What is quality investing – and why does it work?

The quality investing approach has allowed top fund managers like Terry Smith and Nick Train to outperform rivals. It may offer one of the best ways to perform well over the long term, writes Andrew Latto, CFA.

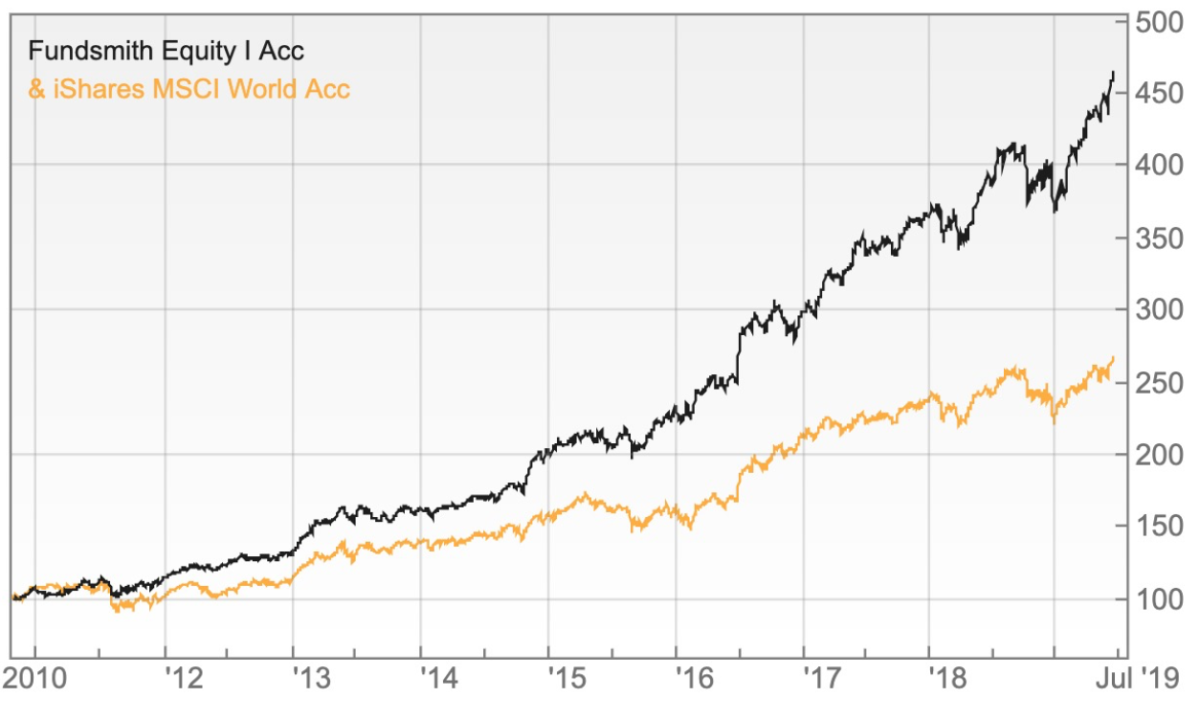

Quality has become a ‘hot button’ topic for investors. Terry Smith describes himself as a quality investor rather than a value investor or growth investor. The Fundsmith Equity Fund that he manages has performed exceptionally well.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

The key question is: how does quality investing differ from value investing and growth investing? Value stocks trade on low valuation multiples − price-earnings (P/E) ratio, price-to-book ratio and price-to-sales ratio – and growth stocks trade on high valuation multiples.

The trouble is that the value and growth labels are potentially misleading. Lowly-rated value stocks can be expensive and highly rated growth stocks can be inexpensive.

The value and growth labels are, however, unlikely to go out of fashion. They are used by academics for research and by investors to categorise stocks.

Warren Buffett stated in the 1992 Berkshire Hathaway annual report that:

“Most analysts feel they must choose between two approaches customarily thought to be in opposition: ‘value’ and ‘growth’…We view that as fuzzy thinking…Growth is always a component of value.”

Quality drives intrinsic value

What matters is the intrinsic value of a company. This alone determines if a share is expensive or good value.

Intrinsic value is the present value of the free cash flow available to investors. This makes sense. Investments should be valued in line with the cash they can return to investors.

High-quality companies are good at generating free cash flow. The quality style of investing focuses on what matters: the ability of a company to return cash to investors.

To quote Buffett again: “Stocks are simple. All you do is buy shares in a great business for less than the business is intrinsically worth, with managers of the highest integrity and ability.”

Fundsmith Equity Fund case study

The Fundsmith Equity Fund follows the quality investing approach. It has outperformed its benchmark (MSCI World sterling net) since inception (1 November 2010) with an 18.9% annualised return to 31 May 2019.

