Stocks in Focus: Physiomics

Derren Nathan of Hybridan explains why Physiomics continues to attract funding to progress its evolving personalised medicine tools.

Physiomics (LON:PYC) is an oncology consultancy using mathematical models and its Virtual Tumour™ technology to support the development of cancer-treatment regimens and personalised medicine solutions.

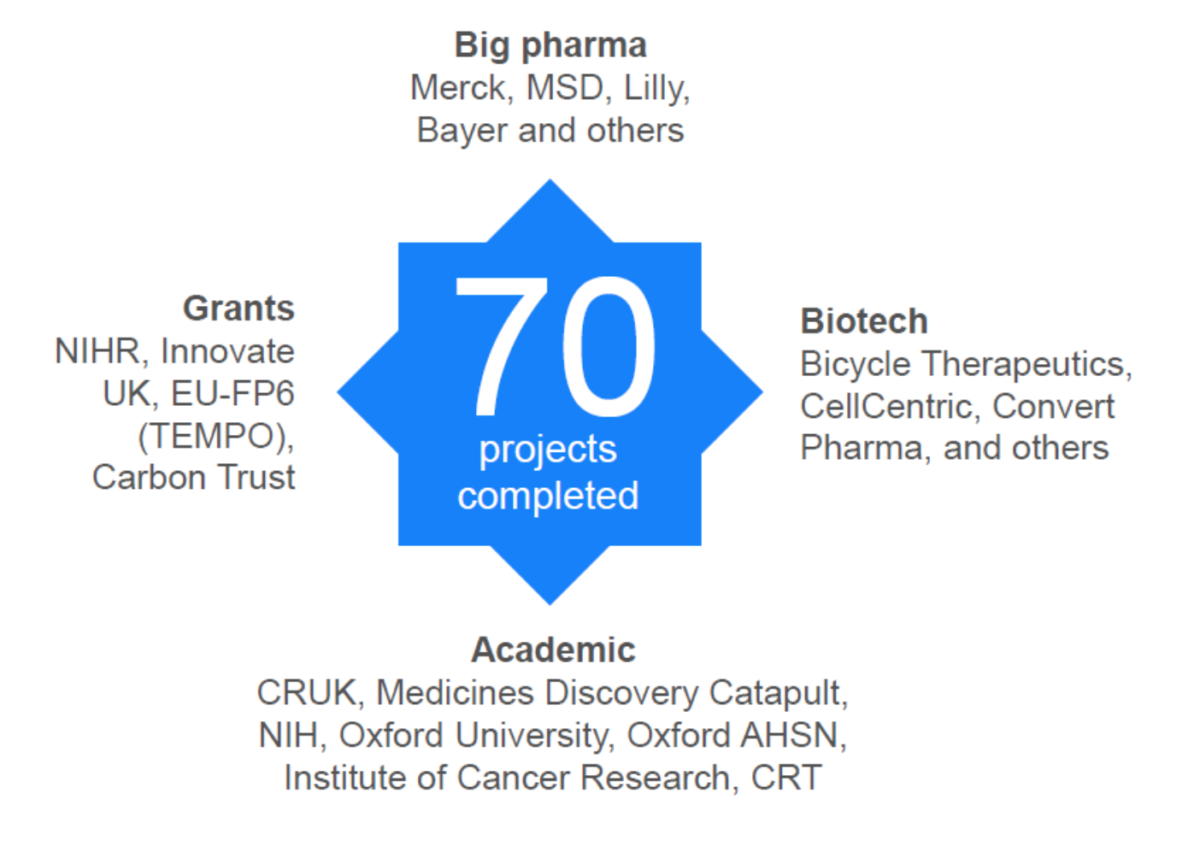

The company’s Virtual Tumour™ technology uses computer modelling to predict the effects of cancer drugs and treatments, to improve the success rate of drug discovery and development projects, while reducing time and cost. The predictive capability of Virtual Tumour™ has been confirmed by 70 projects, involving over 25 targets and 60 drugs. The company also provides pharmacokinetic (PK) and pharmacodynamic (PD) modelling. This combination of services can potentially reduce the number of pre-clinical studies required and support both pre-clinical and clinical-trial designs, particularly in terms of evaluating an optimum dosing regimen and the likely efficacy of a given drug combination.

A selection of Physiomics’ past and present clients is shown in the diagram below:

Clients and capabilities

Physiomics has proved its ability to work with a wide range of clients such as Merck KGaA, a long- standing ‘cornerstone’ customer, where services are offered on a platform basis, and for smaller biotechs where Physiomics may provide the entire modelling function of the company for certain projects. The Virtual Tumour™ model, now in its tenth year, is continually evolving. It is pleasing to see both larger and smaller developers of cancer drugs returning to Physiomics for its expertise, on multiple projects, meaning that new client wins often have the potential to evolve into longer-term relationships.

