Emerging Markets Crisis?

While everyone is concentrating in Greece and the actions taken by the US Federal Reserve, Emerging Markets are collapsing silently. The cracks in the developing economies are deeper than most realise and the risk of a 1997-like currency crisis may catch many by surprise in a not-so-distant future. Instead of achieving a strong financial position, many of the developing countries recently entered a period of increasing leverage, which has led to a huge deterioration of their financial position during the period 2007-2014. A mix of positive events allowed the cracks to go unnoticed and for the euphoria to be perpetuated. But, under a less favourable setting, the cracks are now turning into holes. Still, even though many emerging economies are already being battered, many believe these countries have strong enough finances to sustain the problem and a pool of assets that is enough to keep any currency attacks contained. I strongly disagree.

As I already mentioned in May, rising bond yield in the developed countries tend to open cracks in the emerging world. As soon as investors can get a higher yield on their money if invested in Bunds, Gilts or Treasuries, the opportunity cost of keeping money invested in higher risk assets increases and investors pull out from these assets in favour of higher-yielding safety. We’re no longer talking about investment as a means of expanding an economy’s capacity but rather of speculative money that flows freely and quickly from asset class to asset class and from country to country. A small difference in interest rates may be enough to lead to massive inflows or outflows of money and make countries with less fiscal discipline and unsound finances more vulnerable. The Emerging Market funds attracted large inflows of money during the last few years as investors failed to realise the risks of their investments and were hungrily seeking for a return on their money. But the situation has changed dramatically during the last year and investors are pulling out huge amounts of money from Emerging Markets, equivalent to what happened in 2008 during the financial crisis and in 2013 during the “taper tantrum”.

The problems faced by Emerging Markets are threefold: (1) they have to deal with a “super taper tantrum” related to the first hike in interest rates in the U.S.; (2) they have to deal with slumping commodity prices; and (3) they have a massive problem called China that once was the world’s growth engine but that is now facing a not-so-soft landing. This is an explosive trilogy, one that can turn into a deja vu where the 1997 Asian Financial Crisis is recreated.

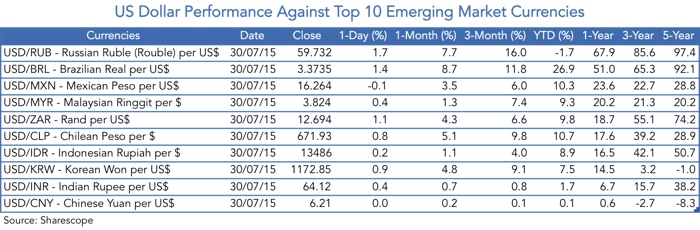

For those who still believe the situation is under control, let me show you the following table where the performance of the US dollar is depicted against the currencies of the top 10 Emerging Markets (in terms of market capitalisation).

In a one-year window the US dollar is up against every currency in the list and with the exception of the Chinese yuan and the Indian rupee, the increase has been exponential. The dollar is up 68%, 51% and 24% against the Russian rouble, Brazilian real, and Mexican peso, respectively. As reported by the FT, emerging currencies hit 15-year lows this week, a metric that should be interpreted with concern and care, as the emerging currencies are a bellwether for investor sentiment. A decrease of this magnitude usually leads to sell-offs in the debt and equity markets. The likelihood of a major slump is increasing.

Another concerning issue is the fact that neither Brazil nor Russia were able to sustain the currency sell-off despite increasing interest rates. The Brazilian BACEN Selic target rate is now at 14.25% while the Russian CBR key rate is at 11.50%. Both central banks have been very active lately. However, neither was able to contain the slump. Many economists believe that Emerging Markets now have a larger pool of assets to avoid a 1997-like currency crisis. But, taking Brazil and Russia’s intervention as an example, I wonder whether that really is the case.

In the past, developing economies were usually happy to see their currencies lose some value against trading partners, as this would give them an advantage in trade, by boosting exports and GDP. But this time, a different mix of events has put these countries in a vulnerable position. When the US Fed started cutting interest rates and injecting liquidity into the economy, the dollar lost value. In 2009, when the US economy started recovering from its recession, the developing world benefited the most. They took the opportunity to cut interest rates to boost consumption and investment while companies increased the pace at which they issued debt, most of it as Eurobonds issued in US dollars. We have lived under loose monetary conditions for almost a decade, which has translated into increasing levels of debt in Emerging Markets. The effects of loose monetary policy in the US may indeed prove very harmful for emerging countries.

