The bond market is your friend

In a stock market crash, the high-quality fixed income segment of a portfolio is all you have to count on.

In a year when technology stocks are up 40% and the broad market is up 12%, it’s tough to convince anyone to invest in fixed income. After all, with yields being so low, why would you exchange the enthusiastic momentum of the stock market for a paltry yield from by bonds?

That’s a fair question to ask. After all, the current US yield curve starts with a yield of 0.07% for a 1-month maturity and ends with a yield of 1.63% for a 30-year maturity. That’s just awful from the perspective of someone trying to grow capital over time to pay for future expenses. If the Fed’s commitment to keep inflation near 2% is to be taken seriously, then you can expect to lose money in real terms by investing on any of these bonds.

However, 2020 has been everything but a normal year. Before rising, the stock market spiralled down into bear market territory back in March. Those who lost their jobs or who needed money had to sell shares at heavy discounts. While the bear market quickly turned around into a bull market, the volatile environment should serve as a warning that, from time to time, stocks crash. When that happens, the high-quality fixed income segment of a portfolio is all you have to count on.

Many believe that the 60/40 stock-bond portfolio allocation is dead. Some go further and argue against holding bonds to any extent, as there are better ways, they claim, to protect against the downside, such as put options, for example. With yields being so low, the opportunity cost of carrying bonds in a portfolio is very high, in particular those of high quality (as they carry the lowest yields). But high-quality bonds are essentially cash and cash shouldn’t be considered a burden. It rather is a means to quickly pay for expenses and buy more stocks when the right time comes. Stock prices rise over long enough periods of time. But that’s a bumpy ride. During euphoric times, investors forget fundamental values and allow stock prices to rise faster than the reality behind them. This often leads to price crashes. Those who hold bonds in their portfolios can hold onto their stock holdings in bear markets, as they don’t need to raise cash through stock sales and they can even use their bond holdings to raise cash to buy more stocks at depressed levels. Stocks are currently expensive, which means this might be the right time to sell them. In my opinion, this is the best time to reduce exposure to stocks and keep the proceeds in high-quality bonds, just waiting for the next opportunity to buy stocks again. This is exactly the opposite of what many investors are doing, but I believe this is a sensible strategy that pays off over time.

The performance of high-quality bonds this year

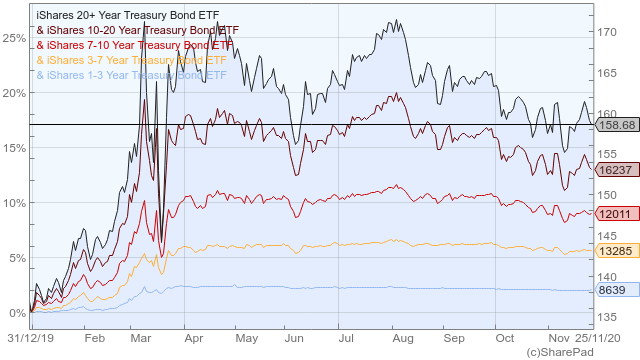

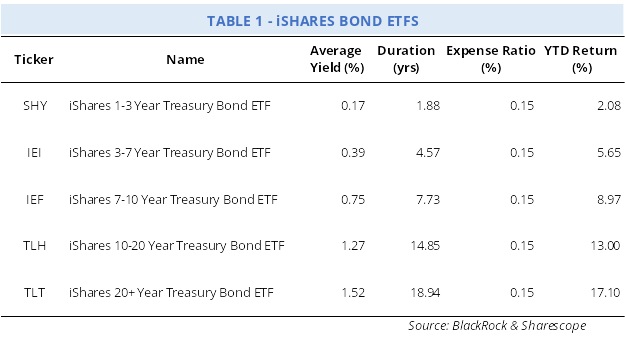

As I already mentioned, 2020 has been all but normal. With the stock market in euphoric mode, we would expect fixed income to perform badly. But that hasn’t been the case so far. Just take a look at table 1, which shows the year-to-date performance of five iShares bond ETFs, covering the full segment of the US yield curve. For the high-quality, risk-free nature of these portfolios and given that inflation has been subdued so far, the performance of these ETFs has been stunning. The shorter maturity of up to three years is up by 2.08%, which more than covers inflation. The longer maturity, of more than 20 years, is up by an enviable 17.1%. These longer-term bonds are outperforming the broad S&P market, which is up 12.3% so far. Additionally, if we look back at what happened between 20 February and 23 March, we can understand why carrying bonds in a portfolio is a good idea. By 23 March, the S&P 500 had declined 33.7% while the iShares ETF (TLT) carrying the 20+ years Treasuries had risen 13.2%. An investor holding both stocks and bonds could at this time use bond holdings to purchase stocks at deep discounts.

