Will Gold Hold?

The resurgence in gold has been remarkable. Since its gloomy low less than three months ago it has risen by more than 20% and, despite a recent recovery in equities spurred by a single economic indicator suggesting the US economy is not as bad as everyone thought, is still forging upwards. So much so that BlackRock’s key gold ETF fund has had to throttle back the investors flocking in.

It looks as though momentum has taken over, as it also has, apparently, for oil. And while some retracement is obviously possible, it seems unimaginable that gold’s determined rise, bursting through so many indicators and term averages on the charts, will peter out very soon. At the very least, the gold chart is telling us that investors’ appetite for a counter to any global problem is on a hair trigger. My bet is that with the BIS’s (the central bankers’ banker) warning of the world’s over-indebtedness and “growing perception in financial markets that central banks might be running out of effective policy options“ we won’t see those gold lows again.

It can’t be emphasised how important this recovery – a full $200 per ounce of gold – is for the economics of gold miners and therefore for the share prices of those junior goldies I have been describing. As is the prospect that so many of them – waiting up to now for the funding that has been held back by gold’s weakness – will now, after a few months for them to gather their wits, spur the financiers to sign up. With a price around $600-$800/oz at which their mines would break-even, gold’s recovery from $1,050 to $1,250 has at a stroke increased their potential profit from a gold ounce sold by 45% for the lowest cost mines and by 180% for the highest.

This highly geared potential is why, having been an equity analyst covering most sectors for 40 years, I spend my remaining years looking at miners for the spectacular potential that mining stocks can offer an investor who gets his timing right. That’s easier said than done in the face of the last eight year mining bear market (save for a brief respite in 2011). But for the last few months I have been on the right track at last! It’s not just gold: even copper (and platinum) is off the bottom, explaining why Antofagasta, the world’s biggest copper miner in the world’s biggest copper producing sub-continent, reached 45% above its recent lows (although it has been relapsing again with some commentators wary of the price recovery). It is also one reason – though not the only one – why in the next article I will be looking up from my long-standing aversion to early stage explorers, and examining one such (Solomon Gold (SOLG)) who I think will be as interesting to follow as the near-term producers.

Back to gold developers… While gold’s recovery has been mirrored in the share prices of the large multinational producers – Randgold, Goldcorp, African Barrick etc. – all ahead by between 50% and 100% – it has yet to be fully reflected in the share prices of many of the juniors still waiting to start their projects. If gold holds, it can’t be long before they follow suit.

Of course, some goldies might be benefiting this week from the PDAC (Prospectors and Developers Association of Canada) annual knees-up in Toronto where, traditionally, miners talk face-to-face with the money men. So depending what gold does, we might see a pause in goldies’ shares when they all go home.

But to recap in the light of an even higher gold price than when I commented last month, what follows illustrates the transformation in prospects brought about by the higher gold price for just two companies I flagged as marginal only a short time ago with gold below $1,100/oz.

Hummingbird (HUM), which is still waiting for Taurus to confirm funding for its Yanfolila gold mine, is ahead from a 12.5p low to 20p – not just because “he’s at it again” (that broker who totes share price ‘targets’ (70p for HUM) without correcting for the finance costs and share dilution that will substantially reduce (or sometimes increase) any honest calculation of share value for holders after the capex has been raised). In Hummingbird’s case, and because his method is wrong for a project like Yanfolila, which is to be 100% debt, rather than equity, financed, his ‘target’ is actually lower than is produced by the correct method.

Just in time for the gold recovery, Hummingbird has come up with a revised mining plan that even without a higher gold price will deliver a considerably higher NPV (at the project level, not at the shareholder level – I have explained the difference ad nauseam) than at the last count.

Taking together a $150/oz higher assumed gold price at $1,250/oz, and the revised plan, the project NPV at a realistic 8% discount rate is now $162m compared with the $88m we were working on before, still for the same $79m upfront capex. But the measure which really illustrates the jump in value is the IRR which goes from 37% to 60% after tax, with payback accordingly reduced to less than two years – very substantial improvements that, surely, are enough to persuade financier Taurus Finance to confirm its offer for the full $79m.

Because that funding is to be by way of a 100% loan (although I wouldn’t be surprised to see a modification to include some equity) the gearing works strongly to the benefit of the present, undiluted, equity shareholders. Their share of the ‘Gross’ Present Value – which I have previously explained is the long-term return to be apportioned between shareholders and finance providers once the capex has been made – now becomes $167m instead of $93m. (Previously it was $79m+$88m less the PV of loan and interest repayments of $74m – i.e. $93m. Now it becomes $79m+$162m less $74m – i.e. $167m.)

On present diluted shares in issue of 120m, that equates to a ‘genuine’ PV per share of $1.39, or approximately £1.00. That broker’s ‘target’ of 70p presumably comes about because he doesn’t understand how wrong it is to divide the project NPV by current shares, and so misses the gearing effect when no equity raise is involved.

