Passive strategies to benefit from both lockdown and recovery

Filipe R. Costa explores the potential for a recovery in airline stocks, while protecting against the possibility of future lockdowns.

“The future is uncertain… but this uncertainty is at the very heart of human creativity.”

– Ilya Prigogine

After more than two months at home, I have finally been able to set foot outside. With most of us having been locked down at home for a while, we now need time to get used to the idea of returning to something approaching what used to be normal, particularly while the virus is still hanging around. Most European governments have already announced post-lockdown measures to reopen their respective economies, but as soon as you go outdoors the “Stay at Home” slogan is everywhere.

It is with this dichotomy in mind, that this month I’m betting on the recovery of an industry that crashed so hard that it currently appears undervalued, while at the same time hedging my bets with investment in a theme that has been ‘flying high’, particularly during lockdown.

Is it time to fly?

The worst thing that can happen to an airline is to be forced to keep its planes grounded for a long period of time, with a long period of time being one hour − maybe two. Airlines keep their planes in the air for most of the day, flying full of passengers from one place to another in a recurring pattern. That’s the only way to keep fixed costs low and be profitable in a very competitive industry.

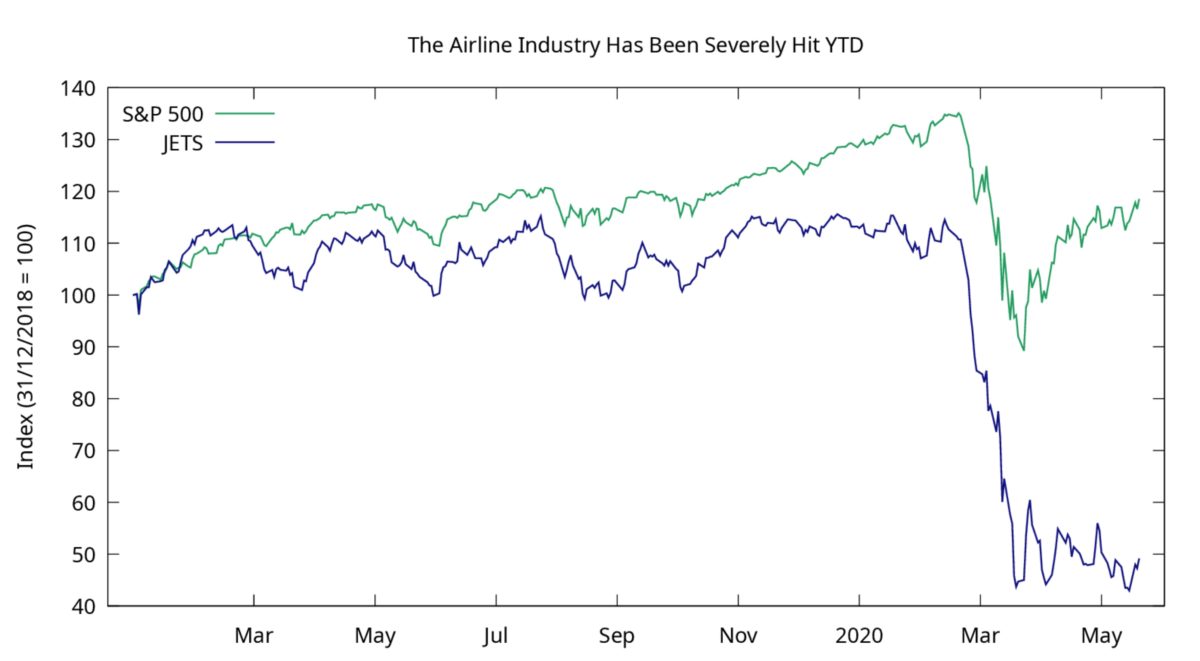

But then Covid-19 came along, destroying nearly 60% of airlines’ market value in just a few months. While the S&P 500 is down 8.8% this year, the airline industry has been battered down by 58.0% and tops the list of the S&P worst-performer industries year-to-date. Airlines have been at the epicentre of the pandemic, as most governments around the world shut down air travel as a last resort to contain the spread of the virus. Most of the airlines have shaky balance sheets and they cannot cope with a shutdown, even just a temporary one. To avoid the worst, many governments approved aid packages for the industry. However, much of the aid has come with several stringent restrictions attached, including an inability to fire staff, limits on stock repurchases, prohibition of dividend disbursements, caps on executive pay and government interference in management. While the aid may help save airlines, it has scared investors away from their stock.

