The best and worst investment trusts of an action packed first half

It has been a dramatic start to the year with a handful of winners and lots of big losers, but it could all change in the second half.

There has been a huge dispersion in performance between the best and worst investment trusts in the first half of the year with a top to bottom difference of 120%. The analysis by Numis, in which they looked at equity trusts with a market cap of over £50m at the start of the period, has laid bare the massive impact that the change in the macro-economic environment has had on returns.

It will come as no surprise that the worst of the lot by far was JPMorgan Russian (LON: JRS) that was down by just over 90% following the invasion of Ukraine and subsequent sanctions, exchange controls and write-downs to investments. Other than that it was mainly growth trusts that have suffered.

The shift to an inflationary environment with potentially significant increases in interest rates has undermined the more growth-oriented mandates. The present value of the future earnings streams of these sorts of long duration stocks is much lower when discounted using higher rates.

Growth takes a hammering

It has been an especially difficult first half for Baillie Gifford, whose growth trusts had been some the most successful during the previous low interest rate regime. The 25 worst performers include: BG US Growth (LON: USA), Scottish Mortgage (LON: SMT), BG European (LON: BGEU), Keystone Positive Change (LON: KPC) and Edinburgh Worldwide (LON: EWI) with six month losses of between 40.5% and 51.2%.

There were also other popular casualties that have been caught up in the growth sell-off, most notably Terry Smith’s Smithson (LON: SSON) with a decline of 41.8%. A couple of the tech trusts have made it onto the list as well, with Allianz Technology (LON: ATT) down 42.3% and Polar Capital Technology (LON: PCT) retreating 32.8%.

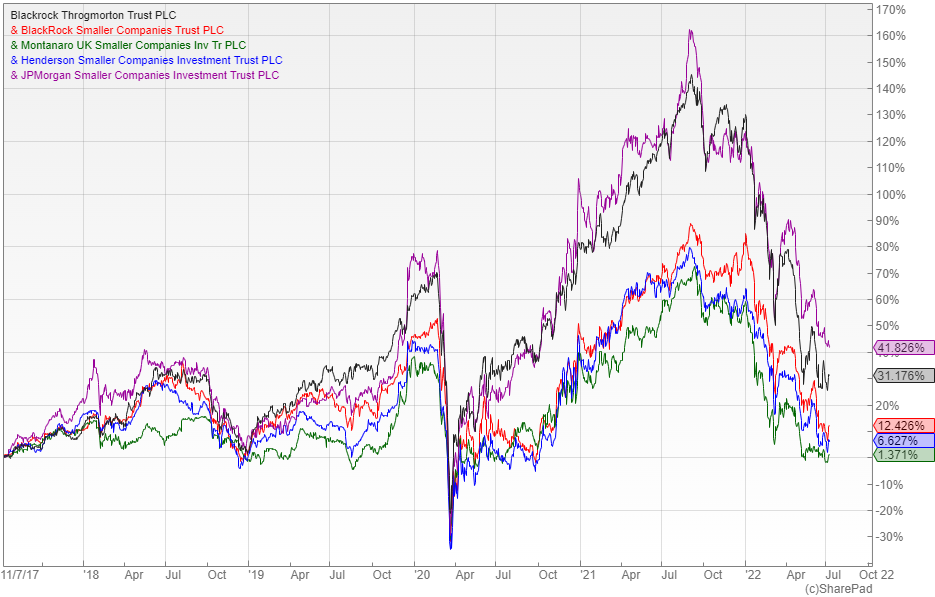

The risk-off attitude has meant that some of the UK small cap trusts, especially those with a growth-bias, have had a hard time of it with BlackRock Throgmorton (LON: THRG), BlackRock Smaller Companies (LON: BRSC), Montanaro (LON: MTU), Henderson (LON: HSL) and JPMorgan Smaller Companies (LON: JMI) all down between 34.9% and 44%. Many of the biggest losers have moved from a premium to a discount and could bounce back quickly if the markets dial down their interest rate expectations because of the impact of a recession.

