Fund Manager in Focus – Leda Braga

Featured in this month’s Master Investor Magazine.

On 22nd February, Patricia Arquette came to the stage of the Dolby Theatre in Hollywood to be awarded the Oscar for the Best Performance by an Actress in a Supporting Role for her superb performance in Boyhood. But while her award did not take many of us by surprise, her speech did, as she took the opportunity to highlight the need to end the pay gap between men and women and relaunch the debate on gender inequality. While the female participation rate in the workforce has been steadily increasing over the years in the developed world, the statistics still show that women are paid less than men for the same jobs and that there are certain senior positions that are almost unattainable for women.

While the participation of women within education roles is huge, it is much more moderate in the investment industry in general and in the hedge fund world in particular. Clearly, it is not the case that women cannot research equities or trade futures on a par with men; it is simply down to the fact that this has been an industry dominated by men for years, and one in which the few interested women have a tough time getting to the top.

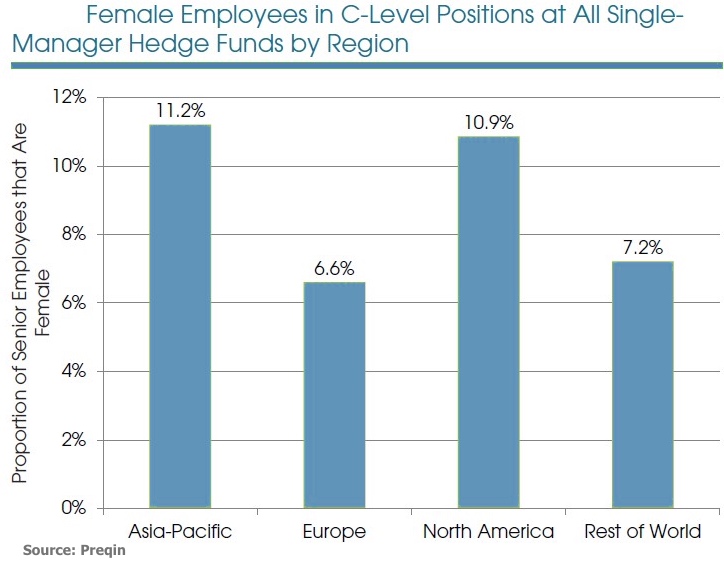

According to a recent study conducted by Preqin, gender equality at single-manager hedge funds reveals that men get almost all C-level positions and that women only have a representation of 1 in 10 at senior roles. Europe is a particular offender, with only 6.6% of existing senior roles allocated to women. When looking at country-level data, Switzerland is the worst performer, with women getting just a 3.8% share of the available senior positions at single-manager hedge funds.

But strangely enough, it is in Geneva, Switzerland that the most powerful female hedge fund manager is based. Supported with a staff of 100, Leda Braga manages two hedge funds with more than $9 billion in assets. The “Carioca” girl, who came to London in her early twenties, quickly turned into one of the most profitable assets inside the hedge fund industry, using one of the most unlikely strategies for a woman, a quantitative approach based on complex algorithms. Leda Braga is an outstanding female success within a male-dominated industry, and serves as a source of inspiration and motivation for all our female readers with an interest in finance and investment. But perhaps more importantly from an investment perspective, Braga serves as evidence that adding women to the investment team is always a good diversification strategy that can only maximise portfolio value.

From Rio de Janeiro to London and Geneva

Leda Braga was born and raised in Rio de Janeiro, Brazil. In 1987, in her 20s, she moved to London to undertake a doctoral programme in engineering at Imperial College. She even lectured some classes during her time there, but she ended up accepting a job as a quantitative analyst for the derivatives research team at JP Morgan Chase. Although not having a background in finance, Leda Braga had the maths skills to enter the complex world of derivatives and structured products pricing and analysis, which would then give her the leverage she needed to build a brighter and more promising career in an investment position.

During a 7-year stint at the derivatives team, she met Michael Platt, a colleague who would become highly influential in her career. In 2000, Platt quit JP Morgan to co-found with William Reeves what would become one of the largest hedge funds in Europe – BlueCrest Capital Management. The company was founded under the offshore privileges of Guernsey but quickly grew to open offices around the world in London, New York, Geneva, Singapore and Connecticut. Platt quickly turned himself into one of the richest billionaires in the UK and his company would become the third largest of its kind in Europe.