Of late, Virtual Tumour™ has seen significant use in immune-oncology settings with several major clients. Whilst we are seeing an expanding universe of immunotherapy agents and approvals for new indications, the percentage of cancer patients who respond remains very low. Combination therapy is one of the key ‘battle grounds’ for improving this dynamic, but there will be many more failures than successes. Physiomics can help researchers to improve the probability of success, identify the most promising combinations and find economies of cost and time in the drug-discovery-and-development process.

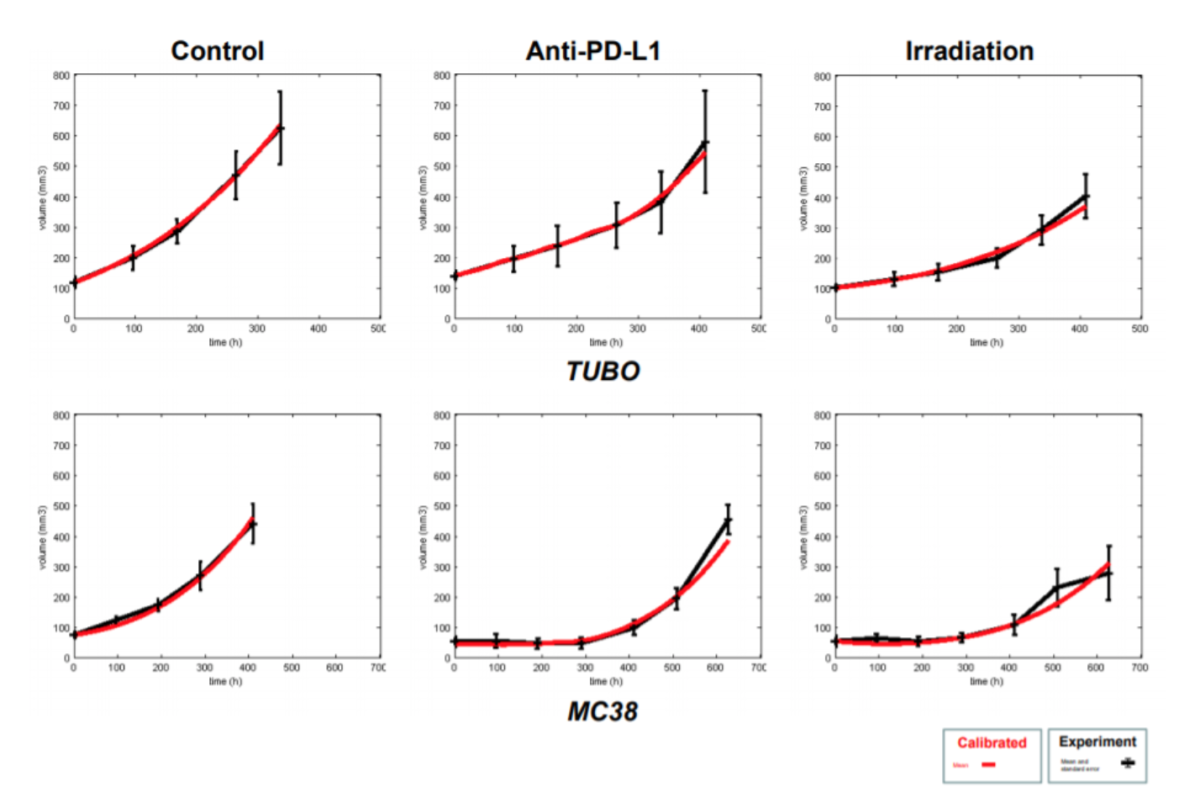

Virtual Tumour™ has well-established predictive capabilities in treatments, including small molecules, biologics and radiotherapies. The more recent immunotherapy module has also been validated, as can be seen in the below schematic. Physiomics evaluated the capability of the extended VT technology to model the efficacy of an anti-PD-L1 antibody in syngeneic mouse xenografts, both alone and in combination with irradiation, through a pre-clinical case study derived from the literature. The VT model was calibrated for the separate monotherapies, using published PK data for the antibody and tumour-growth inhibition data for the monotherapies in two in vivo models (TUBO and MC38). With the X axes showing tumour size and the y axes showing time, we can see that there is very little deviation in the model output when compared with historical pre-clinical data. Perhaps even more importantly, the company has demonstrated the ability of its Virtual Tumour™ immune-oncology model to predict optimal scheduling for certain combination regimens and to explain these effects in terms of species represented within its model (see https://www.physiomics.co.uk/wp-content/uploads/2020/04/Biotrinity-Physiomics-Presentation-Apr-2020.pdf).