While post-lockdown plans are already being announced, most governments don’t know what to do about borders. Even in Europe, where the worst of the pandemic is already past, there are major differences between countries on how to approach this, which means there’s still insufficient confidence to open land borders, let alone allow planes to flight freely. So, even if allowed, it’s doubtful that people would queue to buy tickets as the fear of infection continues. The scenario is therefore mainly negative, and most experts believe the industry won’t fully recover until 2022 or 2023.

Another point to consider, as it is a particularly tricky one, is how to implement social distancing in planes. To be profitable, a plane needs to fly at near full capacity and several times per day. If social distancing is to be adopted by airlines, they either have to significantly increase ticket prices or face bankruptcy.

Airlines have an unfortunate record of being battered down due to recessions; major incidents and accidents; terrorist attacks and public-health crises like SARS and now Covid-19. When looking at the past, the impact of the current pandemic on airlines seems more severe than any previous event. However, the airline industry has always shown an ability to recover quite quickly. Some airlines will disappear and some will take the opportunity to consolidate their position in the market by targeting the stock of others at discount prices. With health experts still warning of a potential return of Covid-19 in the autumn, the recovery process for airlines will be lengthy. It may take a few years until the industry fully recovers to pre-pandemic levels, but share prices may recover way faster. In my view, at a time when 50% of market value has been written off from airlines, I believe this to be a good entry point.

U.S. Global Jets ETF (NYSEARCA:JETS)

While investors may buy the shares of several airlines, it’s relatively expensive and time-consuming to do so, in a way that ensures the creation of a diversified portfolio. At a time of severe difficulties for this industry, it is very risky to pick just a handful of airline stocks because the risk associated with each company is very high and needs to be diversified away. The only risk an investor should bear at this point is the risk for the industry as a whole. Opting for a passive strategy and buying the JETS ETF is a much better option, as the fund has $753m of assets under management and invests in the stock of 15 different companies. Its top holdings are US companies, including Southwest Airlines, American Airlines and Delta Airlines, but it also buys Ryanair, Lufthansa and Air France KLM stock among others across the globe. The fund is down 58% this year, clearly outperforming the broad market, which offers a safety net in terms of the low premium investors are paying over accounting value.

Or is it time to stay home?

The pandemic is accelerating the digitisation of the economy. While consumers were already replacing books with e-books and high-street shopping with online shopping, the lockdown forced companies to accelerate their online presence and find alternative ways of attracting revenues.

One of the most affected sectors is sport and everything that depends on sport. Football, basketball, F1 racing, to name a few, are temporarily suspended, while major competitions like the Euro 2020 and the Olympics 2020 have been postponed to 2021.

Also, without football, basketball and horse racing, there is no sports betting. Many smaller sports-betting companies will struggle to survive. Others have found creative ways of keeping the money flowing in, by replacing the traditional football odds with the following:

- USA to lift the Schengen travel ban by 1-31 May / 1-30 June / 1 July or later;

- When will the National Theatre reopen? 1 July or before / 2 July or after;

- When will schools reopen in the UK? Before June / Between June and August / September onwards;

- Ryanair to fly a scheduled commercial passenger service for paying customers on 1 July? yes / no.

There’s no doubt the people in this industry are talented and dynamic. They can reinvent themselves if needed. But my point is less about the sports-betting industry and more about a growing business that this sector is embracing and boosting: the e-sports market. It is now possible to place money bets on people playing games like CS Go, Dota 2, Call of Duty and many football and basketball leagues and tournaments. The thrill of placing a bet, combined with the boredom created by the lockdown, has helped to boost the e-sports market. Many of these events are even being streamed live, adding to the overall experience.

Lockdown has benefited the rise of the video-games industry, as the games can be played anywhere, turning them into betting opportunities. But demand has not only arisen from having to stay at home. Youngsters are spending more and more time playing video games. The e-sports market is a niche within the video-games industry and one that the sports-betting industry won’t overlook. The threat of further pandemics and lockdowns will help boost the market.