At the end of 2018, the fund’s equity portfolio had a weighted average return of capital employed of 29% and free cash flow conversion of 95%. The portfolio is resilient, with an operating margin at 28% and interest cover at 17x.

The Fundsmith Equity Fund owns quality companies. The free cash flow they generate has driven the fund’s outperformance.

Fundsmith Equity Fund since launch (I Acc)

Source: SharePad

Growth stock case study

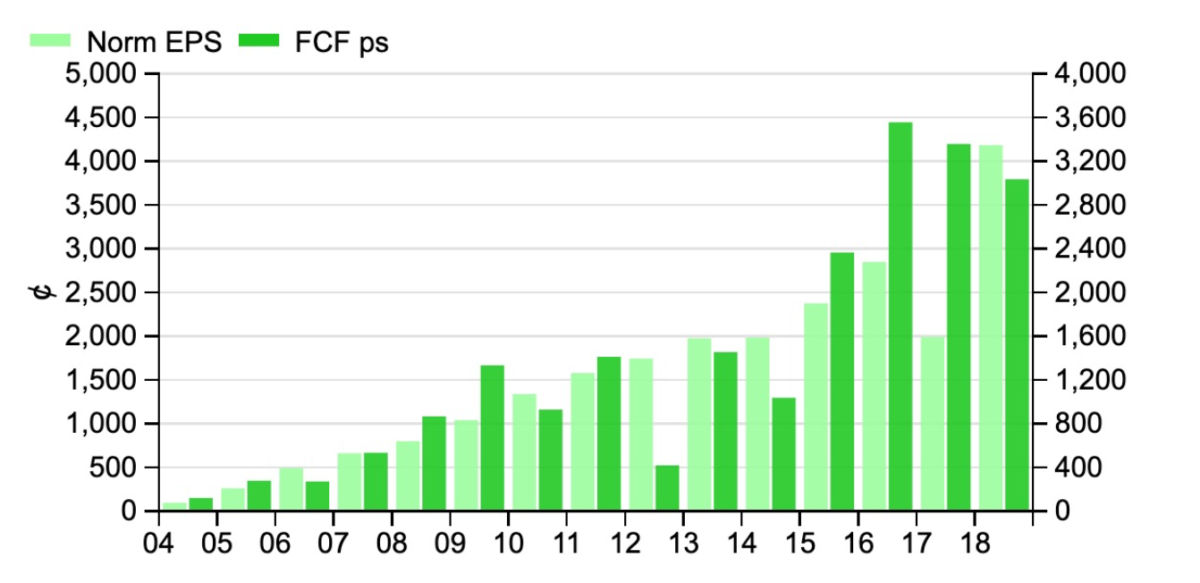

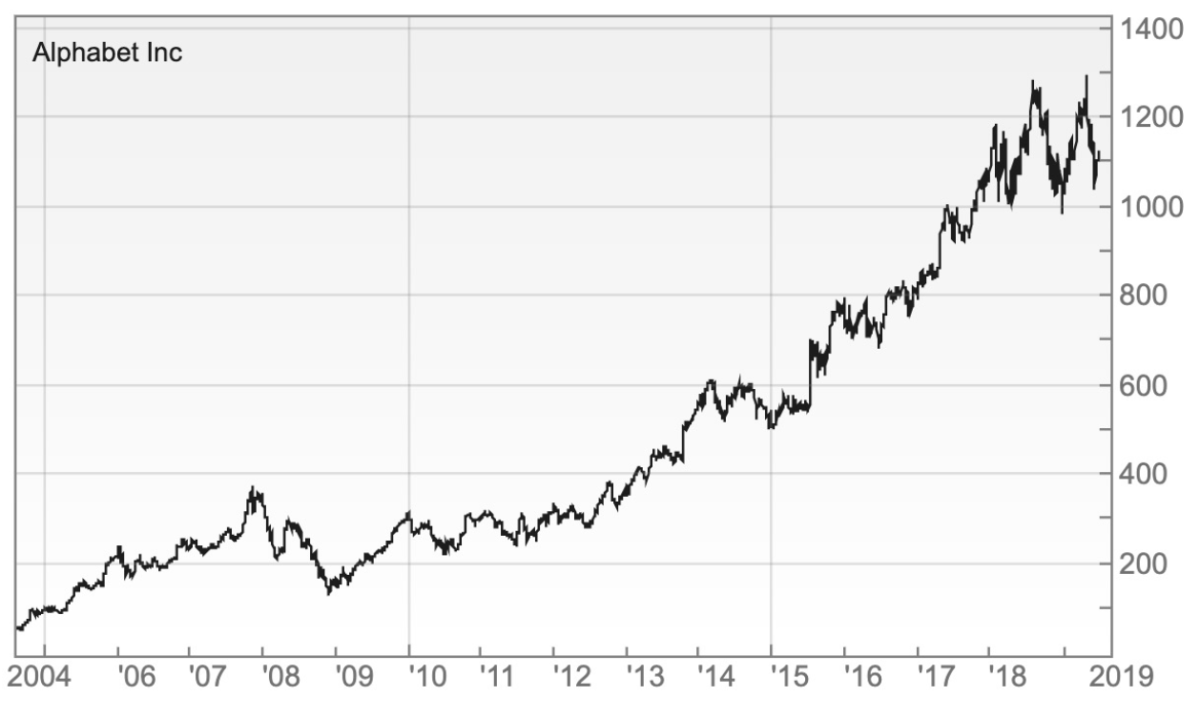

Google (now Alphabet (NASDAQ:GOOGL)) shows that a high valuation multiple in isolation does not necessarily mean a stock is expensive. When Google listed in 2004 it was considered to be a pricey investment.

Google’s free cash flow per share has been on a roll since then, which has resulted in the shares performing well. Growth stocks that can deliver robust free cash flow growth are worth paying up for.

