Three charts to watch in the month ahead

Michael Taylor uncovers some of the trading opportunities being thrown up by the ongoing market volatility.

Correction: In our last issue, we published the letters CFA after Michael’s name. Michael does not hold the CFA qualification, and we apologise for the mistake.

In my last column we looked at SCS, Petropavlovsk, Burberry and OnTheMarket. SCS did not get to the level mentioned in order to short, whereas Petropavlovsk broke through the resistance identified and kept going. Burberry also didn’t make it to the level required to short, as UK equities posted gains in April. A strong bounce was inevitable, though I was surprised at how strong the bounce was. It’s always easy to say in hindsight, but after the biggest shock in stocks ever perhaps I shouldn’t have been surprised and instead should have expected it.

The reason I focus on charts is because they are like video games to me. If a stock is trending upwards, I’ll look to get long, and if a stock is going down I’ll look to get short.

It sounds easy enough, and as a concept it’s as easy as it sounds – if you focus on the detail. Trading constantly requires new ideas and entries to be identified and tracked, and so here are a few I’ve been looking at for this month.

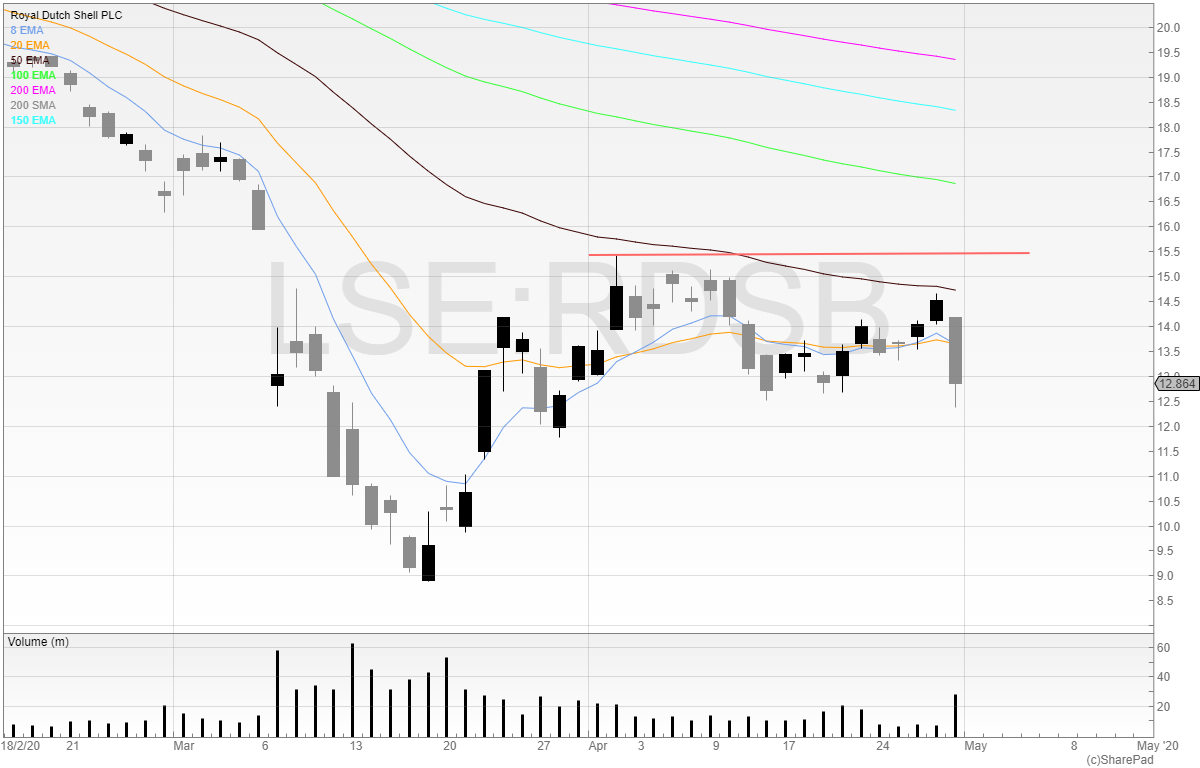

Royal Dutch Shell (LON:RDSB)

Shell is a company that everyone will know. ‘Never sell Shell’ is the old stock-market cliché, as it has never cut its dividend since World War II. But on 30 April 2020, Ben van Beurden went down in history as ’the man who cut Shell’s dividend’.

There are two potential trades here. I was eyeing up the red resistance line as a potential breakout trade, but now the stock has sold off on large volume, I believe we may see a test of 900p. This would form a double bottom and give us a line of support to trade from.

The oil market is currently in contango, and the dividend cut will send shockwaves across income investors worldwide. I don’t feel it unreasonable to assume that Shell’s share price will come under more pressure.

If the support at 900p fails to hold, I believe the stock price could fall a lot further.

Shearwater Group (LON:SWG)

This is a company I have followed for a long time, as the directors have been happy to splurge their own cash on company stock.

