Are Brazilian Stocks Going Cheap?

The expression “may we live in interesting times” could have been written with the principal Brazilian stock market, the Bovespa, in mind. Its performance since 2010 – when the author moved to the country – has been a rollercoaster ride. Six years ago with BRIC-mania at its height, the economy was growing at over 7% a year, the recent investment grading was driving FDI and Petrobras, the national oil champion, launched a $70 billion IPO, which is still one of the biggest in history. With these macro drivers and a new found confidence after years of relative under performance, equities saw an extensive uptick.

So what happened next? The short answer is that a series of acute headwinds, such as commodity price falls, stagflationary pressure, large fiscal deficits and political turmoil, battered the country. Average GDP growth slumped to an average of just over 1% between 2012 and 2014 (with inflation averaging 5% a year over the period) and a close to 4% nominal deceleration in 2015. Moreover GDP in the first quarter of this year fell by a further 0.3%, which was the fifth consecutive quarterly contraction. That, ladies and gentlemen, is approaching the definition of depression level economics. This macro picture was absorbed and reflected in the performance of the Bovespa. Brazilian equities fell by 25% between 2012 and 2015, with annual volatility over this period of 22%. Add in the relative fall in dollar terms – the USD/BRL rate shot up from 2.05 to 3.96 between 2013 and 2015 – and a dollar based investor had almost five years of gains wiped out. Interesting times indeed. The depreciation in the Real, driven by the myriad economic stress factors mapped above, was closely correlated with broader weakness in Bovespa performance.

And although the depreciation in the Real should theoretically make local Brazilian assets cheaper and thus more attractive, the other side of the valuation coin is that dollar converted returns are also less valuable. Furthermore, with so much country risk, investors decided that the juice was not worth the squeeze.

Cheap valuations almost always come with negative newsflow (and more importantly weak fundamentals) and generally follow large losses in stocks (which has certainly been the case in Brazil). A recent google of “Brazil” returned the following results:

– Graphic Brazil Impeachment: The Process for Removing the President (NY Times)

– Brazil’s GDP reveals depths of recession (FT)

– Brazil warned of budget ‘time bomb’ (FT)

– Zika virus makes Rio Olympics a threat in Brazil (Guardian)

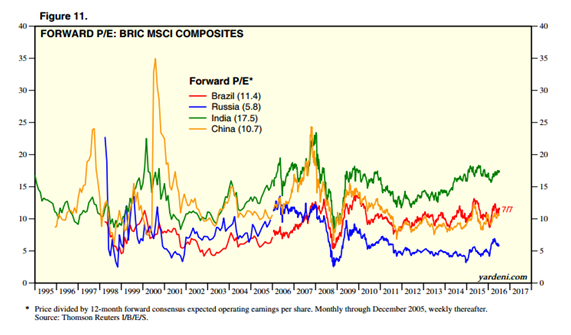

Brazil, in line with fellow BRIC markets, saw a correction in valuations with forward P/E rates following the Bovespa on a downward (or flat) trend between 2010 and 2015, revealing that below the BRIC gloss, perhaps the fundamentals were not as robust as initially expected (especially in Brazil and Russia).

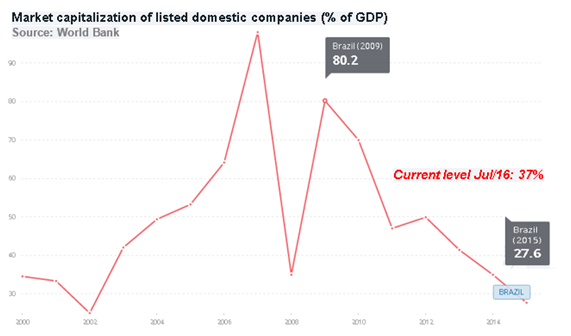

According to analysis by Meb Faber, by the end of 2015, Brazilian equities were some of the cheapest in world based on CAPE, Book/Cash Flow and dividend metrics. Indeed, using one of Warren Buffet’s favourite valuation snapshot measures – total market cap (TMC) relative to country GDP – showed that based on this macro measure, the valuation of the Bovespa had been falling since 2009, when it was equal to 80% of GDP, to close out 2015 at a level of 27.3%, close to its historic minimum.

Nonetheless, tentative signs of improvement in business confidence, inflation and trade indicators have begun to emerge, suggesting that the Brazilian economy may have stabilized.

Moreover, market volatility since the Brexit vote offered a buy signal for emerging-market equities. With the developed world inundated with an increasing amount of negative bonds (jumping to a total of almost $12 trillion by end of June) the search for yield increased the attractiveness of emerging market equities and, notwithstanding political and economic structural issues, their relative risk-reward profiles, in addition to already underweight market positioning. As a result, investor focus also returned to Brazil. This trend has also been driven by broader tailwinds including upticks in commodity prices (65% of the total value of Brazilian exports) led by an improvement in Chinese economic conditions as well as a potential push back in expectations for further US rate rises (higher rates make emerging-market dollar-denominated debt more expensive). Cue a sharp uptick in inbound investment into Brazilian equities.

