Commodities – A Real Recovery or a Dead Cat Bounce?

The Saudis are breathing a sigh of relief, as their oil exports are now valued 45% higher than they were earlier in the year. That is a sentiment no doubt shared by commodities exporters, as iron ore, copper, gold, and many other raw materials experienced two-digit appreciations over the last four weeks. But with the global economy not really showing signs of a strong performance, one wonders if what we’re witnessing is a real recovery in sentiment that will drive the commodities markets higher, or just a dead cat bounce that will soon revert to its prior state. Market fundamentals convince me of the latter.

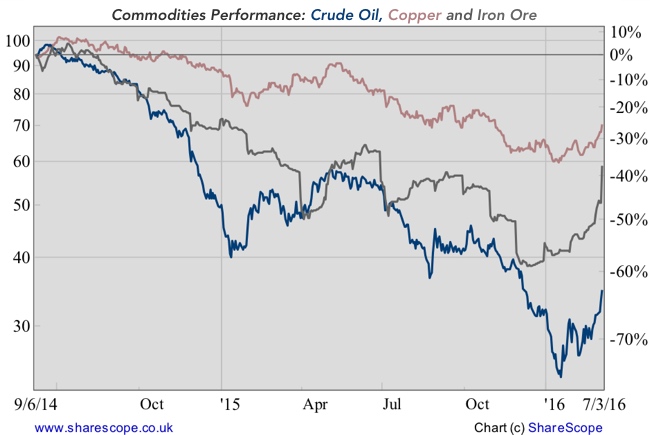

When we take the two-year price chart as a baseline, commodities exhibit a terrible performance. Almost all commodities experienced an epic bear market during the period between early 2014 and the end of 2015. Take oil, for example. It declined by 75% between June 2014 and mid January 2016. Take iron ore, alternatively. It saw its price crash 70% between 2014 and 2015. There are plenty of other examples, as the inversion in interest rate expectations in the US, combined with a cooling of the Chinese economy, quickly drove demand expectations for commodities down, which ultimately impacted prices.

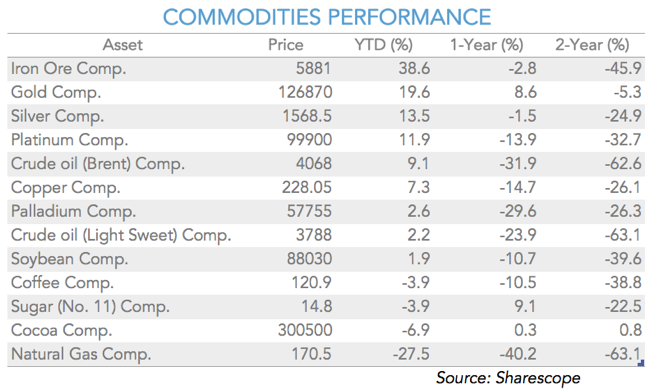

But, when we look at the market starting in 2016 (or, even better, starting at the end of January), what we see is a stunning bullish trend for all commodities except agricultural commodities. Iron ore leads the table with an accumulated gain of 39% YTD. The next positions in the list are taken by gold and silver, which both benefited from the increasing possibility of the FED delaying its second rate rise to 2017 and from the currency wars unfolding in Asia. In general, all industrial commodities are up YTD. Brent crude, for example, is up 9.1% YTD, but is up 45% since hitting a low near $28 on 20 January.

While the bulishness is amusing, it seems unconvincing. Goldman Sachs, for example, has just issued a warning telling its clients that the current rise in commodities may not last due to a lack of accompanying fundamentals. They believe that there has been a permanent decrease in the demand for commodities and that the adjustment in supply levels is far from complete. While I rarely share the same opinion as Goldman, I believe they are right. Global economic data is not supporting a rise in demand for commodities and we know that supply may take years to adjust to these new demand conditions.