However, I don’t believe Shearwater is a ‘gravy-train’ stock. It’s a buy-and-build and cross-sell business in cyber security, an area of growing importance. There have been many cyber-security stocks which have all failed to capitalise on a growing market, and maybe Shearwater Group will join them for all I know, but at this moment in time the stock is looking bullish.

I bought in at the 270p breakout area and saw the stock rally nicely, only for the company to take the momentum out of the stock with an equity placing.

However, the bookbuild was still open on Friday morning and the price hadn’t sunk back to the placing price. I called my broker and had him put in an order on my behalf, and my allocation was scaled back by 60%.

That’s always a good sign, as it means demand was significantly more than supply, and trading is all about supply and demand. Institutions rarely buy in the stock market, but it wasn’t only institutions that took the placing. Retail buyers were involved too, and people like me who didn’t get their fill will be tempted, should the price approach 240p or even go below.

A good placing needs secondary demand to support the price, otherwise if there is no one left to buy, what happens to the price? Companies should always be thinking about the raise after the next raise, and plan properly. Sadly, not many of them do. If only there was someone who helped a company raise capital in the market effectively – like a broker!

The company raised £3m from the market and also announced a £4m revolving credit facility with Barclays. This leaves the company well capitalised for any opportunities it sees.

Shearwater Group is an exciting opportunity, but as a trader if the price drops below 225p I’ll look to sell my position. Running losers does not fit in with my business plan.

JD Wetherspoon (LON:JDW)

I’ve been an active trader of JD Wetherspoon in recent weeks – both long and short – and it’s been a rollercoaster ride for investors. From a low of below 500p a few weeks ago, the company ran an accelerated bookbuild to raise £141m from the market. I put in an order for this and got scaled back to a 0% allocation.

So, even though I think the price is overvalued, the institutional demand is clearly there.

I believe is that if the price takes out the resistance line then the price could continue on its trajectory upwards.

I also believe a June opening is optimistic, and even if we do see pubs open in June, we’re not going to be seeing the bar queue several people deep. Those days are gone, at least for now.

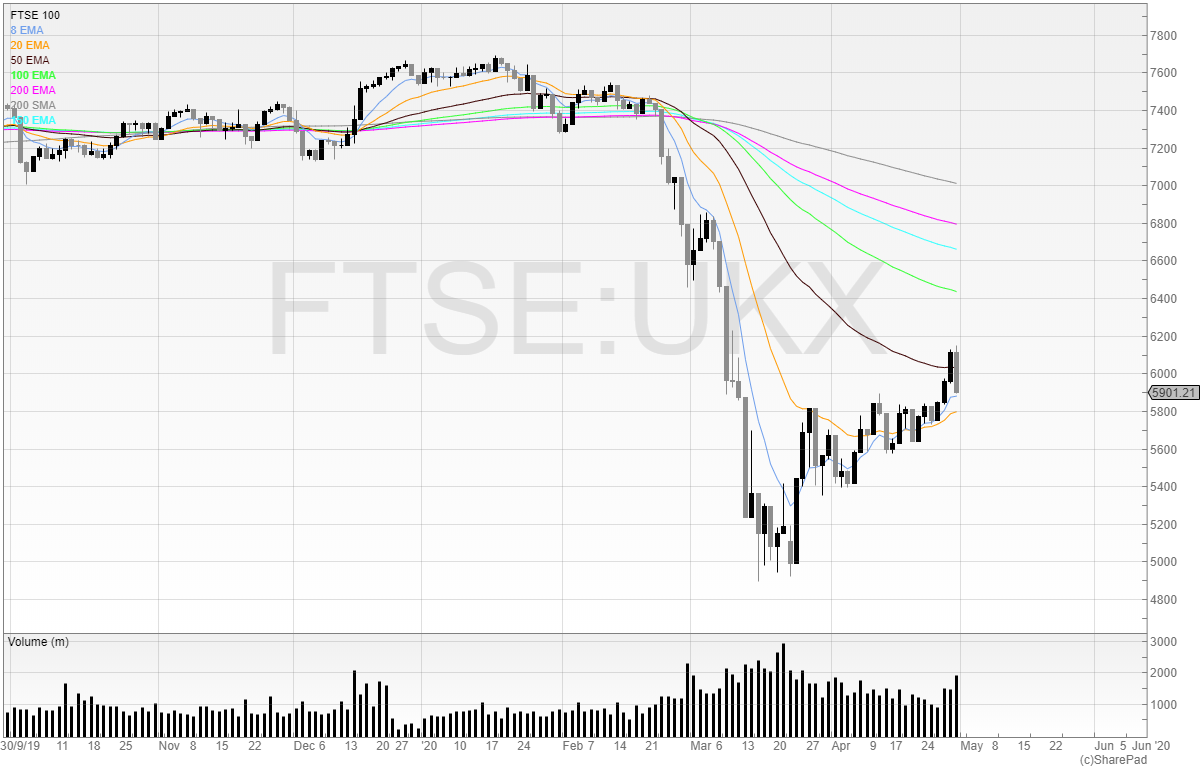

FTSE 100

Here’s a chart of our main index, the FTSE 100. Our index isn’t the greatest (to say the least) compared to the US indices – instead of the FAANG monoliths we have a bank, two oil companies and a telecommunications company. Nevertheless, this is the index we look to.

