BoE Delays Rate Rise but Time Is Running Out

In its first triple release, dubbed “Super Thursday” – a triple bill of data comprising the MPC monetary policy decision, the minutes from the decision and the inflation report – the Bank of England kept its main interest rate unchanged at 0.5pc. While the decision was widely expected, there are a few points that are worth taking note of, with the first being the fact there was only one dissenter from the “no change” camp.

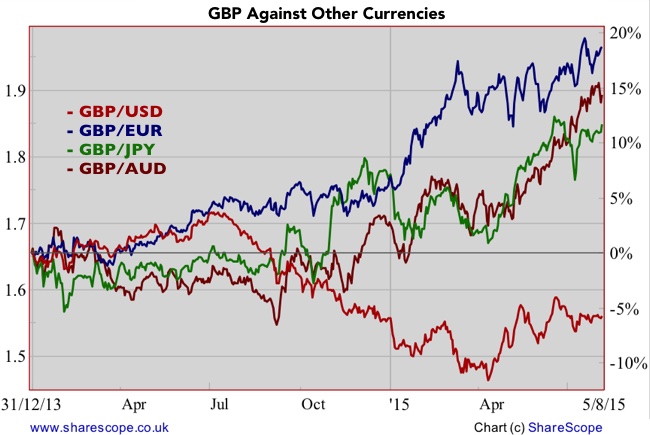

In contrast to the last rate decision, it seems that Martin Weave decided not to join fellow hawk Ian McCafferty, who voted for a rate rise to 0.75pc as expected. This single event has pushed forward expectations for the first rate hike, and has seemingly been confirmed by the subsequent comments from Bank Governor Mark Carney. Expressing concern about the current subdued inflation rate and about the effects of a strong pound, Carney reflected the views of a less hawkish MPC this time round.

To counterbalance the dovish view, the BoE revised upwards its 2015 growth forecast from 2.5pc to 2.8pc and now expects the economy to grow at a pace of 2.6% next year. Carney also hinted at productivity gains and pointed to economic expansion (not just recovery), which he believes will translate into wage growth that will ultimately push inflation to its long-term target.

But while everything seems to be moving along nicely, the BoE is still shy to move on. Mark Carney prefers to follow in the footsteps of Janet Yellen – who has been entertaining the market with word puzzles while postponing the first rate hike – rather than lead the world towards reversing the direction of monetary policy. Central bankers are more careful than ever, as they fear the potential reaction from financial markets.

The BoE mentions the potential effects a strong pound may have in terms of trade and inflation as a reason to keep the status quo. But the main reason why the pound has been rising is because Britain’s trading partners are ailing under a prolonged recession while the British economy is now growing again. Ultimately, the direction of the pound is not in the hands of the BoE, as the exchange rate reflects differences in growth across countries, at least over the long term. Sooner or later a hike will occur and it will be sooner in the UK and later in the EU. Carney may play with the exact timing but cannot do much about the medium-term path followed by the pound. The ECB will keep rates unchanged for a long period of time, as the EU economy is in a different phase of the business cycle. This will press the pound higher and is no excuse to keep rates unchanged, unless the BoE wants to lose its monetary discretion and adopt a model similar to Switzerland and Sweden, under which it could target some EUR/GBP rate level. But, as we have seen, sooner or later it ends badly (FXCM will certainly corroborate it). And in that case, it would surely be better to adopt the euro and have a word on the policy committee.

Regarding the concerns expressed about the effects of the commodity slump on inflation, we know that these effects are temporary and should be disregarded when setting policy. Central banks can’t use core inflation measures when oil prices are rising to justify lower rates and then revert to headline measures once oil prices are falling again to justify lower rates. Theory says that the effects of oil and other commodity prices in inflation are temporary and thus should be treated as such. Besides, I don’t believe the British consumer has been negatively impacted by commodity prices. The slump in prices started many months ago and the British consumer has not refrained from spending. On the contrary, the British economy is now far stronger than before. Were we talking about the FTSE index, the story would be far different, as it is heavily weighted to commodities.

In my opinion, the BoE sees a strong case in favour of rate hikes, but it will delay the first hike to allow the Fed to move first. No one wants to be the first. After so many years of near zero rates, central bankers fear the market reaction to their first rate hikes, as if they were about to raise rates from 0.5pc to 5pc all at once. But, as far as the economy is concerned, it is time to start regaining a much-needed cushion for any downturns that may occur in the future. Excluding the small decline of 2.2% in 2011, the FTSE 100 is about to celebrate its 7-year bull market. After seven years, a bear market may come sooner rather than later. At this stage, rates should have already been normalised.