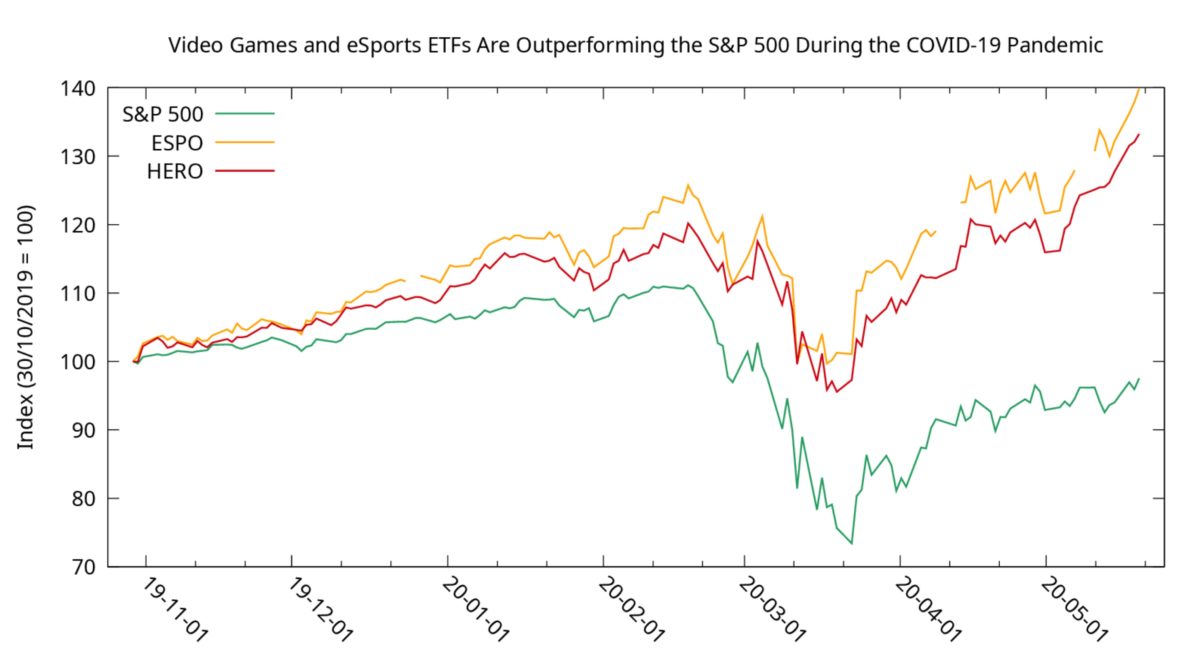

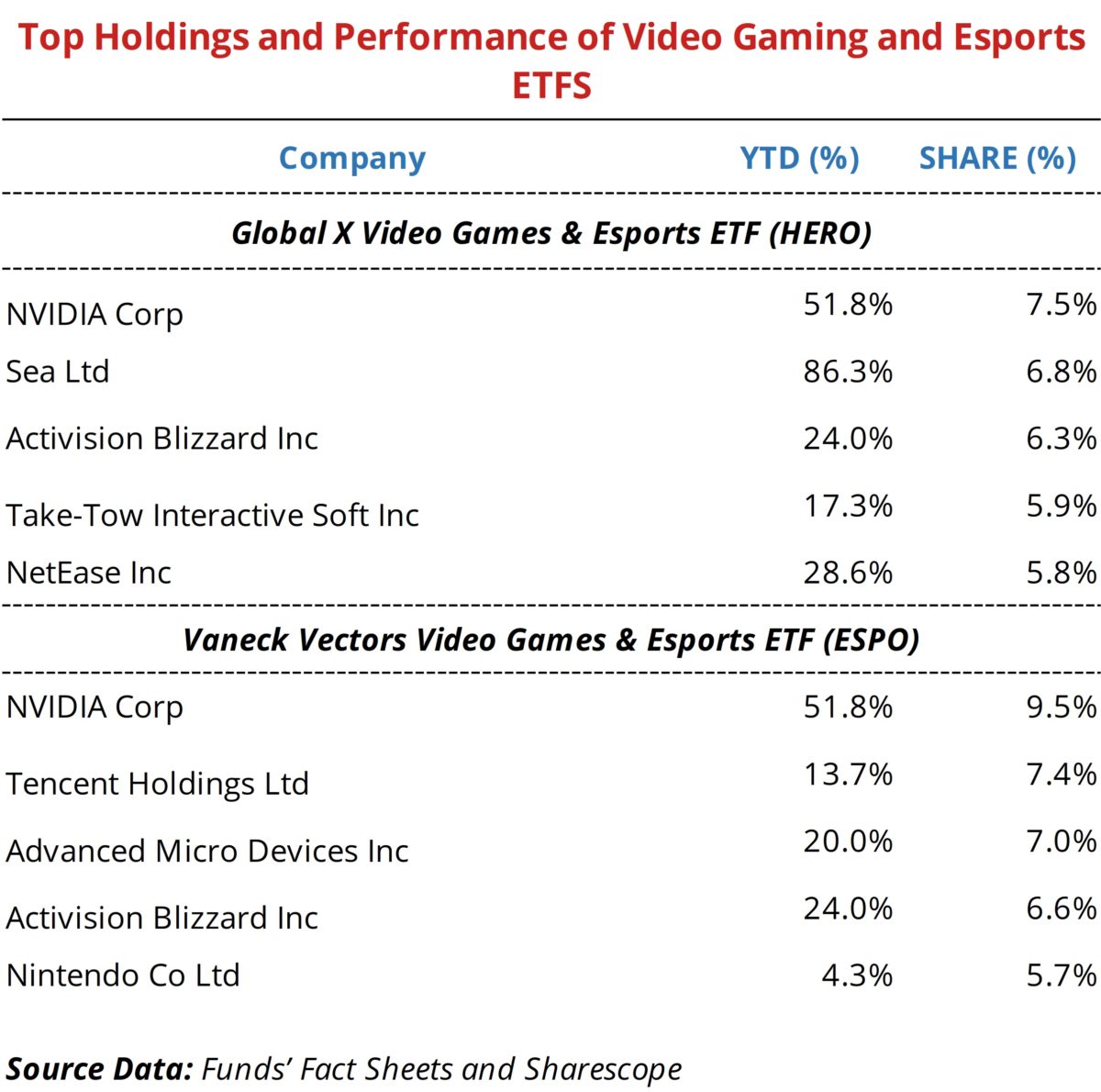

Investors have two very good options for tilting their portfolios towards this market − the Vaneck Vectors Video Gaming and eSports ETF and the Global X Video Games & Esports ETF. Both ETFs are outperforming the broad market, with rises of more than 20% this year. As opposed to the airline sector, which I believe is a value investment due to its decimation during this crisis, video gaming is a growth opportunity, as this industry not only benefits from the current situation but also enjoys huge growth potential in the near term.

Global X Video Games & Esports ETF (NASDAQ:HERO)

The Video Games & Esports ETF (HERO) was created in October 2019 by Global X, with the aim of targeting companies that are positioned to benefit from the increasing popularity of video games and e-sports. It invests in 40 companies that are directly or indirectly related to the video-gaming industry, from across the globe. The fund invests in the US (29.9%), Japan (26.5%), China (17.3%), South Korea (9.6%), Singapore (5.7%), France (5.1%), Sweden (4.3%), Ireland (1.1%) and Taiwan (0.6%). Top holdings include NVIDIA, Sea, Activision Blizzard, Take-Two Interactive Software and NetEase. While this ETF doesn’t follow an equal-weight approach, it also doesn’t concentrate too much of its funds in two or three companies, which is a very favourable point for those looking for diversification.

