The Battle Between CPI and PCE

Central banks have been so fixated on fighting inflation that they have killed it completely. Now they have the reverse problem and need to find ways of generating it again. But, at a time when interest rates are already near zero, central banks need to jump into the unknown world of unconventional measures where quantitative easing and cash bans are just an example of the weird tricks they still have to hand. But none of this is really necessary. The death of inflation was only statistical, as in the real world inflation is still alive and well. All central banks need to do to avoid deflation is return to the old CPI days.

It was in 2000 when Alan Greenspan decided that the CPI index was no longer fit for purpose as the main inflation gauge for monetary policy-setting. In the “Monetary Report to the Congress” of 2000, a footnote reads:

“In past Monetary Policy Reports to the Congress, the FOMC has framed its inflation forecasts in terms of the consumer price index. The chain-type price index for PCE draws extensively on data from the consumer price index but, while not entirely free of measurement problems, has several advantages relative to the CPI. The PCE chain- type index is constructed from a formula that reflects the changing composition of spending and thereby avoids some of the upward bias associated with the fixed-weight nature of the CPI. In addition, the weights are based on a more comprehensive measure of expenditures.”

Alan Greenspan declared the death of CPI and adopted the new PCE chain-index, a major upgrade on the rotten and old-fashioned CPI. Why wait two years for changes to the fixed components? Why even use fixed components? The PCE just offered a much better world where inflation could be measured almost in real time… And, of course, could also look much lower.

Without going into too much detail, let me just point out some features of both gauges. The CPI index directly measures consumer spending, based on consumer habits. Its composition is fixed and doesn’t change from period to period. This doesn’t mean it doesn’t suffer revisions; it does, but these occur every two years or so. The PCE is an inflation gauge with life. It automatically changes composition from period to period depending on the configuration of spending. But it doesn’t just account for consumer spending; it accounts for all spending, be it on the part of consumers, employers, or any other agent. If someone goes to the doctor and pays only a fraction of the total expense while the insurer pays the rest, all that is accounted for by CPI is the change in price on the part paid by the final consumer. The PCE also takes into account the part paid by the insurer. This is a major change to CPI because it will overestimate some categories of expenses while underestimating others. In the end, the PCE is not a consumer price index at all, but an expenditures price index.

A few days ago, Joe Lavorgna, chief economist at Deutsche Bank claimed that “the Federal Reserve doesn’t have a deflation problem; it has a measurement problem”, as he believes PCE is a deficient measure for inflation. I entirely agree with him. Let’s me explain why:

– PCE underestimates housing spending, which is a major contributor to CPI. At the same time, it overestimates medical expenses by considering the expenses made by non-households. In fact the difference between the two is abysmal. The shelter category, which is related directly with housing expenses, does take up 31% of CPI while being minimised to 15% in PCE. Medical care accounts for 7% of CPI but is maximised to 20% in PCE.

– The PCE takes into account substitution effects, which the CPI does not. While at first this may seem like a good upgrade, I’m not sure if that is the case. When the price of a good increases, similar goods become more attractive. Consumers may then replace the goods that became relatively more expensive by other less expensive goods. The reasoning is that what should really be accounted for is what the consumer actually buys and not what he was purchasing beforehand. By allowing an automatic adjustment, the PCE captures this substitution effect. By being updated only every two years or so, the CPI doesn’t capture this, unless the change becomes permanent. Just think about a very simple example. Let’s say leisure and entertainment weights 20% in both CPI and PCE in a given period. Over the next period, average prices in this category increase by 40% and consumers completely replace this category with another. Faced with the price increase, consumers just boycott spending in this category. If all other prices rise by 2%, the CPI would then show an increase of 9.6% while PCE would show a 2% increase. This happens because the PCE would no longer give a weight to entertainment because it did not account for any spending. This way, the FED would be happy with its monetary policy when using PCE because it would see inflation exactly at the 2% level. But in doing so the central bank would be ignoring an inflation problem that was so harsh that it culminated in severe substitution effects. In fact the consumer is much worse off.

– No one else uses PCE. If the government adjusts social security contributions and payments using CPI, and if wages are also indexed to CPI, why is the FED using a different index? Even without recognising that one measure is better than the other, one should recognise that the central bank should set its policy to the standard and not to something else. And, if PCE were that good, why isn’t the government using it?

– Inflation expectations are CPI-based. Inflation expectations are one of the key drivers of monetary policy. When expectations are below the central bank’s 2% inflation target, the FED conducts policy aimed at changing them and driving them towards its long-term policy goal of 2%. But as expectations are linked to inflation while the FED goals seem to be linked to PCE, there is Just look at inflation-linked bonds. Those instruments protect investors against inflation and do reflect expectations on inflation. On which index do they base their price adjustments? CPI.

While the discussion on which gauge is the best would lead to a long list of arguments on both sides, the discussion on which index keeps inflation lower is straightforward:

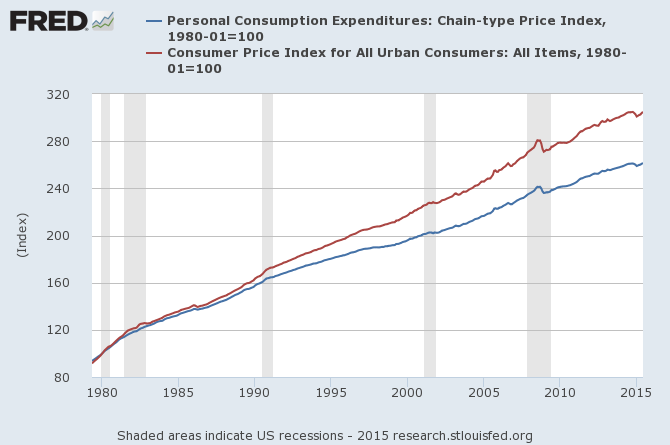

If we take 1980 as the base year where the price of a basket of goods and services was equal to 100, the price of the same (or equivalent) would today cost 248.1 (when using the PCE), or 287.3 (when using the CPI). Only rarely has PCE been above CPI, which clearly corroborates the idea that PCE may undershoot inflation.

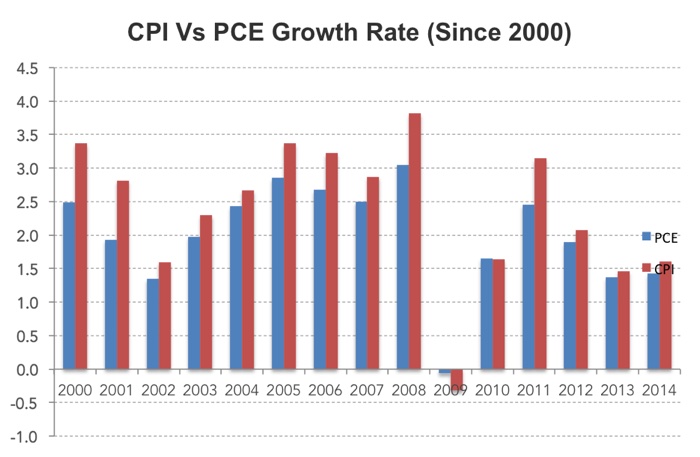

Since adopting the PCE in 2000, average inflation has been exactly 2.0% when measured with PCE but 2.4% when measured with CPI. That is a significant difference, meaning the central bank may be adopting a policy that is too expansionary.

The best thing for the FED to do now is to revert to the CPI index. All deflation fears would disappear. But I guess that would leave less room to keep interest rates extremely low and to purchase trillions of dollars of assets in the future… something that may be of interest to some…

Comments (0)