Google’s EPS and free cash flow per share

Source: SharePad

Google’s (now Alphabet) growth made it cheap at the IPO

Source: SharePad

Value stock case study

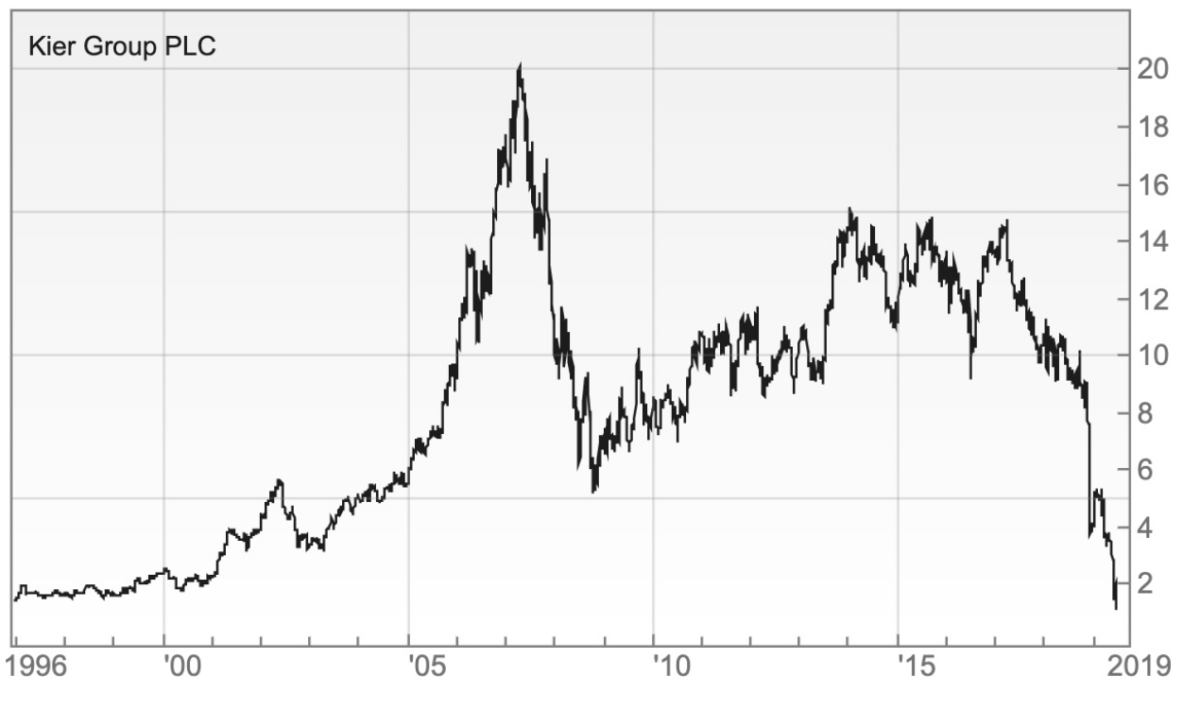

Value stocks tend to be cheap for a reason.They often have little scope to grow free cash flow. They may also be at risk of disruption, perhaps from the internet or new competitors.

Most value stocks have meaningful ‘blow-up risk’. This reflects a weak underlying business and/or a weak balance sheet. A ’value trap’ is a value stock that proves to be anything but a bargain.

The UK construction group Kier (LON:KIER) traded on a modest P/E ratio of around 10x from 2000 to the end of 2018. While it would have been described as a value stock, it has proven to be expensive for investors – ie a value trap.

