Utilico Emerging Markets: well-placed to benefit from the recovery in global growth

Investing in key infrastructure and utility providers offers a less volatile way to benefit from the long-term potential of the emerging markets with the returns underpinned by an attractive quarterly dividend.

The £535m Utilico Emerging Markets Trust (LON:UEM) aims to provide a long-term total return by investing predominantly in infrastructure, utility and related sectors mainly in the emerging markets. It focuses on companies that offer essential services, or that have a unique product or market position.

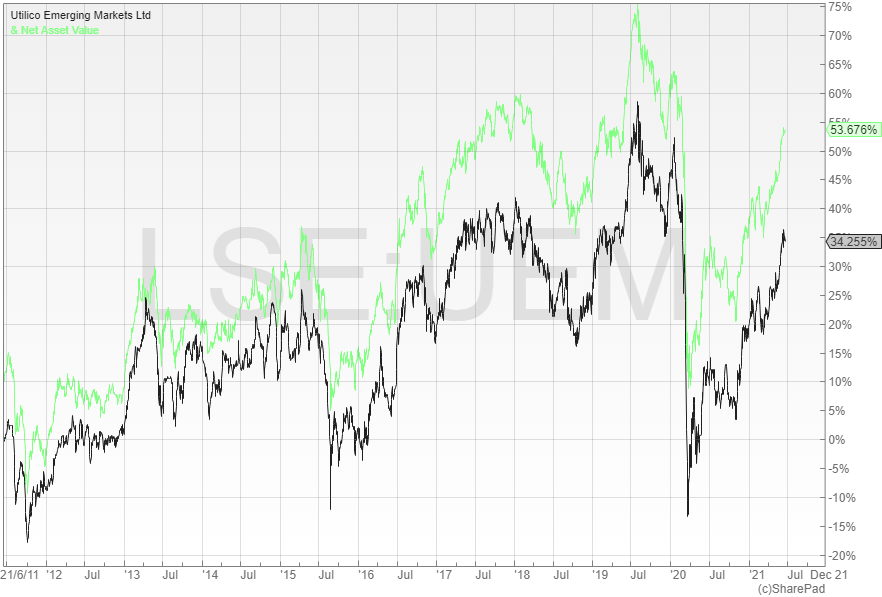

In its recently released accounts for the year ended 31 March 2021, UEM reported a NAV total return of 30%, which was well ahead of the 17% gain made by its MSCI emerging markets (EM) utilities sector benchmark. Since inception in July 2005 it has generated an impressive annual average compound return of 9.7%.

The long-term case for investing in EM revolves around the fact that they offer higher GDP growth than the developed markets with the burgeoning middle classes expected to double in size in the next ten years. Investing in key infrastructure businesses ensures a more predictable and sustainable income stream that should reduce some of the inevitable volatility, although not to the same extent as investing directly in the underlying assets.

Diversified portfolio

UEM holds a diversified portfolio, with the top 30 holdings at the end of May accounting for two-thirds of the assets. The three largest country weightings at between 14% and 20% were Brazil, China and India, with the main sector allocations being electricity, ports and logistics, data services and infrastructure, followed by gas, telecoms and satellites.

Some of the emerging markets have recently seen a resurgence of coronavirus cases and renewed restrictions and this has led to a significant divergence in economic performance. India was hit hard by a second wave in May, yet the local stock market had a strong month and is approaching its all-time high, while the Brazilian economy has recovered to pre-pandemic levels, despite passing half a million deaths, with share prices benefiting from higher commodity prices.

The key to the performance of EM is China. In the short-term the board expects the country’s economic growth to remain well above its long-term trend line, although they warn that GDP could fall back sharply later this year as the country’s Covid policy responses are scaled back.

Attractive prospects

In the last financial year UEM’s dividend was increased by 2.6% and was fully covered by earnings, with the board forecasting a payment of eight pence per share in the current period, giving the trust an attractive prospective yield of 3.6%. Despite the strong performance the discount has widened slightly and currently stands at around 12%.

UEM has an active share buyback programme and acquired 6.6m shares in the latest accounting period. The board is keen to see the discount narrow and has traditionally intervened whenever it goes above ten percent in normal market conditions, although it remains an investment decision.

Utilico Emerging Markets is mainly invested in relatively liquid, cash-generative companies that have long-duration assets which the managers believe are structurally undervalued and offer excellent total returns. With the world reopening, the acceleration in demand should result in stronger global GDP growth over the coming months and support the recovery in the share price from the pandemic-related sell-off.

So what is the ongoing charge and total charges? Do they eat into most of the div, effectively?