Chart Navigator: three stocks to watch in the month ahead

Recent volatility has drawn more new investors to the market. Michael Taylor explains why, and reviews some stocks to watch.

It’s been an exciting month for traders. Volatility has continued in leaps and bounds, with stocks gapping up and rallying, and multibagger stocks across the board. It’s a market fuelled by speculation and private-investor capital.

There are several reasons for this. Firstly, some stocks have risen as a result of Covid-19. For instance, diagnostics company, Novacyt, sparked a wave of ‘hot money’, which was then invested in other Covid-19-related stocks, which also rose substantially.

Secondly, many people have been furloughed and are now at home, bored, so stock-market news is attracting their attention. As a result, they are opening brokerage and spread-betting accounts with gusto.

All of these accounts bring in net funds to the stock market, and when net funds are deployed it means inflows −and inflows drive prices.

Speculators in the US are opening Robinhood accounts in droves. They’re taking on the most dangerous and speculative of stocks. And they’re winning!

This isn’t supposed to happen. New investors are supposed to get ‘burned’, and we’re all meant to get beaten to the point of despair in a bear market.

But what bear market? Despite being bearish myself about the overall economy and consumer spending, the markets have roared defiantly higher.

In my last column, we looked at Royal Dutch Shell (LON:RDSB). We saw the drop I predicted, and the stock is still trading below the price when the last issue was published, but so far it hasn’t come down to test 900p. It’s also not broken out of the trendline I highlighted either, so it’s been a ‘drifter’. It’s hard to make money on drifters, because stocks need to be in play or we ought not to bother with them. Therefore, Shell leaves my watchlist until it does something significant enough to return to it.

JD Wetherspoon (LON:JDW) also broke out of the level we identified to the upside and is now advancing. Given that this stock was trading below 500p not long ago, then has come to raise over £100m at 900p – perhaps that was the low? If so, not only would it be the quickest crash in history, but the quickest recovery too.

We may not be out of the woods yet, but with interest rates so low there is no alternative for returns. Everyone is forced to buy stocks because what else do you buy? Do you buy bonds? No thank you.

That means that any dips may see investors pile in as they missed the bottom last time. FOMO is a powerful thing.

In any case, if you did miss the bottom and you’re rueing that you missed out on some wonderful stocks at cheap prices, it’s time to move on. Everybody else has, and opportunities are everywhere. And we may even see short opportunities once more – but for now, I remain long. That is the trend of the market, and only a fool would try to fight it.

