Online payment innovator coming to a website near you

Late last year, Master Investor ran a field-test among our readers. We tried out an innovative new payment mechanism that lets web users easily and safely pay for content. The company that invented this platform has just raised another round of seed funding and its technology is now being tested more widely. Swen Lorenz, editor of Master Investor, managed to get hold of Meinhard Benn, the founder of SatoshiPay. The following interview should be of interest to anyone who has ever purchased content on the internet – not to mention those who are looking to invest in a fast-growing tech start-up.

Swen Lorenz: You are aiming to give Internet users a new option for making payments on the Internet. Normally, when users want to buy music or other content, they use a credit card or payment platforms like PayPal. Please explain to us the idea behind “nanopayments”, and why the system your company is developing is different from what we use now.

Meinhard Benn: The term used to describe payments below £10 is “micropayments”. With our technology you can pay amounts 1,000 times lower than that: 1p or even less, hence the new term “nanopayments”. With the payment methods you mentioned, in most cases there are minimum transaction fees of at least 10p, so paying a few pennies for a purchase is not feasible. We believe being able to pay nano amounts will unlock whole new markets, for example for small increments of web content, arbitrary small digital goods, micro services or in the Internet of Things.

SL: Please give us a few practical examples where SatoshiPay could offer a new payment option both for web-based companies seeking to generate revenue and for Internet users who are looking to make payments in a way that is easy, cheap and safe.

MB: The first application of our payment technology is the monetisation of web content. A publisher using SatoshiPay can, for example, sell articles, high-resolution versions of images, PDF downloads or media files individually, without forcing their readers into subscriptions. Because our system works across websites, it also allows casual visitors to a website to make purchases with just one click or completely automatically. It enables a “pay-as-you-go web”.

SL: What are the smallest possible payments that can be done with SatoshiPay, and what are the transaction costs for such small payments?

MB: This gets technical quickly. We are using Bitcoin as the backend of our nanopayment system. This means the smallest possible payment is 1 “Satoshi”, which is about 0.0003p. A Satoshi is the smallest unit of Bitcoin, 100,000,000 of them make 1 Bitcoin, so it’s sort of Bitcoin’s penny. Currently we charge a flat 10% fee to the publisher for every content payment. If for example a purchase for 1p was made, 0.1p goes to us – in Bitcoin. A more differentiated fee structure will be introduced later.

Page with content that needs to be paid for

SL: Bitcoins and other cryptocurrencies have not yet entered the mainstream. They are written about a lot, but seldom used. Bitcoin has even been in the news in connection with large-scale frauds and bankruptcies. Can consumers really trust such a system?

MB: Seldom used is relative. In the case of Bitcoin there are more than 200,000 transactions, generating a total volume of almost £100m, per day! It even overtook Western Union at one point. Regarding trust, it’s the same as with every other currency: You need to be careful with your choice of gatekeepers. I’m talking about exchanges, people that hold funds on your behalf or payment processors, but not the monetary system itself. Talking about monetary policy, in Bitcoin it’s all predictable math, not seemingly random politics, so if you ask me it’s much more trustworthy than currencies issued by central banks.

SL: Is your system tied to Bitcoin, or could it operate with other cryptocurrencies, too?

MB: Currently we are building on top of Bitcoin, because it is the most widely used, most mature and most stable cryptocurrency out there. If this changes at any point in time, we can simply migrate to a different back-end, meaning another cryptocurrency. But cryptocurrency, also known as “blockchain technology” will always be in our DNA, simply because it’s a great set of tools and infrastructure with which to build a payment service.

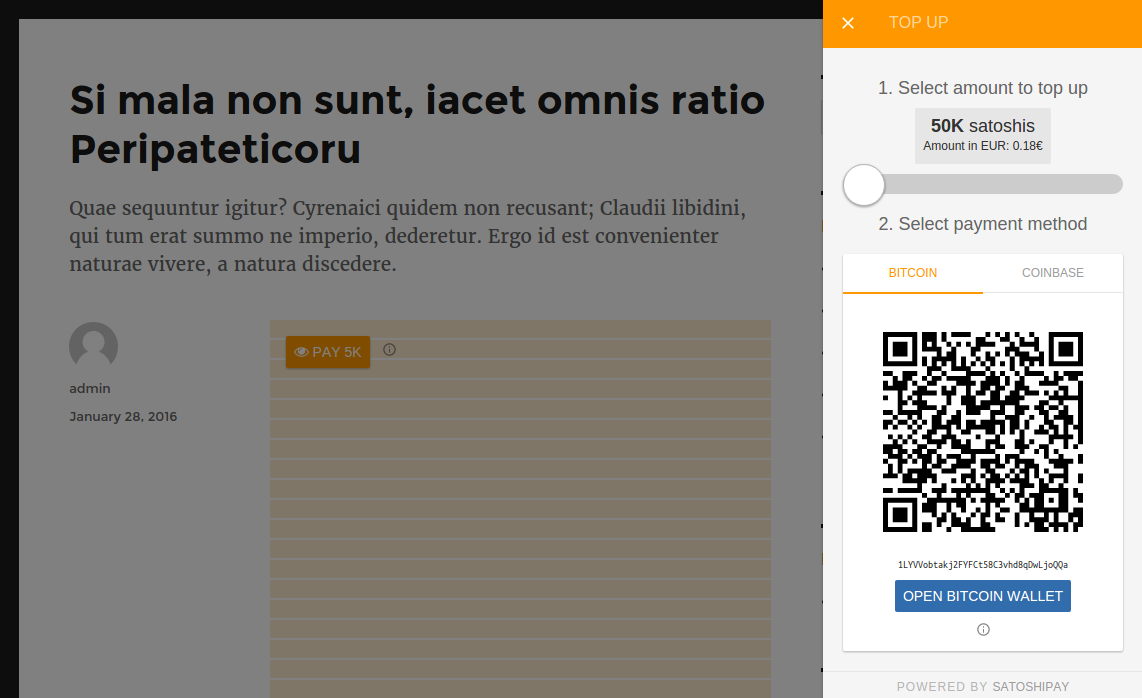

SatoshiPay website widget top-up screen

SL: What has been holding back companies like VISA or Mastercard from offering their own nanopayment system? Surely one of the giant payment processing companies operating globally should be able to offer such a system as an add-on to their existing platform if they saw it as being viable and in demand from consumers?

