Chart Navigator: eve Sleep, Conroy Gold, FRP Advisory and Jet2

As we near the end of summer and people gradually begin to return to something that distantly resembles normality, Michael Taylor reveals four charting picks where the momentum looks to be building.

I said last month things can change quickly. And they did. Boris Johnson was accusing Keir Starmer of ‘wanting to plunge the country back into a devastating lockdown’, just ten days before he plunged the country back into what we can only assume he thinks is a devastating lockdown (unless it’s now a ‘good’ lockdown?).

I don’t care much for politics, but the incumbents in the UK leave a lot to be desired. And in the US both candidates should probably be in a care home. It’s a strange world where these four men are the crème de la crème, but I have long ago accepted that nothing makes much sense and I may as well just keep trying to profit from it.

And so with that pre-amble aside, let’s have a look at some stocks for the coming month.

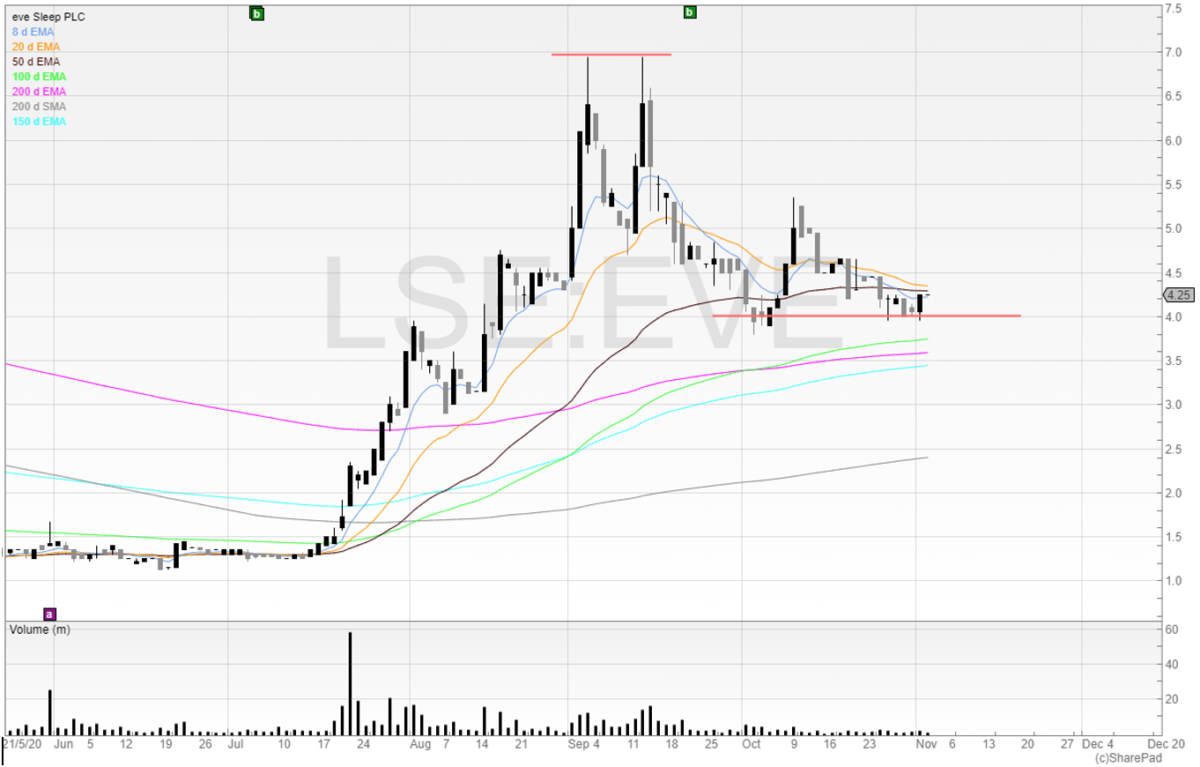

eve Sleep (LON:EVE)

I hold eve Sleep. It’s an online mattress selling company – or was. Now it calls itself a “sleep wellness” company. That certainly sounds more sophisticated but I’m not sure it’s much different.

