Small Cap Opportunities in a Post-Brexit World

On an asset class basis, most of the investment media focus post Brexit has been upon the performance of sterling, which as I write is down by 9.4% against the US dollar since referendum day and 7.5% lighter against the euro.

In contrast, despite banks and housebuilders having plunged in value, blue-chip stocks on the whole have done well, with the FTSE up by 5.2% to 11-month highs as investors seek out quality assets. Government bonds have also seen a flight to safety, with yields falling to all-time lows, and in some cases (the 2 year gilt for example) even turning negative. However, the FTSE 250, which is more heavily exposed to the recession-threatened UK economy, has fallen by 3.4%.

But how have small caps fared since that fateful decision was finalised in the early hours of Friday 24th June?

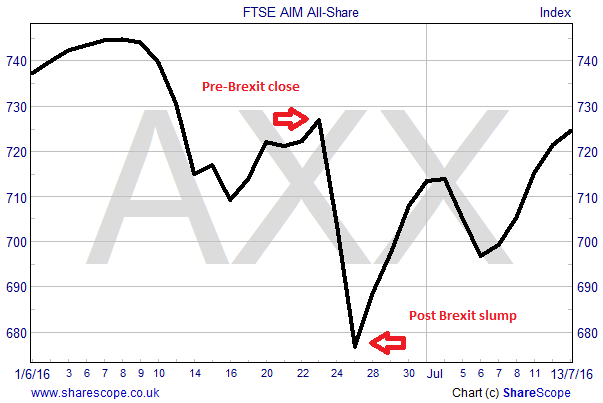

The answer is, not as badly as you might have thought given their higher risk status. As the chart below shows the FTSE AIM All Share index initially fell sharply in the 2 trading days following the referendum but it has pulled back since to be just 0.3% lighter. On an individual stock basis, 30% of AIM companies have seen their share prices rise since the referendum, with 11% flat and 59% down.

Here follow two stocks where I see potential trading/value opportunities following the referendum result:

Staffline Recruitment – Not the time to be short of STAF

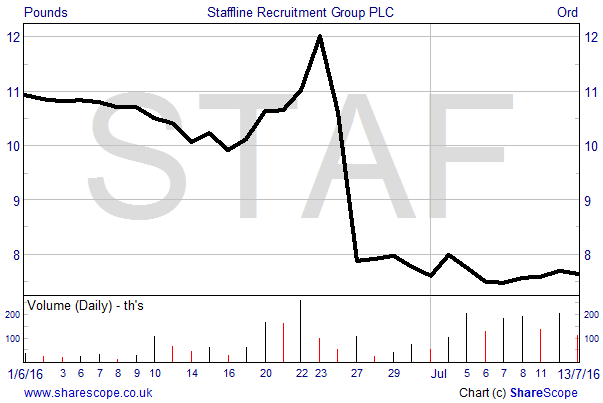

A number of individual stocks have seen a battering of their share prices post Brexit. Notably, several recruitment companies have fared badly as investors have become concerned about a potential recession causing a recruitment freeze in the UK. To take the most dramatic example, shares in AIM listed Interquest (ITQ) have plunged by 46% on the back of a profits warning, caused by clients delaying hiring decisions in the run up to the referendum. Peer Staffline (STAF) has also been caught up in the malaise, with the shares down by 36%. But in contrast to Interquest, Staffline has been performing well and I see a potential value opportunity on the back of the recent sell off.

Staffline is a recruitment and staffing services company which made revenues of £702 million in the last financial year and supplies around 45,000 workers every day to more than 1,300 clients. The company operates via two divisions, Staffing Services focusses on supplying workers to industries such as agriculture, manufacturing and food processing. Secondly, the Employability division provides training and support services, along with a number of a government contracts, including the Welfare to Work programme. The company is currently in the fourth year of a five year plan to, in its own words, “Burst the Billion”, or to grow revenues to over £1 billion by the 2017 financial year.