The data coming from the US regarding its job market has been great. Take last Friday, for example. Non-farm payrolls rose 242,000 in February, a number that surprised everyone on the positive side. GDP for the 4th quarter was also revised up from 0.4% to 1.0%. But while the demand coming from the US weights positively in the commodities market, I’m sure that it is not enough to determine a rise in industrial metals demand. China, instead, moves those markets.

When we take China into consideration, any positive sentiment regarding the commodities market evaporates. GDP growth is now at 6.8%, a level barely seen over the last 25 years, as the Chinese authorities had been pushing it to the two-digit level through huge infrastructure investments. But not anymore! The country now wants to move on to the next stage, and that means allowing the consumer, not the government, to assume the main role in driving growth. This simple fact means we will most likely see 5% growth rates over the next decade rather than anything above 7.5%. Not that such growth rates aren’t enviable from a European point of view, but they’re not enough to sustain the epic demand that drove a decade-long bull market for commodities. The Chinese economy is slowing (or growing at ever lower rates, to be precise). The manufacturing and construction sectors are at risk of entering a recession, as they no longer live off the Government boost of the past. The country’s trade position is also deteriorating. Exports fell 25.4% in February from a year earlier, which is the worst 1-month decline since early 2009. This number comes on top of an 11.2% decline in January. In terms of imports, the numbers for February and January respectively are -13.8% and -18.8%. Demand from China is definitely down and no material improvement is rationally expected in the near term.

We still have Europe and the ECB. Today Draghi has extended its QE programme and made a few other tweaks to keep investors entertained. But we all know that monetary policy has been ineffective at this extreme and that demand from Europe is not enough to drive commodity prices higher. Growth in the Eurozone is at 0.3% (4th quarter of 2015 over prior quarter) and seems stagnant, while the unemployment rate is still at an unhealthy 10.3% and inflation is at negative levels. This is not exactly the scenario that will ignite and feed a bullish trend in commodities.

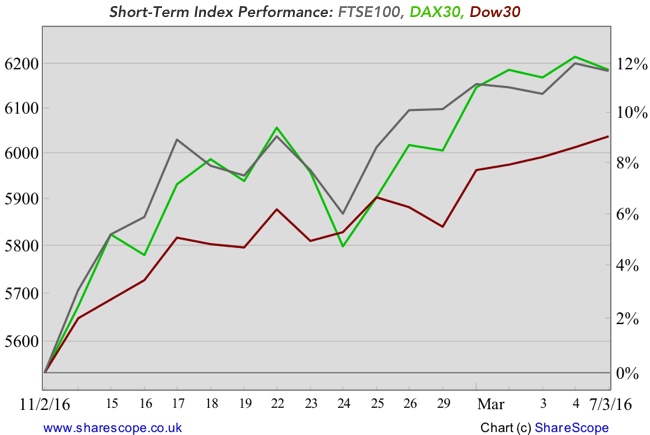

Equities have been rising substantially since mid February. On the one hand, the quick and huge recovery in metals and oil helped indices like the resource-rich FTSE 100, which experienced a rise of 12% during the last one-month period. On the other hand, anticipation of today’s ECB move was also feeding a rise in European markets like the Dax. I believe that both incentives will quickly vanish over the next few weeks.

The huge pessimism that had pervaded commodities markets was suddenly turned into a bout of optimism that led to quick and huge price increases but without accompanying fundamentals supporting the rally. Demand for industrial metals will continue to fade and press prices down. The market is still in need of production cuts. The recent rally will just delay those cuts, as it acts as an incentive for all those companies that were on the verge of bankruptcy to increase production again. I’m visualising Venezuela and Russia trying to pump more and more oil now that the commodity is up 45% from its lows. This behaviour will prevent further price increases. For all these reasons I’m with Goldman on this one: the rally in commodities seems more like a dead cat bounce than a real recovery. There are exceptions though. Agriculture commodities are not part of this trend. They will be driven by climate and other very specific conditions. As for gold and silver, it is not time to sell. As the risks mount on global markets, the brighter the outlook for these precious metals becomes.

Comments (0)