Kier Group’s modest P/E ratio did not make it ‘cheap’

Source: SharePad

The intrinsic value approach

The intrinsic value approach assesses free cash flow generation – ie the surplus cash available for investors. The drivers of free cash flow are business quality and the scope to realise high-return growth.

The combination of quality and growth can deliver significant free cash flow growth – as we saw with Google. It is easy to underestimate the earning power of a high-quality business with a growth tailwind.

Quality means durability

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

With capital preservation paramount, quality investors seek to own businesses that will stand the test of time. A modest return and durable business may be a better investment than a high-return business.

The tobacco sector has generated high returns in the past but is threatened by regulatory change and disruption – ie e-cigarettes, regulation etc. Tobacco stocks may therefore fail to preserve value for investors.

High-quality and resilient businesses rarely make the headlines. They simply deliver consistent results in an unassuming manner. Examples in the UK include the testing group Intertek (LON:ITRK) and the product-safety group Halma (HLMA).

The quality investors Lindsell Train believe that: “Investors undervalue durable, cash generative business franchises.” The bottom line is that: “investment brilliance depends on business resilience.”

Do stocks outperform Treasury bills?

Research from Professor Bessembinder (Do Stocks Outperform Treasury Bills?) shows that most stocks deliver poor returns. He has examined 90 years of US stock-market history from 1926 to 2016.

During this period, 22 out of 23 stocks collectively matched the return on one-month US Treasury bills over their lifetimes. One in 23 stocks explained the US equity market’s outperformance in comparison with one-month Treasury bills.

Only one in 281 stocks explained the majority of the US market’s outperformance against Treasury bills − a few winners drive the market. The companies that do well over the long term are resilient to change, such as competition or disruption.

Quality means high returns

To formalise the quality investing approach, we need to establish a quality threshold. Otherwise quality will be in the ‘eye of the beholder’.

The metric that quality investors focus on is the return on the capital invested in a business. For every £1 million invested in a business we want to see an attractive annual return.

Terry Smith sets the quality threshold at a 15% annual return on capital employed (ROCE). This needs to be earned over the full economic cycle and not just during periods of strong economic growth.

Smith also requires that corporate profits be backed up by free cash flow. This means that every £1 million invested in a business generates at least £150,000 in cash per year (before tax).

ROCE

ROCE is the annual profit (before interest and tax) divided by the total capital invested. It is independent of the capital structure of a business and therefore puts companies on an equal footing.

One way of thinking about ROCE is as the lump sum return. It is the return a business generates if it had been given a single lump sum of capital.

ROCE is the product of the operating profit (or EBIT) margin and the capital- turnover ratio (sales/capital employed). An increase in the profit margin and/or the capital-turnover ratio will increase the ROCE.

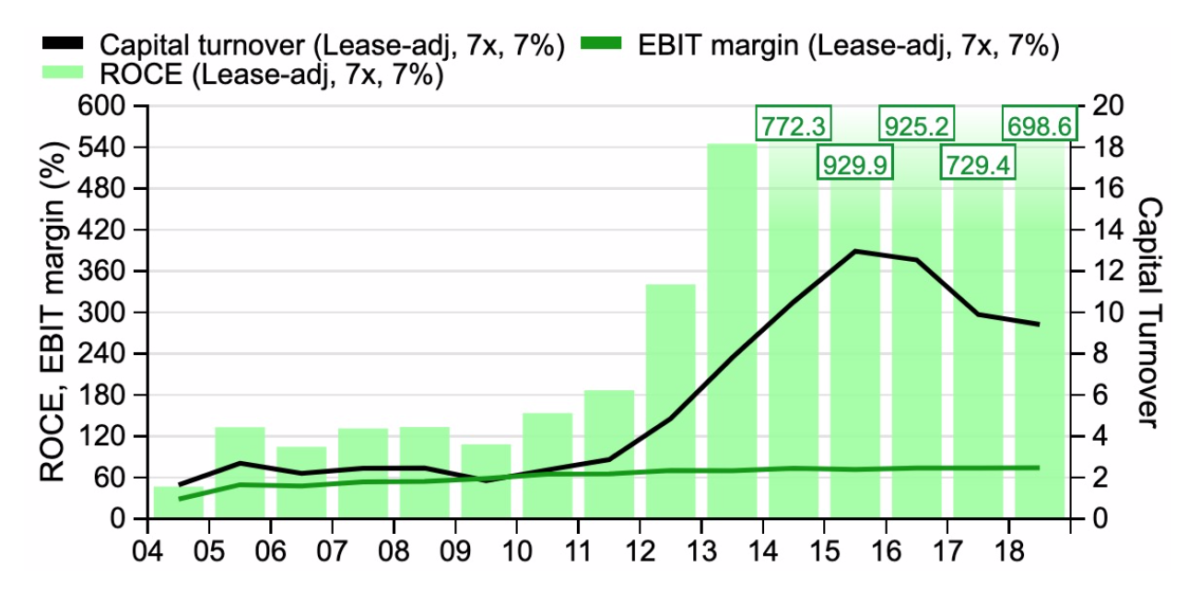

Rightmove case study

If we want to own high ROCE businesses we need to find companies that generate high margins and/or use little capital. The UK online property-listing platform Rightmove (LON:RMV) scores on both fronts.

