Fintech Investing in 2020

Martyn Holman, Partner at Augmentum Fintech, explains why fintech is the undoubted growth driver behind European venture capital.

Amongst the venture capital community, fintech is a regular term that describes any emerging technology that offers the delivery of financial services in a more expedient way than traditional methods. This article tracks the relatively nascent emergence of the sector as a focus of venture funding (which in itself is only slightly more mature), and why we at Augmentum Fintech are excited by the potential for its future.

Fintech: A latent force rises

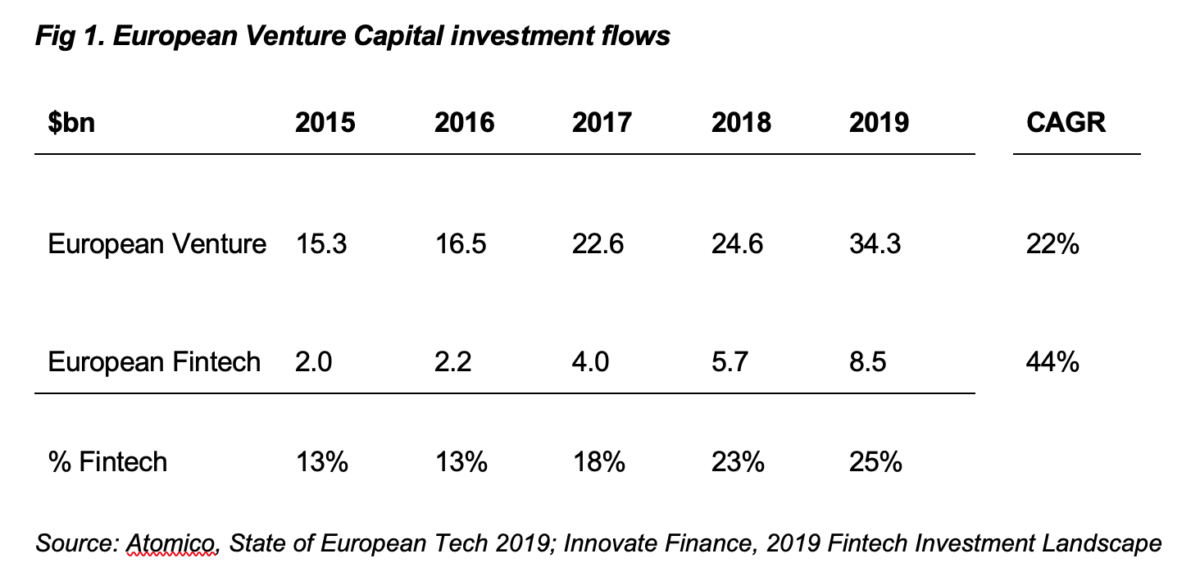

Investment in European Venture Capital as an asset class has shown significant growth since its inception in the 2000s, and particularly in the last decade. In the 5 years to 2019, capital invested per annum in Europe increased by 124% to over $34bn. Driven by a self-strengthening cycle of increasing skills, access to markets, permissive regulation, and critically results, access to capital for early stage tech enabled businesses has expanded rapidly.

Within these numbers lies an even more explosive story. 5 years ago, the fintech segment accounted for less than 15% of total venture capital invested in Europe at $2bn. By 2015 other industry verticals had been quicker to exploit the advantages of digital distribution, task automation and data processing at scale, thus taking the lion’s share of investment capital. Financial services on the other hand with its heavier layers of regulation, its seemingly entrenched customer pools and its apparent capital intensity had seemed destined to take more of a back seat.

Since 2015 however, investment in European fintech has grown at over twice the rate of venture capital as a whole. In 2019 $8.5bn of capital was invested by VC funds in new and emerging financial services business, representing more than a quarter of total capital invested. Today fintech is the undoubted growth driver of European VC.

Beginning of the end? Not even the end of the beginning….

Financial services is by most measures, the largest global industry sector, accounting for between 11 and 19% of global GDP – something in the region of $15trn revenues in 2019. It cuts across all other industry sectors, it is the enabler for world economic activity, daily trade and day-to-day activity for consumers, and businesses large and small.

Despite early encroachment by new entrants, most financial services segments are still dominated by large incumbents who are increasingly slow to react to changing customer needs. Perhaps the segment that has found most traction so far is in payments, but even there most estimates suggest new entrants account for less than 6% of global revenues. The top 6 banks in the UK still account for 87% market share despite the huge successes of the neo banks like Revolut, Monzo and Monese. Within this context, the $8.5bn deployed last year in fintech is simply dwarfed by the estimated $500bn spent each year globally by banking incumbents alone in maintaining outdated and legacy technology stacks.

Just small shifts in the status quo will therefore create opportunities out of all proportion to those seen thus far. By most estimates the Total Addressable Market for Fintech propositions is in excess of $4trn of revenue globally. It is the sheer scale of these markets, and the seemingly inexorable ability of technology to better address the changing needs of consumers that sum up the opportunity available to fintech. And it is this opportunity that is driving ever increasing capital to fintech.

Next wave

Augmentum Fintech is Europe’s first publicly listed fintech venture capital fund. Augmentum focuses on later stage venture propositions, those that have a solid early foundation and are seeking larger sums of capital to scale their growth.

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

As a listed vehicle Augmentum’s capital is “permanent”, meaning that capital returns to the fund when an investment is exited, rather than being returned to directly shareholders. Shareholders benefit from these returns being reflected in the fund’s share price on the secondary market, and the fund benefits from being able to re-deploy the returned capital into new investments. As such the fund is not constrained by the artificial timelines imposed by private fund structures and can accommodate both shorter term and longer-term investment horizons.

The first wave of meaningful innovation in Financial Services has largely addressed consumer facing pain points at the front end of interaction – for example new business models such as P2P lending, and better customer interfaces in the neo banks. Augmentum’s current portfolio reflects this trend with exposure to alternative lending models (iwoca, Zopa, Habito, Previse), neo-banking (Monese, Tide), and new consumer business models (Grover, Farewill).

Looking forward, Augmentum expects that deeper innovation from the application of big data analytics and AI in the middle and back-office environments will likely start to drive ever more frictionless customer experiences at the front end e.g. automated verification (Onfido, DueDil). These experiences will expand the audience of participation in fintech beyond the first-movers into broader markets – a self-strengthening cycle that will drive continued adoption. Augmentum will continue to look for exceptional businesses that seek to exploit these trends.

About Martyn Holman

Martyn has nearly 20 years of experience as an operator, advisor and investor in tech and growth spaces. Martyn’s early career was spent as a strategy consultant with the Boston Consulting Group, consulting with FTSE 50 clients across consumer, energy, financial services and heavy industry. Since then he has accrued 15 years of experience as both an operator and investor in the tech/VC space. He was a key member of the early Betfair team, the UK’s first true unicorn, and later co-founded LMAX Exchange which has since featured as the number 1 Times Tech Track Growth Company. More recently, Martyn has a number of years as an investor and Partner in several UK-based venture capital funds, including Augmentum Fintech where he is currently a Partner.

Comments (0)