No Good News Is News

For those that aren’t familiar with it, a leading indicator of economic activity is the PMI (Purchasing Managers Index) and each developed nation has at least one. China has two: one produced by the government, which is not to be relied upon as it adopts the Eastern cultural norm of being over-optimistic and denying failure until well beyond the eleventh hour, and one by HSBC which is considered the standard by investment banks.

Basically the PMI is an index of the answers to key questions about company activity across different industries. Questions like are you sending more or less goods out of the door now than before, do you have more or less new orders. This is what will filter through into company results in months to come, so it’s a great heads up on how the markets will fare in the next few months.

Markit produces a PMI report for the UK, and currently it signals the weakest figure since April 2013, and at 53.3, where anything below 50.0 shows contraction, it’s not far off underpinning a proper recession. It tells us most sectors are struggling out there.

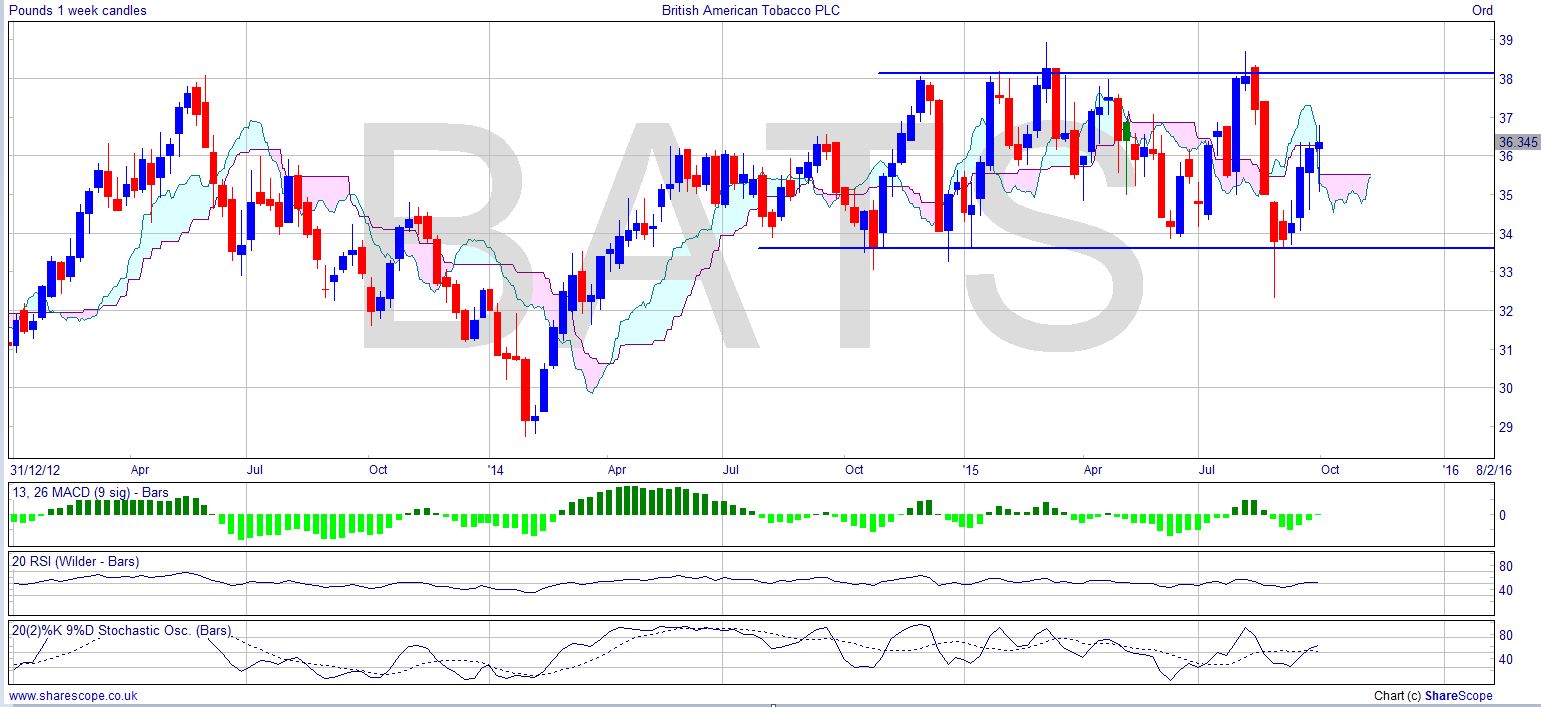

Surrey County Council are the latest organisation to be accused of double standards as they support Stop Smoking campaigns whilst investing in tobacco. The same criticism was levelled at Comic Relief. Unless it’s an IPO then I can’t see how it makes a difference what they buy. In fact it’s all the more ironic, isn’t it, if they’re making money of fag shares to help people quit. No sense of fun, some people. I wrote about the tobacco market back in early June and it was looking good long term. Right now BAT [BATS] is range bound and holding up quite well while many stocks are floundering in the FTSE 100.