In any case, what is different is that the company has slashed losses and in its interim results generated its first positive cash flow in the company’s history.

This is significant. In a company that has seen Woodford’s stake obliterate the stock price, and the takers of the Woodford overhang become overhangs themselves, nothing is priced in here (in my opinion, of course).

Everyone knows eve as a complete dog. Because it’s always been one. It has massively spent on revenue with no regard for profitability. The previous board couldn’t find value in the middle aisle in Aldi. There is a new board, and a new chief executive, who is very much focused on profitable growth. It’s easy to talk the talk – but so far these results are suggesting she may be able to walk the walk.

It’s early days of course. And in H1 the company saw most of its competitors completely shut, as bricks and mortar stores were locked down for three months. So naturally, those results are flattered by the closure of its competitors. But lockdown is coming again and from Thursday 5th everyone will be locked down again.

The company now generates a positive marketing contribution. This in turn is driving gross profit and losses have been drastically reduced. With a strong balance sheet of £9.2 million net cash against a market cap of £11.5 million at a share price of 4.25p, my belief is that the company offers a nice risk/reward trade.

Let’s look at the chart.

We can see that the stock has risen from a range of 1p to 1.5p. It’s risen a lot already, and so it’s natural the stock is consolidating and letting profit takers out and new shareholders in. I would like to see the stock test the highs at 7p at some point and then break out of the range.

It may take a while, but buying at support I feel the risk/reward is very much in favour to the upside.

However, I could always be wrong – so as always – time will tell!

Conroy Gold and Natural Resources (LON:CGNR)

This is a very interesting stock. I’m disappointed I wasn’t shown the placing as this came with warrants. Anglo Asian Mining (LON:AAZ) have agreed to fund some exploration for CGNR – a company which I rate highly given the returns it has delivered for shareholders.

Again, the chart looks potentially exciting here.

We can see a gap up and a spike on large volume, only for the stock to come right back down.

This would typically be a bearish signal. But given that the stock was very thinly traded it’s likely stale bulls cashing in their chips. These shares then changed hands into stickier hands, and the resulting share price has seen huge growth.

So far, the 50 EMA (black line) has acted as resistance for the stock. Right now, I want to go long on a breakout of that recent high at 39p. Yes, I can buy cheaper now, but what if the stock tracks back down to 20p? Then I’d be 33% down on my capital which is no good.

It’s better to pay more and be right at the right time, rather than enter cheaper but potentially be wrong for a while. There’s also no guarantee that the stock will break out either – and so by virtue of the stock breaking out it is showing us that we want to be long at the correct time.