The companies in which HERO invests “develop or publish video games, facilitate the streaming and distribution of video gaming or esports content, own and operate within competitive esports leagues or produce hardware in videogames and esports, including augmented and virtual reality”, according to the fund’s prospects. Assets under management are a modest $109.8m, but the fund has been growing at a rapid rate. The expense ratio is not exactly cheap at 0.50%. If we’re talking about a broad-market fund I would say it was expensive, but for a specialty, highly themed ETF it seems relatively fair.

Vaneck Vectors Video Games & Esports ETF (NASDAQ:ESPO)

The other alternative is the Vaneck Vectors Video Games & Esports ETF (ESPO). With its inception date in October 2018 and $219.5m in assets under management, ESPO is not only older but also bigger than HERO − but it invests in fewer stocks and is more concentrated on its top holdings.

The fund tracks the MVIS Global Video Gaming and eSport Index, which is intended to track the overall performance of companies involved in video-game development, e-sports and related hardware and software. To be included in the portfolio, a company must derive at least 50% of total revenues from video gaming and/or e-sports, in order to assure a proper tilt to the theme. The ETF is also diversified geographically like HERO. It includes the US (36.7%), Japan (21.6%), China (17.2%), Taiwan (6.9%), South Korea (6.6%), Poland (5.3%), France (4.1%) and Sweden (1.5%). When compared with HERO, ESPO has slightly more exposure to the US and less to Japan, no exposure to Singapore and Ireland and includes Poland. In terms of fees, investors face an expense ratio of 0.5%, which is the same as for HERO.