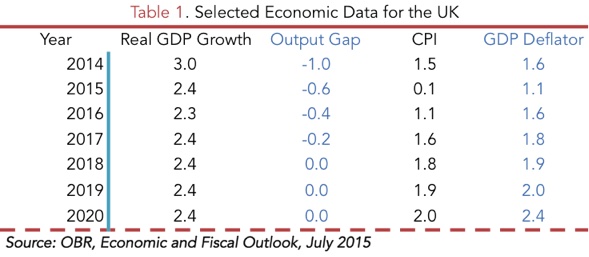

I know that central banks fear they might derail the current economic recovery and thus want to be triple sure before moving, but it is difficult to justify the current rate level. The following table shows selected economic data from the Office for Budget Responsibility, as updated by the Economic and Fiscal Outlook released last month.

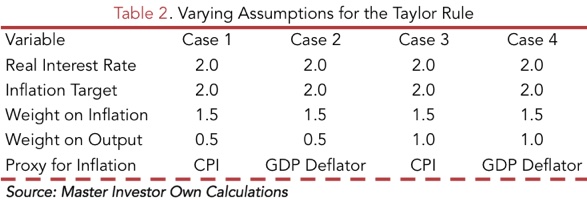

The OBR predicts a gradual increase in inflation to its long-term level and suggests the output gap will disappear by 2018. At a time when the output gap is projected at just (0.6%) and inflation seems to be only temporarily low, the current level at which the interest rate lies is completely unjustifiable. Not that I believe monetary policy should follow strict rules, but the existence of some rules serves as guidance against which any discrepancies should be justified. The Taylor rule is always a good metric to serve as guidance, as I explained here when discussing the Fed’s policy back in April. Because there are several variations of the rule regarding the proxy used to measure inflation and the weights given to the output gap and the inflation gap, let’s consider four different alternatives for the British economy, as depicted in table 2.

Cases 1&3 basically use the CPI as a proxy for inflation while cases 2&4 use the GDP deflator (as originally used by Taylor). Cases 1&2 give a weight of 1.5 and 0.5 to inflation and output respectively (again, as originally used by Taylor) and cases 3&4 attribute a weight of 1.5 and 1.0, more in line with Ben Bernanke’s model. The question that arises at this point is this: Does the current policy rate find any justification in Taylor’s rule?

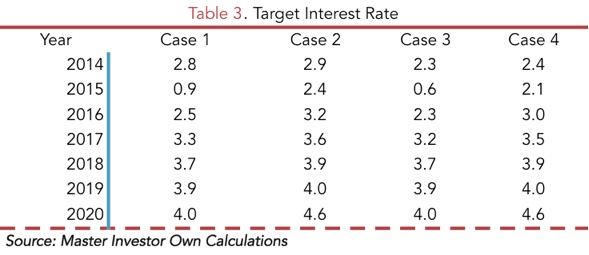

The most standard case would be case 2, which uses the original GDP deflator and 1.5/0.5 weights. According to this base case, the current policy rate should be 2.4%. When using the CPI instead, the rate falls to 0.9% and when using CPI and attributing a heavier weight to the output gap its decreases to 0.6%. In my view, and according to the data released by the OBR (and also by the BoE today) the 2015 CPI seems to be capturing a temporary decrease in prices. Everything points to an increase over the next few years. When setting its key rates, the central bank should base the decision on its predictions and not in the past observed values. According to the picture depicted in table 1 and table 3, not even the extreme cases justify the current 0.5pc rate.

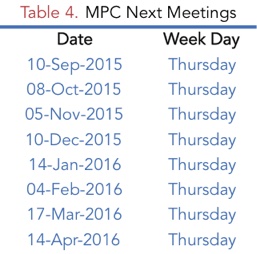

Let’s put it another way. According to the economic projections, both inflation and the output gap are expected to approach their long-term (or equilibrium) levels during 2018-2019. When that happens, the interest rate should be around 4%, which is often seen as the equilibrium long-term rate. But, according to the latest MPC meeting, the Bank seems to be comfortable with postponing the first rate hike to 2016. This delay increases the likelihood of the BoE having to move in a faster pace than everyone is anticipating, at the risk of creating severe economic distortions.

Finally it is worth mentioning that at a time when the economic recovery is plainly evident, the failure to raise interest rates is a sign of weakness. The central bank gives the market a clear sign of distrust, which has a negative impact on investment and consumption decisions. While rates are kept at a minimum, many investment decisions will be delayed. This may sound awkward at first, but it is much like what happens with asset prices and airline tickets. Before seeing the first rise, everybody keeps delaying decisions; when the first rise occurs, and as long as it is not too wide, everybody will finally wake up and start buying, before the rise continues. Time is running out.

Comments (0)