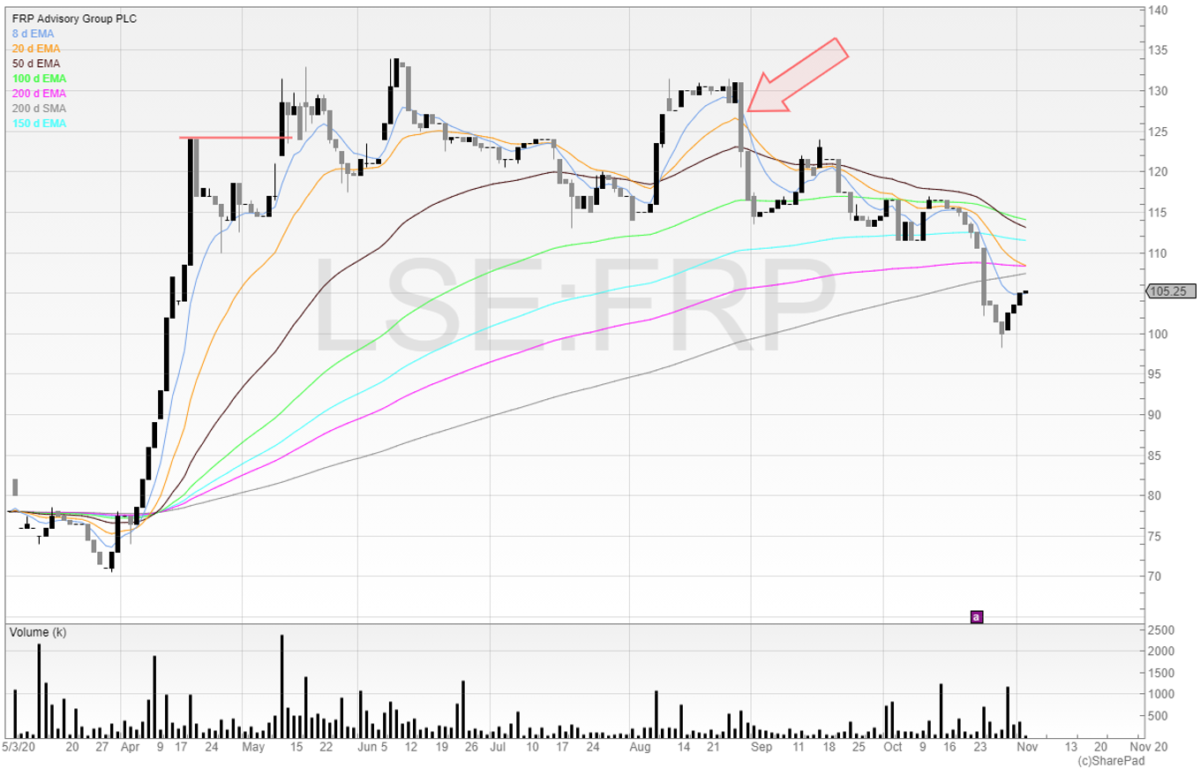

FRP Advisory (LON:FRP)

FRP Advisory is a new company that specialises in many things corporate finance based as well as administration appointments. Given that we are going to see many businesses going under over the coming six months, this should be a stock we need to keep watching.

I’ve marked an arrow on the stock when the results came out. Many investors were expecting these results to be good and so were buying into the stock pre-results anticipating the stock to gap up on good earnings.

This is exactly why I say that buying a stock before earnings is gambling. Firstly, you don’t know what the results are going to be. Secondly, and more importantly, you don’t know how the market is going to react. The stock could post fantastic earnings, but what if they were not what the market was expecting? All that is going to happen is the stock sells off, as it did in this case. It’s simply not worth taking the risk and buying a stock before earnings because the risk/reward is not in our favour.

It’s much better to trade the reaction every time. It’s the same with oil drills and phase III pharmaceutical trials. Trade the reaction, and not the prediction.

This is exactly why I say that buying a stock before earnings is gambling. Firstly, you don’t know what the results are going to be. Secondly, and more importantly, you don’t know how the market is going to react. The stock could post fantastic earnings, but what if they were not what the market was expecting? All that is going to happen is the stock sells off, as it did in this case. It’s simply not worth taking the risk and buying a stock before earnings because the risk/reward is not in our favour.

It’s much better to trade the reaction every time. It’s the same with oil drills and phase III pharmaceutical trials. Trade the reaction, and not the prediction.

I’ve got an alert to buy the breakout at 134p. If the stock doesn’t print there then I don’t buy.

