Which trusts and funds are the professionals buying?

The latest updates from the various fund-of-funds can give some useful pointers as to where the managers are finding value. This can provide a good starting point for your own research and help to identify trusts and funds that are worth a closer look.

It is a tricky environment at the moment as inflation is rising and interest rates will probably have to be tightened, yet some parts of the market look extremely expensive. This has prompted a rotation from growth to value, but it is unclear how long it will continue.

Looking at where the professionals are investing can be a good way of coming up with some ideas for your own money, although it is essential to understand why they are doing it so that you can decide whether it is something that you feel comfortable with.

It is also important to appreciate that all of the fund-of-funds have different objectives and risk tolerances and take a portfolio approach to the problem. The managers make sure that they are always well-diversified and never over commit to a particular area, which is a sensible precaution that we all need to bear in mind.

Another key point is that some of these vehicles are much more actively managed than others and will look to take a quick ten percent out of the market and then move on without necessarily updating investors in a timely fashion. If you are going to follow them it is much safer to stick to the longer term opportunities where you can run the position to get the full benefit, rather than just trying to take advantage of the short-term fluctuations in sentiment.

Capital growth

Miton Global Opportunities

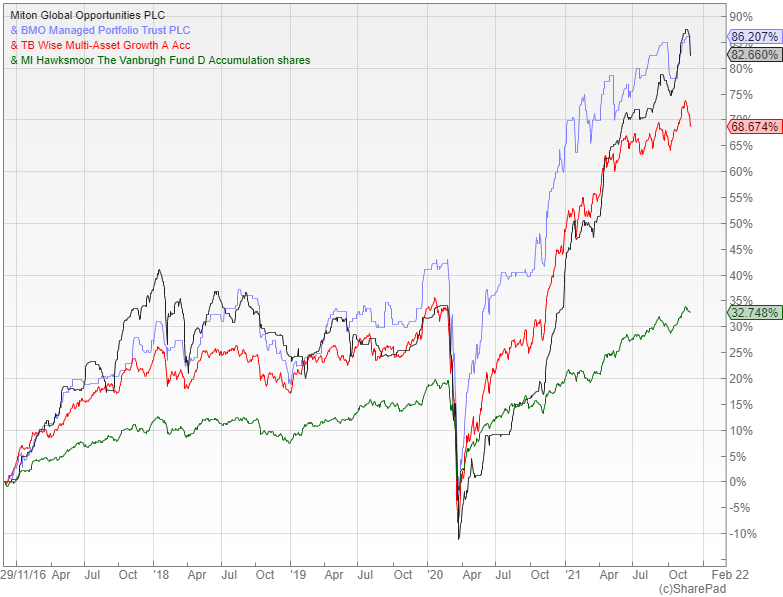

The £100m Miton Global Opportunities Trust (LON: MIGO) targets capital growth by investing in mispriced investment trusts. It operates in the flexible investment sector and over the last five years has generated a first quartile return of 82%.

Lead manager Nick Greenwood mainly aims to exploit pricing anomalies, such as by buying investment trusts that are trading on wide discounts where he thinks there will be a catalyst for a re-rating. This approach enables him to put together a highly diversified portfolio of different asset classes that has a low correlation with mainstream indices.

The largest part of the portfolio other than the general equity-based trusts is private equity with the 24% allocation including significant positions in vehicles like Dunedin Enterprise (LON: DNE) and NB Private Equity (LON: NBPE). In a recent investor presentation Greenwood said that these sorts of trusts are trading on wide discounts at a time when the net asset values are increasing nicely.

Another area they are targeting at the moment is emerging and frontier markets, especially places like India and Vietnam that they are accessing via the India Capital Growth fund (LON: IGC) and VinaCapital Vietnam (LON: VOF). Greenwood is bullish on both of these countries and considers them to be special situations where the discounts are likely to narrow as the demand for the shares picks up.

BMO Managed Growth Portfolio

The £114m BMO Managed Trust Growth Portfolio (LON: BMPG) aims to generate capital growth from a diversified portfolio of at least 25 investment trusts. It operates in the same sector as MIGO and has delivered a similar five-year return of 86%, yet despite the near identical performance, manager Peter Hewitt has put together a very different set of holdings.

