Building an income portfolio in a rising rate environment

The historically low interest rates and bond yields over the last decade have resulted in a surge in demand for income generating assets. With central banks beginning to tighten it looks as though this period of easy money is coming to an end, which makes some of these sources of yield extremely vulnerable, whereas others are likely to thrive.

Inflation in the UK, US and elsewhere is now at multi-decade highs and the various central banks have started to raise interest rates to get it back under control. Government bond yields have been rising in anticipation, although there was a short-term pullback because of the war in Ukraine.

It is likely that the conflict will delay some of the planned rate increases, but the authorities have no option but to tighten now that inflation has taken hold. When they do it will have a mixed impact on the different income generating assets.

“Higher interest rates can be a negative headwind for certain equities, particularly growth-oriented stocks. Resource companies tend to be an exception, when rates are rising because of inflation, due to the strong relationship between commodities and inflation,” says Mick Gilligan, portfolio manager at Killik & Co.

Bond funds can be particularly vulnerable as rising interest rates make their yields less attractive, prompting the capital values to fall until their returns become competitive again. This is especially the case for fixed coupon instruments with a long time to run until maturity.

“Where a fund or trust invests in bonds it is important that the underlying portfolio duration – the average time to receive cash flows − is short as this indicates a lower sensitivity to interest rates. For example, a duration of 10 indicates that a one percent rise in interest rates is likely to result in a 10% decline in capital,” explains Gilligan.

Some assets will be more resilient than others

In a rising rate environment, it’s likely that those companies seen as value or cyclical plays such as oil and mining stocks will be able to deliver solid dividends as their profits grow, whereas other areas such as growth companies that are beginning to pay an income may take a hit and see dividend cuts.

“Firms with pricing power whose products and services are in strong demand can put up their prices to reflect higher costs and should, in theory, be better placed to cope. For some businesses this could help to offset the impact of rising inflation and interest rates,” explains Rob Morgan, spokesperson and chief analyst at Charles Stanley.

More cyclical areas that directly sell raw materials may be well insulated, especially if they are part of the inflation being generated. Other businesses could also be well-placed to withstand the pressure, especially if they don’t have much in the way of expenditure on goods or materials, or if profit margins are sufficiently wide to absorb higher costs.

The key is to put together a resilient portfolio that balances the desire for a higher income today with the prospect of dividend growth over time. This means blending different investment styles together, as well as looking to have geographical and sector diversification to ensure that you are not overly reliant on particular companies, countries or sectors to deliver your income.

Ryan Hughes, head of active portfolios at AJ Bell, says that although the temptation may be to look for higher yielding areas, this may lead to future difficulties if those yields are artificially high because the company is in trouble.

“The UK has been seen as a higher yielding market for many years and has an index with oils, miners and financials making up a decent element of it, all of which pay high yields. That’s fine while cyclicals are performing, but leaves a portfolio vulnerable to dividend cuts should the economic winds change as we saw during the pandemic.”

The way to avoid this is by adding exposure to strategies focused on higher quality, more reliable income payers, as this should make it possible to smooth out some of the risks from just investing in higher yielding areas.

Diversifying the sources of income

“It’s also beneficial to look overseas for dividends as this often adds in companies that are at a different stage of the economic cycle. Asia has a very strong dividend culture and it’s possible to pick up some decent yields from this region, particularly as there are so many companies that are not laden with debts on their balance sheets,” says Hughes.

It is a similar story in Japan, where although the market is lower yielding, it has huge potential for dividend growth. After a long period of prudent management, companies have low debts and significant cash on the balance sheets, which is starting to be paid back to investors via dividends.

A traditional income portfolio typically consists of equities and bonds, although there are other asset classes that can help to add diversification to make it more robust. These are especially important at present as there is a greater tendency for bonds and equities to rise and fall in tandem.

“One such is infrastructure projects, which can potentially provide investors with an attractive, income-oriented return. There are a number of specialist investment trusts that own a variety of assets, such as hospitals, schools and toll roads that are often backed by long-term revenue streams from local or central government and tend to be uncorrelated to the wider economy,” explains Morgan.