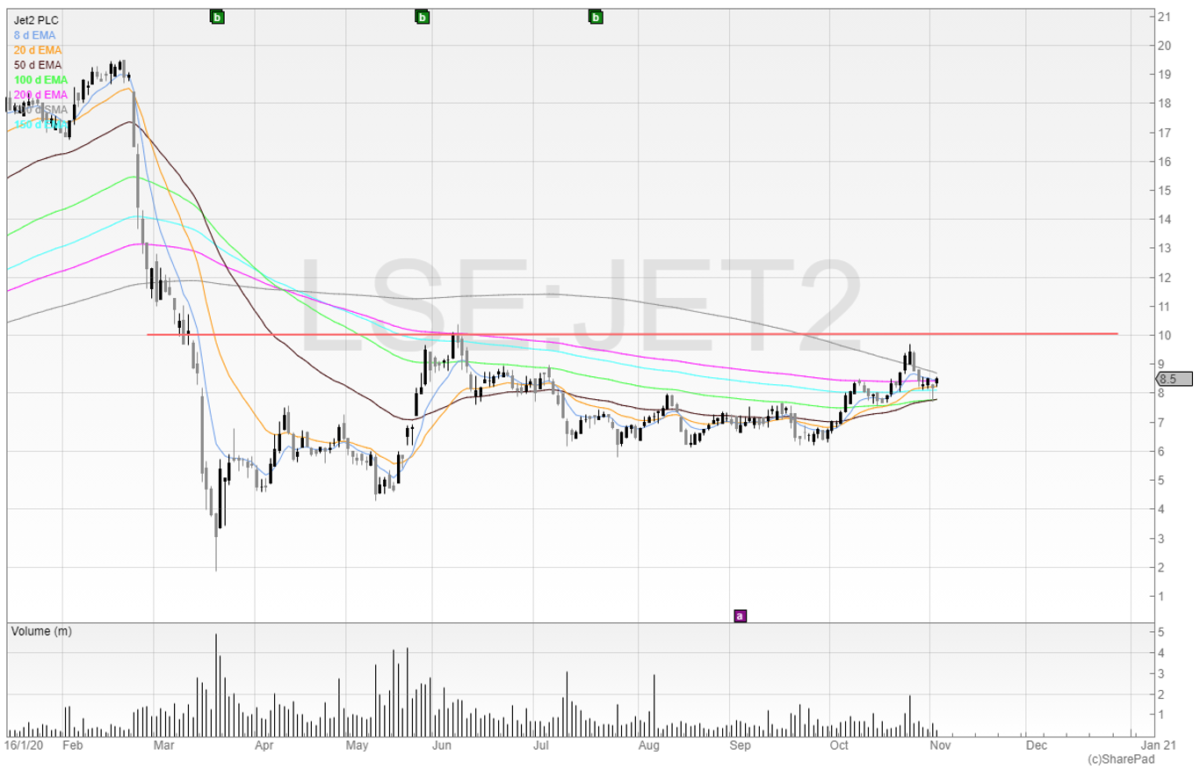

Jet2 (LON:JET2)

Here’s a stock that you’re probably not thinking of buying right now. Jet2, the old Dart Group, is going through a rough period as are all airlines.

Yet the stock is showing remarkable resilience. It’s financed itself with a placing and the chart is showing signs of consolidation. It’s easy to believe the narrative but what actually matters is the price action, and supply and demand.

If you look at the chart, we can see that 1,000p has proven resistance. The stock is putting in higher lows, and bowling slightly upwards towards the red resistance zone.

I’ll be long the stock if it breaks 1,000p. People can tell me airlines are dead all they want, but the price never lies.

The coming month

We should have plenty of updates next month. That means lots of opportunity.

Whoever wins the US election, we’re going to see lots of stimulus. In that sense – we’re all winners. I have few shorts on my book at the time of writing and intend to increase long exposure as stocks break and advance northwards.

If we’re coming into the beginning of a huge bull market, then getting in on market leaders early will drive outperformance in the P&L.

Watch for stocks breaking out and as always manage your risk.

- Michael has released his UK Online Stock Trading Course. Master Investor readers can download Michael’s book and learn more about the course by visiting www.shiftingshares.com/online-stock-trading-course

- Twitter: @shiftingshares

- New subscribers to SharePad can claim a free month of data with the code: Michael

Comments (0)