BMPG is heavily tilted in favour of technology trusts with Allianz Technology (LON: ATT), the tech heavy Scottish Mortgage (LON: SMT), Polar Capital Technology (LON: PCT) and Herald (LON: HRI) all making it into the ten largest holdings. This is because the manager thinks that the longer term prospects for technology still look really exciting, even though it is possible that they could lag behind more value-oriented areas for a while.

Another well-represented area is private equity with HgCapital Trust (LON: HGT) and Chrysalis Investments (LON: CHRY) being amongst the top ten positions. Both are trading at a modest premium to their estimated NAVs, whereas many of the other trusts in the sector are on wide double digit discounts.

Hewitt says that Chrysalis focuses mainly on high growth UK companies that are perhaps two to three years from listing on the stock market. It has a concentrated list of ten to fifteen investments and is prepared to continue holding the stocks as they move from being private into the public arena, a strategy that is well placed to achieve strong growth in the coming years.

Hawksmoor Vanbrugh

Hawksmoor Vanbrugh is an open-ended fund that attempts to generate capital growth from a portfolio of other open-ended funds and investment trusts. It is cautiously managed and aims to generate returns after charges in excess of inflation. Over the last five years it has appreciated by 29% making it a second quartile performer in its mixed investment 20% to 60% shares sector.

In the third quarter of the year the managers increased their exposure to private equity and real assets with the end of September allocations standing at 5.1% and 21.5% respectively. The latter consists of a diverse collection of investment trusts that would all be expected to benefit in one way or another from rising inflation.

The real assets weighting includes: Digital 9 Infrastructure (LON: DGI9); the energy storage trusts Gore Street (LON: GSF) and Gresham House (LON: GRID); music royalty funds Hipgnosis Songs (LON: SONG) and Round Hill (LON: RHM); as well as the maritime shipping vehicles Taylor Maritime (LON: TMIP) and Tufton Oceanic (LON: SHIP).

I covered the digital infrastructure and maritime shipping IPOs earlier in the year as both look like interesting new asset classes for investors to consider.

TB Wise Multi-Asset Growth

A more aggressively managed option is the open-ended TB Wise Multi-Asset Growth fund that attempts to generate rolling five-year returns in excess of the Cboe UK All Companies Index and in line with or in excess of CPI inflation. In the last five years it has gained 73%, which is well ahead of both of its benchmarks.

It is an interesting product that focuses on high-quality funds and investment trusts operating in out-of-favour areas, with managers Vincent Ropers and Philip Matthews adopting a value bias.

Well-known value holdings include: AVI Global (LON: AGT), AVI Japan Opportunity (LON: AJOT) and Aberforth Smaller (LON: ASL), which was recently topped up when the discount widened to 13%. Private equity is also well represented via the likes of Pantheon (LON: PIN) and Oakley Capital (LON: OCI).

The managers have recently increased their position in the TwentyFour Income Fund (LON: TFIF), which they see as attractively placed in an inflationary environment given the floating rate nature of its holdings. It invests in asset-backed securities and is yielding a high 5.7%.

Growth funds: Top 10 holdings: Source author

| TB Wise multi-asset growth | Hawksmoor Vanbrugh | BMO Managed Growth | Miton Global Opportunites | ||||

| AVI Global Trust | 5.7% | Allianz Strategic Bond | 3.7% | Monks Investment Trust | 4.6% | Baker Steel Resources Trust | 6.4% |

| Caledonia Investments | 4.8% | Jupiter Gold & Silver | 3.7% | Allianz Technology Trust | 4.5% | Dunedin Enterprise Investment Trust | 6.3% |

| Oakley Capital Investments | 4.3% | Oakley Capital Investments | 3.6% | Scottish Mortgage Investment Trust | 4.3% | EPE Special Opportunities Ltd | 5.9% |

| Pantheon International | 3.9% | TwentyFour Monument Bond | 3.5% | Polar Capital Technology Trust | 3.7% | VinaCapital Vietnam Opportunity Fund | 5.5% |

| Schroder Global Recovery | 3.8% | Phoenix Spree Deutschland | 3.3% | HgCapital Trust | 3.6% | Alpha Real Trust | 4.7% |

| Fidelity Asian Values | 3.6% | WisdomTree Physical Gold | 3.0% | Chrysalis Investments | 3.5% | Phoenix Spree Deutschland Ltd | 4.3% |