Rightmove had a capital-turnover ratio of 9.4x in 2012 and an EBIT margin of 74.2% (both lease-adjusted). Multiplying these together gives a ROCE of almost 700%.

Rightmove’s ROCE drivers

Source: SharePad

Quality and growth drive value

The intrinsic value of a company is driven by its current cash flow and the scope to increase it over time. Organic growth will increase free cash flow but acquisition-driven growth is capital intensive.

Sources of free cash growth include the ability to attract more customers; selling more products to existing customers; the ability to steadily increase prices; and the ability to increase margins.

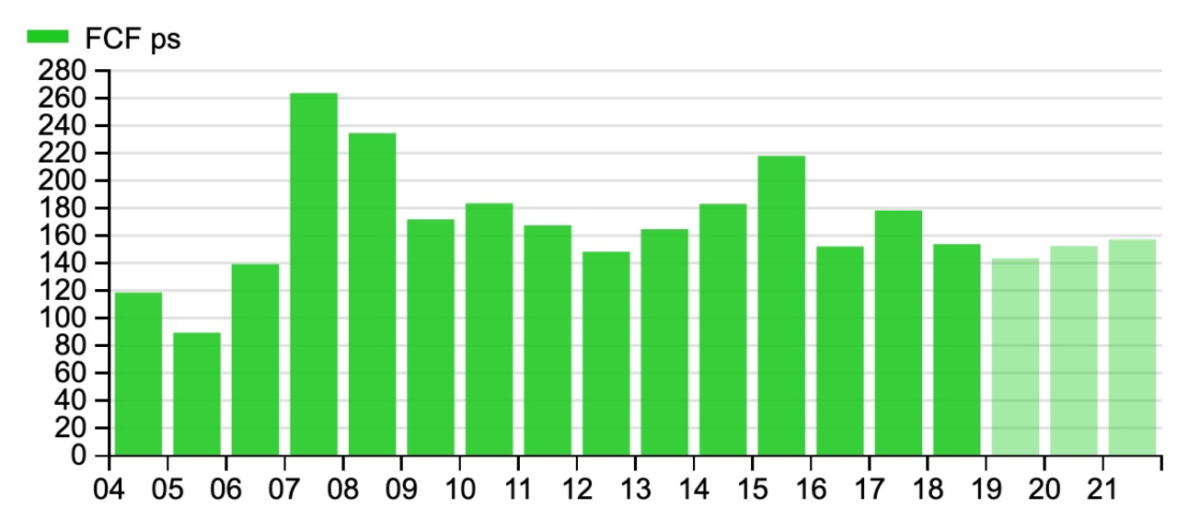

In the absence of growth, a high-return business is comparable to a high-grade bond – it will return all of its free cash flow to investors. A good example is the Spanish stock-exchange group Bolsas Y Mercados Españoles (BME:BME).

BME generated a robust 45.6% ROCE in 2018, while its EBIT margin was 54.7%. However, the group has returned the bulk of its annual profit to investors and free cash flow has made little progress since 2004.