A trading update released on 5th July reported “excellent” progress in the first half of 2016 with trading in line with expectations. Perhaps the main sentence to note in the statement was,

“Furthermore, to date, there has been no change in demand following the recent EU referendum vote and the Group continues to source record numbers of workers to supply this demand.”

The key point with Staffline is that it focusses on the provision of temporary workers. During times of economic uncertainty the demand for temporary labour tends to rise as employers put off hiring people on full time contracts. In addition, much of the business is focussed on getting jobs for the long-term unemployed via the government’s Work Programme. As such I believe that Staffline looks well placed to grow even if there is a recession in the UK.

Staffline shares currently trade at 761p, less than half the all-time high of 1,623p seen just seven months ago. Given the sell off, I believe that, for those investors who think that the UK will be able to muddle through the EU exit relatively trouble free and not enter a recession, there could be a good value opportunity here – the shares now trade on a multiple of just 6.7 times consensus forecasts for the current year and yield 3.22% on expectations for a 24.55p dividend.

Brokers also see value in the shares, with Finncap, despite having recently trimmed its target price on the shares from 1,700p to 1,615p, having a “buy” stance, with the (house) broker Liberum having a 1,100p target. Even the most pessimistic analysts at Berenberg Bank have a 900p target, which implies 18% upside.

Of course a UK recession will hinder the company’s ability to grow at rates seen in the past (40% revenue growth in 2015). But I believe that the markets are currently pricing Staffline as if a downturn is a certainty. All in all, given the value opportunity here, I believe it might be worth picking up a few Staffline shares ahead of the interim results, which are due to be released on 27th July.

Gear4music – Making lute in the EU

The days and weeks following Brexit have seen the regulatory newswires full of statements from companies updating the markets on how the vote has affected their trading. While many of these have been negative one business announced a particularly pleasing update last week.

Gear4music (G4M) is a company I first covered in the August 2015 edition of Master Investor magazine. As a reminder, the company is an internet based retailer of musical instruments and accessories, fulfilling orders for its c.31,500 products from a 135,000 square foot warehouse based in York.

In the first full calendar week following the referendum the company saw its European like-for-like sales surge by an impressive 191%, up from a 120% like-for-like rise in the week before the referendum. Europe is a key market for the company, with 27% of sales coming from the continent in the last financial year and the company estimating the total market is valued at £4.3 billion. There is plenty of room for expansion, with the York facility able to fulfil c.£50 million of annual sales and net cash of £2.6 million as at 29th February available to support growth.

The strong post-referendum trading came as the weaker pound attached more European customers and the company remained responsive to pricing. I believe the figures are all the more impressive considering that European sales have been booming for some time now, rising by 73% in the last financial year (to Feb 2016). We can see how the rest of the month pans out shortly, with a further update expected from the company at its AGM on 29th July.

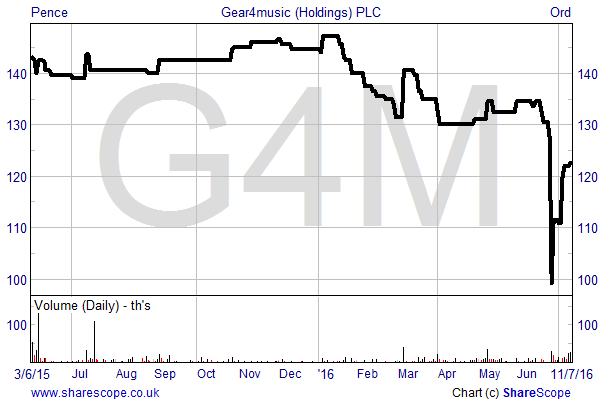

At the current price of 122.5p Gear4music shares are down by 12% on last June’s IPO price and remain below pre-referendum day levels despite the positive update. Yet with a market cap of £24.7 million the company is highly rated, with adjusted pre-tax profits coming in at only £0.6 million for 2016. But the company is continuing to see strong top line growth, which should further drive profits in the long-term.

Broker Panmure Gordon has a 180p target price, with forecast earnings of 10.7p next year (Feb 2018) putting the shares on a reasonable looking multiple of 11.4 times.

Comments (0)