The Monks investment trust: a portfolio of Baillie Gifford’s best-ideas

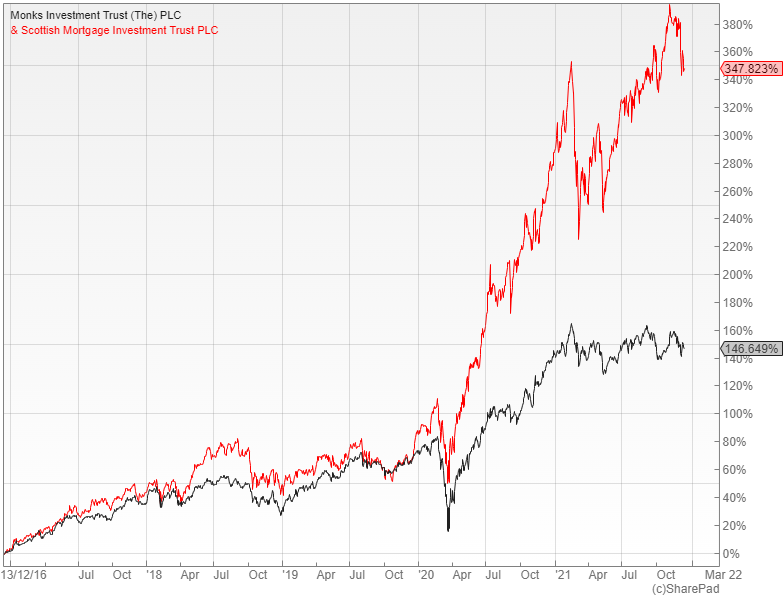

Although not as well-known as its larger stablemate, Scottish Mortgage, Monks provides a great way to gain exposure to Baillie Gifford’s growth disrupters.

The £3.5bn Monks investment trust (LON: MNKS) probably doesn’t get the recognition it deserves, yet since Baillie Gifford took over the management in March 2015 its NAV has risen 189.3%, which is well ahead of the 126% achieved by the FTSE World index. Despite this excellent long-term record, the recent performance has been slightly weaker and led to a de-rating of the shares.

Its interim results for the six months to the end of October disclose an NAV total return of 6.5% versus an 8.9% increase in the benchmark. Since then the fund has given back most of this gain whereas the index is up a further percent, hence the reason the shares are currently available at a small discount.

Managers Spencer Adair and Malcolm MacColl divide the global portfolio into four growth categories: growth stalwarts, rapid growth, cyclical growth and latent growth. Most of the latest additions have been in the second of these groupings with stocks like the home fitness company Peloton, which benefits from its innovative software and growing addressable market, as well as Carvana that sells used cars and is well-placed to disrupt the industry incumbents.

Portfolio positioned for change

Other recent purchases include: Denso, a Japanese car parts supplier whose long-term business plan aligns with the global shift towards electric vehicles; plus the business simulation software provider Certara, whose programs allow drugs trials to be conducted more quickly and at a lower cost.

The fund’s ten largest holdings at the end of October accounted for just under a quarter of the assets with well-known Baillie Gifford holdings present like Alphabet and Tesla, as well as less familiar names such as the digital content provider Sea, the ecommerce retailer Prosus and cement maker Martin Marietta Materials. Although it doesn’t have as much invested in unquoted stocks as Scottish Mortgage (LON: SMT), its largest holding is the firm’s Schiehallion fund (LON: MNTN) that invests in later stage private businesses.

Adair and MacColl believe that the pandemic has brought about significant societal change and that we are only at the beginning of the transition period with further structural shifts to come. They have positioned the portfolio in such a way as to benefit, while recognising that the revenues, earnings and cash flows will be delivered in different ways.

Positive outlook

The broker Investec says that Monks provides exposure to a clear and distinct investment process with the managers focusing on the identification of world-leading companies that enjoy durable growth opportunities, deepening competitive advantages and rising real earnings power. Underpinning this whole approach is the belief that sustainable compound growth drives long-term wealth creation.

Investec expect the trust to deliver superior long-term returns, although they warn that there will be times when it lags the wider market, during which the performance may diverge substantially and for prolonged periods. They have just reiterated their buy recommendation.

The shift in favour of value stocks in recent months has provided something of a headwind for Baillie Gifford’s various growth funds, but there is no denying their long-term track record in which they have beaten the market hands down. Monks offers a more diversified way to benefit from their approach than its better known peer Scottish Mortgage and may not be as vulnerable if the macro environment remains unfavourable.

Comments (0)