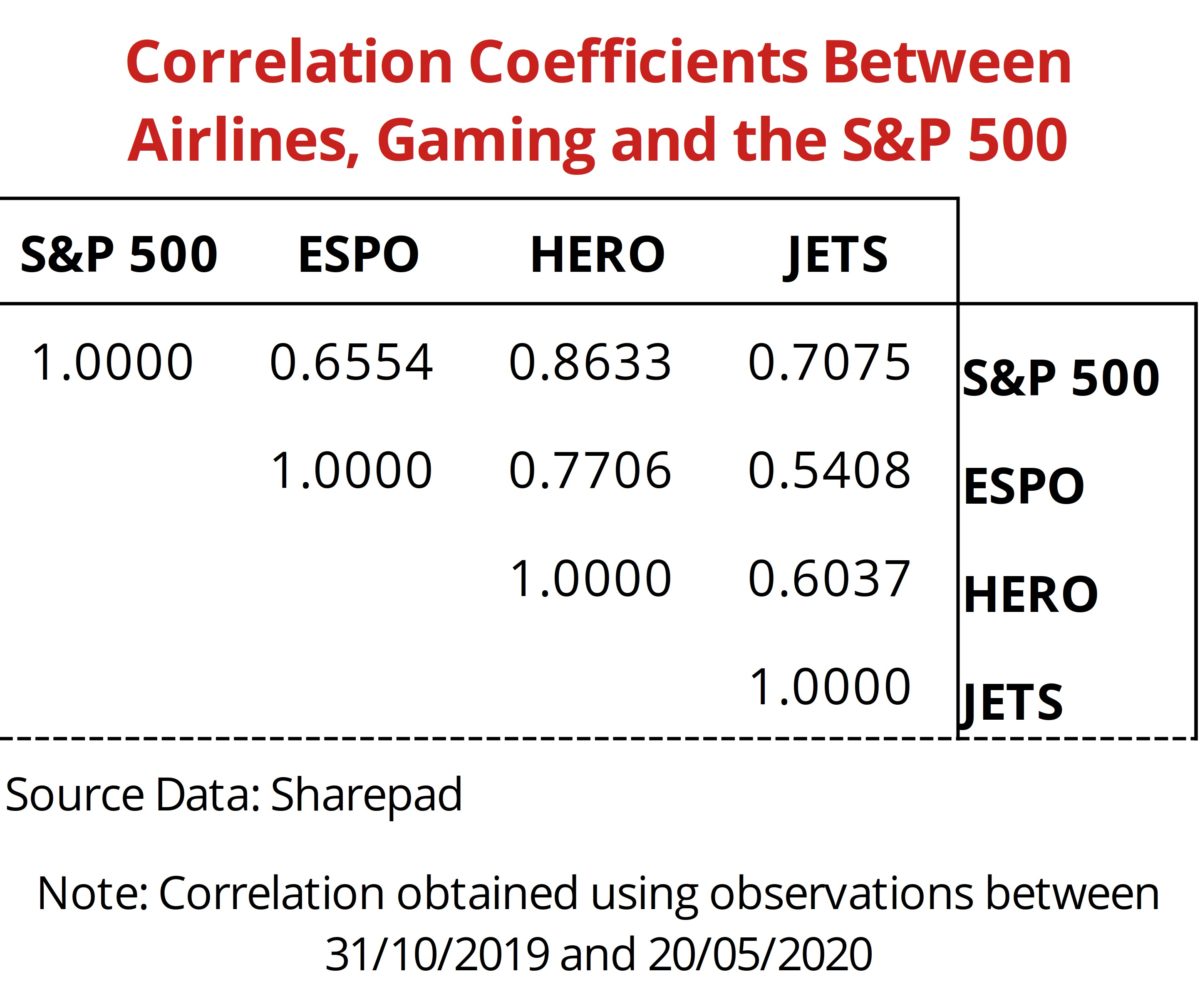

Investors looking for exposure to the video games and e-sports themes should choose just one of these two ETFs or split the amount they are willing to invest carefully. This is important because, while the funds are different, there’s a huge overlap. The correlation between them is moderately high at 0.77 and I fear this number underestimates the true correlation, because these two funds are new and there’s therefore not enough data yet to make safe conclusions.

Final thoughts

A global decline in demand, either voluntary, as people cancelled flights or forced, as governments shut down borders and air travel, led airlines to slash their capacity, laying off part of their workforce while firing the rest. They are being severely punished by investors with their stock prices dragged down, while the broad market is already recovering. But air travel will return sooner or later and the industry is poised for a recovery.

However, we’re living in uncertain times. Covid-19 is not gone for good; it’s just hibernating. There’s still a high risk of it coming back later in the year. But, if lockdowns ground planes, they allow video games to ‘fly’.

Comments (0)