Where next for precious metals?

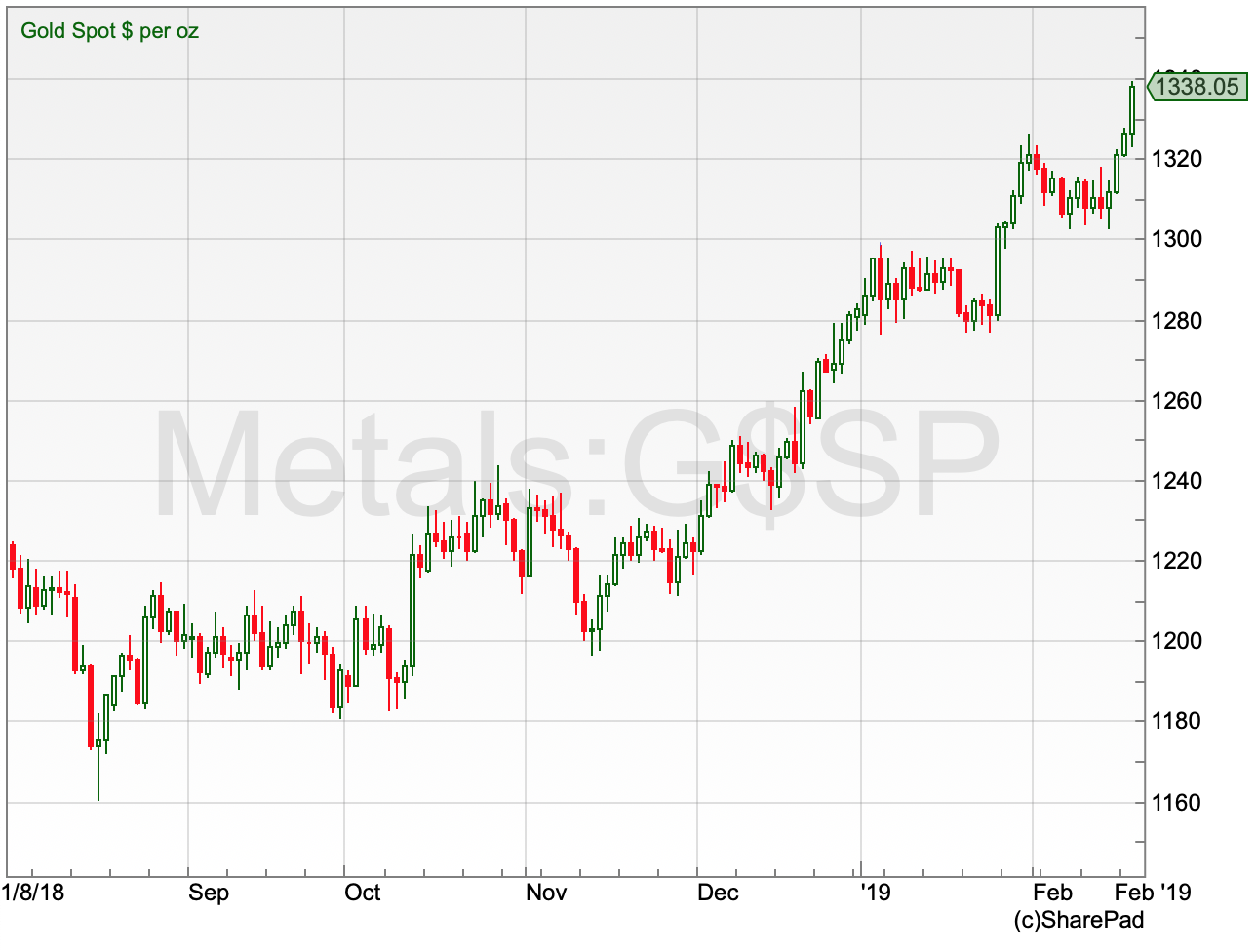

It has been a few months since we last looked at the value of gold – and in that time the price has continued to recover. Given the strong start it has made to the year, I thought it was worthy of a catch-up with the yellow metal and its close relation, silver. These sorts of assets are traditionally seen as safe havens in times of uncertainty, and we have certainly had that by the bucket-load so far in 2019.