That, of course, is not to say that £1.00 is a valid ‘target’. As I have explained before, it is in fact the long-term ‘value’ of the project per current shares in issue, from all profit earned over the 10 year life of the mine. No sane investor – certainly no institutional investor – will pay that same price now for value to come over a long future period. Instead, if he wants to make a profit from the shares, he will only pay a fraction. And in any case, Hummingbird won’t be paying out those profits and the cash it will be generating as dividends, because it will probably plough them back into developing its next mine at Dugbe, which promises to be larger than Yanfolila, if somewhat less profitable.

By saying that, I’m not denigrating the shares which appear to have among the best long-term potential around. It is just that the value will take time to be realised, so that sensible investors won’t be chasing the share price up to anywhere near that broker’s ‘target’ or my own ‘long term value’. And one more thought. With prospects and ‘value’ now better, and the share price stronger, Hummingbird would be missing a trick if it doesn’t raise more equity, even if not needed for Yanfolila. With such good value already, such an equity raise won’t be too damaging. But per share ‘targets’ will have to be adjusted (down) accordingly.

The other company whose prospects are now improved if not yet transformed is, of course, Kefi Minerals (KEFI), with its Tulu Kapi project. It, too, has also come up with a revised plan, which adds an underground mine beneath the present plan’s open pit and, it claims, will increase its ‘share’ of the project NPV to $150m at $1,250/oz gold. As ever, one ‘commentator’ (not the house broker) has pointed to this (10 times the present market cap) figure as indicating the shares must be 1/10th their proper value. Suffice to say this is wrong, because not only do we still await the full funding arrangements for Tulu Kapi which will include a large chunk of ‘streaming’, with its accompanying high cost to be deducted from the NPV, but the extra profitability underground which increases the NPV will only kick in after 2022 so that, again, no sane investor will pay now, for extra value that far ahead.

But it is this enhancement to the long-term economics (and misperception of its consequences) that seems to have kicked Kefi’s shares upwards, rather than the improving gold price – hardly the most logical behaviour! That’s not to say that my feeling a month ago that Kefi’s shares aren’t primed to perform once all funding is in place by the promised July date is wrong.

A quick mention of Aureus Mining (AUE). As I suggested last week that they might, the shares made a substantial ‘relief in the absence of further bad news’ bounce, doubling in four days to 9p.

I wish I’d been there. But I thought it was too risky, and it is risk that has now prompted profit taking down to 6p and is in charge of sentiment. Some argue that a higher gold price will help revenues on whatever production AUE manages to maintain and will take the banks off its back. Some also believe that another cash raise might even be possible at slightly higher than the last (distressed) raise, to give the company more elbow room. But don’t forget that the intrinsic value per share investors thought was there has already been seriously diluted away in the last few months and that even a broker ‘target’ value (admittedly at only $1,150/oz gold) as we calculated last time was only 14.5p per share – i.e. our own buying price would be substantially lower. That probably hasn’t sunk in yet, so it’s probably better to await the revised mining plan and see whether the banks will let Aureus off the hook of further share dilution, before taking any action. There are many goldies out there with much better potential value, even Kefi Minerals.

And what about Armadale Capital (ACP)? Another 8% dilutive equity placing at a distressed price (to fund resource expansion which will only generate value many years ahead) which with the poorer economics I described last month helps to damage the picture – increasingly looking as if it might have been fantasy – of a project fully funded by debt that would have avoided dilution for equity shareholders. Hey Ho!

I will discuss Solomon Gold next week.

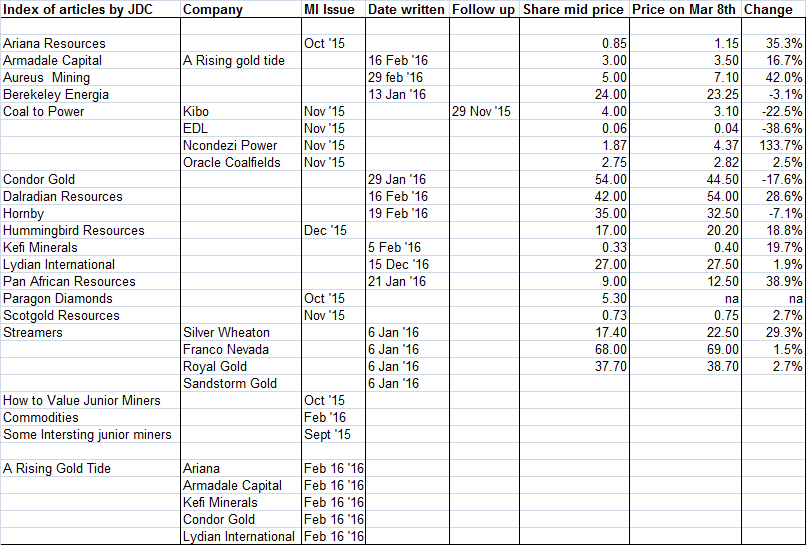

P.S. For ease of reference I’ve included the following table:

Comments (0)