The Oil Services Sector Looks Ripe for M&A

In a booming market, many of the best opportunities are to be found using a picks ‘n’ shovels investment approach – in other words, via investing in those companies that facilitate rather than produce. To a large extent, the same was true of the last bull market in the oil & gas sector. While the share prices of many an oil exploration company went up and down on the back of the latest news from the drill bit, the share prices of oil & gas services companies tended to advance steadily, on the back of the premise that demand for their wares was being underpinned by an incessant search for a finite resource that was becoming ever more difficult (and expensive!) to find and extract.

But then the party came to an end – abruptly. Global forces conspired to push the oil price to lows not seen since the financial crisis. Oil services companies, whose fortunes are closely correlated with the price of black gold, are now beginning to realise that the old picks ‘n’ shovels adage cuts both ways. The question now on the lips of oil company bosses: How long will the oil slump last? Such a question is of paramount importance in the capex-heavy oil industry, where projects have to be committed to on a long-term basis and where the costs of mothballing projects can be very high indeed.

The truth is that forecasting the oil price is essentially a mug’s game. North Sea Brent crude oil spot prices increased by $10 a barrel in February to reach an average of $58 a barrel, marking the first month in which Brent prices increased since June 2014. However, no-one really knows whether this marks the start of a sustained recovery or merely a ‘dead cat’ bounce. For what it’s worth, the EIA projects the Brent crude oil price will average $59 a barrel in 2015 and $75 a barrel in 2016.

The trillion dollar question

The statistics stacking up against the oil and gas services sector do not look pretty. Goldman Sachs looked at 400 of the world’s largest new oil and gas fields and found projects representing $930 billion of future investment that are no longer profitable with Brent crude at $70 per barrel. That puts almost a trillion dollars of projects at risk if the oil price doesn’t bounce back – and that’s not including US shale projects, which the Saudis are implicitly trying to wipe out.

In the US, low oil prices are rapidly turning boom into bust. According to the latest statistics released from Houston-based oilfield services company Baker Hughes, rigs engaged in exploration and production in the US totalled 1,192 for the week ended 6th March 2015, down from 1,792 a year ago and representing the lowest level in 5 years. In particular, the number of horizontal rigs (encompassing new drilling technology that has the ability to drill and extract gas from dense rock formations, also known as shale formations) was down by more than 25% versus a year earlier, which suggests the Saudi stance of not cutting back on supply is beginning to have its desired effect.

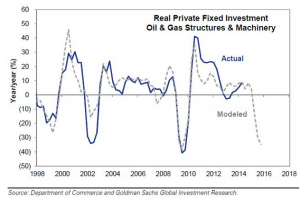

What’s more, there’s growing evidence that oil bosses think that lower prices may be here for some time. BP, BG Group, ConocoPhillips and China’s Cnooc have all announced cuts to capital expenditure for 2015. In the US, Goldman Sachs expects total energy capex will collapse by 25% in 2015. This looks set to put a major dint in forecasts for oilfield services companies. According to Moody’s, sector earnings could fall by 12-17% if oil averages $75 a barrel in 2015, while an average price below $60 a barrel could drive earnings down by 25-30%.

Opportunity knocks

In what could be a sign of things to come, US oil services giant Halliburton is currently attempting to buy smaller rival Baker Hughes in a deal worth $35 billion. There are two factors at work here. With its rival’s share price at its lowest in more than a year, Halliburton obviously sees an opportunity to consolidate its market-leading position at a discount. On the other hand, Baker Hughes, perhaps recognising that market conditions might remain tougher for longer, could welcome the reassurance provided by being part of a much larger entity. The same logic was no doubt in play with Verisk Analytics’s recent deal to buy energy consultancy group Wood Mackenzie for $2.8 billion.

In addition to industry peers on the hunt for bargains, M&A action could just as well emanate from the private equity sector. Indeed this was a key theme at February’s annual private equity SuperReturn conference in Berlin, where leveraged buy-out firms such as Blackstone said they were “very busy looking at energy deals”.

In the UK, the sector is relatively fragmented and there are no major consolidated players like Halliburton or Schlumberger. This could mean that the UK oil services sector is particularly open to consolidation, either from overseas rivals looking to pick up some of the specialist capabilities on offer, or from national peers looking to simply consolidate their own situation and generate efficiency savings. The UK sector also looks attractive in that it generally competes on the basis of skills and technology rather than purely on costs. It is also relatively asset light versus international peers, which generally makes it more able to adapt in the face of a downturn.

Back in December, Deutsche bank said that the prevailing prices represented “a reasonable starting point for long-term investors to begin building positions in asset light engineering service companies.” Citigroup also chimed in, arguing that “While the free falling oil price impacts all companies in the OFS space, we see it creating opportunity as high quality names become devalued.” In terms of the criteria that investors should look for when making their selection, Deutsche recommends avoiding stocks with operational risk, low balance sheet flexibility and significant earnings downside. Meanwhile, Citigroup suggests that investors should favour asset light (engineers) as opposed to asset heavy (seismic, drilling) business models and look for a combination of low risk backlog, free cash flow and a healthy balance sheet.

The bigger picture

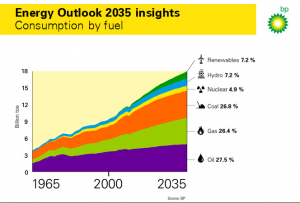

In the short-term the market is a voting machine but in the long-term it is a weighing machine, or so the saying goes. Although the market is currently focused on the collapsing oil price, the longer term picture remains one of growing demand for energy, underpinned by the rise of the middle classes in developing economies. According to the new edition of the BP Energy Outlook 2035, global demand for energy is expected to rise by 37% from 2013 to 2035, which equates to an average rate of 1.4% a year. Given that oil fields naturally decline at a rate of more than 10% per year, the current mothballing of projects will only serve to exacerbate the whiplash effect on prices further down the line. Indeed, Chevron CEO John Watson recently predicted that capex cuts would “bring supply and demand into balance in 2016, and move prices up”.

All this means that the longer-term picture for oil services companies remains positive. In its recent quarterly publication of “The World Oilfield Services Market Forecast”, Douglas-Westwood said it expects “sustained and substantial growth” in the global oilfield services market, which it forecasts will grow from $354 billion in 2014 to $521 billion in 2018. This stands to reason when we consider that the majority of major new oil discoveries are generally harder to get at than they were in the past, and therefore require more sophisticated technology to exploit. While the providers of such technology may find themselves left out in the cold under the current situation, we should be in no doubt as to the short-term nature of their predicament (barring some major advance in clean energy, of course, which seems unlikely at present). Indeed, the longer-term risks to the oil price – and thus oil services companies – are to the upside.

Comments (0)