| CF Ruffer Equity & General | 3.6% | CG Dollar | 2.9% | Impax Environmental Markets | 3.1% | NB Private Equity Partners Ltd | 3.7% |

| Aberforth Smaller Companies Trust | 3.5% | GVQ UK Focus | 2.9% | Herald Investment Trust | 3.0% | New Star Investment Trust | 3.7% |

| AVI Japan Opportunity Trust | 3.5% | CIM Dividend Income | 2.8% | Mid Wynd International Investment Trust | 2.8% | India Capital Growth Fund | 3.6% |

| Odyssean Investment Trust | 3.4% | Prusik Asian Equity Income | 2.8% | Fidelity Special Values | 2.8% | Atlantis Japan Growth Fund | 3.6% |

Income

BMO Managed Income Portfolio

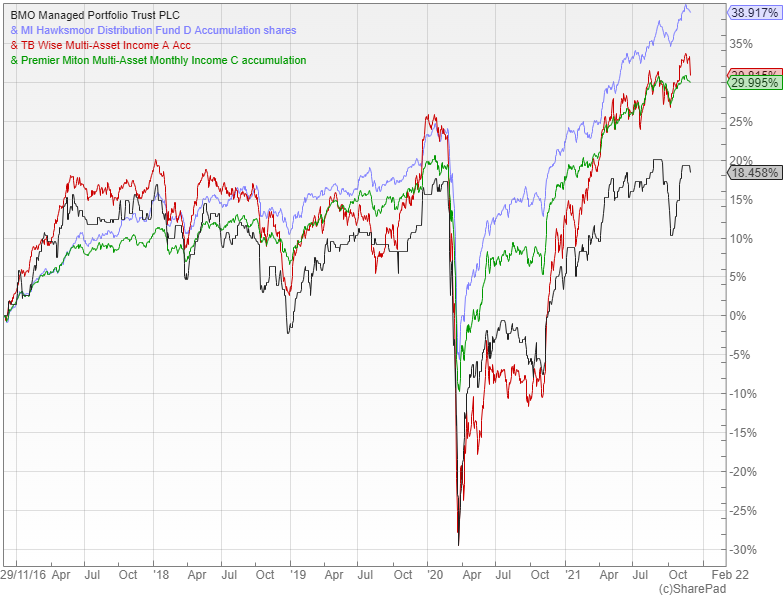

There are also several fund-of-funds aimed at income seekers with a good example being the £76m BMO Managed Trust Income Portfolio (LON: BMPI). It is yielding 4.2% with quarterly dividends and the share price total return over the last five years is 56%.

Manager Peter Hewitt aims to generate an attractive level of income, with the potential for income and capital growth, from a diversified portfolio of investment trusts. Performance is benchmarked against the FTSE All-Share index, which the trust has comfortably beaten over most time periods.

One of the major themes in the portfolio is private equity with the largest holdings including the likes of NB Private Equity (LON: NBPE) and Princess Private Equity (LON: PEY). Hewitt says that they are selling at double digit discounts to NAV despite strong asset performance and that both have recovered well from the worst effects of the pandemic.

You wouldn’t normally expect to find private equity in an income portfolio, but investment trusts are allowed to pay dividends from their capital reserves, with NBPE yielding 2.4% and Princess 3.2%.

Another key holding is the Law Debenture Corporation (LON: LWDB), a unique global investment trust that includes an independent professional services business, which generates a steadily growing stream of revenue. It is currently yielding 2.5% and trading close to NAV.

Hawksmoor Distribution

An open-ended alternative is the Hawksmoor Distribution fund whose primary aim is to generate an attractive level of income, whilst also delivering capital growth over the medium to long term. It holds a diversified portfolio of funds and trusts and is yielding 3.4%, but the five year return of 34% gives it a lowly third quarter ranking in its mixed investment 40% to 85% shares sector.

The managers have recently increased their allocation to private equity and real assets, with one new addition being the £604m Home REIT (LON: HOME).

HOME is a property trust that provides accommodation for homeless people. The fund rents the accommodation to charities and housing associations on long, inflation-linked leases and is offering an attractive, defensive income with a yield of around 5.5% a year.

