Ben Bernanke and the Taylor Rule

The problem with central banks is that they initially wanted to be independent from us but now they want us to be dependent on them.

Many years ago, there was a time when economic policy was part of a government’s list of affairs, with both fiscal and monetary policy being part of it. But, for the sake of price stability, a new, modern central bank, independent from the government (and thus from political will), was created. Its sole aim was to ensure price stability. Monetarists and Keynesians (and other related and unrelated schools of thought) disagree on everything but one issue: in the long-term monetary policy does not derive any real effects, as prices are flexible and adapt accordingly.

With the above observations in mind, the best would be to let the government decide on what the best fiscal policy is (allowing it to use its fiscal tools to smooth the business cycle), while giving an independent central bank the role of assuring that prices are stable over time (as there is no trade off between inflation and growth/employment in the long term). Thus, no matter how sensitive a government is to the unemployment rate, monetary policy doesn’t help it achieve a better outcome in the long term.

To help central banks define their policy, John Taylor wrote a paper in 1993 where he defined a rule (later to be known as the Taylor rule) which establishes a central bank’s policy rate as a function of the real long-term equilibrium interest rate, the output gap and an inflation deviation from a target inflation rate. The equation set forth by Taylor is one of the simplest rules that can be used at setting monetary policy and is relatively easy to understand. It goes as follows:

i = r + p + 0.5 (y – y*) + 0.5 (p – p*)

The main idea is that the policy rate (i) should increase when the inflation rate (p) rises above its target (p*) and when GDP growth (y) rises above its potential (y*). The formula predicts that the central bank,

- Should increase its policy rate 150 basis points, when inflation rises 100 basis points;

- Should increase its policy rate 50 basis points when the output increases 100 basis points.

So, let’s suppose the economy is at full employment at 5% and inflation is at the target rate of 2%. If the long-term real equilibrium rate (r) is 2%, then the policy rate should be set at 4%. If GDP then rises an additional 1% to 6%, the policy rate should be hiked from 4% to 4.5%. Had a similar change occurred in the inflation rate instead, from 2% to 3%, the required increase in the policy rate would have been of 1.5%, from 4% to 5.5%. The higher sensitivity to inflation is a natural consequence of what was said above – i.e. that over the long-term increases in the money supply can’t drive growth higher but they rather only create inflation, as prices adjust accordingly.

The inclusion of a sensitivity parameter to output deviations in the rule is a recognition that an increase in output above its full employment level will generate future inflation and thus is a complement to the price stability goal. When the economy is growing below its potential, inflation pressures are lower and the central bank doesn’t need to increase its policy rate as fast in reaction to the current inflation rate. The output term of the rule is more related to the long-term risks to the price stability objective than to the aim of boosting growth. Not that I’m saying the central bank shouldn’t care about growth; it should, but only in the sense it derives consequences for price stability. That happens because, in the long run monetary policy can’t derive real effects, and in the short run, growth may be the result of a trade-off that requires political judgement that best falls under a government’s mandate.

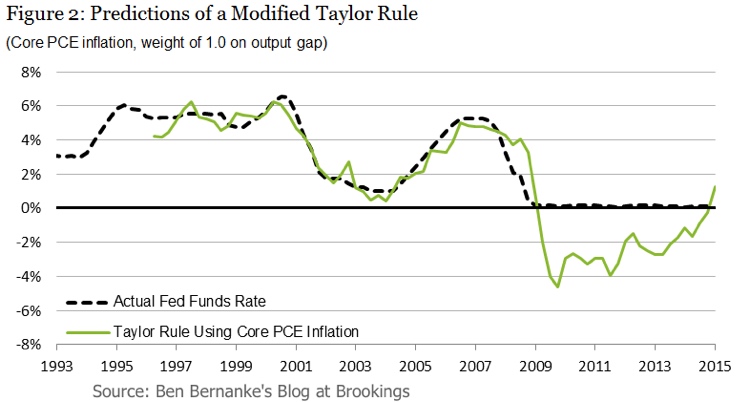

With all this in mind, we can apply the Taylor rule backwardly, using the historical data that served as a basis for policy action in the past and then compare the results obtained with the effective policy rate that was set by the Fed. I have done a similar exercise in a prior blog (http://www.spreadbetmagazine.com/blog/expect-the-fed-to-hike-rates-very-soon.html), but as it uses a slightly different methodology, let’s stick to an estimate made by Ben Bernanke in a recent blog he wrote (http://www.brookings.edu/blogs/ben-bernanke/posts/2015/04/28-taylor-rule-monetary-policy).