Indeed, the Ibovespa is the best performer among major global benchmarks this year on optimism that the impeachment process against ex-President Dilma Rousseff will finally go ahead and that a more pro-market and fiscally conservative government will regain business and investor confidence and shore up the nation’s finances as a starting point for broader economic recovery.

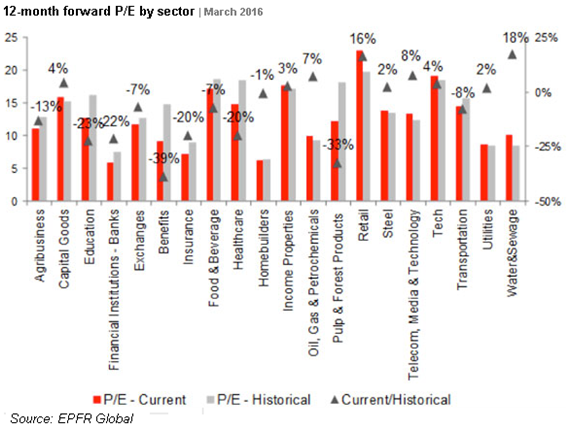

Thus, reduced political uncertainty and the subsequent reductions in analyst estimates for Brazilian companies’ cost of equity – even though earnings remain subdued – and predictions that the economy is bottoming out, have increased relative valuations. By the end of March of this year, the Bovespa was trading at an 11.2x forward P/E against a historical average of 10.3x. The following graph from EFPR Global helps break this down this performance by sector.

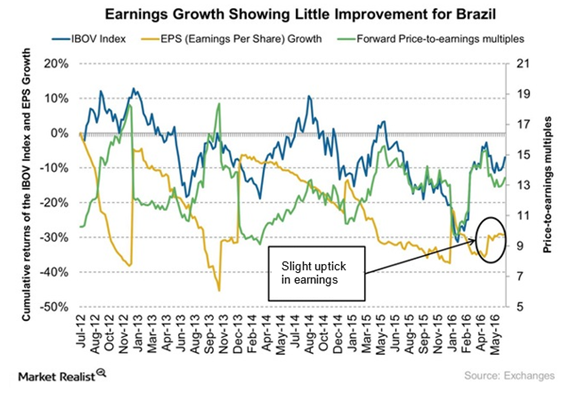

By mid-July the index was up by over 30% YTD, reaching its highest level in 14 months and approaching the upper band of its 52 week range. Medium-term technical indicators – such as RSI & EMA – were also flagging positive signals. EPS growth and forward P/E indicators started to pick up from April this year, supported by a 17% appreciation in the USD/BRL rate.

Furthermore, a main driver behind any Bovespa upside movement is the relative performance of Vale (BVMF:VALE5) (the world’s largest iron-ore producer) and Petrobras (BVMF:PETR4), who together make up almost 15% of the index’s weighting. The rally in global commodities, especially iron-ore (+25% YTD) and oil (+19% YTD) has pushed both stocks upwards – Petrobras +16% and Vale +7% just in the month of July (by 15th July), with Petrobras almost 70% higher YTD. For Petrobras in particular, higher valuations look buoyed by rising analyst forecasts for oil prices and improved company fundamentals after one of the biggest corporate corruption scandals in history. Banking stocks (together around 25% of the index) have also been at the forefront of the Bovespa’s advance in 2016.

So, is the recent performance sustainable? And where next for the Bovespa? There has certainly been a correction in the market this year. Yet there is a risk that the rally has been overdone. Brazilian stocks were cheap for a reason. Value is based on firms’ risk and return profiles and both of these valuation building blocks have been impaired over the last few years.

However, analysts say the rally has not yet made Brazilian stocks too expensive, as the index’s current P/E ratio remains slightly below its historical average of 12x, according to Thomson Reuters calculations. That said, also add that further upside this year could be limited.

Ultimately, for equity valuations – and not simply short-term price considerations – to improve over the longer term, micro (company specific) and macro (the economic environment) fundamentals also need to pick up. Long-term investment in Brazilian equities is a play on the future economic trajectory of the country. The key question therefore is: what is the long-term perspective for the Brazilian economy?

The recent improvement in expectations has been a positive development. Nonetheless, the interim government (the Senate will vote on the final outcome of the impeachment process by September) faces major political and economic challenges to implement much needed structural reform and fiscal adjustment, especially at a time when the private sector is also deleveraging.

Growth is expected to remain constrained for some time. Indeed, Marcos Casarin of Oxford Economics forecasts that it could take 10 years for Brazil to recover the level of per capita GDP of 2013. This could be overstated, but such a scenario would significantly impact investor confidence and company earnings, both key drivers of the valuation narrative.

Any further near-term improvement in equity performance is likely to be fragile as well as volatile. Where the Bovespa – and broader Brazilian economy – is concerned then, we could continue to live through interesting times.

About the Author

Adam Patterson is an economist from the UK, currently living in Brazil where he is founder of a valuation fintech and partner in a corporate finance office. He has previously worked in the UK Parliament, various investment practices and HSBC Brazil. Adam’s research focus is on political economy, infrastructure investment, Brazilian financial markets and asset valuation. He read politics at Leeds and economics at the University of London as well as studying at the CISI. Adam also holds an MBA Finance from the Federal University of Paraná, Brazil.

Comments (0)