BME’s free cash flow per share

Source: SharePad

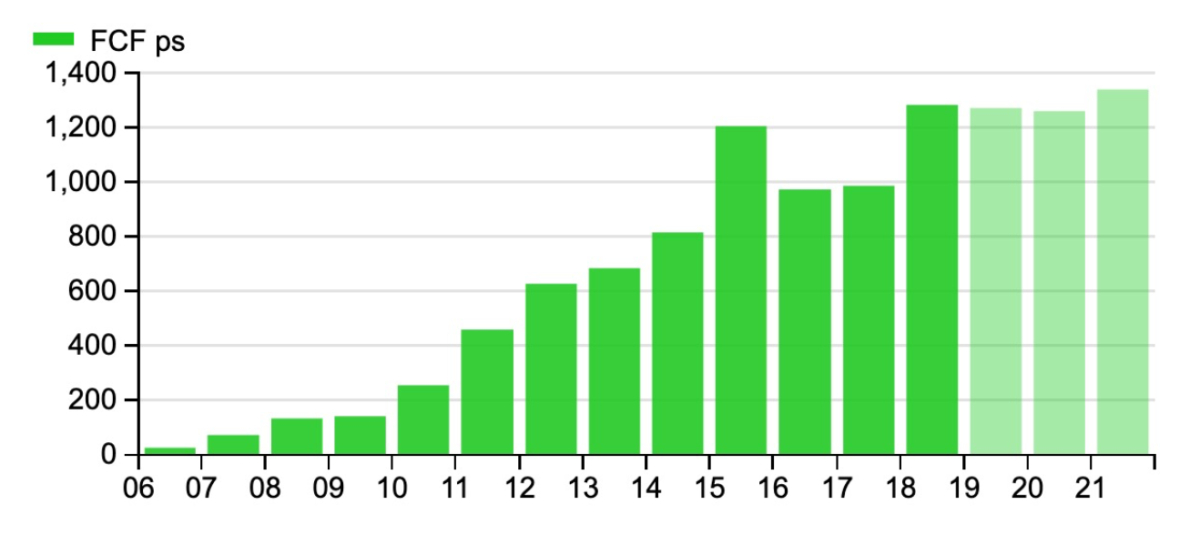

Stock compounders

Given the importance of quality with growth, I use the term stock compounders to describe companies that can generate high returns, sustain high returns and realise high-return growth.

Stock compounders are able to grow free cash flow over the medium to long-term. This will result in share-price momentum, provided that the initial valuation is not exorbitant.

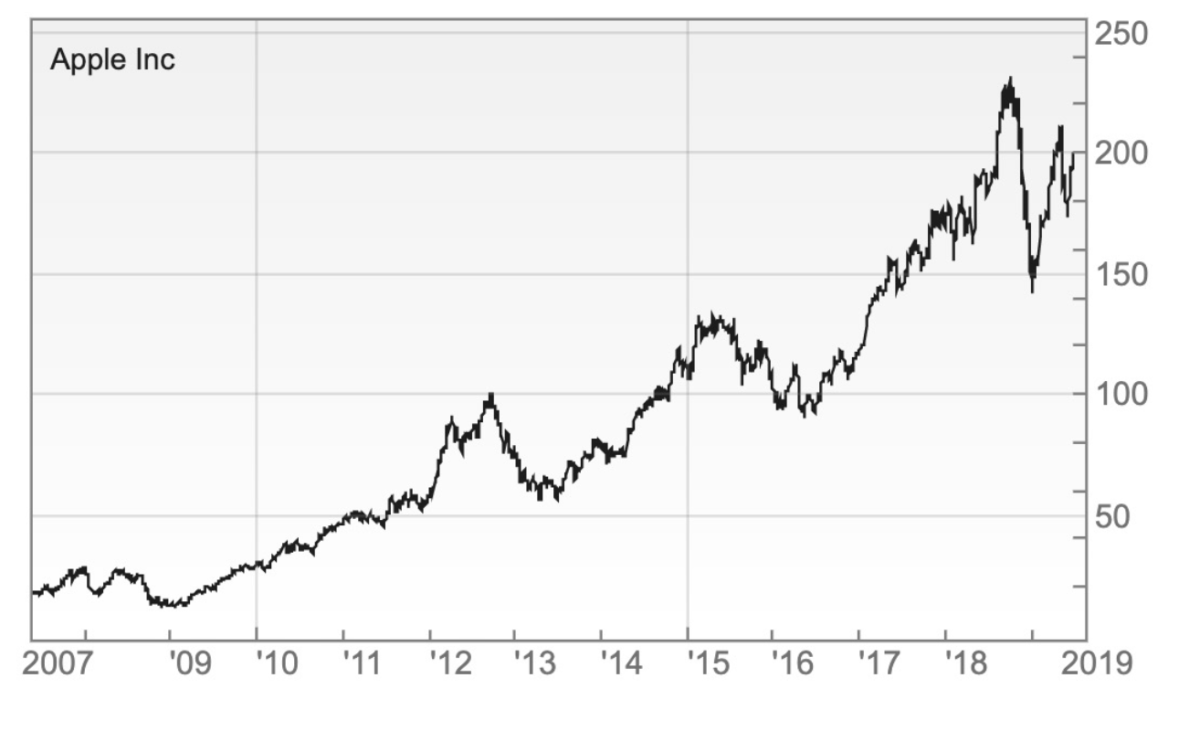

Stock compounders need a growth tailwind to generate high-return growth. Apple Inc (NASDAQ:AAPL) provides a good example with its free cash flow per share increasing ninefold (excluding dividends) since the launch of the iPhone in 2007.

Apple’s free cash flow per share: the iPhone effect

Source: SharePad

Apple share price since the iPhone launched

Source: SharePad

Stock compounders are durable

How can we identify stock compounders like Apple Inc? The first criterion is that a company needs to be durable. They have to be able to hold their own for the next 10 to 50 years.

A durable business benefits from resilient demand, good margins and a strong competitive position. They tend to have robust balance sheets with plenty of scope to service liabilities.

