Draghi still has ammunition in his bazooka

Earlier in the year the ECB announced its own asset purchase programme to reflate the Eurozone economy. Investors received the news with exuberance and drove equity prices to historical highs. But so much has changed since that moment, such that what looked like the best plan in years is now seen as mere routine, embraced with indifference. A few months ago the debate was based on the legality and effectiveness of such an unconventional step. Then it was about the serious implementation issues it would encounter. After both obstacles were overcome and the programme initiated, it only took a few months for many voices to call for its end as the positive effects were by then already noticeable. But just a few months later, the situation has changed dramatically. If something is to be expected, it is an extension in time and scale of the current programme and not its end. With the Eurozone economy still sluggish, the international picture unfavourable, and all the legal barriers overcome; no one will prevent Mario Draghi from increasing the scale of the current programme, at a time inflation is subdued at 0.2%. A tweak to the current €1.1 trillion asset purchase programme can come as early as today.

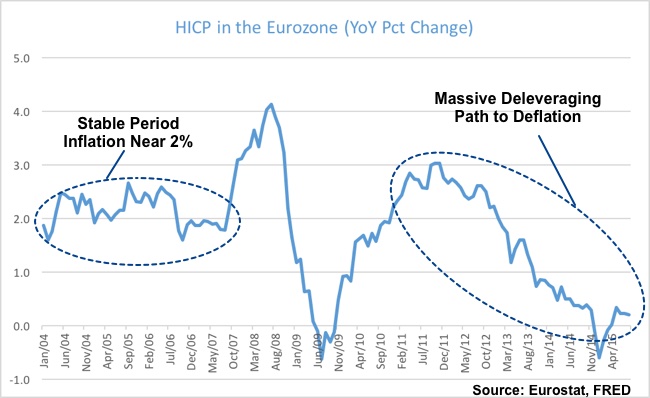

Since its inception the ECB has been a success case in terms of pursuing its main goal of price stability. The central bank has kept inflation very near its 2% target for years. But the situation changed dramatically at the end of 2006 when the inflation rate gained life. At the end of 2007 the inflation rate started rising faster than expected to hit a level above 4% over the next year. But the overshooting of the ECB inflation target was then followed by an undershooting, as the inflation rate rapidly declined to below zero in the course of just one year. The Eurozone couldn’t resist the aftershocks of the Lehman crisis and the negative impact of deleveraging its high sovereign debt levels. The events led to an extreme contraction in demand, forcing the central bank to bring interest rates down to near zero levels and to adopt a few unconventional measures to avoid a deflation spiral. As the US economy started recovering in 2009, the ECB was relatively successful in pushing inflation higher to normal levels, but the achievement was short-lived as inflation lost traction in 2012, entering a downhill ride that ended in deflation in December 2014.

As soon as Draghi saw the negative number, he announced a €1.1 trillion asset purchase programme that is now in its seventh month. At first policy makers praised its success as the brief deflation experienced between December 2014 and March 2015 was reversed. But the latest HICP figures point to an increase in Eurozone prices of just 0.2% in August (YoY), for the third straight month and down from 0.3% observed in May. These latest developments led many to cast doubt on the real effectiveness of the current programme but also serve as support for others to urge for an extension of it. At a time when other central banks are worried about the negative impact a potential policy normalisation may have on their economies, and considering the Eurozone is clearly in worse shape than other developed economies, Draghi has a great opportunity to push for further easing.

