How to value junior mining stocks

As featured in this month’s Master Investor Magazine.

By John Cornford

Smaller mining shares are among the most volatile in the market, for good reasons, among which at the moment is that volume is so very low that share traders have a large effect. Institutions, who in the past added some stability, just aren’t there in the face of commodity price weakness.

But another reason has always made junior miners interesting for their scope, which is the fact of their earnings cycle – where years exploring and then developing their mines, with many calls for shareholder funding – culminates in a period where high profits have to compensate for the lean years.

So the obvious investment strategy is to catch them just before the lean years come to an end. Easier said than done maybe; but that is how, with good research, investors might hope to make larger returns than in the market generally.

There are around 80 small cap miners listed in the UK (and many more in North America and Canada). But the mining and commodity slump of the last seven years has not only decimated their share prices and almost (although not quite) dried up the funding that many of them need to get their mines into production; it has also dried up the quality research that investors, institutional as well as private, depend on to invest in them.

Not all these juniors have had to slow or stop their projects, however. There is now an interesting set of miners that have made it through commodity price worries and funding shortages – to the point where investors can see production, and therefore earnings, in the next few years.

The trouble remains that dearth of good research. Unlike companies in other sectors for whom it’s not all that difficult for tipsters and journalists to make reasonably good guesses, analysing and producing forecasts for mining companies with just one or two projects calls for much more detail and professional knowledge. For miners, apart from the day-to-day operational risks, there are three main uncertainties that investors have to ponder. Firstly the capital cost; next the returns to be expected (i.e. commodity price worries); and last but by no means least, the price the company (and its shareholders) will have to pay to get its project funded. Unfortunately, the latter often has little regard for the interests of long term holders.

A few specialist brokers publish now and again to their institutional clients, but the private investor has to rely on the occasional sketchy comment in a few investment magazines, or on a few private client brokers whose research tends to be very basic – aimed at generating sales rather than guiding investors toward the correct timing. Otherwise the private investor has to rely on the bulletin boards, where anyone experienced in investment will despair at the often dire level of understanding displayed.

Sites like Proactive Investors are an excellent source of information, sometimes reproducing limited broker research. But it is more of a PR site than a source of solid analysis and recommendation, so investors would be well advised to do their own research, and at least read up the basics of investment as applied to companies with projects.

But here is a guide to help investors avoid buying at those spikes in share prices that the intermittent puffs and promotions by the companies (when they want funds) and brokers (when they want business) bring about.

In later issues I will be applying its principles to the set of companies I think look ripe for a re-rating at some point. I won’t necessarily produce recommendations there and then, but hopefully we can set up readers to make their own decisions at the right time.

Before that however, we must bear in mind some factors regarding the market’s current view of junior mining companies:

1) The ‘value’ of their ‘mineral’ (copper, gold, nickel etc -) resources ‘in the ground’ is being almost completely ignored.

2) Also being ignored is the prospect of achieving profitability within a relatively short timeframe.

‘How to value a junior miner’

Or

(When a Net Present Value isn’t a Present Value – and when (often) to ignore a broker ‘target’)

One of the most confusing topics for a less than experienced investor (and the most frequently obscured by brokers who rarely produce the calculations) is the correct valuation of a company with a project not yet up and running. Biotechs as well as miners are in this position, but the principles apply universally.

Projects are usually presented to investors with an NPV (a net present value – approximately the long term profit minus the initial cost to build). Inexperienced investors make the mistake of thinking that if the company ‘owns’ the project, then the present shareholders ‘own’ the NPV and that, therefore, the NPV is the value of the company.

That is only so if the project is up and running and paid for, or the company possesses the necessary funds to build it. If it doesn’t, then to raise them it will have to ‘give away’ or share a (sometimes extremely large) part of that NPV with the fund providers – whether these are outside lenders or new and existing shareholders buying new equity shares.

These costs are often glossed over (because they need assumptions in order to forecast) but can be so large as to drastically eat into the real value to existing shareholders. In an example I shall discuss later, a project loan to meet the usual 70% of the capital cost will ‘take away’ in interest, some 20% of the project’s mooted initial NPV, while an even larger part will go to the extra issued shares to meet the equity component of the capex. But some on the bulletin boards (and even this particular company’s broker) seem to think that the project NPV already belongs to the existing shareholders, even though no funds to pay for it have yet been raised.