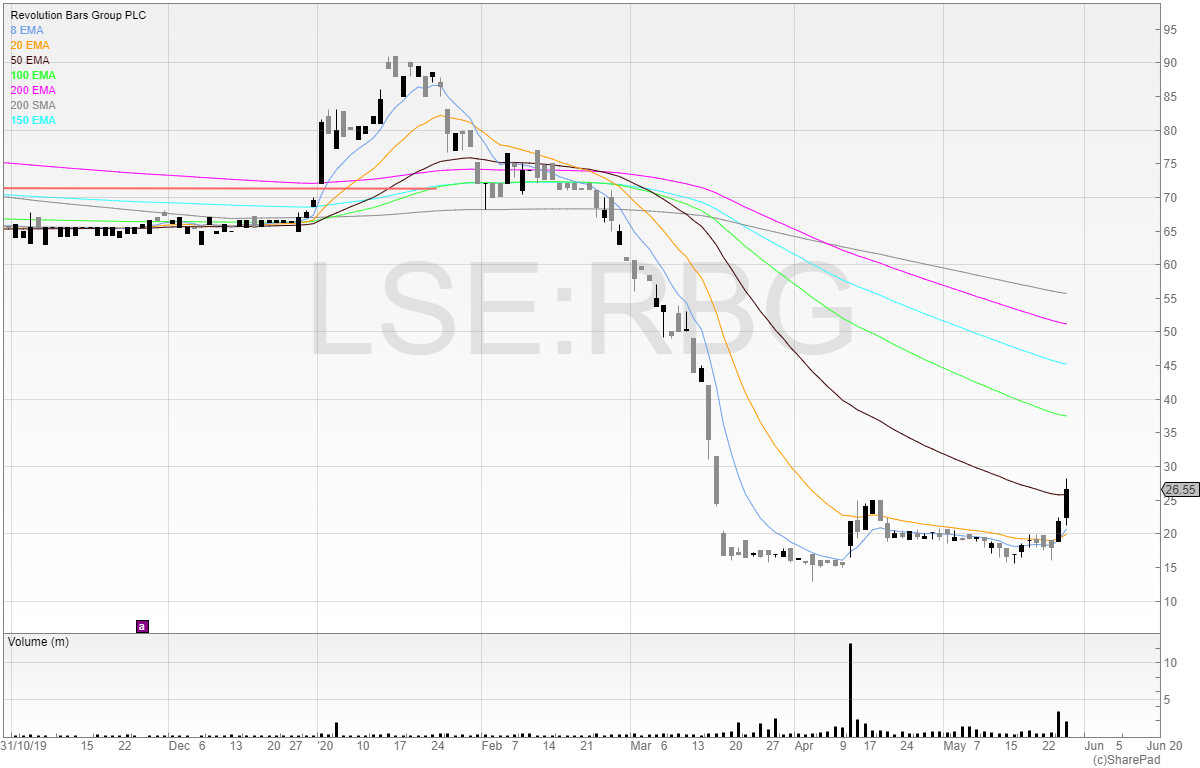

Revolution Bars Group

Revolution Bars Group (LON:RBG) is a stock I am long of from 18.3-18.9p. It seemed a surprise to me that the stock wasn’t gapping up in the opening auction when it had just announced positive funding news.

Even weirder was that it was not a problem to buy ‘on the bell’ – causing me to question if I was actually right. Usually good news means stock can be scarce, but this wasn’t an issue with Revolution. Luckily, I was right, and the stock began to move upwards.

With a market cap of £13.3m at a share price of 26.5p, if Revolution survives – and its recent RNS funding announcement suggests that it stands a chance – then the stock is surely a multibagger.

Of course, the pre-Covid-19 Revolution looks very different to the Revolution that will be in the future.

Wetherspoon’s pubs will adhere to social-distancing rules and the company has started placing screens in between booths and tables to protect customers. There will also be restrictions on capacity. No matter how much people might want to drink – sales are just not going to be what they once were.

Wetherspoon’s is definitely the safest option here in the sector, as the clear leader. But the safest does not always offer the most upside, and therein lies the trade-off.

Eagle Eye

Eagle Eye (LON:EYE) is a business that offers “digital promotions” – which means online coupons – and these coupons work in real time for all of the business’s clients. Its key USP is its software platform, Eagle Eye AIR, which is a software as a solution model and provides high levels of recurring and growing revenue.

How this works is that Eagle Eye offers both the creation and redemption of these digital offers as well as rewards for Eagle Eye’s clients and customers. Growth comes from the acquisition of more customers, as well as existing customers taking out more services. Already the company has some impressive clients signed up to its service, including Asda, Heineken, Walkers and Greggs.

Looking at the chart, we can see that the stock has sold off heavily from the start of the crash, shedding 50% of the company’s market value from peak to trough.

I think this is an attractive discount for a company that (based on its last results) is self-sustaining. However, given many of its clients have been closed, it makes sense that revenues are likely to take a tumble. It’s impossible to quantify this, and so we are reliant on the next market update to reveal how trading has been.

I’m going to keep this one on my watchlist, as trading may not been as bad as the market has priced in.

