The under-the-radar trust that is trading at a 56% discount

It is not often that you come across an investment trust that is available for less than half of its net asset value (NAV), but this niche vehicle looks like it is materially undervalued.

The £309m Georgia Capital (LON: CGEO) is unique as it is the only investment trust focused on the Georgian market. This small country has a population of just 3.7m, yet its position sandwiched between Europe, Asia and the Middle East allows it to act as a regional trading hub, especially as it enjoys political stability and a business friendly regime.

It is an interesting fund with 19% invested in the listed Bank of Georgia and the rest in a portfolio of unlisted stocks. These provide exposure to a range of assets including schools, water supply and car insurance.

The main reason for the large discount other than the niche nature of the investment is the uncertainty over the valuation of the assets, but there are grounds for optimism. Since June the fund has sold $45m of holdings at an 11.3% premium and if this trend continues it should help to convince investors of the true value of the portfolio.

Portfolio

The Bank of Georgia has recently released its third quarter trading update in which its profits were 26% higher than the equivalent period last year. Numis believe that the company offers lower risk, materially higher returns and structurally superior growth, compared to every UK lender, as it is being valued at just 4.7 times current year earnings with a dividend yield of 6.3%.

Georgia Capital’s large unlisted holdings are valued independently by Duff & Phelps on a semi-annual basis with the first and third quarter figures being put together internally by the trust. The biggest investment in this area at 21% of the portfolio is healthcare that has benefited from a significant increase in the number of admissions to hospitals and clinics.

Another key element are the retail pharmacies (18% of the assets) that have seen strong growth as a result of the launch of new outlets and by winning several state tenders. There is also a similar allocation to water utilities that have experienced a large increase in revenues due to higher water consumption by corporate clients.

Strong performance

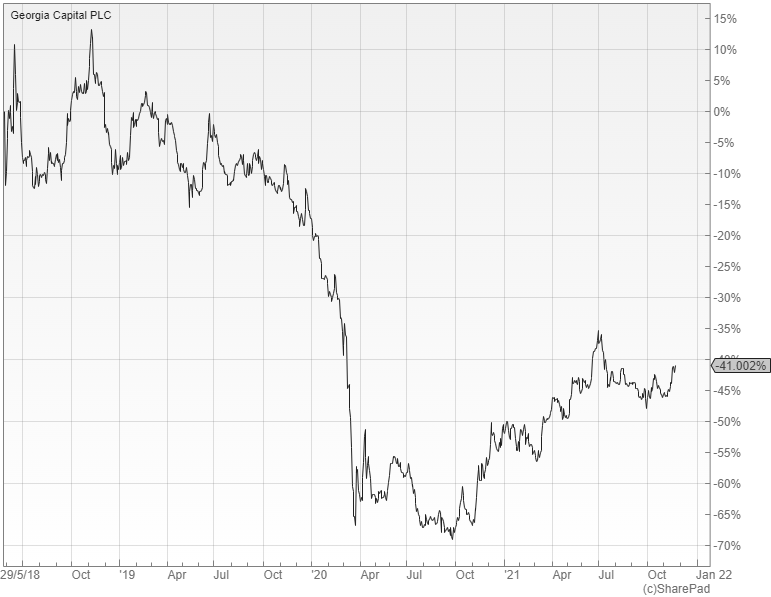

In the three months to the end of September Georgia Capital’s NAV was up 12.9% in sterling terms due to the strong performance of the Bank of Georgia and its large unlisted holdings. Despite the impressive returns the fund’s share price has risen just 15.7% year-to-date and the shares are currently trading on a 56% discount to the estimated NAV.

The Georgian economy continues to enjoy a remarkable recovery with GDP growth of 11.3% in the first nine months of 2021 thanks to the expansionary fiscal policy, robust domestic lending and the rebound in tourism. Inflation however is expected to average over nine percent this year before normalising to four percent in 2022.

Numis believe that the local economy is likely to deliver solid growth over the next few years and that Georgia Capital provides a well-managed exposure to a number of growth sectors. They say that the 56% discount offers significant value and it remains a strategic priority for management to sell one of the large portfolio company assets to provide a catalyst for the discount to narrow.

Comments (0)