Source: Abstract No 4866 AACR Meeting April 2015 Philadelphia, PA, USA

Progress

Physiomics has witnessed solid growth and demonstrated prudent cash management since the arrival of chief executive, Dr Jim Millen, in 2016, who has over 20 years’ experience in life sciences, including senior corporate-development and commercial positions at GSK and Allergan.

The continued engagement with Merck KGaA, which has awarded over £1m of contracts since the announcement of a master services agreement in 2017, as well as significant newer client wins such as CellCentric and Bicycle Therapeutics, is helping to strengthen Physiomics’ position as a valuable partner to a range of companies developing therapies in oncology. The company has a strong pipeline and believes this has strengthened further since the interim results announcement in March this year, a period in which the company achieved a small cash inflow.

Just last month, Physiomics announced that it had received a strong indication that a significant contract is likely to be signed with a new large pharmaceutical client, with which it has been in discussions since late 2019. While is it still possible that the potential new client could withdraw, it is the directors’ opinion that this is unlikely. Should the contract be signed, the work is expected to take two technical staff around five months to complete.

The company now has the balance sheet to do this, having recently completed a £0.83m over-subscribed fundraise at 3.5p, which included director participation and the arrival of the company’s first small-cap institutional fund onto the register.

Whilst Physiomics has derived commercial revenues primarily as a service provider, it has also been investigating the application of its technologies in personalised oncology through the development of a software tool to optimise dosing for individual patients and avoid toxicity. This has been largely funded by the award of grant funding to date, most latterly through the award of a NIHR i4i grant (March 2020) to undertake an observational trial to generate data in support of a personalised dosing tool in advanced prostate cancer.

The trial will not directly involve the use of the tool itself, but will focus on collecting key patient data that will enable Physiomics to further explore and validate the value of the tool, as well as to begin to build a case for possible future regulatory approval of the tool. Physiomics is in the process of completing study documentation and applying for UK regulatory approval for the trial. The company remains in discussions with several companies that have an established presence in this field to explore opportunities for commercialisation.

In an update on the impact of the Covid-19 outbreak on its opportunities in March this year, the only material risk the board commented on was a possible delay to the trial due to measures being taken by all hospitals in the UK to minimise non-Covid-19 related activity.

The impact of Covid-19

Conversely, in a recent blog post by Dr Jim Millen, he commented that in today’s climate, clinicians need to balance the risk of treating cancer patients against the risk of contracting Covid-19. For example, the immunosuppressive effect of chemotherapies means that patients on these therapies are more likely to become severely ill if they contract Covid-19, and many centres have taken the view that it is safer for patients to remain untreated until the immediate threat has reduced. There is concern, however, that this could mean some patients missing out on life-extending therapies and it will certainly mean a backlog of undiagnosed and untreated cancers.

More than ever, this dilemma highlights the value of work that is currently being carried out in cancer-drug development and the importance of continuing these efforts, despite the immediate crisis. Physiomics’ capabilities lend themselves well to enabling advances in some of the key focus areas of research, including immunotherapies, personalised medicine and data-driven selection of potential breakthrough therapies. Economically, Covid-19 is shining a laser-like focus on costs across all industries and public bodies. Not only can the use of Virtual Tumour™help to optimise the development of new cancer therapies, but its evolving personalised dosing tool has the potential to ensure that cancer patients are treated in a cost-effective manner, improving outcomes and potentially reducing hospitalisation time.

We therefore believe that the current environment may well have a net positive effect on Physiomics’ capacity to win new business. At an enterprise value of under £5m and with an operating performance approaching breakeven, we believe the market capitalisation significantly underestimates the value of the company’s Virtual Tumour™technology and simulation expertise. While turnover is set to have more than trebled since 2017, this has been achieved with a modest number of clients, and the use case for Physiomics’ solutions continues to gather strength. The recent fundraise announced at the end of May will allow the company to capitalise on this.

Meanwhile, Physiomics continues to attract non-dilutive funding to progress its evolving personalised medicine tools and will supplement this with company funds as commercial interest dictates. There are multiple potential catalysts for share-price appreciation, including further contracts in oncological simulation, or potential industry collaborations on personalised medicine.

Physiomics is a corporate client of Hybridan.

Comments (0)