TB Wise Multi-Asset Income

The TB Wise offering in this space is tasked with providing an annual yield in excess of the Cboe UK All Companies Index and with the potential to provide income and capital growth over rolling periods of five years in line with or in excess of CPI inflation. It pays monthly distributions, which is an attractive feature for income seekers and is forecast to yield 4.5%.

TB Wise Multi-Asset Income has generated a total return over the last five years of 36% from its portfolio of funds, trusts and direct shareholdings. It is a diverse offering with the largest allocations including: value trusts such as Temple Bar (LON: TMPL) and Aberforth Smaller (LON: ASL); private equity vehicles like BMO Private Equity (LON: BPET) and Princess (LON: PEY); as well as property trusts Ediston (LON: EPIC) and Standard Life (LON: SLI).

One of the latest purchases is the Schroder Global Equity Income fund, which was added after an upbeat update with the managers. In a recent factsheet they said that a notable feature of the current market is the divergence in valuations between the cheapest quintile of global equities and the most expensive quintile.

The former currently sits at a valuation below its long run average since 1990, a level which has historically generated strong positive returns over the subsequent decade, whereas the most expensive quintile has only ever been more expensive during the technology boom in the year 2000 and we all know how that ended.

Premier Miton Multi-Asset Monthly Income

The £539m Premier Miton Multi-Asset Monthly Income aims to pay a high level of income from a well-diversified portfolio and is yielding 4.4% with monthly distributions. It operates in the mixed investment 20% to 60% shares sector and has returned 28.5% over the last five years.

Their investment decisions are based on a three-stage process, the first of which is the asset allocation. It is then a case of choosing which funds to use to provide the exposure given that they want stable options that are not too closely correlated. The third stage is then to actively manage the resulting portfolio.

Equities currently make up just under half of the assets with UK equities by far the largest component at 30%. The biggest holdings in this area are: Evenlode Income, Franklin UK Equity Income and Allianz UK Equity Income.

There is also a significant 31% allocation to bonds, most of which fall into the specialist category and 14% in property. The latter includes the Impact Healthcare REIT (LON: IHR), a specialist trust that owns a portfolio of residential care homes and is yielding more than five percent.

Impact looks like a decent option for income seekers, especially given the reliability of the underlying revenue streams. I recently covered it in more detail in my weekly blog.

Income funds: Top 10 holdings: Source author

| TB Wise multi-asset income | Hawksmoor Distribution | BMO Managed Income | Premier Miton Multi-Asset Monthly Income | ||||

| Legal & General | 5.4% | Gresham House UK Multi-Cap Income | 5.7% | BB Healthcare Trust | 4.3% | Evenlode Income | 5.2% |

| Blackrock World Mining Trust | 5.2% | Prusik Asian Equity Income | 5.6% | NB Private Equity Partners | 4.1% | Franklin UK Equity Income | 4.7% |

| Ediston Property | 4.6% | CIM Dividend Income | 5.0% | HBM Healthcare Investments | 4.1% | Allianz UK Equity Income | 4.6% |

| Temple Bar Investment Trust | 4.6% | Man GLG Income | 4.6% | Law Debenture Corporation | 4.1% | BNY Mellon Global Infrastructure Income | 4.2% |

| Aberforth Smaller Companies Trust | 4.6% | GVQ UK Focus | 4.5% | JPMorgan Global Growth & Income | 3.7% | Fidelity MoneyBuilder Dividend | 4.2% |

| BMO Private Equity Trust | 4.5% | Oakley Capital Investments | 4.3% | Scottish American Investment Company | 3.6% | GAM UK Equity Income | 4.0% |

| Standard Life Property | 4.2% | Phoenix Spree Deutschland | 4.0% | Invesco Perpetual UK Smaller Cos Inv Tst | 3.5% | CC Japan Income & Growth | 3.8% |

| Middlefield Canadian Income | 4.1% | Jupiter Japan Income | 3.4% | Princess Private Equity Holding | 3.3% | Man GLG UK Income | 3.6% |

| Twenty Four Asset Management | 4.1% | Polar Capital Global Convertibles | 3.4% | Secure Income REIT | 3.2% | Impact Healthcare REIT | 3.2% |

| Aberdeen Asian Income | 4.0% | Jupiter Gold & Silver | 3.3% | European Assets Trust | 3.2% | Fidelity Emerging Markets Debt Total Return | 3.1% |

Comments (0)