Fruitful Homes: Building the future of housing

Fruitful Homes is the first marketplace that enables investors to make the great return from property developments, while making beautiful, sustainable homes affordable for everyday people. James Faulkner caught up with their Founder & CEO, Luke Barnes…

James Faulkner: Hi Luke. Thank you for taking the time to speak with Master Investor. For the benefit of the uninitiated, can you give our readers a brief overview of what Fruitful Homes is all about, along with a little bit of background on the company?

Luke Barnes: Hi James. No problem at all; thanks for having us.

Fruitful Homes was founded with a simple mission – to make beautiful, sustainable homes affordable for everyday people.

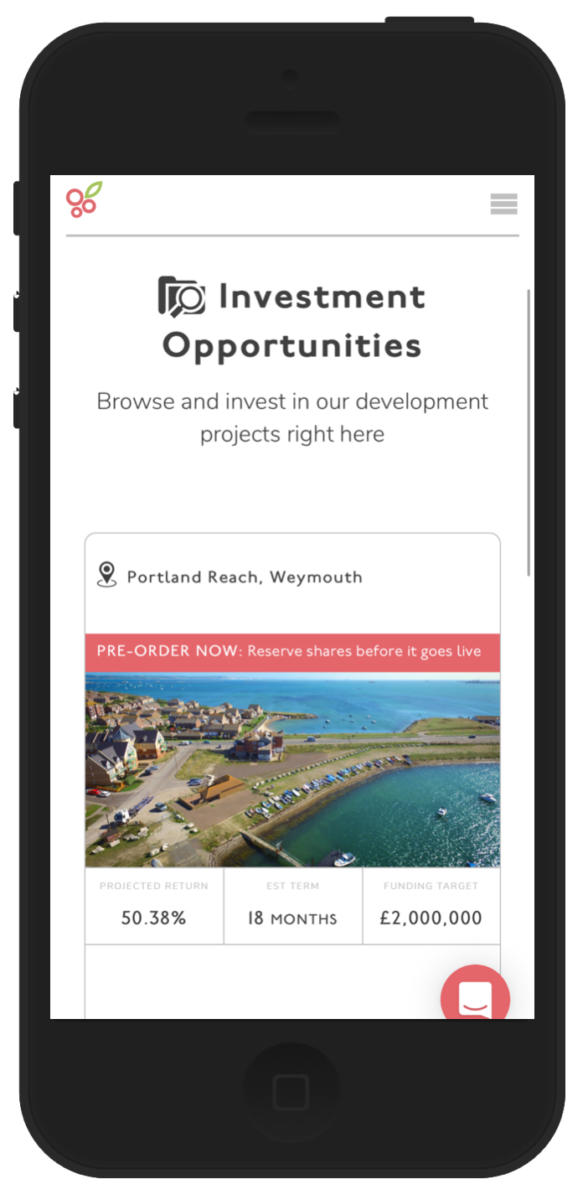

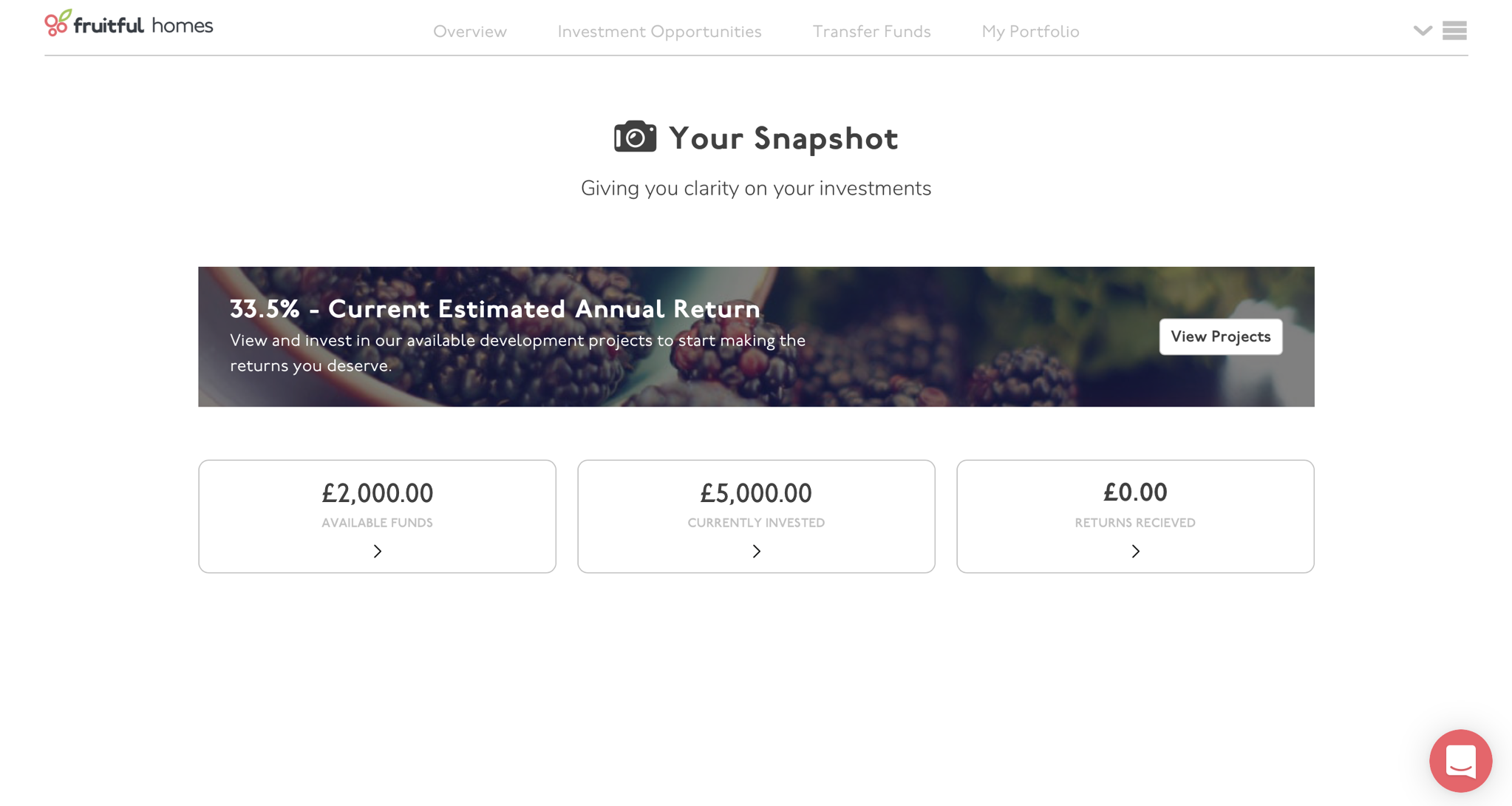

As part of our mission, we’ve created a platform that enables anyone to invest in our projects online from just £1,000 and receive the majority share of net profits. This provides investors with market leading returns, while enabling Fruitful to undertake larger development projects and build more homes to help solve the UK housing crisis.

Over the past year we’ve been extremely busy, not only developing our project marketplace, but working alongside our construction partner, SIG PLC, designing our modular homes that are not only cost efficient, but built to a superior quality to the conventional new build property.

JF: It’s pretty obvious to most people that the UK has a housing crisis. But what evidence do you have that prospective homeowners would be willing to turn to pre-fabricated homes in order to step onto the housing ladder?

LB: This is actually a very good question and one which many people may be asking since modular homes are relatively new to the UK housing market. The simplest way of explaining this is to think of modular as a construction method, just like brick, concrete, steel or timber frame. Our modular homes are in fact timber frame properties, the only difference being that they’re assembled in a controlled factory environment rather than on site. We actually make our homes a lot more rigid than your conventional new build timber frame building for transportation purposes.

Fruitful Homes are also finished to a much higher standard than your average new build property, including modern features such as complete underfloor heating, air source heat pumps, heat recovery systems, nest thermostats, super insulated walls and aluminium triple glazed windows. This not only helps to fight climate change and make our homes cheap to run, but also provides home buyers with a lot more value for their money.