Greggs

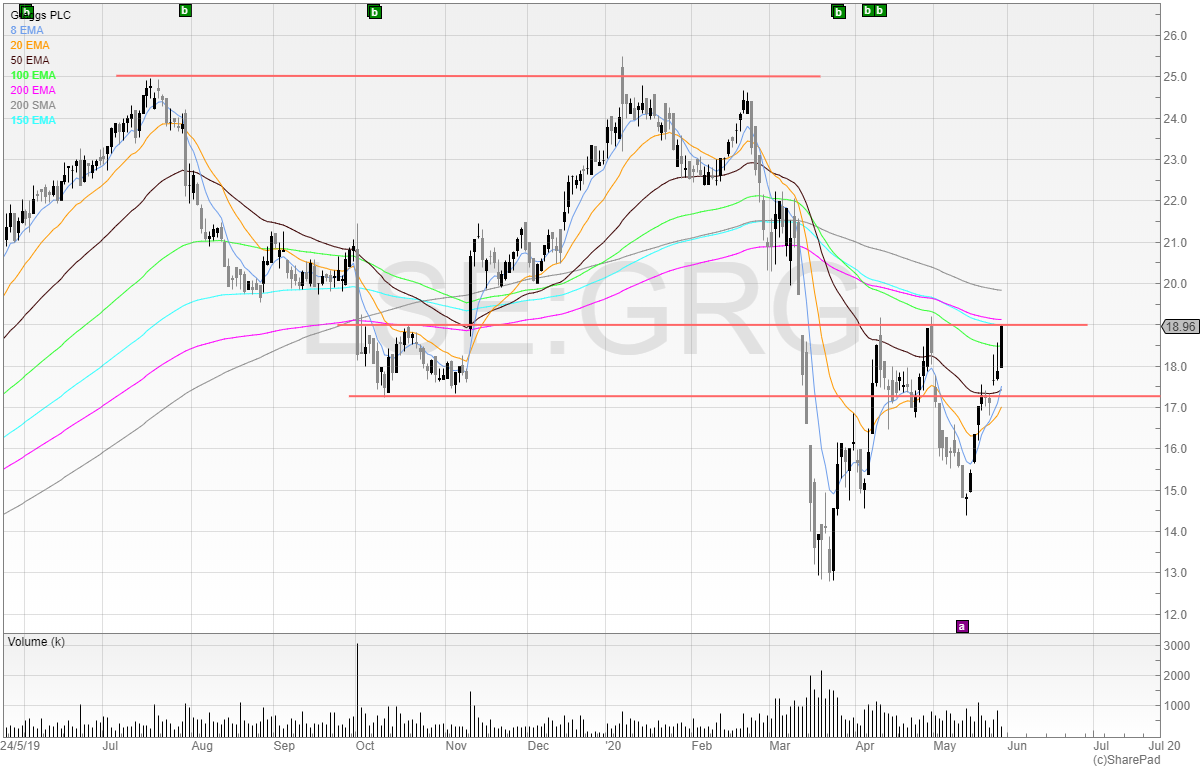

Greggs (LON:GRG) has been a stock-market success, and a stock that many of us have interacted with at some point.

It’s a quality business and sees breakfast as the new area of potential growth.

Looking at the chart, the stock has been tradeable from various ranges. It’s currently trading in a range with resistance around 1900p – if the stock takes out this level, then I’ll take a long position.

This is significant resistance, as we can see the stock has bounced and failed to break through it four times already. Should it be different this time, the price will very clearly be telling us something that is changing.

With the economy opening up and Greggs having a strong presence in the high street and other prime locations, perhaps the company may not be hit as hard as other high-street businesses.

Looking ahead

It’s impossible to predict anything with any certainty about what will happen in the next week, never mind the next month.

However, be careful of having too strong an opinion. Traders need to be flexible, and able to change their minds instantly. The best traders trade what they see and are able to freely admit when they are wrong. Being able to completely change your mind when the facts materially change at speed is a great skill and a factor of outperformance. An example of this is my Revolution Bars Group trade, which at the time of writing is over 72% up in just two trading sessions.

Most people don’t bother to read RNS announcements. However, it’s in this hour that the money can be made. The market is inefficient, even for SETS-traded stocks. By reading many of the trading updates and results, you begin to see the story of each stock. This knowledge is broadened and added to whenever you next see an RNS announcement. This database in your mind is an incredible asset – and one many traders don’t bother using to its full potential.

If you don’t know the story in the first place, how do you contextualise any update or piece of news?

It is my belief that those who put the time and effort in will continue to reap the rewards in this market.

To read Michael’s free book How To Make Six Figures In Stocks go to his website: www.shiftingshares.com

Twitter: @shiftingshares

New subscribers can claim a free month of data with SharePad

Comments (0)