The last six weeks have seen a huge rebound. So where now?

Given the fastest crash in history, it was inevitable we would see a huge bounce at some point. Many are calling that the next bull market has begun, and that we are leaving the coronavirus crisis behind. I need not remind everyone that even when the death toll was mounting up in Italy – where the numbers were not fake like they could’ve been in China – global equities still hadn’t priced in any economic downturn.

Several weeks later, and we have money printed like McDonald’s Monopoly stickers, and helicopter money. The government has reacted quickly with stimulus, and the London Stock Exchange has decreased regulation on raising capital, with many companies choosing to take advantage of the extension by placing 19.9% of their share capital rather than the standard which is half the size.

Germany is seeing deaths increase with lockdown restrictions beginning to be relaxed, and while UK deaths appear to have flatlined they certainly aren’t receding as fast as everyone would hope. People are dying – and sadly more will die once lockdown restrictions are relaxed here.

The US appears to be a ‘circus’ with many protesting the lockdown and infecting each other in the process. One of the world’s greatest economies has now been brought to a grinding halt.

And what about the personal debt that is piling up? Many Americans need a car to get to work. But most Americans have their car on finance. So, if they lose their job they’ll have to give the car back. And if they don’t have a car then they can’t get a job. Then what happens?

There is a lot to be fearful about. But being scared doesn’t help anyone, unless we can do something about it. In the meantime, stocks will continue to move up and down, and it is our job to trade them and make money from them.

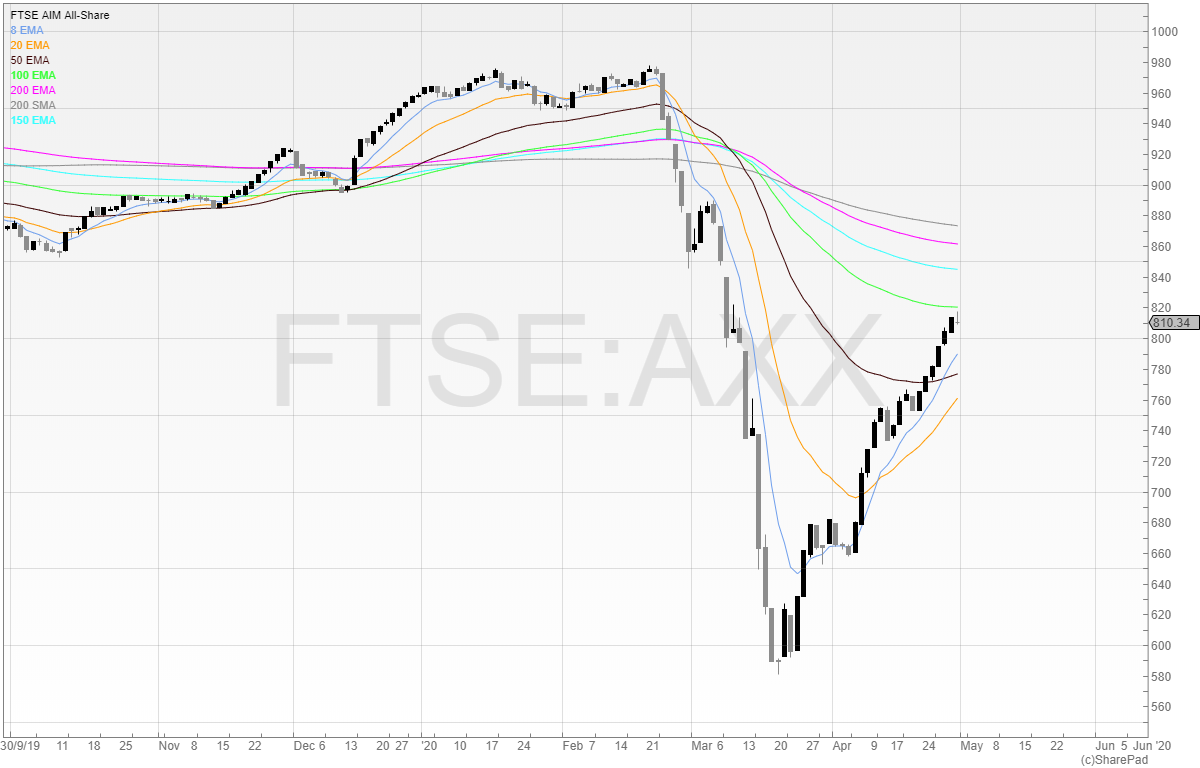

Here’s the FTSE AIM All-Share.

The opportunities have been there. But perhaps the bounce is running out of juice. It may be time to start searching for stocks to short again!

I hope you have a fruitful and profitable May, and please keep safe.

To read Michael’s free book How To Make Six Figures In Stocks go to his website: www.shiftingshares.com

Twitter: @shiftingshares

New subscribers can claim a free month of data with SharePad

Comments (0)