Chart Navigator: LoopUp, Xaar, N. Brown and DX

In this monthly charting column, full-time trader Michael Taylor reveals three stocks that he reckons could see fireworks in the month ahead.

Things change quickly. Whereas Covid-19 was increasingly looking less bad, and Eat Out To Help Out was a great success, the message is now stay indoors. We could be forgiven for getting confused, as indeed Boris did when he told the public they could do something when actually it was forbidden.

However, deaths are not increasing at the same rate as they were during the first ‘wave’. So perhaps it’s not as bad as we thought? But even so – that is not the main lever for the markets. What matters is that people are now going out less, spending less, and that means a hit to the economy. Maybe we have not yet seen the after-effects of the lockdown. Maybe we are going to see the biggest bull market the world has ever seen. Either way, we can profit from it. The charts will tell us everything we need to know.

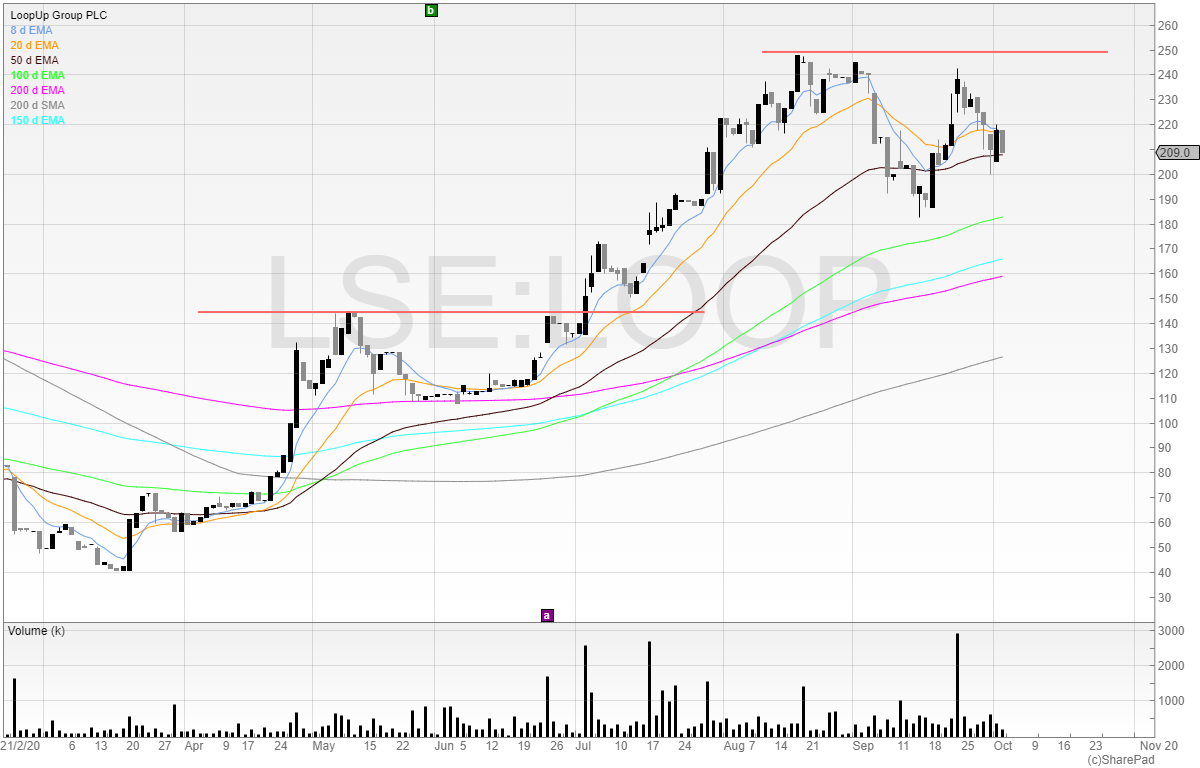

LoopUp (LON:LOOP)

LoopUp is a software company that operates virtual meetings. It’s very much like Zoom, which you have probably come across in the last six months. Understandably, Zoom has been on an absolute tear in recent months due to the boom in working from home and the need for video conferencing.