Property investments can also provide an attractive and rising rental income with the prospect of capital growth over the long-term. Areas with overcapacity are less likely to make a good inflation hedge due to the structural challenges, but other sectors such as warehouses, logistics, data centres and healthcare could be more resilient, although valuations are more expensive.

The key things to look for in an income trust or fund

Darius McDermott, MD of Chelsea Financial Services, says that when looking for a fund you want a growing income stream that can match inflation.

“This is the best way to preserve your capital. An optically high income in structurally challenged businesses is not going to protect you, as when buying shares or an equity fund you’re buying the future.”

Hughes says that it’s vital to understand the style of investing that a manager follows.

“If they have a clear bias to value, there may well be a risk that the distributions could be lumpy, which can make it more of a challenge to budget if you are relying on the income. A higher quality focus may have a lower staring income, but it might be more sustainable.”

By understanding the strategy, you can set your income expectations for each fund and manage your portfolio accordingly. Some of this will become clear by looking at the distribution history of a fund, which will show how smooth the payments have been over time.

Investment trusts have an inbuilt advantage over their open-ended counterparts as they are able to hold back up to 15% of their income each year and add it to their revenue reserves to support the dividends in more challenging market conditions. Some trusts made significant use of this facility to protect their distributions during the pandemic, whereas the equivalent funds had no option but to slash their income.

The best income generating investment trusts

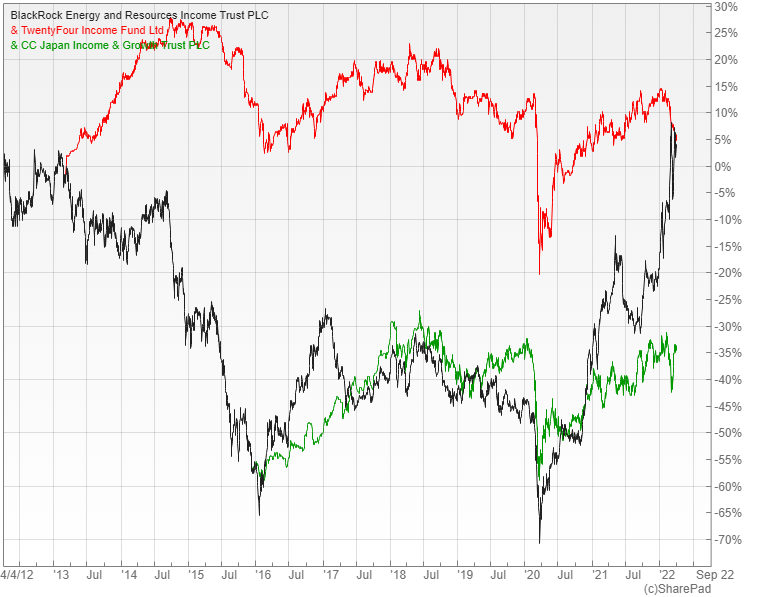

Gilligan recommends Blackrock Energy & Resources Income (LON: BERI), which he says offers a 3.2% yield and exposure to a globally diversified portfolio of oil and mining interests, with only 1.4% exposure to Russia at the end of December. “If the current energy supply demand imbalance persists then it should benefit trusts like this.”

The portfolio is divided into three sections: miners, traditional energy businesses and companies involved in the energy transition process. It has had a strong 12 months with the shares up around 40% and they now trade close to NAV.

Alternatively he suggests the TwentyFour Income Fund (LON: TFIF) that holds a portfolio of asset backed securities and other credit instruments. Unlike traditional bonds, asset backed securities typically have floating rate coupons that rise with interest rates. It is currently yielding six percent with quarterly distributions.

The market for these types of securities got off to a strong start this year with a number of attractive new issues. These were healthily oversubscribed and experienced robust pricing as a result of the excess demand.

Hughes singles out Coupland Cardiff Japan Income & Growth (LON: CCJI) that is managed by the highly experienced Richard Aston. It is yielding three percent and was able to grow the dividend during the pandemic as the strength of Japanese companies came through.

“Japan has continued to be a shining example of how to manage company balance sheets in recent years with many sitting on huge amounts of cash without the millstone of enormous debts. This is translating into strong dividend growth at a time when income feels like a scarce commodity.”