In that same example, in order to raise the capex, the number of shares in circulation might have to expand (at an optimistic issue price) by nearly five times – substantially more than the 42% by which (in this case) the ‘Present Value’ will increase after the investment has been made. So the ‘NPV/share’ that some investors thought they were worth will, in reality, be cut by nearly four times. Similar reasons explain why many junior miners are now being valued at less than 1/3rd of their theoretical NPV.

The maths is not difficult, even though there are a number of factors to take into account, which depend on the circumstances. A low share price at which funding is secured, or a low rate of profit on the project in relation to interest costs, will have a severe effect on the ultimate share value. Unfortunately, in the present state of the market, even some projects quite close to production are having to raise the equity component at value damaging (if not utterly destructive) to prices or (e.g. Ormonde Mining) having to accept harsh terms from a rescuing partner.

An NPV is a very imprecise guide in any case. Mine planners only use it (‘at the project level, not the ‘company’ and shareholder level’) to give loan providers an indication of the risk of lending to a particular project in relation to their appetite for risk and expectations of long term interest rates. It is not the ‘value’ today to anyone – let alone shareholders.

That is partly because the NPV calculation is not a ‘real’ number – being dependent on an arbitrary parameter – the discount rate – which reflects a particular lender’s requirement. Hence a wide range of discount rates for the various NPVs reported by companies and by different engineering consultants for particular projects.

To simplify, for those not familiar, an NPV is the ‘net present value’ of all the cash inflows (profit) less the outflows (investment) year-by-year, over the whole of a project’s life, with each cash flow ‘discounted’ at a rate chosen to reflect the perceived risk.

The lower the discount rate used, the higher the apparent ‘NPV’, so that a 20 year project’s ‘value’ at 8% would be about half that at nil (i.e. not correcting for the time value of money) whereas at 12% it would be halved again. (The figures are different for different lives).

The rate which accords with how the market is actually valuing projects at present seems to be around 10%, although for those that are near-term and in a benign jurisdiction, that could turn out to be too conservative. In other words, a project might be more valuable to present shareholders than the bare NPV would suggest, depending what financing package is used. The trick is to know when and why that might be.

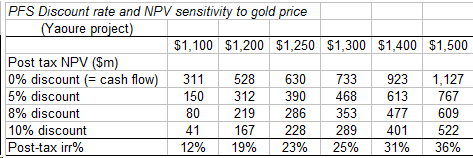

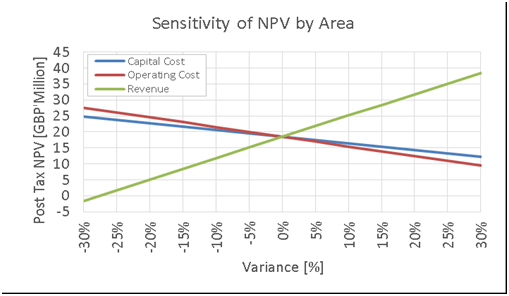

Reflecting that the discount rate is an arbitrary figure, technical/economic reports on a project usually contain a ‘sensitivity’ analysis (like the one shown below) showing how the NPV varies with the discount rate and other factors like commodity price, operational costs, and capital cost.

They will also usually give diagrams showing how at a given discount rate, the NPV will vary with factors like costs or revenue.

However, the resulting NPV remains of little use to an investor, who would like to see it translated to the more familiar earnings per share (EPS). This is subject to the biggest uncertainty of all – the financing that will be used to meet the capex and which will take away a large part of that NPV. For the real examples that I will describe in later issues, I will be making my own EPS estimates based on best guesses about the funding arrangements.

Having said that, the NPV is likely to remain the key figure that companies will use when persuading investors; and here it needs to be said that as well as being no guide to shareholder value, an NPV is also no guide to a project’s real profitability, or to the desirability (for the shareholders) of their company taking it on. That depends on other measures, the most significant of which is the IRR (internal rate of return – very roughly the rate of return over the whole period on the initial investment) – a figure that is not affected by any choice of discount rate for the NPV.