Still within the JP Morgan sphere, Braga worked at Cygnifi Derivatives Service (a JP Morgan spin-off) for a while but ended up leaving the company to join Platt at BlueCrest in 2001. A background in engineering, mixed with the experience achieved in complex derivatives pricing, would allow her to apply a systematic strategy to portfolio management. At first, Platt allocated Braga to an existing portfolio worth $300 million, the BlueCrest Capital International Fund. But after a few years of good performance, Platt gave her the opportunity to create and manage her own fund. In 2004, Platt and Braga created the BlueTrend fund and Braga was allocated the responsibility to manage it alone. BlueTrend was a managed futures*, trend-following fund, which aimed at capturing profits through a systematic investment strategy using complex algorithms and computer-driven trading styles to make money from identifying patterns across financial markets. With a passion for technology and maths, Braga improved the system over the course of a decade and ultimately turned it into one of the most powerful quantitative-based trading systems around.

During the first few years the fund didn’t attract much attention from investors, but that would change when it returned 43% in 2008. At a time when most hedge funds were being decimated amidst the Lehman collapse, most hedge funds were fighting to keep their neck just above water, let alone record a barnstorming performance like the one achieved by Braga. With the exception of the Paulson & Pellegrini duo from Paulson & Co., who made a 590% profit in 2007 on the best trade ever, there aren’t many success stories among hedge funds during the financial crisis. From a $300 million portfolio, Braga grew BlueTrend into a $9 billion titan in just over a decade of trading. BlueTrend recorded an average performance of 11.8% between 2004 and 2014 and it recorded a loss in just one calendar year.

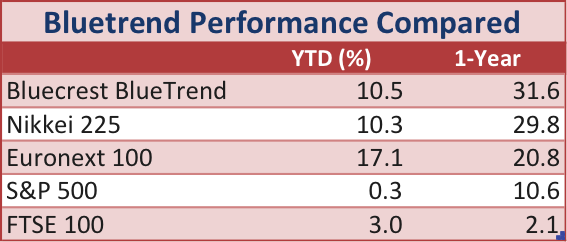

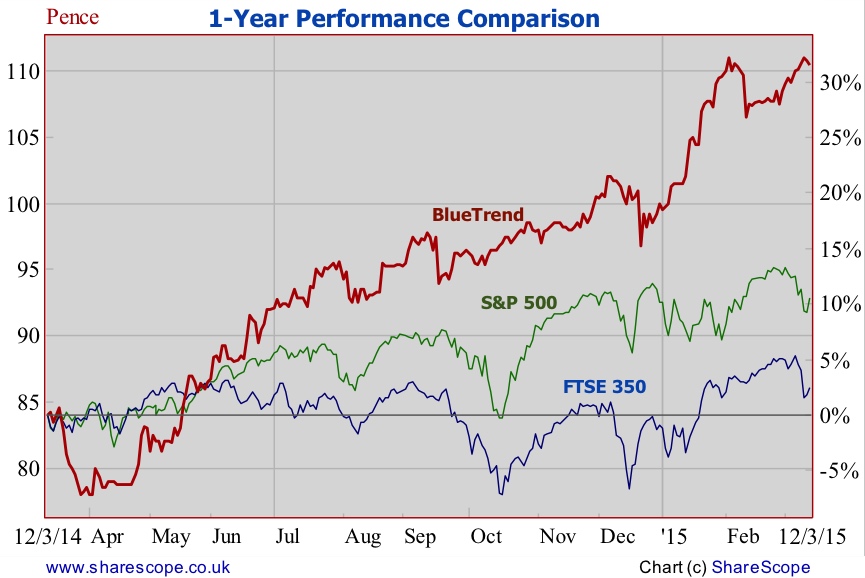

By 2013, with interest rates near zero, the link between asset classes that is often exploited by quantitative funds was being broken, making it ever more difficult to make a profit out of the strategy, which led BlueTrend to a loss of 11.5%. At the same time, as technology advanced, so too did computer-based trading, which allowed for assets under management globally assigned to quantitative strategies to grow from $100 billion to $260 billion since 2008. This severely increased the level of competition and contributed to an erosion of profitability. But Braga is the kind that never gives up and was able to reverse the loss with a 12.7% gain in 2014. In fact, if we consider a one-year time window, the BlueTrend fund is currently up 31.6%, surpassing even the high-flying Nikkei and the QE-boosted Euronext.