The government is preparing to sell the public some Lloyds shares. I remember a Liberal Democrat MP -back when they had enough to not be able to remember which one said something- suggesting that the share certs for each citizen should be sent out and we could sell the shares when it suited us. We’ve all paid through the nose for these shares once, back when the government of the day should have adopted the maxim ‘fail not bail’, and I don’t really want to pay for them again. In any case, Banking is still a damaged sector and worth avoiding. Be careful that if you do subscribe to the public offering that they don’t then take it all back in taxes, increased regulation or fines through their para-military quango the FCA.

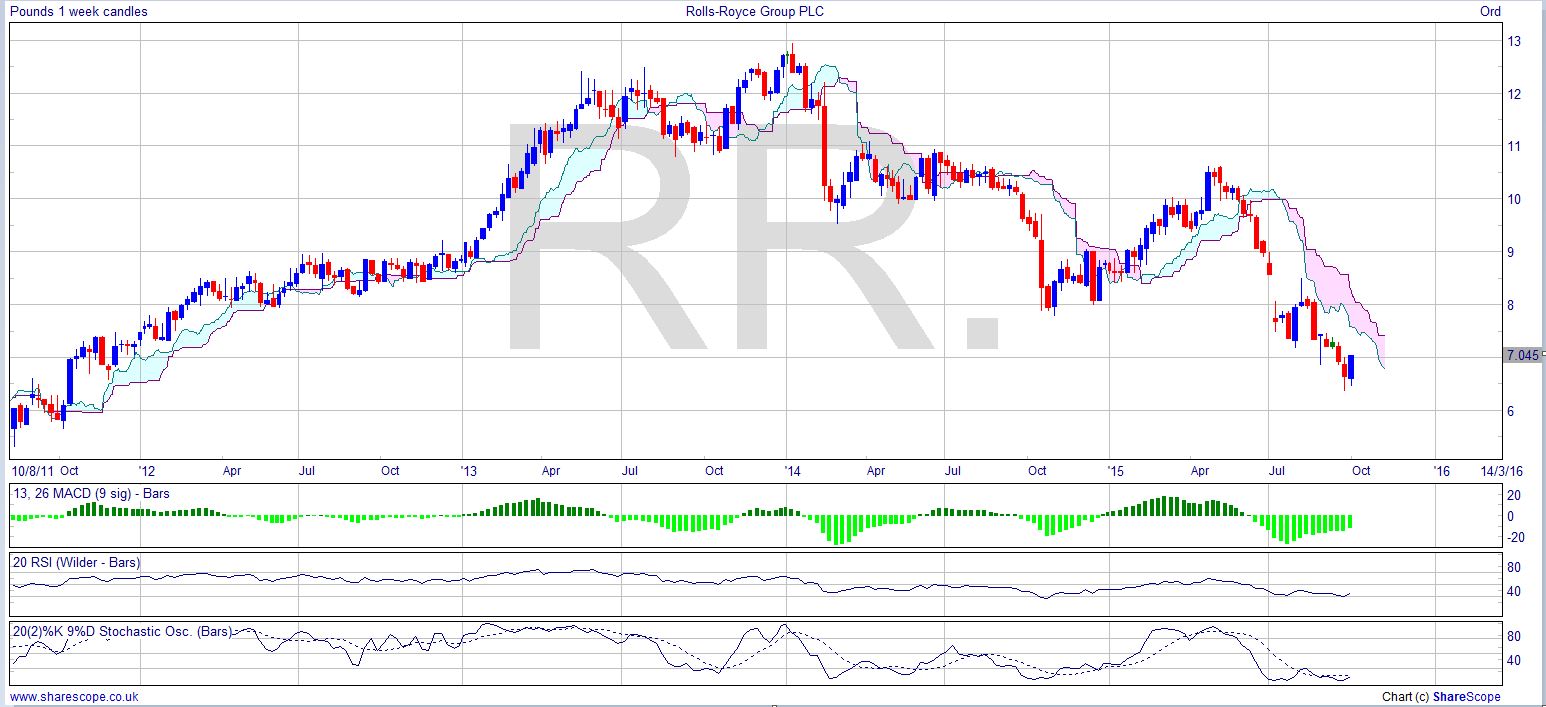

Meanwhile Rolls Royce [RR.] is laying off 400 management employees. Hardly surprising when you look at the chart. I wrote of them in July “Who is still in RR apart from pension funds, forced to stay invested by the straight jacket of regulation?” And that still stands, and they’ve fallen a further 10% since then. Mind you better management to actually lay some workers off than pretend you can borrow your way out of mismanagement.

This is the backdrop against which we have news of a serious lack of business confidence in the UK. It should come as a surprise to anyone who follows my posts!

Comments (0)