Why have the prices of gold and silver been rising?

Both of these metals have done well over the past six months, rising by at least 10% since the end of the summer. If you are unfamiliar with these markets, one way to view them is just like any other currency, such as the euro or pound. If the value of the US dollar rises, it does not rise in isolation; it means another currency (such as the euro or the pound) is falling. In recent months, the US dollar has been sliding; however, gold and silver have seen their values increase during the same period with both of these metals quoted in dollars.

Gold six-month chart

Silver six-month chart

But there is more to it than that. Global stock markets experienced some incredible volatility towards the end of 2018, with the US benchmark index, the Dow Jones, having its largest December fall since the Great Depression. Market uncertainty leaves investors looking for somewhere to park their money – the safe haven. Traditionally that has been gold and, to a lesser extent, silver. Although the US dollar has grown in favour with investors looking for safety in recent years, it experienced a run of strength for much of 2018, during which stock markets witnessed a period of turmoil.

As stock markets recover, why aren’t precious metals falling?

What is interesting is the continued appeal of the two precious metals into 2019. By mid-February, the Dow rallied by 4,000 points from its December lows and stock markets have, so far at least, experienced what is best described as a “V”-shaped recovery. But investors have not deserted the precious metals; silver has reached a six-month high and gold is at its highest level in nine months.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

For now there seems to be more to their appeal than just insurance against plunging equity markets. Given the size of the fall that both metals experienced from April to August 2018, one argument could be that they were simply undervalued. Markets do overshoot in both directions, and gold, for example, dropped $200 in a little over four months. Plenty of investors may have thought the sell-off had simply gone too far.

But regardless of how you measure it, the financial and political climate is more perilous now that it has been for a long while – and increased uncertainty traditionally helps the precious metals. In the UK, we have Brexit looming large. It doesn’t matter which side of the fence you sit on, the lack of progress as we get down to the wire is not doing anything good for the economy. The uncertainty also impacts continental Europe. We have already seen Italy slip into recession – admittedly there is nothing particularly new here as it’s the third time the Italians have entered into a recession in a decade. But more concerning is that the German economy came very close to following Italy down the recession road, with the traditional industrial powerhouse posting zero growth in its latest quarter. It’s entirely possible that Germany falls into a recession in the near term as time goes on.

There are still ongoing talks on settling the trade war between the Chinese and Americans. The global economy did not look in peak condition towards the end of last year, and as talks drag on, it is just another factor that is doing little favours for the economy.

Despite the strong bounce back by stock markets over recent months, the above mentioned factors are helping to keep the likes of gold and silver in the spotlight, providing an attractive alternative asset class in an uncertain world.

What could de-rail the metal rally?

Just because both silver and gold have performed well in recent months, it does not mean they should be taken for granted and that the rest of the year will be plain sailing.There are factors that the prudent investor should be aware of.

As unlikely as it might seem, a soothing of the waves of the geo-political situation would be expected to negatively impact the appeal of safe havens, as investors turn-up their risk appetite once again. If Brexit gets negotiated successfully – to the satisfaction of everyone – the European economy booms and China and the USA resolve their differences and live happily ever after, then silver and gold will lose their shine. Let’s not hold our breath.

A resurgence in the US dollar is a little more realistic, but recent US retail figures left investors disappointed enough to start muttering about the possibility of a US recession. The US central bank, the Federal Reserve, has also started to backtrack on its planned interest rate rises this year, which could well stem any major US dollar progression.

Perhaps the biggest threat is just how far these markets have come since their 2018 lows – particularly with regard to the gold price. The $1,370 area has been a real cap to any progress for more than two years now.

Gold three-year chart

And for silver, the argument could be made that the trend from mid-2016 is still intact and the current run of strength is nothing but a “dead-cat bounce” before the price turns lower again.

Silver three-year chart

But unless the political and economic worlds clean up their acts overnight, these two markets are likely to retain their appeal with investors and traders alike and remain interesting assets to follow for the rest of 2019.

Comments (0)