The above figure shows that had the Taylor rule been applied, the policy rate would have been often higher than it really was. In fact, Taylor has been criticising the Fed for not following the rule, claiming that in the period 2003-2005 the Fed kept interest rates too low, which make it partially liable for the booming house prices and the financial imbalances that proceeded. He additionally claims that the current near zero interest rate policy should have ended years ago. If Taylor is right, the Fed has a major role in this century’s great financial imbalances.

But, of course, not all agree with Taylor’s view. First of all, Taylor advises for a rules-based monetary policy as opposed to what central banks actually most like to pursue – a discretionary policy, allowing them to go the extra mile when they believe they need to. Second, as Ben Bernanke points out in his blog, the real world is too complex to be accounted for in such a simple rule. Ben Bernanke redefines the Taylor rule with two major changes:

- He replaces the original GDP deflator for the core PCE price index;

- He attributes a higher weight to the output gap term in the equation.

He then proceeds to re-estimate everything and compare the results with the Fed’s policy. The chart below reflects the modified rule.

Now there is justification for the past Fed action for both the 2003-2005 period and for the long period of near zero interest rates, where the rule advises for a negative rate and thus justifies the use of unconventional tools as QE. But with Bernanke having been the Fed’s chairman during the largest part of that period, it shouldn’t come as a surprise that the data fits so well. Nevertheless, the main issue here is with the redefinition Bernanke (and the Fed to some extent) makes to the rule to justify the past monetary policy action. Not that I believe a blind, rules-based policy should be applied mechanically, but modifying a rules-based indicator to justify a large divergence and extend the initial central bank’s mandate is problematic. In Bernanke’s words:

With respect to the choice of the weight on the output gap, the research on Taylor rules does not provide much basis for choosing between 0.5 and 1.0. However, the choice of 1.0 seems best to describe the FOMC’s efforts to support job growth while also keeping inflation close to target in the medium term.

I partially disagree with Bernanke’s comment. While a weight of 1.0 may better reflect what the Fed has done, it doesn’t necessarily reflect a more effective action to keep inflation within the Fed’s goal while supporting the economy. As I stated before, there is a strong justification for a central bank to pursue a price stability goal, but the same does not apply to a growth objective. The output gap in the equation should be interpreted more as an indication of overheating (and thus future inflation) rather than as a second goal for policy action. While there is not enough empirical evidence to support a specific weight, it seems reasonable to accept that the weight afforded to inflation should be higher. In increasing the weight afforded to output, the central bank is reversing its initial mandate and claiming a larger share of economic policy (which should be under public scrutiny). In terms of literature on the topic, it would be easier to justify a complete absence of the output gap in the equation than an increased weight given to the output gap because of the neutrality of money over the long-term. Regarding the short term, output fluctuations are still better tackled by the government through fiscal policy.

The change in the Taylor rule results in a recommended policy rate that is lower, justifying the effective level of interest rates in the pre-crisis period of 2003-2005 and the massive unconventional intervention in the prolonged period of 2008-2013. By using two simple tricks – replacing the GDP deflator by the core PCE price index (to keep inflation lower) and giving more weight to the output gap – the Fed justifies its actions, which is a major distortion of its mandate. For the sake of boosting output (which we know the Fed can’t reliably do over time), the Fed kept interest rates below their natural levels, leading households, governments and companies to take financial decisions based on erroneous assumptions.

Companies have been investing in projects that have a negative NPV (net present value) but look profitable because of an artificially low interest rate. Consumption and investment are both possible to attain at the same time through credit creation, while savings are decreasing over time. Some like Ben Broadbent, deputy governor of the Bank of England, believe that central banks are just accommodating the market and that the policy rate is just the result of lower rates required by the market. He believes that the natural, unmanaged interest rate is now very low, if not negative. But that couldn’t be further from the truth. The natural level for an interest rate should reflect the level of savings in the economy. When the stock of savings in a country is high, the population is willing to exchange more of their present consumption for future consumption. As a result, the interest rate decreases. But unfortunately, the reality the UK faces lies in the opposite direction, as the current savings rate is negative, which means the country’s natural interest rate level is high, much higher than the current managed level. This just means that current policy is unsustainable and will eventually crack.

Extreme central bank intervention, facilitated by major tweaks central banks have made to their mandates, have been leading us from crisis to crisis, from price bubble to price bubble. The developed world is desperate as it is no longer able to innovate and increase productivity at even single-digit numbers, which are the basis for wealth creation. Printing money out of thin air does not create wealth, it create bubbles.

Comments (0)