Infrastructure Trusts

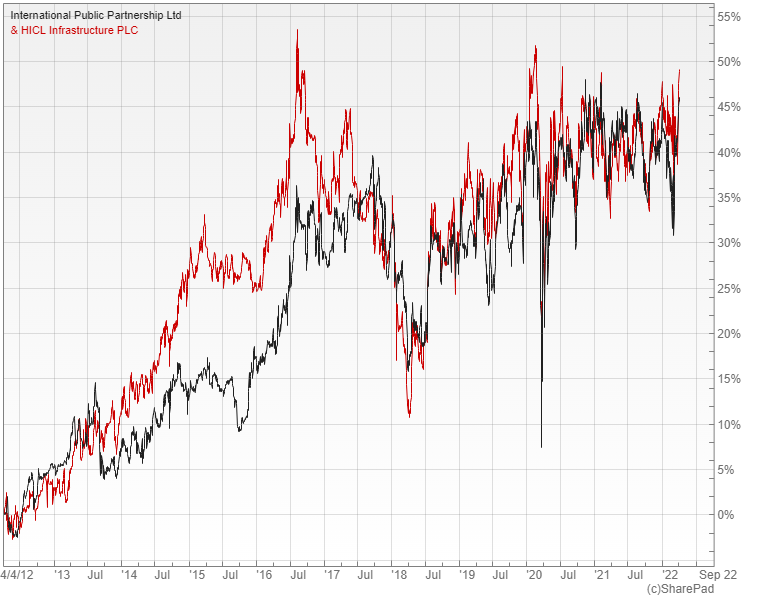

Another option mentioned by Gilligan is International Public Partnerships LON: (INPP), which invests in a wide range of essential infrastructure projects, including schools, hospitals, and utilities.

“It has an inflation delta of 0.78, so if inflation rises by one percent, the trust estimates that its NAV should rise by 0.78%. This inflation linkage is very helpful to income investors in the current environment with INPP currently yielding 4.3%,” he says.

Morgan prefers HICL Infrastructure (LON: HICL) that operates in the same sector. It invests in essential public assets – roads, water, schools and hospitals – mainly located in the UK, but with some exposure to the Eurozone and North America.

“It has a higher yield than much of its peer group at 4.6%, but invests more in demand-based concessions, which have a limit of 35% in the portfolio and are more economically sensitive. For those seeking long-dated income with a high degree of inflation protection it’s a good diversifier.”

Investment trusts are the ideal vehicle for these types of illiquid assets as the managers cannot be forced into selling the underlying holdings to meet client redemptions in the same way that an open-ended fund might.

Open-ended funds

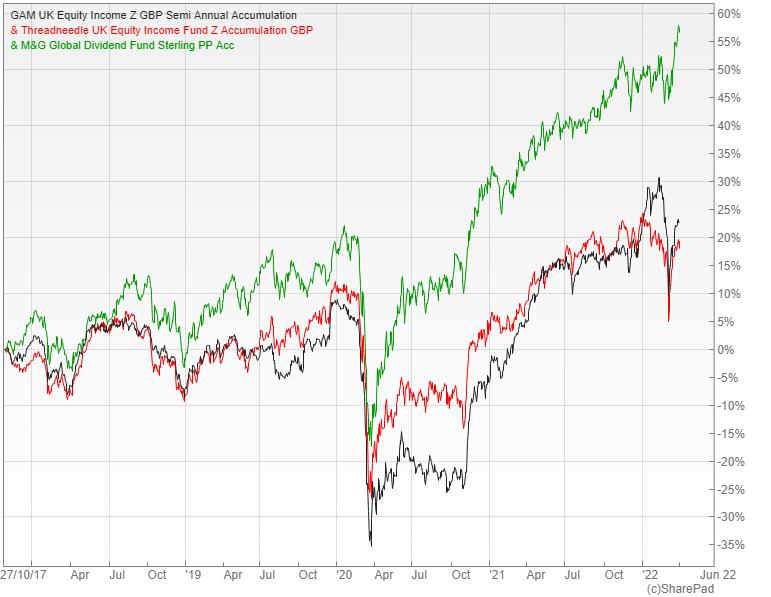

When it comes to open-ended funds McDermott recommends GAM UK Equity Income that is currently yielding 3.6%. It was launched in October 2017 and invests in companies of all sizes, from the very small including those listed on AIM through to the FTSE 100.

