Own a classic exotic: TheCarCrowd’s novel fractional investment platform

Alternative and passion investing are an area that has seen considerable growth in recent years, with investors seeking returns from more unusual – or personally familiar – sources. We recently spoke with David Spickett, CEO of TheCarCrowd, about the drive behind passion investing and his platform’s success as an accessible entry point to the lucrative classic car market.

The idea of investing in niche areas of interest and away from the conventional is a concept that has grown legs in recent years. The meteoric rise of fractional investment has generated a level of attention and ‘buzz’ that has surprised much of the traditional investment industry. In fact, the US fractional investment market has risen from $1.5 million in 2015 to $1.5 billion in 2022. This appetite for accessible alternatives has given rise to asset-backed fractional investing, often in luxury goods. Now, though, TheCarCrowd is giving investors a clear pathway into high-value classic cars.

The premise is simple; TheCarCrowd’s expert panel researches and selects classic cars based on strict criteria, divides them into between 250-1,000 shares and offers these to qualifying investors on the platform. The business warehouses the vehicles and shareholders vote on pre-screened offers to democratically decide when to sell, adding to the engagement and excitement.

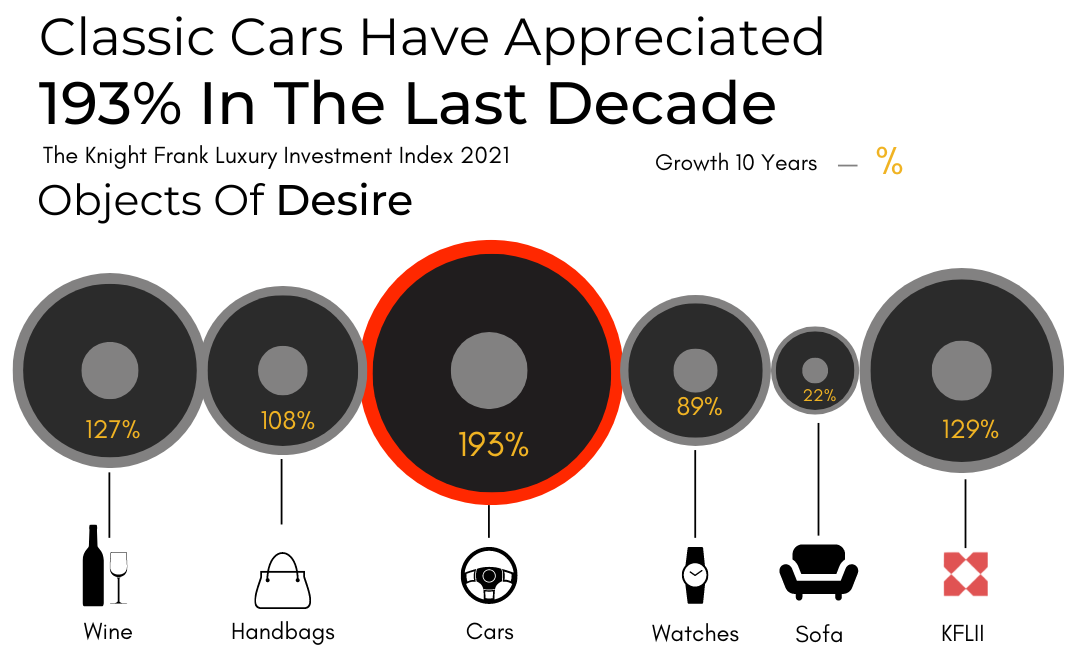

It is a new and interesting take on fractional investment – one that has already proved popular among ‘petrol heads’ and those looking to benefit from the classic car market’s substantial growth. According to the Knight Frank Luxury Investing Index, classic and luxury cars have returned 193 per cent over the past decade.

With extensive experience operating in an FCA-regulated environment in a previous role, Spickett sought to balance this novel idea with the familiar, rather than utilise something like blockchain tokenisation. It was a recognition that transparency, regulation and easy accessibility would be determining factors in the platform’s success.

