The Fine Wine Market – Evidence of Stability and Reasons for Growth

As featured in this month’s Master Investor Magazine.

In my last article for this publication in February I outlined the journey the fine wine market has been on historically, but most importantly where it has travelled in the last ten years, the most extraordinary period of time this market has ever witnessed. In this piece I suggest where it may be off to next.

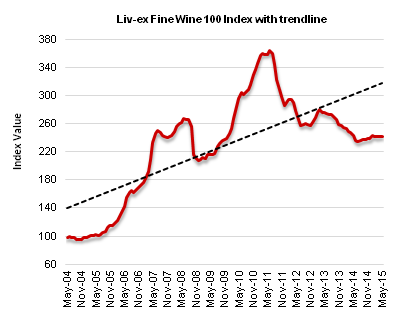

The chart below maps the industry benchmark index, the Liv-ex 100. Liv-ex, standing for London International Vintners Exchange, is an independent fine wine exchange for professional wine traders and the only truly independent source of quality fine wine data. The 100 index represents the price movement of 100 of the most sought-after fine wines on the secondary market. It is easy to see how far below the long-term trend line the market is currently trading. Obviously the trend line guarantees nothing, but following a 36% correction from mid-2011 and mid-2014 and a year of price stability since then, there appears to be little downside to this investment case.

Following the rise and fall brought about by ‘The Red Obsession’ (this was actually the title of a documentary film on the subject!) in China, prices are behaving more along the lines of what we would expect and indeed how they used to behave.

During the boom, old fashioned principles of wine buying went out the window. The list of criteria for wine selection changed from the quality of each wine, the brand, the vintage and how old it was (and therefore the assumed rarity) to purely the brand and the lowest possible price for which the brand was attainable. Larger volume was also preferred, again reversing previous logic. Probably the first consideration any connoisseur would make would be the quality of the vintage, but this did not matter one jot to the new breed of wine buyer.

The best performing wines were actually the lower quality, second wines produced by the top Chateaux, as these allowed access to the greatest brand names at a fraction of the price of the first wines. Carruades de Lafite, the second wine of Chateau Lafite, outstripped all others. I am glad to say this period of history is closed and there are good early indications of the old order returning.

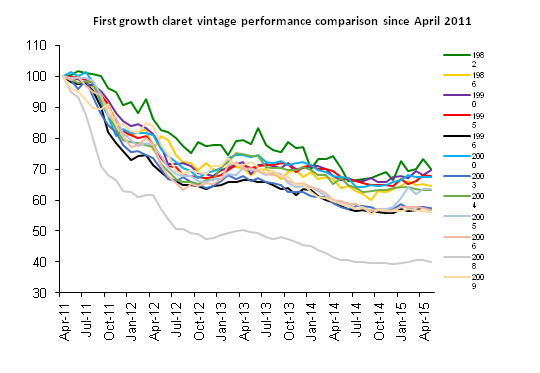

On this theme, it is interesting to note that during the correction the best performing vintages amongst the first growths were 1982 and 1990 – the most mature of the very best vintages from the last thirty years. (See chart below. Some of the lesser quality vintages have been stripped out.)

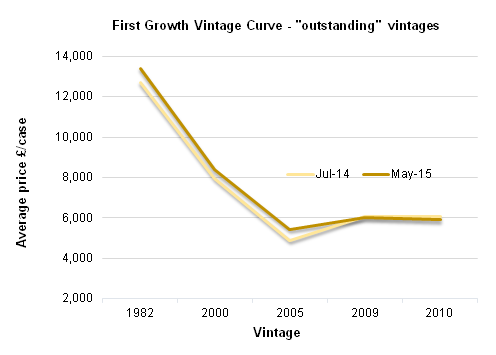

As part of the capital market discipline we employ in our research we look at the ‘Vintage Curve’, which functions rather like the yield curve but with Bordeaux vintages of similar quality rather than bonds. For the Vintage Curve for the outstanding vintage category we looked at the average price of first growths from 1982, 2000, 2005, 2009 and 2010. Older vintages are more scarce and therefore one would expect a downward sloping chart where older vintages feature first, as below. Over time we expect to see a shift upwards in the curve as prices increase, as evinced in the chart below. We singled out 2005 as the best value vintage in this category, evident in its position on the Vintage Curve as well as for other reasons, explained below. Since the summer of 2014 the older vintages have started to shift upwards, notably 2005. The youngest vintages (2009 and 2010) have not moved as there is still ample supply. 2010 in particular, which is a powerful, tannic vintage will take longer to mature than 2009, and remains relatively over-priced. Again, this would indicate a semblance of normality has appeared in the market.

If we assume this analysis is correct and with all else being equal, it is safe to assume the long-term fundamentals of decreasing supply of highly sought after wines will start to play out and prices will begin to gradually increase once more. If western economies continue to improve and there is a reversal of fortunes in the emerging markets, marginal demand will be created. This would test the supply side of the equation and it would be interesting to see how inelastic it may become; after all, the boom sucked a lot of stock out of the market at a much faster rate than we have ever witnessed before.

In the past, wine prices have benefited from the first release of a superior vintage. This creates a focus which brings wine back onto the radar for consumers and speculators. The market reacts positively, phones start ringing and emails start flying around. People get involved because people like a taste of the best and enjoy the hype. As en primeur is largely dead, at least for now, owing to the over-pricing of young wine, a new focal point is needed. Inadvertently the all-powerful ‘Nose of Baltimore’, Robert Parker, the world’s most influential wine critic, may be about to provide one. Mr Parker recently announced his retirement form tasting en primeur but will continue to score in bottle wines, at age 3, and has stated he will revisit the 2005 vintage, now aged 10. For whatever reason – and this is universally accepted – Parker originally underscored the outstanding 2005 vintage and will very soon be posting his updated scores. Given a recent re-rating of Chateau Mouton Rothschild 2005 from 96 points to 99+ and his attached comment “the greatness of this vintage is increasingly apparent as the wines throw off their cloaks of tannin”, we would not be surprised to see a broad-based re-rating and much adulation. Incidentally, the price of Mouton ’05 increased by 20% in short order.

In summary, there is enough evidence to suggest the wine market will return to its time honoured fashion of steady returns, set against low volatility. Older quality vintages from 2000 and beyond look set to outperform over the longer term while it would come as no surprise if there was a short term jump in some 2005 prices.

Comments (0)