A Big Ego is a Big Problem

As seen in the latest issue of Master Investor Magazine

There are a lot of reasons people fail to become Master Investors. The usual suspects are fear and greed. But there is something that isn’t discussed much – ego.

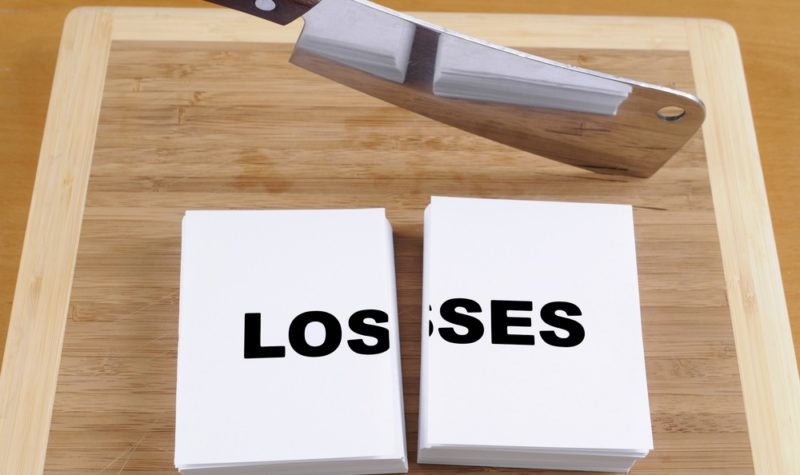

If you’re one of the (probably) few women reading this (most traders are men), then pat yourself on the back – women suffer a lot less from this. A big ego is a major problem for traders and it stops them in particular from selling losers. Selling a loser is very bad for the ego and many just can’t cut losses.

It’s all fine and dandy to have an ego in other aspects of life. After all, most of the people who get to the top positions in their field have big egos. That drives them to succeed. But it’s not much good in trading. That big ego stops you from taking losses. Makes you trade too much. Makes you do all sorts of silly things.

Here’s a trader I met who had been brought low by his ego. (Except for his self-esteem, which was still flying as high.) Harry came to a seminar of mine. Short of ripping off his shirt and zip-lining into his chair from a helicopter hovering outside the seminar room, he did everything possible to convey his status as an ‘alpha male’.

He actually asked a lot of questions but it soon became clear he wasn’t listening to much that I was talking about. Hunched over an alpha male laptop, he was probably ‘trading’ while I was talking. He was, frankly, Mr Ego. Everyone could tell he felt himself superior to the rest of the room – and superior to me – and I was supposed to be the teacher! He was just there to confirm what he was doing was right (and what I was doing was wrong).

The funny thing was, he was convinced he was right on everything… but he had lost a lot of money. It was no surprise. I talked about a company on the day and why I thought I might buy it. I discussed my research. Harry piped up to say my research was wrong, as were my figures. I gently pointed out that my figures were right, taken directly from the company’s report. He had got his from a website that hadn’t updated to the latest figures. That’s because he hadn’t listened to the bit where I explained where to get the figures from.

If you let your ego sabotage your trading, like Harry did, don’t be surprised when you run into problems. If he can’t remove that emotion from his trading he hasn’t got a chance of succeeding in the stock market. Our ego is bound with up our pride and “achieving pride” is one of the “intangible motives” that psychologist Daniel Kahneman of Princeton University says really drives financial decision making rather than money.

I don’t want a desire to feel proud to affect my trading so I try not to brag to anyone when I have made a lot. But I have done it to the wife – and what’s funny is I know when I am doing it. It’s an alarm bell – every time I have bragged, it was time to bank profits. If you are to become a Master Investor the ego has to go. If you have got one, it won’t be easy. Self-awareness doesn’t come readily to someone with an ego.

I know, I know: “Who the hell is this Robbie Burns to tell me I have an ego? Where does he get off suggesting I might be blind to my weaknesses? I could crush his head in one of my hands while putting on a successful Forex day-trade with my other and that’s not even mentioning where I’d put my knee.” Also, maybe, just maybe, you have an ego. Seriously, if something or someone is telling you that you might just have an ego… try and consider that possibility. I have an ego. I don’t deny it.

But when it comes to trading I ensure that it doesn’t surface. I look at cold hard facts and if I get something wrong I admit it right away and cut the position. Take a good hard look at yourself: do you think trading rules are for other people? Or you’re simply a cut above others intellectually? Other people are a bit dim and you’re the shining star? Nothing can go wrong for you?

Cut the ego to make money. How to cut it is the hard bit. Perhaps try and become more self-aware. Realise when you made a mistake. Don’t worry about cutting a loss: it isn’t a mistake. It’s a mistake to keep the share that’s going down. Consider sometimes you will get things wrong, you really are only human.

Comments (0)