JF: How does the economics of modular housing stack-up against that of conventional housing?

LB: The key benefit of modular housing is we mitigate the risk of prices escalating on developments. Because our homes are constructed in a controlled factory environment at a known cost, we’re able to accurately project the development cost and investor returns.

Fruitful Homes are cheaper to produce at scale, which is one of the reasons we created our platform to undertake larger projects. This means that including all of our sustainable features and high standard finishes, each of our homes are the same price as a “normal” new build, if not cheaper, depending on location and land costs.

…each of our homes are the same price as a “normal” new build, if not cheaper, depending on location and land costs.

JF: How many projects do you have in the pipeline right now?

LB: We currently have our Portland reach project live on our marketplace, giving investors an estimated return of 50.4% over 18 months. Following this project we have four others in the pipeline, ranging from 50 homes up to 300.

We have a great team here at Fruitful Homes to continue sourcing land and planning projects for investors to back throughout the year.

JF: Your website states that investors can earn a return of 33% per year (after fees). That’s certainly a very high return. What are the risks involved for investors? Presumably that return reflects some leverage on your part?

LB: You’re right, our returns are certainly market leading, but like any investment they do come with an element of risk. Whilst we mitigate the majority of risks associated with developments through our modular factory construction, our main risk lies in being able to sell properties once complete.

Every development project goes through a rigorous planning process before being made available on our marketplace, including full site surveys, obtaining planning consent and conducting thorough market research. We conduct market research using national statistics as well as appraisals from local agents to determine the gross development value of our homes. We also underestimate values when projecting investor returns, as we believe it’s always better to over-deliver.

In order to enhance investors’ returns, some of our projects are leveraged, usually between 60% – 70% of the development costs. We feel transparency is key in any investment, so details of each project’s full financials are available on our marketplace to ensure investors fully understand where their money is going.

