lyxor World Water UCITS ETF (LON:WATL)

Lyxor offers a way to get exposure to the global water scene. Much larger in terms of assets under management than GLGG, the Lyxor fund tracks the world’s 30 largest companies operating in the water infrastructure, utilities or treatment sectors, which derive at least 40% of their income from water related activities. However, WATL is much less diversified than GLGG, as it invests in less than half the companies and is a capitalisation weighted index. Its top five holdings account for 42% of the fund, which substantially increases its riskiness. At the same time, WATL is more concentrated around conventional utilities and thus is less able to capture new trends.

The fund’s top holdings include big names like Geberit, American Water Works, Veolia Environment, Xylem and Masco and investments are dispersed mainly across the US, the UK, Japan, Switzerland and France. Dividends are not reinvested, and the total expense ratio is 0.60%.

iShares Global Water UCITS ETF (LON:IH2O)

The BlackRock offer is the largest in terms of assets under management and is the oldest, with its inception in 2007. The main goal of the fund is similar to the other two but, in this specific case, it tracks an index of 50 global companies operating in the water industry. Its top holdings include American Water Works, Xylem, Veolia Environment, Halma and Geberit, which are very similar to the top holdings of WATL. It shouldn’t come as a surprise that the correlation between the two funds’ returns for the last 18 months has been 0.945. This means that buying these two is almost the same as buying two times one of them, and for that reason, investors should be aware of the poor diversification gains of investing in all these funds instead of buying just one.

Again, the country with the largest contribution for the fund is the US, which represents half of the fund’s assets, followed by the UK, France, Switzerland and Canada. The total expense ratio comes at 0.65%, which is the largest of the three funds reviewed. Still, I don’t think that paying £65 per each £10,000 invested each year to be much for a themed fund like this one.

Drink wine, invest in water

At a time when everything has been explored, it seems like there are no areas in the market offering good opportunities. From online retail to clean energy and robotics, everything has been pushed up at the expense of the traditional and conventional business models. These trends have been accelerated by the pandemic. But there are still areas to explore further. The traditional defensive utility company is undergoing a modernisation process. This is no longer about providing energy and water but about using more efficient technologies, revolutionising logistics and mixing digital technologies with conventional businesses. If you have the patience to wait, water is a good theme to add to your portfolio and keep for a few years. In the meantime, while you invest in clean water, you may want to enjoy a glass of Portuguese “Barca Velha” wine to help ease your way through the tricky times we’re living in. Unfortunately, that will cost you more than the £65 in fees to invest in IH2O!

Comments (0)