The Future Is Bright: The Future Is Red

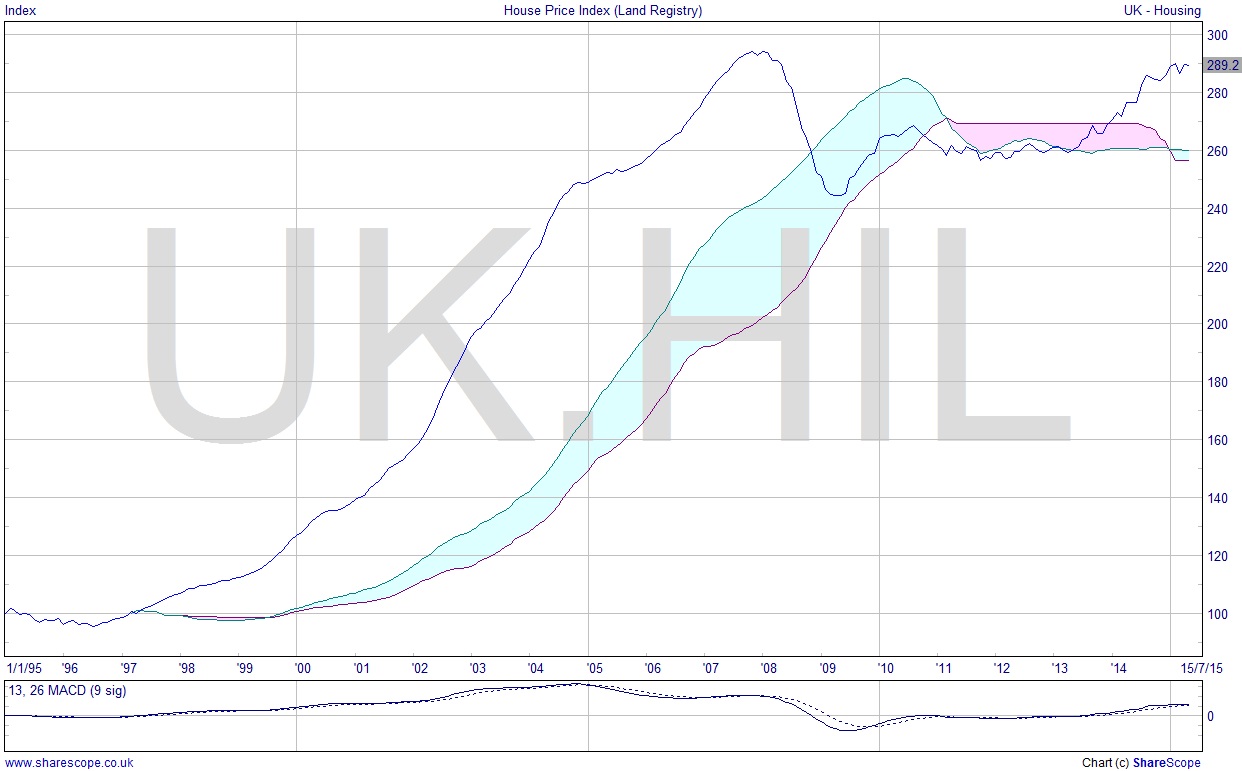

I was talking to a friend about mortgage rates the other day and they were wondering what would happen to interest rates. The short answer is the same as it is in the US. So how likely is it that US interest rates will rise? Increasingly likely I would say. Which in turn would lead to rises here, albeit reluctantly. There’d be repossessions and all those zombie companies that we’ve been supporting would finally go to the wall, prompting a rise in unemployment and falls in house prices.

Japan had their baby boom a few decades before the UK. As a result they had their demographic time bomb go off in the ‘80s. Over subsequent years, the property market in Tokyo fell as much as 80% from its highs. Low interest rates have prevailed since, and the Nikkei 225, which in the late 80’s reached around 40,000, has only ever recovered to around half of that number. It’s presently at 20,522.75.

Most really bad crashes are based on the fact that metrics are expected never to move outside of certain parameters. The sub-prime collapse was caused by these sorts of assumptions, in that case that property prices could never fall, well, at all really. Which was clearly, and now demonstrably, flawed logic.

So back to the UK. If rates initially rise just half a percent, then what? Well of course these things take time to play out. Those on fixed rates wouldn’t be hit until after their fix expired, but those with variable mortgage rates would start to feel it as soon as any savings they have run out, and failing a pay rise at work, would be caught short. They won’t be able to remortgage as they won’t have the income multiple any more. This is also assuming they still have a job. And an increase of even just half a percent, which sounds laughable to those of us who remember paying rates around 17% back in the early ‘90s, would be an extra 12.5% on a rate of 4%, and a greater relative increase on any rate lower than that.

If rates were to then rise further, again due to economic pressure from the Americans raising rates, then we’d start to see the sort of repossession figures we should have seen around 2009. The good news is that would mean lower house prices, because obviously they are a function of the cash available to buy them, and what would be an over-supply. Great time to buy, but do expect the donkeys being repossessed to smash the place up and steal all the radiators and copper pipes for scrap before not going quietly. Been there, seen that!

In terms of companies, these low interest rates have created an atmosphere of businesses being ‘on benefits’. If they’re not hitting profit or sales targets, well it’s not so important, as they can borrow money cheaply to tide themselves over. This has encouraged borrowing that can’t be supported if and when rates rise. I also suspect there are plenty of companies that are doing ‘creative accounting’ to keep their results looking good, and becoming complacent because business failure is happening in slow motion at the moment, giving rise to a false sense of security. Benefits create a climate of irresponsibility, because there’s always a safety net. So do very low interest rates.

I’m betting that within a year or two of rises we’d start to see some household names collapse and their boards under investigation. In the early ‘90s I knew of cases where malpractice became commonplace as a means to an end; for example, one where the old school tie enabled a business owner to illegally ‘borrow’ almost all the funds in his clients’ accounts to support his stumbling business. So don’t be under the illusion that this sort of thing isn’t pretty rife, even in big companies.

Back to the future: higher interest rates would be a good thing. Stacks of opportunities! Imagine house prices at 50% off! And shorting the stock market is much more fun than investing! Seriously, shorting is a much more efficient use of capital than going long. Moves tend to be better signposted and more concise.

Oh but what if rates don’t rise? The same thing happens, just in slow motion, and probably more severe.

The future is bright: the future is red.

Comments (0)