JF: What are the mechanics of investing with Fruitful? For example, are investors locked in for a period of time? Can investors sell their holdings before a project is completed if they need to access the cash?

LB: Investors can view and invest in any of our projects on our marketplace from just £1,000. Our projects are short-term investments, ranging from 12 months up to 36 months with high returns. Because our projects are short-term, we don’t have a secondary marketplace at present, although this may be something we look to implement in the future.

JF: What protections are in place for investors? Clearly their funds will not be covered by the Financial Services Compensation Scheme, but presumably investors’ assets are ring-fenced from those of the company?

Because our homes are constructed in a controlled factory environment at a known cost, we’re able to accurately project the development cost and investor returns.

LB: That’s correct, although investments aren’t covered by the Financial Services Compensation Scheme, we ensure investors’ funds are protected every step of the way.

- Money that isn’t invested in a project is held in a segregated client escrow account with Barclays.

- Each project is ring-fenced through a special purpose vehicle. When making an investment in a project, investors are buying shares in this SPV.

- Each of our funds are operated and administered by Langham Hall LLP, regulated by the FCA (one of the UK’s largest and most reputable fund administrators) and managed by Fruitful, registered as an alternative investment fund manager with the FCA.

- Investments are secured against land and property at the UK land registry.

- Our team have decades of experience in both finance and property development, holding senior positions for some of the UK’s largest banks and home builders.

JF: What are your expectations for the wider UK housing market? Are we set for a slowdown as Brexit sets in or are the fundamentals strong enough to overcome any Brexit-induced uncertainty?

LB: The UK now has a defined strategy for Brexit. Even in the uncertainty phase following the election, the UK housing market stood strong with areas of our proposed projects continuing to see a rise in property prices alongside demand.

LB: The UK now has a defined strategy for Brexit. Even in the uncertainty phase following the election, the UK housing market stood strong with areas of our proposed projects continuing to see a rise in property prices alongside demand.

Theresa May’s government has pledged to build one million new homes by 2020, the number required to meet the unmet demand in the housing market. Our experienced team here at Fruitful Homes, as well as market leading analysts, predict that UK house prices will continue to grow in-line with the ever increasing demand over the next five years.

JF: You’ll be exhibiting at the Master Investor show on Saturday 25th March. Where can attendees find you on the day?

LB: Yes, we’re very much looking forward to meeting investors at the Master Investor show on Saturday. We’ll be there to answer any questions and even show investors how to create an account and invest in our projects within seconds on our iPads. We can be found at stand 13, directly in front of the main entrance to the exhibition. Our stand is bright and Fruitful so you can’t miss us.

This is the same Luke Barnes who had four fund raisings from Crowdcube investors for Crowd Mortgage, subsequently renamed Fruitful and then Fruitful Finance.

The same Luke Barnes whom just put Fruitful into liquidation, losing a lot of money for a lot of small

investors, with a barely articulated explanation of how he got from A to Recievership.

James, have you done any due dilligence at all on this?

Just for clarification, I founded and ran the UK’s first P2P mortgage platform for 4 years. Our customers loved what we did, but unfortunately the business wasn’t sustainable to run on the low margins made on mortgages, unless at huge scale. So back in 2015 we made the tough decision to close the mortgage business and return lenders capital.

Fruitful Homes is a new property development company, which we have ensured is viable to run even at low volumes and believe will create a positive impact on the UK housing market.

We’re always open to any questions potential investors may have.

I think it’s really bad PR to send an email to your previous investors out of the blue accusing them of sabotaging your rights to start a new venture. I’d never have found this page if it were not for your needlessly confrontational email nor would I feel compelled to post on this matter. I might see your point if you had pursued a genuine fresh start… but I think there are legitimate unanswered questions about the way assets have been transferred between the two companies. This is the reality of equity crowdfunding – small investors are far less likely to seek redress – but the trade-off is that there’s a good chance your dirty laundry will be aired in public.

Picking up on some of the points from your email:

-On the ‘new team’: This is only partially true. The NewCo team includes half of the team from the OldCo ‘about us’ page. OldCo has also previously used the same trading address as the NewCo

-On the ‘new website’: Maybe the domain is new – but comparing the html sources of pages I think you’d have difficulty arguing that the NewCo site is not based on the OldCo and has used design assets belonging to the previous company. Further evidence that they are linked – WayBackMachine from Aug 2016 shows the OldCo website showing the NewCo company registration information.

-As others have pointed out, your disclosure about personal ownership of the logo is not accurate. Registration of the IP indicates that ownership transferred between the two companies on 14 September.

A couple of further questions that other people will be wondering:

-Why was the new company incorporated in April 2016 before the old company had failed – and the day after an undisclosed investor was tried to shift £50k in shares in the OldCo

-How the old company was not prohibited from strike-off under s1004 in September despite emailing investors about ongoing development in the old company’s exciting new product as late as August.