“The manager believes that dividends are the most important driver of total returns and while he is targeting a yield higher than that given by the UK stock market, he is also looking for steady dividend growth.”

Hughes likes Threadneedle UK Equity Income that follows a gently contrarian approach that makes it a useful holding alongside the more traditional funds in the sector. It currently has big underweights in financials, miners and oil stocks, despite their potentially higher yields, instead focusing on industrial and healthcare with the likes of AstraZeneca, Rentokil and 3i making up large positions.

“Manager Richard Colwell is proof that value can be added despite being significantly exposed to larger companies. While this is an income focused fund, it is very much managed on a total return basis and makes for a solid core UK equity holding.”

Looking further afield both McDermott and Morgan recommend M&G Global Dividend that invests in companies from around the world that provide stable and rising dividends. It is currently yielding 2.1%.

“The fund contains a core of dividend bankers, which are stable multinational businesses in strong industry positions, but it also owns disciplined companies in more economically sensitive industries, which gives it the scope to add value in various market conditions,” says Morgan.

Manager Stuart Rhodes believes that income strategies outperform over the longer-term, yet owning companies that have consistently increased dividends over an extended period delivers better share price performance than those with the highest starting yields. His aim is to build income over time, which should help yield hungry investors in an inflationary environment.

Far Eastern funds

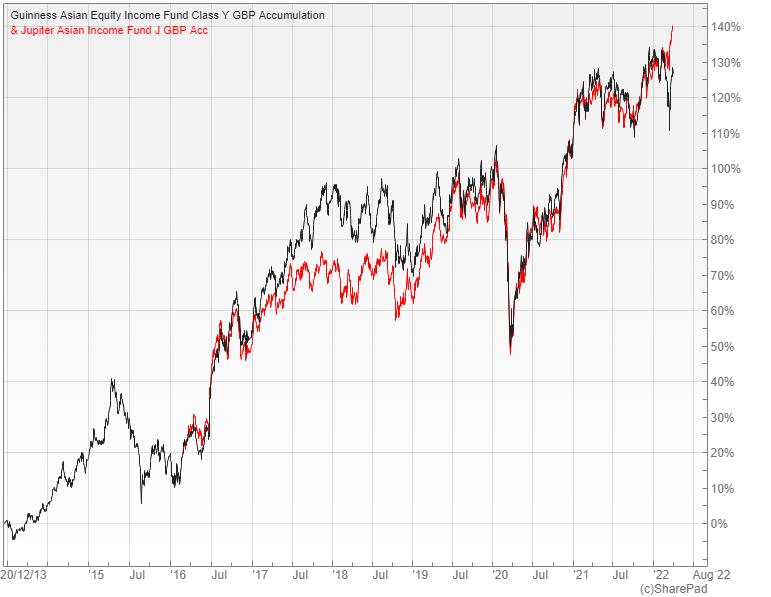

The Far East has a strong dividend culture, which is why McDermott suggests Guinness Asian Equity Income, a regional fund that is currently yielding 3.45%.

“It invests in companies across the whole Asia Pacific region, including Australia and is slightly different to its peers in that it is concentrated into just 36 equally-weighted stocks. The fund has a one-in, one-out policy, so conviction is always strong with the managers looking for a combination of capital and dividend growth,” he says.

Dividends in Asia fell sharply in 2020, as they did around the globe, but this fund’s dividend held up better than the market and rebounded by a market-beating amount in 2021.

Hughes recommends Jupiter Asian Income that is managed byJason Pidcock, a cautious investor who seeks out high quality companies that have strong management and governance and a clear focus on shareholders to ensure that dividends are a key part of the company strategy.

“The fund is significantly underweight China, preferring the more predictable governments of Australia, Taiwan and Singapore among others. Asian companies continue to be relatively well managed with low debts, helping support the dividend, which currently sits at over three percent from a concentrated portfolio that includes the likes of Samsung, Taiwan Semiconductors, Macquarie and BHP Billiton.”

Comments (0)