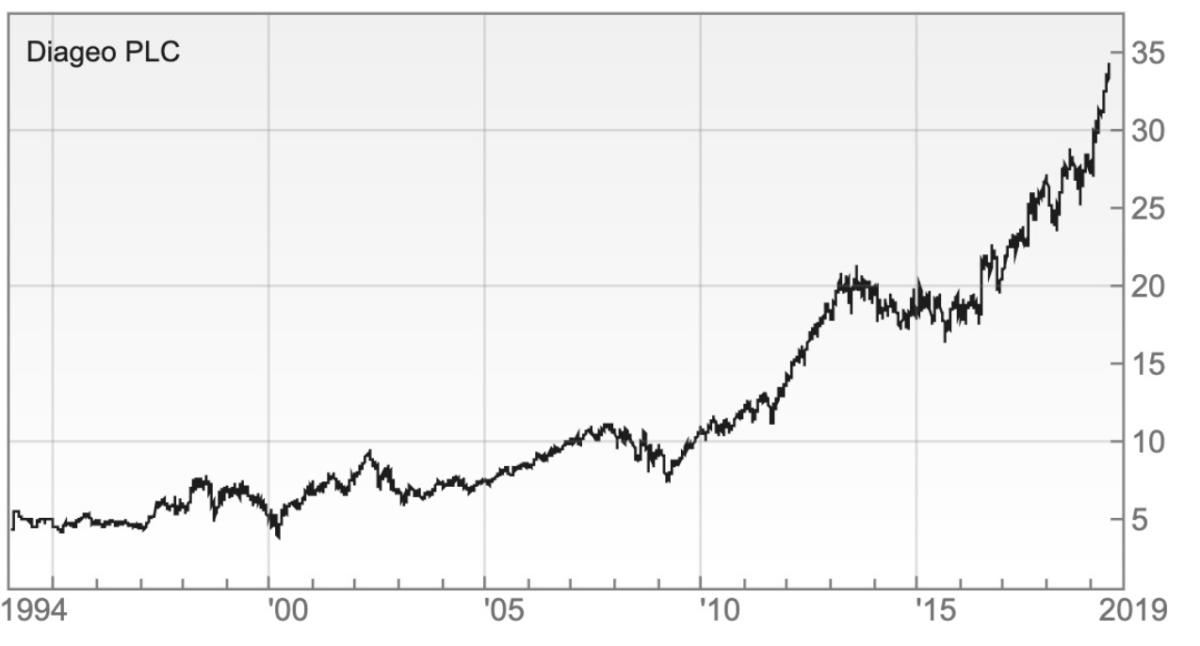

The spirits group Diageo (LON:DGE) is a durable on account of its portfolio of long-established spirits brands. Guinness, Johnnie Walker, Smirnoff, Captain Morgan, Baileys and Tanqueray all appear to be here to stay.

Diageo’s top spirit brands

Source: Diageo

Stock compounders tend to generate high margins

High operating-profit margins are an indicator of a robust competitive position. Diageo generated a robust 34% margin of earnings before interest and tax on revenue in fiscal 2018.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

What matters, though, is the sustainability of margins. Companies need competitive ‘moats’ to keep rivals at bay. These include strong brands, network effects, switching costs, economies of scale, patents and distribution channels.

When it comes to spirits, consumers tend to focus on brand quality rather than price. Diageo also often controls product distribution, and bars and supermarkets have limited space to stock spirits.

Stock compounders are not unduly capital intensive

It is no use generating high margins if a business is extremely capital intensive. National Grid (LON:NG.) is a case in point. The utility group has an EBIT margin of 23.3% but a capital-turnover ratio of only 0.3x. The result is a 7% return on capital.

Franchisors like Domino’s Pizza Inc (LON:DOM) are capital light because franchisees fund the business. Platform businesses that act as intermediaries, such as Rightmove and AutoTrader (LON:AUTO) are also capital light.