“Generally speaking, fractional investment is quite a new category,” explained Spickett. “Having seen the scepticism around things like crypto and NFTs among traditional investors, I wanted to ensure it was far more conventional and familiar – I didn’t want to mix a new category of investment with a new investment technology. We wanted to adhere to all current crowdfunding regulations, which has allowed us to gain far more traction than other start-ups with similar ideas.”

Fractionalisation has become a popular way to lower the barrier to entry of high capital asset investments. Spickett points out that it is also simple to understand – for a certain amount of money, an investor receives a specific fraction of an asset, the value of the asset changes, and the investor seeks a return. While it has been used in more conventional markets like property, it is now available in markets like art and rare whisky. So, why classic cars?

“There are two fundamental reasons why we have brought fractionalisation to the classic car market. Firstly, it was an area of great personal interest, experience and knowledge; and secondly, because the high returns often seen in classic cars are entirely unavailable to most people – it requires a lot of capital to enter, let alone to diversify within it. Our approach has not only created an opportunity for those passionate about these stunning machines, but also those looking to benefit from this niche market’s growth.”

TheCarCrowd’s expert selection panel conduct exhaustive research on the most appropriate models and specific examples to offer for investment. Spickett points out that understanding the market, vehicles, and geographic demand play a large role in how and when they decide a car is right.

“So, one example would be the ‘25-year rule’ in the US. Back in the early 2000’s,, they introduced automotive industry regulations to prohibit the importation of non-US-compliant vehicles until they reached 25 years old and were considered classic cars. Well, when we’re talking about the US, we are talking about a huge market with a rich automotive culture that is limited by domestic supply. We use this to our advantage, purchasing vehicles as they approach this milestone – the Ferrari Testarossa, for example, has risen over 21%* since reaching exportable age. Similar is true of left-hand-drive vehicles, which are seen as undesirable in the UK but highly prized in the US market.”

In fact, some modern classics like our Renault Clio V6 appreciated over 25%** in just 9 months. We have seen valuations of other cars on the platform like the Sierra Cosworth and Mini Cooper also grow by around 15%. Often, these vehicles cost in excess of £100,000, making them an unobtainable or far riskier proposition for an individual investor.

“Unlike other categories, like funds, that may have a minimum investment of circa £50,000, TheCarCrowd’s minimum investment is around £500. There is also an increased sense of security because it is a physical, tangible object. TheCarCrowd operates a ‘destination’ café where investors and members of the public can come and see the cars themselves. We currently have 3,000 registered users, roughly half of which are qualifying investors, the majority of whom have already invested in one or more vehicles.”

Spickett admits that classic cars bring their own set of challenges. Safely storing, insuring and maintaining classic cars for extended periods can be expensive. This is particularly true of the models that typically see high growth, think Ferrari or Lamborghini supercars from the 70s, 80s and 90s. That is part of TheCarCrowd’s unique approach. Vehicle selection, care and maintenance are all covered by the business, which makes its money via a curation fee and a premium on the initial offering price.

“Most of our investors are in it to realise long-term gains, which could be substantial over 5 to 10 years. At the same time, we understand that life changes, and individual users should not have to wait for the sell vote to realise their gains. We also wanted to increase the ability for investors to trade or sell their shares and so will be launching a bulletin board style secondary market in 2023. Whilst there is no guarantee of a sale we hope that with over 3000 registered investors we will help to create an element of liquidity for investors.

While alternative and passion investing will never be the backbone of a portfolio, it does allow investors to diversify into unusual markets and offers an outlet for their interests. Perhaps most importantly of all, platforms like TheCarCrowd are making these asset classes far more accessible than ever before, while also removing many of the headaches and costs by operating at scale. It will be interesting to see how this category evolves over the coming decade and how these alternative markets perform. One thing is for certain, though, if you want a share in TheCarCrowd’s latest offering, a bright yellow Lamborghini Diablo SV, you’ll need to get in quick.

TheCarCrowd and Master Investor will be appearing at the London Investor Show, which will be taking place in London on the 27th of October

Comments (0)