NPVs and IRRs are therefore two completely different measures which are not correlated in any way, and the size of the respective numbers is, likewise, no guide to the real level of profitability on which lenders (and new shareholders) can rely for security. For a good mining project the IRR needs to be at least 30-40% and some are much higher, but others are closer to the 20% which, in my view, indicates an only marginally attractive project – unless for a solid business with guaranteed offtake and prices, like energy generation (but, again, depending on other factors in the equation).

By and large, one can say that the key factors affecting eventual value to present shareholders are the following:

1) The ratio of NPV to a) its capex and to b) the company’s present market cap – where for a) a high ratio is good but for b) not necessarily so; and

2) The IRR in relation to borrowing costs.

But within these, the details will be highly relevant. Value to shareholders is certainly never the bare ratio of NPV to present market cap, which brokers often latch onto (in their ignorance – or perhaps in hopes of their clients’ ignorance) as indicating ‘value’. In practice the opposite can be the case – as will be evidenced in our examples.

The valuation picture for a particular company becomes more complicated if, as is usual, it has other assets which, in normal times it would have relied on to prop-up its share price or to sell in order to part-fund its project. Unfortunately, in present markets, juniors are not being given much credit for exploration. Even when they delineate a resource, the market attaches very little value to it, and if and when it is sold – unless it happens to be close to or fills another miner’s gap in production or raw ore supplies – it will receive but a fraction of the so-called ‘in-ground’ value, for which market prices of less than 1% (even for large – and therefore considered economic to mine – resources) are not unheard of.

So, for any miner with a project, it is the ‘project financing cost’ that will dominate. A few (mostly large conglomerates) might already have funds for the capex. But where, as for most juniors, the only sources are project loans; customer loans in advance of receiving the product; equity share issues; or a rich partner – all can carry a high cost.

A major problem with an NPV calculation is that it might be the small difference (the net long term profit) between two large numbers (the capex and the long term return) which any mathematician will tell you is highly susceptible to inaccuracy in the two big figures. The positive component of an NPV is the unreliable forecast of future cash inflows over the 5-25 year project lifetime discounted at a rate that no-one knows will turn out correct but which will be chosen to be conservative for the lender.

And even the Bankable Feasibilty Study, which is supposed to be the most up-to-date and accurate assessment by experienced engineering consultants, can never be taken as 100% reliable. While for a pre-feasibility study consultants will quote an accuracy of only +/- 30% (which means a cost or a loss could turn out 30% more than stated), that of a BFS is generally quoted at within +/- 10% – still a large margin for error.

In the face of all this uncertainty, it is not surprising that project lenders will demand a high interest rate – and, therefore, investors should also apply their own cautious discount.

But despite the fact that valuing a mining project is a very uncertain exercise, readers shouldn’t be completely deterred. Most juniors are currently at such extremely distressed values that while making funding that much more difficult and, when done, more dilutive of shareholder value, I hope to find examples worth looking at, even if others turn out to be disappointing.

A distinct positive to bear in mind is that many projects, while stating a given lifespan, have scope to extend their lives through continuing exploration and later to move on to other things. That is because, to make any project stack up the profits it makes when up and running after a long period of gestation and spending have to be much larger than is the case for most industrial projects or businesses. They will generate large surpluses of cash over and above loan repayments, which will become available for its owners to expand.

In addition to this is the fact that smaller miners can be less affected by low commodity prices than the multi-national multi-commodity miners who, in order to keep up the scale of their businesses, have to incur ‘sustaining’ costs – which can be 10-25% of their operational (or cash) costs. That adds considerably to the risk they will report losses if commodity prices fall even lower, while juniors are usually targeting small, niche, mines where costs – without the need for ‘sustaining’ costs – can be considerably lower. They, unlike the majors, will already be valued to take account of their limited lives, so will be less at risk of falling market ratings. In addition, they will always have that cash flow (not needing to be ploughed back into ‘sustaining’ costs) to be returned to shareholders as dividends, or used to fund expansion down the line.

NEXT TIME

Appearance Vs Reality

Appearance – Why aren’t my shares recognising closer production?

Reality – They are – but you haven’t noticed.

Comments (0)