MB: First of all these credit card companies have a pretty comfortable position and their existing fee structure generates them very good revenues. Currently they are not known for adding new features to their core products, but this might change. I agree that once the nanopayment market is proven by ventures like ours, they will want to participate in it as well. Both Visa and Mastercard are running innovation labs which are openly engaging with blockchain technology, which is very good news for the community, because it adds a huge amount of credibility and attention.

SL: “Ad blocking” has received a lot of media attention recently. Using relatively simple software, internet users can now prevent ads from appearing on their computer screen. The web-based publishing industry had a difficult time already, given the lack of willingness among web-users to pay for content and online services. The same companies are now at risk of seeing their ad revenue eroded. Have you already received enquiries from web-based publishing companies who are seeking an alternative for generating revenue, but who simply don’t want to pitch conventional subscription-based payment models to their users?

MB: We are in talks with a couple of bigger publishers, yes. For them, understandably, the biggest issue with our system is that currently we are only supporting Bitcoin as a top-up method. Smaller publishers and bloggers are often less concerned about this, and especially Bitcoin related websites see this as a great application for cryptocurrency and are very supportive. Initially we will target this niche market, but we are working on making other payment methods available as well, which should open up a lot of doors for us.

Page after successful payment with readable content

SL: Is your system safe and secure, does it offer to protect users’ privacy, and is it simple enough for my parents to use it?

MB: Let’s say it helps that most of our team have a history in securing websites, building and integrating payment systems and in working with cryptography. User privacy is protected by the fact that we don’t need to collect any data on our end users to make our system work. Not even an email address or a name. The user’s digital identity in the form of a private cryptographic key (which is never directly accessible by us) is all we need to facilitate payments. That’s the power of cryptocurrencies! As for your parents, we wrapped all that magic in a very easy to use interface, so they won’t even know any of this. It will just work with one single click.

SL: How did you, personally, get started in this business?

MB: I was always curious about alternative currencies and I researched a couple of them before, in 2011, Bitcoin crossed my path. I was intrigued by its technical finesse and when it hit a certain technical and investor mainstream in 2013 I knew I would want to work full time with it. In 2014 I started SatoshiPay and it has been a great trip so far!

SL: Please tell us a bit more about your team. You are based in Berlin – why not London or Silicon Valley?

MB: In our Berlin office we have up to seven people working on the project, some of them remotely and part-time. I like working with a flexible network of people because this has worked very well for me in the last 20 years and it keeps us very agile. Regarding Berlin, I grew up two hours north of it in a small town called Schwerin, and being close to home can be very practical sometimes. But Berlin also offers great conditions for start-ups, with a steady influx of great talent and affordable living and office spaces. That said, I go to London all the time, because that’s where interest in the fintech and blockchain space is strongest in Europe at the moment. Silicon Valley has its own vibrant energy and I am looking forward to going over there soon to show off what we’ve been building here in the last months.

Geographic locations of publishers on SatoshiPay’s waiting list

SL: How would you describe the first 16 months of being the entrepreneur behind SatoshiPay?

MB: It has been absolutely amazing so far! And it went very quickly from sitting at my friend’s kitchen table and building a prototype, to the board rooms of some pretty influential people who wanted to hear my story. The support I’ve received from all sides has been very uplifting, and it doesn’t seem to stop flowing. Building something unique and risking a moonshot does earn you the respect of some very inspiring people.

SL: In Jim Mellon, the owner of Master Investor, you have won a widely known financier as backer. Who else have you received funding from?

MB: I am very thankful to Coinsilium, the lead investor of our last funding round, for introducing me to FastForward Innovations directors Jim Mellon and Stephen Dattels. Prior to that, Axel Springer’s Berlin-based start-up accelerator AS Plug and Play as well as my co-founder Henning Peters contributed angel funding.

SL: You mentioned your product for web publishers a couple of times. We at Master Investor were lucky enough to be the very first website to try it out on an article written by Jim Mellon. Is it now available to a wider audience?

MB: Yes, from today onwards we will allow interested publishers to create their account and participate in our public beta. We have a couple of hundred people from all over the world on our waiting list and we are thrilled to see how our nanopayment technology will help them to monetise their content. For the initial launch we are focusing on WordPress, which is the biggest publishing platform out there. WP runs 25% of the web, which is millions upon millions of websites.

SL: These are all exciting developments, and your company seems to move forward at a rapid pace. What’s next?

MB: Depending on demand, we will add support for other content publishing platforms besides WordPress, more payment methods and also localisation for big markets. For example, we are starting to develop a following in Indonesia, where I am currently located. It’s a country of 250m people and a blogger in a small town here could sell a piece of content to someone in South America with just one click and be paid in seconds because no bank is involved, which is pretty exciting indeed.

SL: Where would you like to see SatoshiPay in three or four years?

MB: I’d like to see it as a global brand that is widely recognised by people who sell or consume digital goods. Nanopayments would officially be the “killer app” for Bitcoin and SatoshiPay would have successfully transformed that niche into an industry.

SL: Thank you for the interview. We’ll keep an eye on you!

MB: It was a pleasure. Thank you, Swen.

Comments (0)