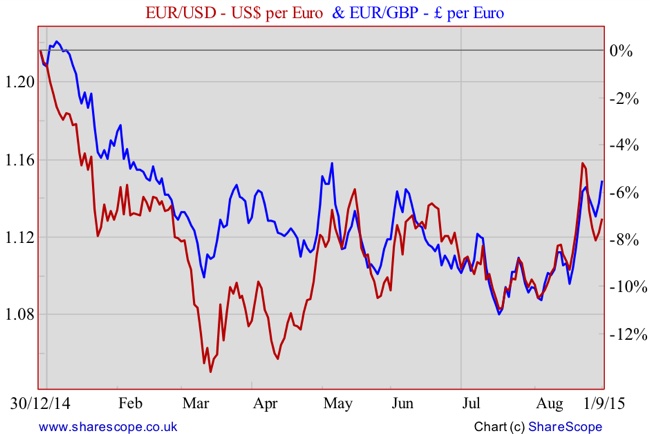

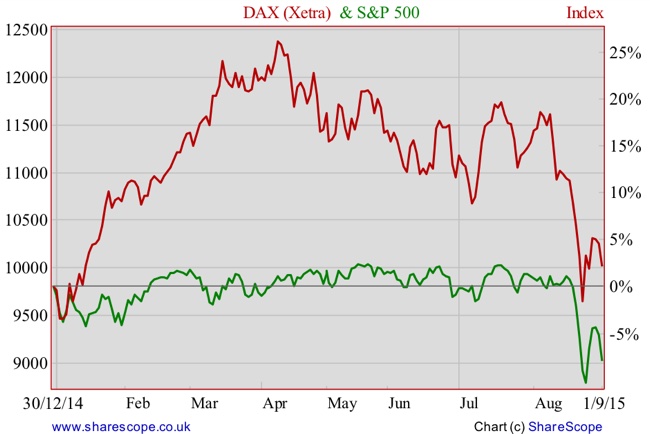

The initial surprise effect of the announcement of QE, combined with the expectations for rate hikes in the US and UK and the improving oil price, all helped the Eurozone avoid a deflationary spiral. But the latest international developments all weigh negatively. First of all, the US Federal Reserve and the BoE are clearly postponing for the first rate hikes; second, China is growing much slower than anticipated and currently faces severe financial turmoil; third, some emerging economies are near a currency crisis; fourth, oil prices resumed their slump (now having accumulated an 18% loss YTD on top of a 48% loss last year); fifth, the Euro is rising again (turning import prices cheaper and further contributing to a decrease in inflation); and sixth, the equity markets, once up by almost 25% on the year, have reversed gains almost entirely (weakening one of the most important transmission channels the ECB was counting on). These are more than a handful of reasons for Draghi to act rather than to wait.

While I am still not sure whether Draghi is willing to do it today or later, I am sure he will extend the current programme as soon as inflation turns negative again. The ECB has been giving some clues it is willing to act. Speaking last week, ECB Chief Economist Peter Praet pointed to slower growth in emerging economies and falling commodity prices as key drivers of intensified deflation risk, opening the door for further ECB action. During the Jackson Hole Economics Symposium last weekend, Vitor Constancio, the ECB Vice President, gave additional clues that the ECB should do something if inflation does not head towards the central bank’s target.

While the US and UK economies have been gaining some traction in terms of growth and job creation, the Eurozone economy is moving in slow motion. The latest data show Eurozone GDP growing 0.3% in the second quarter, down from 0.4% growth during the first quarter. The unemployment rate is now at 10.9%, a three-year low, but a figure that is not only much higher than in the US and the UK, but also significantly above pre-crisis levels. This kind of growth path is not enough to boost demand and lead to higher prices, thus constituting a risk the ECB will certainly take into consideration.

All the above make the case for the ECB to enhance its current policy through a mix of: (1) extension of the programme beyond September 2016; (2) elimination of the restriction on the amount of bonds the ECB purchases from each member country; and (3) expansion of the current €60 billion monthly purchase target.

While I believe the adoption of massive unconventional policies leads to major distortions in the economy by artificially inflating the price of assets, leading to wrongly-formed decisions, and redistributing wealth; I also believe the ECB largely ignores those effects and is desperate to generate inflation. This will push them into action and will create opportunities for investors, as equities will be boosted once again.

The ECB “Shadow Council” (which is a panel of top European Economists convened by the German newspaper Handelsblatt 4-5 times a year to anticipate the ECB monetary policy decisions) expects the ECB to take further action to stimulate the Eurozone. They expect it to occur as early as today. The panel anticipates that inflation will remain below target at 1.1% during next year, which is also below the ECB 1.5% projection. While not agreeing on the exact form the action will take, they believe this will most likely happen this year.

While I am not willing to guess whether action will be taken today or not, it is becoming obvious that ECB policy makers are really concerned with current economic developments and that they are prepared to extend the current programme at the first sign of further deterioration. An extension of the current programme beyond September 2016 is a possibility but something that isn’t strong enough to lead to visible results. The ECB will be looking for something that can surprise the market, which suggests an increase in the monthly limit and the abandonment of country limits. With German sovereign debt yielding negative or near zero rates, there’s no point in spending 25% of the ECB ammunition purchasing German bonds when there is debt from other countries with much higher yields. The ECB needs to remove country quotas.

With all the above in mind I expect the ECB to act during the next few months (if not today) and to contain the Euro appreciation. The current differences in the business cycle don’t justify the rise in the euro that occurred over the last few weeks and the direction will most likely reverse again.

Regarding the equity market, Europe continues to be the best market to bet on. With the DAX unable to retain its 25% gain it achieved at one point in the year, the prospects of further action give investors a second chance to enter. At the same time, European markets don’t look overvalued as US markets do. Cyclically Adjusted Price-Earnings ratios (CAPE) are below 15x in most Eurozone markets while the same is 24.5x for the S&P 500.

But the best opportunities are in smaller Eurozone economies that were battered with austerity measures. In particular Portugal seems like one of the best opportunities. The market is greatly undervalued showing a CAPE ratio below 10x at a time when the economy seems to have found some footing. The unemployment rate is finally decreasing at a decent rate and the economy started showing some growth while inflation is picking up at a pace of 0.7%.

Comments (0)