For the sake of completing the analysis, let me say that there’s still drawdown risk for bonds and the asset class has also experienced a bumpy ride in 2020. TLT experienced a drawdown of 15.7% in the period between 9 March and 18 March. The decline was smaller than for stocks but still large. However, TLT is the most volatile of the funds from table 1 due to its longest duration. If we take an intermediate duration instead, the iShares 7-10 years ETF (IEF), the drawdown shrinks to 4.7%, while the year-to-date return is still a generous 9%.

In general, bonds provide two sources of return, just like stocks: income and capital gains. In terms of income, bonds have been a lousy investment as their yields are very low. Table 1 shows the average yield for each of the five ETFs reported. The yields range between 0.17% for the shorter maturities to 1.52% for the longer maturities. This means that, on average, you would get between $17 and $152 per year for each $10,000 invested in these funds. But there’s still capital gains to account for, the most important source of returns thus far, largely due to central bank intervention. As the Federal Reserve keeps its key target interest rates low, keeps buying bonds in the open market and commits to keeping rates low for years, it contributes to an increase bond prices across the whole segment of the yield curve. Lower bond prices lead to further declines in yields. But, for those who already own bonds, the increase in price turns into the most important source of return. Price increases have been the key source of return for bond holders in 2020.

Ditch or pitch?

There are many arguments against holding bonds, in particular when the music is playing for stocks. Let’s look briefly at some of them to understand how valid they may be.

Interest rates are ridiculously low. Indeed they are! The current yield curve points to the lowest interest rates ever seen. Fifty years ago, such rates would be considered an insult and demand for Treasuries would be negligible. Thus, we should expect some kind of mean reversion to higher levels. Even Keynes often refer to “normal” interest rate levels to explain the demand for money and bonds.

If rates are going anywhere, it’s up. The Federal Reserve is already targeting a rate of between 0% and 0.25%, which means there’s virtually no space to cut it further without going negative, which is a territory the central bank has been avoiding. If zero is the limit, then it is fair to assume that, if rates are going anywhere, it can only be up.

There’s plenty of alternative fixed income assets. With yields being so low, why buy Treasuries? There’s high-yield corporate debt, municipal bonds, emerging market bonds and even dividend-paying stocks. All of these offer better yields, at reasonable risk levels.

While the above arguments certainly have their own merits, I believe they don’t take into account the full picture. While rates are low, I’m not sure they’re at their lowest point. If inflation remains subdued, the Federal Reserve may cut its key rate into negative territory, as have many central banks across the world. Moreover, the central bank doesn’t need to cut its key rates for yields to decline. This has been pretty much what has been happening in Europe. Expectations about future economic conditions, in particular concerning inflation and growth, are key drivers for the yield curve. At this point, after 10 years of economic expansion and with many economies around the world struggling to grow, the odds of future recession are rising. At the same time, and despite massive central bank intervention, a generalised consumer prices increase is nowhere to be seen. It seems that all the money thrown at financial assets has served to just push their prices higher and disconnect them from the real economy, with little or no effect on consumer prices. Within an environment of little to no inflation, bonds are an attractive investment.

We should also not forget that the pandemic crisis isn’t over yet. Past experience shows that it takes years for viruses to be defeated. The record time taken to develop the vaccines and the enthusiastic reception from the stock market may open space for future disappointment and market corrections. If not, it will at least take time to distribute the vaccine, which means months of further restricted economic activity. Sooner or later, unemployment numbers will grow, despite the current efforts to hold them down through artificial measures that disallow or restrict the permanent dismissal of employees. For all this, I believe central banks still have further ammunition, which will translate into even lower yields. This is in particular the case in the US.

With the above in mind, I believe that bonds still have an important role in a portfolio. They are good at preserving their value, thus allowing us to sell them easily to purchase more stocks when prices decline. But for this to be possible we need a reliable cash alternative, which is where Treasuries fit in well. Meanwhile, higher yield bonds offer higher expected returns but with higher risk, which is exactly what we want to avoid with the bond segment of the portfolio. Higher-yielding bonds are linked to the same sources of risk that impact stocks and therefore don’t fit well in this strategy.

