ScS Group – An investment you can sit on

It’s a long running joke that no one has ever bought a full priced sofa. With 50% mark downs, mega discount deals and snap sales the furniture retailers always seem to have promotional offers on the go to attract the punters. Nevertheless, there is still money to be made in the sector for investors. The largest listed UK furniture business DFS (DFS) looks like a steady buy and hold investment, but providing much more upside in my opinion is FTSE Fledgling listed ScS Group (SCS).

There’s sofas in store and also some floors

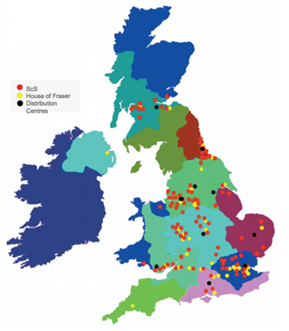

ScS (which stands for Sofa Carpet Specialists) is one of the largest retailers of upholstered furniture and floorings in the UK. The company currently trades from just under 100 stores around the country, targeting its products in the mid-market range. ScS specialises in selling fabric and leather sofas under its own brands (such as Endurance and SiSi Italia) and also offers third party products including La-Z-Boy, G Plan and Parker Knoll, with some models being supplied on an exclusive basis.

In 2012 the firm further expanded its operations by launching a flooring business focused on carpets, laminates and vinyl. Then in 2014 it began operating the furniture and carpet concession ranges for department store House of Fraser‘s “For Living” brand. ScS currently has 30 such concessions around the country, with this side of the business now bedding down after a challenging start.

In its current form ScS listed on the Main Market back in January 2015. But this was not the first time the company had graced investors with its presence. Under the name of ScS Upholstery the company traded on the LSE until July 2008, when it was then placed into administration. This came after poor trading during the financial crisis saw the withdrawal of credit insurance from the market, causing consequent working capital problems. Private equity firm Sun European then pounced to buy the firm in a controversial rescue deal before selling off half of its stake at IPO.

Bank Holiday woes

It wasn’t a great start to life as a renewed public company, however. Just a few months into its new existence ScS announced a profits warning after seeing poor trading over the important Easter Bank Holiday weekend – a time when customers traditionally make big ticket purchases. Like-for-like sales in the four weeks to 2nd May, beginning on Easter Monday, were down considerably, falling by 15.9% compared to the previous year. The company gave, in my opinion, some pretty poor excuses for the downfall, blaming warm weather and uncertainty over the general election for the weak performance. The markets reacted badly to the news, sending the shares down by 31% on the day of the update.

But sofa so good in 2016

The damage done by the profits warning has since been partially healed. Results for the year to 25th July 2015 helped investors to regain confidence after the company posted a 13% rise in revenues, held firm on its promise for a £5.6 million dividend, and reported some good post year end trading figures.

Then in January ScS revealed that profits for the current year would be significantly ahead of prior expectations. This was after strong trading over the key Christmas and January sales period – like-for-like order intake for the 25 weeks ended 16th January 2016 grew by 8.8%. Nevertheless, at the current 186p the shares remain short of the 229p high seen in March last year and trade only slightly above the IPO price of 175p.

Risky Business

Understandably, investors will be wary of putting money into a business which in a not too dissimilar guise went bust a few years ago. But ScS has put itself in a much better position, having a wider product range, much improved internet offering (online sales grew by 25.4% in 2015) and decent growth potential via the deal with House of Fraser.

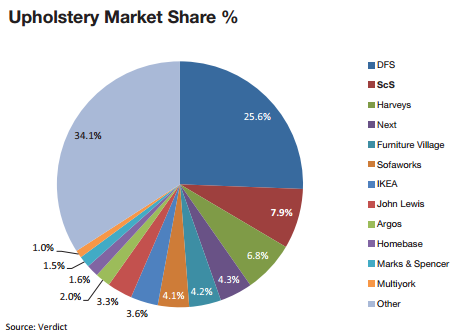

Of course furniture and flooring are cyclical markets, being exposed to economic recessions and the level of housing transactions. And growth in the industry as a whole is only modest – analysts at retail consultancy Verdict expect the UK upholstered furniture market to grow at a CAGR of just 3.2% from 2014 to 2019 and flooring sales by 2.4%.

Nevertheless, ScS has been growing sales well ahead of these figures recently, supported by the current positive housing market. Evidencing the current favourable conditions, rival DFS recently reported that sales were up by 7% in the 26 weeks to end January and noted a “…healthy furniture market environment…”. A fragmented furniture market also provides expansion opportunities – according to Verdict retailers outside of the top seven account for 43.5% of the market by revenues.

What’s it worth?

One of the main attractions of the ScS investment case is the bumper dividend yield.

Assuming last year’s full year payment of 14p per share is maintained then the current yield on offer is 7.53%. This may look too good to be true and a potential sign of a classic “yield trap”. This is especially the case given that historic dividend cover was 0.98 times earnings. But I believe that the payment is sustainable for several reasons:

– the company’s dividend policy is progressive and based upon an 8% yield referencing the IPO price of 175p.

– net cash as at 25th July was £21.1 million. This amounts to c.3.75 times the expected £5.6 million annual dividend payment.

– the business is highly cash generative. Stripping out last year’s exceptional costs related to the IPO, free cash flow (after capex) was £7.7 million – covering the dividend 1.4 times. In the previous year free cash flow was £10.7 million. Future capex requirements should be modest, with only 2-3 new stores expected to be opened per annum.

Given the risks involved I believe that a yield of 6% would be a reasonable valuation for ScS at present, implying a share price of 233p – 25% ahead of current levels. That implies a price earnings multiple of 14 times market consensus forecasts for the current financial year, which also seems reasonable. We can put weight behind this valuation given that rival DFS is currently valued at 14 times forecasts for the current financial year yet is only expected to grow earnings by a CAGR of 10% between 2015-2017, in contrast to 13.7% expected growth at ScS.

I believe that if ScS maintains steady trading over the next year or so then a re-rating could be on the cards. For the rest of 2016 the company still has to face the key trading periods of Easter and the May bank holidays. But, while timings are different, the election is out of the way and last year’s comparatives are weak. Of course there is always the weather.

Overall, for a bumper yield and potential re-rating shares in ScS look good value.

Comments (0)