“My colleague said at the time, ‘Only the fools and the trend followers are long fixed income in 2014.’ But it paid off,” Braga explains. “We were not long as a punt, but because we had analysed the data. Because the systematic approach does this in an objective way, it means we can be contrarian.”

The Rise of Systematica Investments

After being on the verge of hitting the $50 billion level in terms of assets under management, BlueCrest experienced a setback. The year of 2013 was not great in terms of performance for the company’s funds. Computer-based trading didn’t return a profit and the company’s new venture into equities also ended with several portfolio managers being fired. At the same time, the company was accused of opacity regarding its strategy, and the fact that it was managing an internal fund at the same time as it was managing its open funds didn’t help on transparency. Investors pulled out some money from the company.

Even though Braga and Platt still share common interests, two of the funds managed by Braga spun off from the parent company at the beginning of this year. Was it a consequence of the recent criticism or just a step towards a more efficient allocation of the funds? We can’t know for sure. Braga was allowed to depart with a hundred staff to found Systematica Investments while keeping the $9.2 billion in assets under management from the BlueTrend and BlueMatrix funds. BlueCrest retains a minority interest in the new venture but Braga is its majority owner. There is now a clear detachment of Braga from Bluecrest.

Systematica Investments could not have got off to a better start. First of all, with so much assets under management, Systematica easily ranks among the top 100 hedge funds. Secondly, during the first month of its existence as a separate entity, the BlueTrend fund achieved a 9.5% performance, its third best month ever. Well-timed bets in fixed income helped the fund achieve such a high performance while it cleverly escaped the Swiss National Bank decision to end the peg of the franc to the euro that hit many other hedge funds. Since the separation, the assets attributed to BlueTrend have already grown from $8.4 billion to $9.2 billion, as Braga continues to beat many other hedge funds at a time the quantitative strategy is not driving the kind of results it used to in the past. With a standard fee of 1.5% of assets plus 20% of profits, BlueTrend charges slightly less than the industry 2-20 norm, which is perhaps a necessary step for the fund to recover from its peak at $15.4 billion in April 2013.

Final Remarks

Leda Braga continually seeks to improve the algorithms that allow BlueTrend to exploit profit opportunities at the lowest risk possible. The algorithms that work under one scenario don’t always work under a different one, and it is particularly difficult to develop a model to work well when central banks are breaking the old correlations between assets. That explains why 2013 was such a tough year for Braga. But nevertheless, surviving a financial crisis without a loss and averaging a 12% gain in the period between 2004 and 2014 is something that deserves attention and indeed makes Leda Braga a top hedge fund manager.

*Managed Futures

Managed futures has existed for more than three decades as an investment style or strategy. It consists of trading futures contracts on metals, grains, equity indexes, soft commodities, foreign currencies, and government bonds, while attempting to uncover trends in the movements of their prices. The strategy is often referred to as trend following.

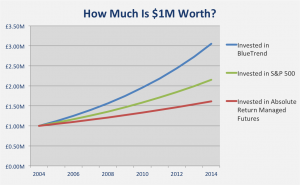

More than being a simple strategy, trend following may indeed help to reduce portfolio risk. It is not unusual for portfolio managers to refer to it as an alternative investment class, providing diversification to the assets already in a portfolio. When compared with bonds and equities, managed futures usually returns less profit, but for such a comparison to be fair we should also look at its risk. When the risk-adjusted performance is considered, managed futures has actually outpaced bonds and equities. When the period between 1980 and 2003 is considered, the maximum drawdown experienced by the Nasdaq and the S&P 500 was -75% and -45% respectively, while just -16% on managed futures.

Comments (0)