Looking at the chart, we can see the drive in the recent price from around the end of March. This is when we were first put into lockdown (crazy to think that was nearly seven months ago now – how time flies!) and early birds were getting into the stock predicting the trend.

There was a good risk/reward entry into the stock after a bowl. We can see the stock tested the 200 exponential moving average (pink line) before forming a cup and handle and breaking out.

The stock is now taking a breather again and I am hoping for it to breakout from the 250p level. I took a small position on the results. Currently, there is a seller depressing the stock but perhaps once he or she clears the stock can move forward.

The results for the company showed staggering growth. We saw that the stock took a dip on these results – perhaps they were expected and priced in? However, let’s take a closer look at the company’s revenue performance.

Revenue growth came in at 43% to £31.9 million at a gross margin of 71.4%. But this period is for the six months ending in June. One can assume that the growth in revenue came sharply from March onwards, which suggests that the growth rate has been even quicker in recent months. Maybe this could continue in the future? I think it’s likely LoopUp will continue to drive revenues and all of its financial metrics will keep moving in the same way. Therefore, I will add to my position when or if the price breaks the 250p level.

It’s also worth pointing out that the company is not heavily indebted. The net debt was “materially” reduced down to £5.3 million. In terms of cash generation, this is manageable, and should continue to reduce.

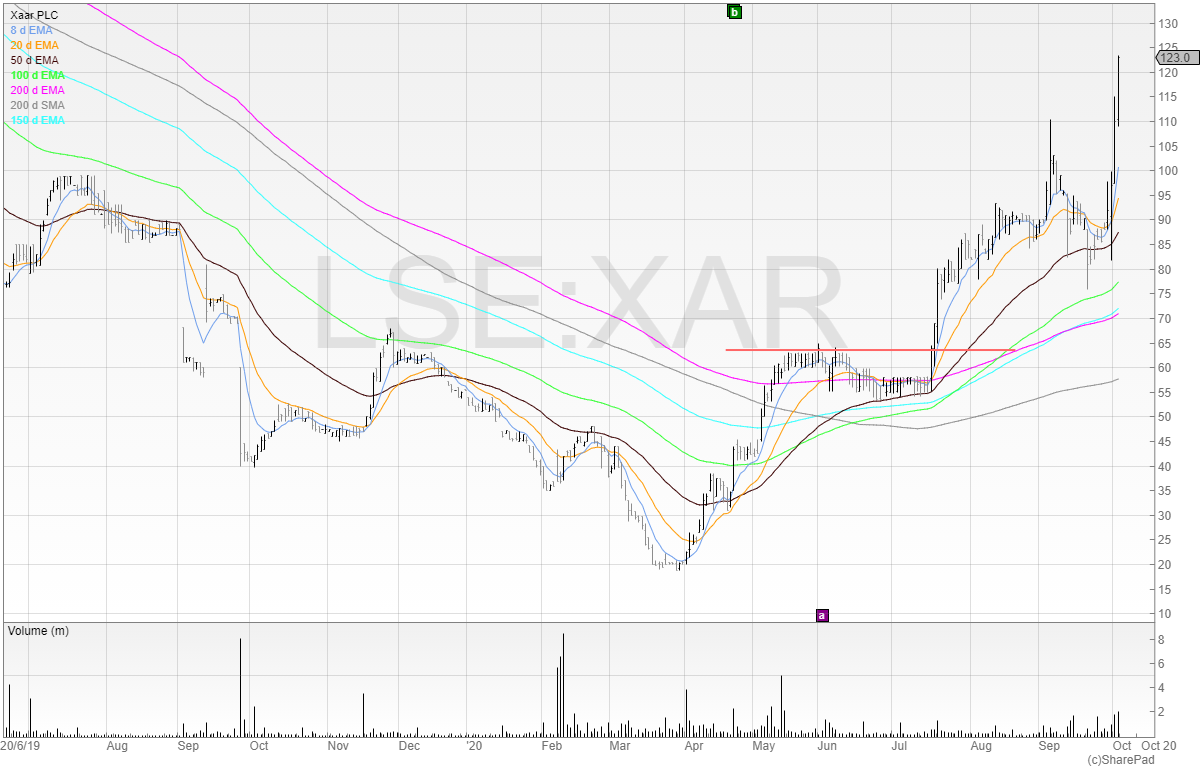

Xaar plc (LON:XAR)

Xaar is a company that develops digital inkjet technology. It also does other things, but those were not explained in plain English and so there is little point trying to explain it. However, the company has recently changed its strategy and rather than selling to end users it is now selling to Original Equipment Manufacturers (OEMS). This means that the company can sell more (although at a lower margin). It should increase quality of sales too.