Beware bond duration

Bonds do have some risks. US Treasuries are (almost) free from default risk. You can expect to receive the semi-annual coupon payments and the lasting face value at the maturity date, without a glitch. However, there’s still interest rate risk. It’s important to know how much the price of a bond is expected to change when interest rates change. If you keep the bond until its maturity, this doesn’t matter because you would never sell it and all you get is the current yield at the purchase time. But, if you buy an ETF targeting a segment of the yield curve, like those featured in table 1, duration is an important risk metric to consider. Duration is often measured as the weighted average maturity of bond payments. In other words, it gives the time in years that it takes for you to be repaid the bond’s price by the bond’s total cash flows. Duration is higher for longer maturities and for lower coupon payments. A 20-year zero-coupon bond has a duration of exactly 20 years, as its sole cash flow occurs at the maturity date.

Duration can also be interpreted as the expected bond price change given a 1% change in its yield. Therefore, if the yield on IEF increases by 1%, its price is expected to decrease 7.73%. In the case of TLT, the expected decline is 18.94% and for SHY the drop is significantly lower, of just 1.88%.

Why is all this important? Because only after understanding the relationship between maturities and prices are you prepared to make the best investment decisions.

Choose the part of the curve where you want to be

You can invest in an ETF targeting a specific segment of the yield curve, from the very short-term of less than one year to the longer-term of more than 20 years.

If you’re a long-term investor seeking for a bond component to your portfolio, then you may look at the iShares offer depicted in table 1. There are five products that cover the full spectrum of the yield curve. They are: iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY), iShares 3-7 Year Treasury Bond ETF (NASDAQ:IEI), iShares 7-10 Year Treasury Bond ETF (NASDAQ:IEF), iShares 10-20 Year Treasury Bond ETF (NYSEARCA:TLH) and iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT). Keeping in mind what I said about duration, you can decide on the maturity that better fits your portfolio. The shorter maturities are less exposed to an interest rate hike but provide almost no return while the longer maturities are better at providing capital gains if interest rates decline further and at providing income if they remain unchanged.

Finding alternatives to avoid interest rate risk

If you are willing to invest in bonds just for the sake of matching your savings with future needs, and you want to (almost) completely eliminate interest rate risk, then the best option is to first set your investment horizon and then buy a bond with a maturity date that matches that horizon. This means the only source of return for you is the current yield. However, there’s no price risk, in this case. You can still buy these bonds through ETFs. BlackRock offers a class of iShares iBonds Term Treasury ETFs that offer access to US Treasuries for specified maturities ranging from 2021 to 2030. These instruments are designed to mature like a bond but combine the defined maturity and regular income characteristics of a bond within the transparency and tradability of an ETF. As an example, the iShares iBonds Dec 2029 Term Treasury ETF (NASDAQ:IBTJ) expires by the end of 2029. It currently trades with a yield of 0.76% and an average duration of 7.73 years. Unlike the aforementioned ETFs, duration for these products declines over time.

Maximise exposure to interest rate risk

If you are a speculator wishing to play with interest rates, then you want to maximise the duration of the bond you buy (or sell). For a zero-coupon bond, duration is equal to time to maturity. For this goal you can take a position in iShares 25+ Year Treasury STRIPS Bond ETF (BATSGOVZ). This ETF gives you exposure to US strips with remaining maturity of at least 25 years. This is a portfolio of zero-coupon bonds. The duration is 27.1 years, which means that if yields decline 1%, its price rises by approximately 27.1%. Be careful as the opposite is also valid. This is a rather high impact holding in a portfolio, which means this is not exactly the perfect fit for a stock-bond portfolio.

Minimise exposure to interest rate risk

If you’re not happy with the iBonds product because you don’t want to miss any upside in interest rates, you still have the floaters. A floater, or floating-rate bond adjusts its coupon according to changes in interest rates. In a scenario of rising interest rates, these bonds outperform the others as their coupon is raised. This allows prices to be stable over time, as much of the adjustment comes in coupon rates. In this case, duration doesn’t matter, as you minimise interest rate risk. iShares Floating Rate Bond ETF (BATS:FLOT) offers you exposure to this market. However, I should note that, as expected, the performance for this ETF has been flat, rising 0.82% year-to-date. The protection comes at a cost. This kind of bond is better tailored for someone concerned with interest rate risk, at a time when interest rates are already rising, which isn’t the case yet.

Final comments

When stocks rise no one cares about downside risks and bonds are discarded. But we shouldn’t look at bonds as a burden, in particular the high-quality ones. They’re essentially cash in the portfolio, which helps us pay for expenses during difficult times and buy more stocks when the equity market crashes. What’s important is to understand the risks behind each segment of the bond market and choose the right instruments wisely. In these times of pandemic, bonds retain their appeal.

Comments (0)