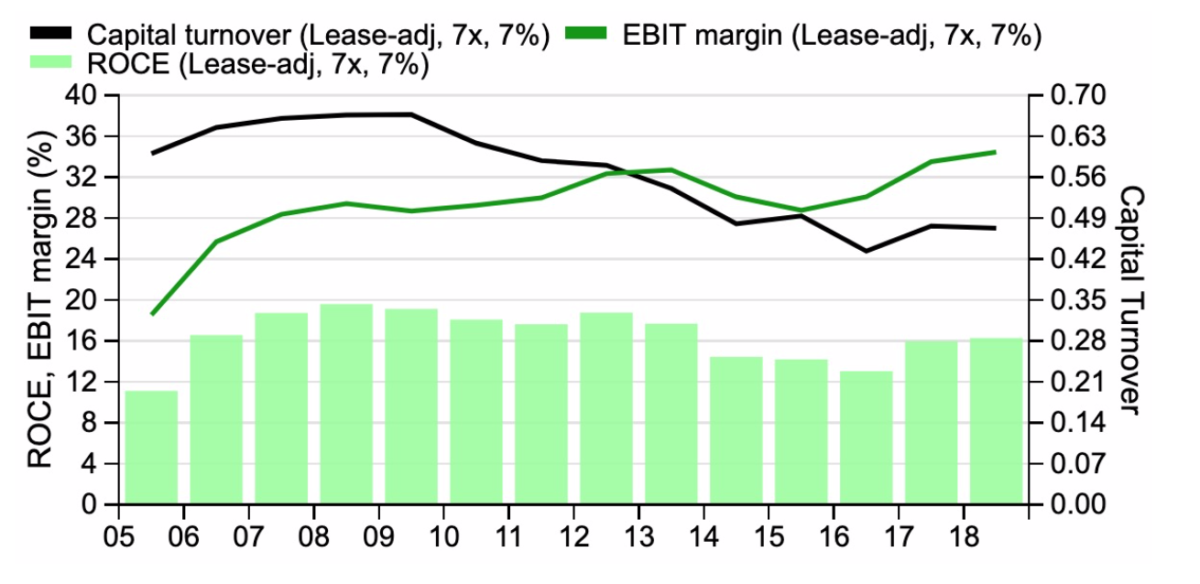

The capital invested in a business may reinforce its economic moat and long-term durability. Diageo is a capital-intensive business with a capital-turnover ratio 0.5x − each unit of invested capital generates 0.5 units of revenue.

This is partly down to the capital tied up in brown spirits that take a long time to mature. While this reduces the return on capital it also provides a powerful competitive moat – competitors cannot launch rival products overnight.

Diageo ROCE drivers

Source: SharePad

Stock compounders have a growth tailwind

To grow free cash flow a stock compounder needs to benefit from a long-term growth driver. Current global growth drivers include increasing travel, health-care demand, urbanisation and the shift online.

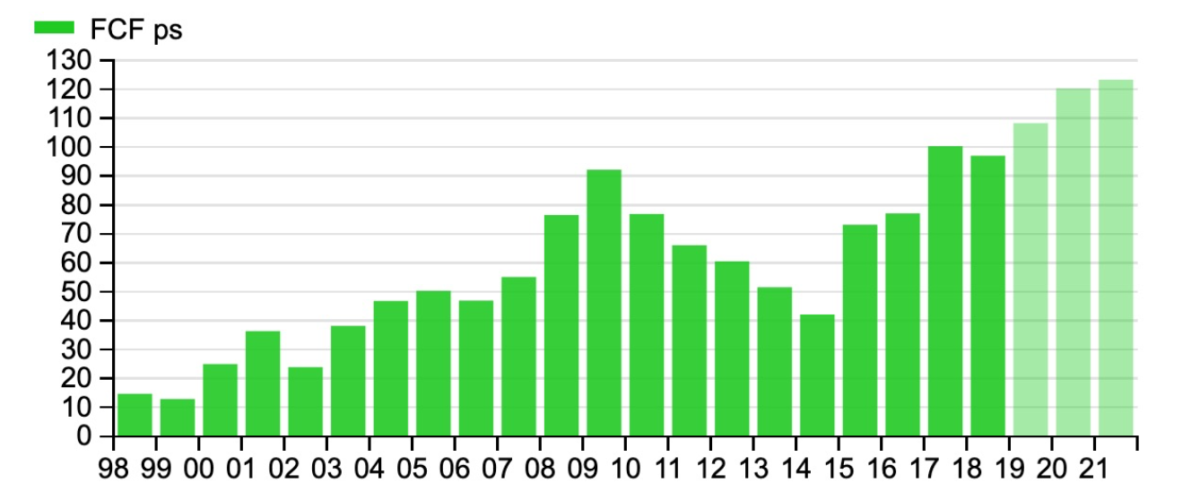

Diageo is benefiting from the increasing global demand for Scotch whisky, emerging-market demand for spirits and product premiumisation. These factors have helped the business to increase free cash flow per share.

Diageo’s free cash flow per share

Source: SharePad

Diageo’s share price since 1998

Source: SharePad

Quality investing: summary

The starting point for quality investors is to identify durable businesses. The next stage is to identify companies that can generate high returns, sustain high returns and realise high-return growth.

The quality investing approach has allowed fund managers like Terry Smith and Nick Train to outperform rivals. It may offer one of the best ways to perform well over the long term.

great article Andrew

As always Andrew, eloquently written with a great deal of informative and relevant information. Look forward to reading your next piece.