The company has £23.9 million in cash and so is well capitalised. The business is in a turnaround stage and the chart appears to reflect this for now.

Here is the company’s historical chart going back to 2013. We can see that the stock traded close to 1200p. Now, just because the stock is currently 123p does not mean the company is cheap. One mistake of private investors is to assume that because the price is low that the stock is cheap – but this discounts the very factors that have had an effect on the stock price in the first place.

Looking closer to the more recent trading history we can see that there was a volume spike in February, and average volumes continued to remain elevated. This to me shows accumulation in the chart, and we know that Andy Brough of Schroders Asset Management took close to 30% of the company. It’s now looking like a stage 2 stock as it has cleared all of the moving averages, and they are now all pointing upwards which is bullish.

Some may be put off by the stock as it has risen sixfold since its low of 20p, but the best stocks to buy in the market have often multi-bagged already. This is because the trend upwards is confirmed and obviously anyone wishing to sell is constantly getting taken out by the increase in demand. This is what pushes the share price higher. It’s not a question of how high the price has risen, but a question of supply and demand. More supply, and the share price falls. More demand, and the share price rises. That is what it comes down to at the end of the day.

N. Brown Group (LON:BWNG)

N Brown Group is a multi-channel retailer that serves the underserved and is increasingly going online. Its biggest brands are JD Williams, Simply Be, and Jacamo.

However, 92% of its revenues are now online and the net debt continues to reduce. Here’s the chart.

Again, we can see the volume ramp up in April. This suggests accumulation in the stock and a potential change in trend. The low in the stock was below 20p and it currently trades at 50p. That suggests that the trend may indeed be changing.

Let’s take a closer look at the chart.

What is important to note here that the stock is putting in higher lows. It’s also not giving much back on retraces which shows clear demand. I currently don’t have a position in the stock but would like to see this print above the red line of resistance around 66p where I’d like to take a position.

DX Group (LON:DX.)

DX Group is another turnaround play. It’s a logistics company that is seeing better fortunes.

Notice a pattern here? Again, volume is on the up, and the stock price is appreciating. Whenever you see a volume spike in the chart it pays to take note. This can often give traders an early warning sign that things are changing. We can see that the black line has also provided support on several occasions. This now marks as a significant price action zone to me and so I want to see this hold. A breakdown of this area would show that the price is not ready to move higher.

What’s also interesting to note is that other delivery firms have been powering forward. Clipper Logistics and Wincanton have seen good business performance in their sectors. So there is a rising tide in the industry, but can DX deliver (sorry – couldn’t resist)?

It’s also interesting to note that the directors have been buying stock since the results. There have been no less than four director shareholding RNSs. Director share purchases should always be contrasted to the directors’ net worth, but whilst these are not exactly huge purchases, they are not token amounts of less than £2,000 either. Certainly, nobody puts a gun to a director’s head and forces them to buy stock.

The coming month

As we head into quarter four of 2020 it’s likely we’re going to see continued volatility. Lots of companies reported in September and announced better than expected trading. Costs have been slashed and it has given management an excuse to get rid of the deadwood that they can’t justify when times are good. Covid-19 has provided an excuse for restructuring and rebuilding, and making companies leaner.

I remain bullish on stocks but will keep an eye open for shorts too. Remember, as traders we should remain agile and retain the ability to change our minds quickly when the facts change.

- Michael has released his UK Online Stock Trading Course sharing his knowledge and how he trades the stock market. Master Investor readers can take advantage of an introductory offer by visiting shiftingshares.com/online-stock-trading-course

- Twitter: @shiftingshares

- New subscribers to SharePad can claim a free month of data with the code: Michael

Comments (0)