Janet Yellen, Ben Bernanke and Paul Krugman – just to name a few – don’t perceive the risks that come from prolonged intervention or, rather, they don’t properly account for the negative effects, such that the final balance seems positive to them. After all, it is all about short-term growth and short-term inflation, and both have been going in the right direction in the US. No need to worry! But while consumer inflation remains subdued and the economy has been given a short-term boost, prices are rising substantially elsewhere. By “elsewhere” I mean financial assets, both in the US and overseas.

With the real economy still lagging and the US consumer not healthy enough, the new money created served partly to boost equity prices in the country and partly to boost the price of assets in Emerging Markets. At a time almost every developed country was experiencing low growth and near zero (or even negative) interest rates, investors found Emerging Markets to be the best possible asset class to invest in. This is not exactly the kind of investment that expands these countries’ output capacity but rather hot money flows seeking out the highest yields, which are always very sensitive to any minuscule change in expected returns. As soon as interest rates start rising in the developed world, one expects the inflows of recent years to be reversed in a short time span. The prolonged easing hugely increases the likelihood of a currency crisis in these countries.

But the story with Emerging Markets doesn’t end with inflows and outflows of speculative money seeking the best yields. A recent study conducted by consultants McKinsey in February shows that global debt has increased by $49 trillion between 2007 and 2014, while it increased by $37 trillion between 2000 and 2007. But while the increase in the pace may be something to reflect on, what is really concerning is the global shift in indebtedness by country group. In the period 2000-2007, developed countries represented 78% of the increase in debt while developing countries just 22%. But in the period 2007-2014, the share has changed to 53%:47% respectively. This means that the pace of increase in debt decreased from $29 trillion to $26 trillion in developed countries and jumped from $8 trillion to $23 trillion in developing countries.

In China, for example, debt has quadrupled since 2007, and no one knows for sure what the consequences of this may be, as there is a growing shadow banking system where complex derivatives are the norm and there is huge off-balance sheet borrowing by local governments. At the same time, a concentration of bank credit in real estate means that the sector is heavily exposed to systemic risk. That explains why the PBoC keeps its own version of quantitative easing through which the central bank buys shares from state-owned banks to directly push up their price…

With interest rates kept so low for so long in Emerging Markets, the incentive to consume played its role very well (Krugman would certainly praise this “achievement”). But household debt has grown accordingly. In Malaysia, the debt-to-income ratio is now 146%. In Thailand the same figure is 121%. Both are unsustainable in the long term. In other countries like China, Brazil and Russia, household debt is currently at sustainable levels, but has increased substantially during the last few years. It has grown from 36% to 58% in China, from 27% to 41% in Brazil and from 17% to 27% in Russia.

In the end we have major distortions created in the emerging world due to the excessive loose monetary conditions within the developed world. In 2013, when the US Fed threatened to tighten policy, Emerging Markets entered a “taper tantrum” state, when they experienced massive outflows. Years later these countries will experience a “super taper tantrum” when the hike in interest rates does actually materialise. During the last few months the outflow from Emerging Markets funds has been huge and the asset class is already underperforming.

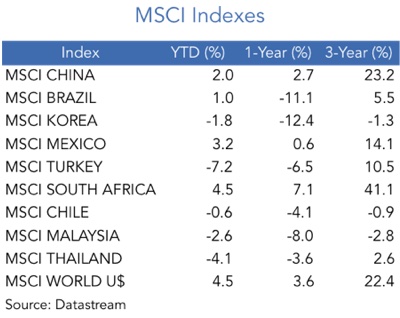

While the MSCI World index has risen 4.5% YTD, almost all country-level MSCI indexes for emerging economies are in the red (or at least below the MSCI World). What has been a great outperformance during the last few years may quickly turn into a huge headache. A new currency crisis is not out of the question, as some countries hold a vulnerable position: running large current account deficits, experiencing high inflation and commanding slow growth. That is the case with India, Brazil, South Africa, Indonesia and Turkey. We should also not forget that China is no longer the world’s growth engine… and that is quite a problem. As always, too much money is invested through credit creation, but that money doesn’t go in the direction of expanding output potential. The result? Debt grows faster than the asset base, until the point everyone realises debt can’t be repaid. Before that time comes, this is a good opportunity to pull out money from Emerging Markets as an asset class.

Comments (0)