Sing when you’re winning

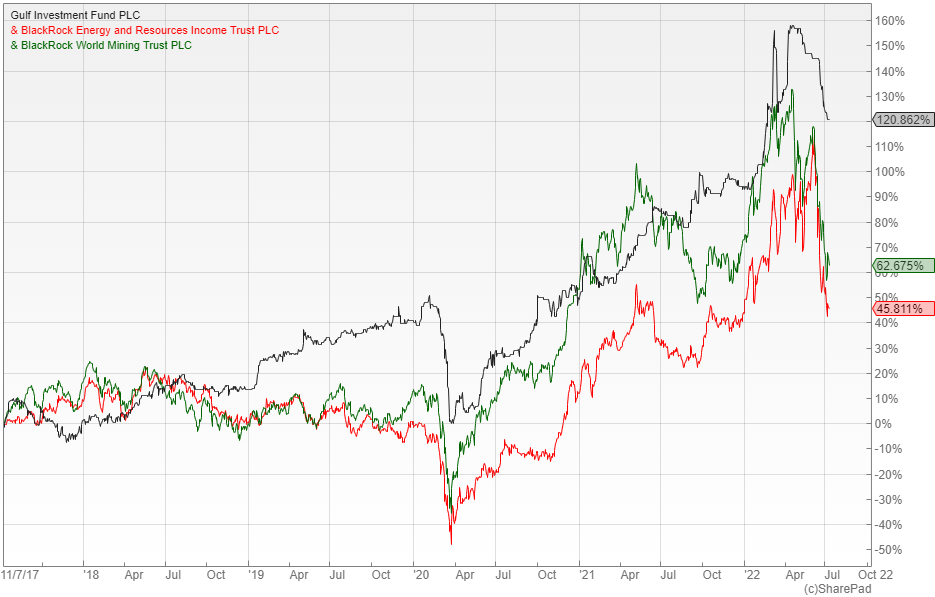

The list of winners is much more select with Numis only identifying 19 equity investment trusts in positive territory over the last six months, of which just 11 have made more than five percent. Of these, the best by far with a return of 30.6% is the Gulf Investment Fund (LON: GIF) that invests in the Gulf region and has benefitted from rising energy prices.

Several of the others have also profited from the energy and commodity markets including: BlackRock Energy & Resources (LON: BERI) and BlackRock World Mining (LON: BRWM) with gains of 9.1% and 0.9% respectively. It is worth noting that both have pulled back sharply towards the end of the period as the risk of a recession has grown.

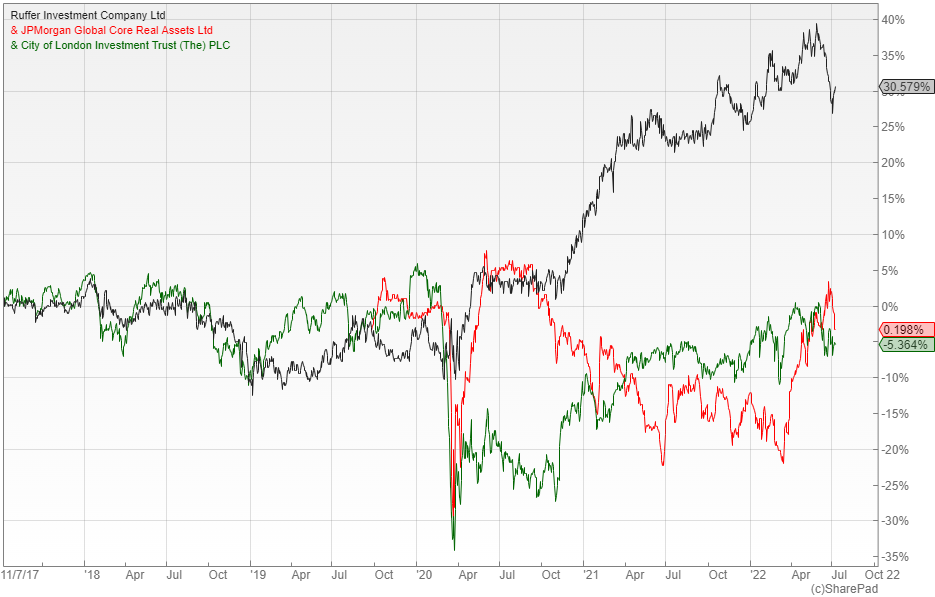

Two of the defensive multi-asset trusts – Ruffer (LON: RICA) and JPM Global Core Real Assets (LON: JARA) − have held up really well with returns of 3.1% and 17.6%. City of London (LON: CTY) also deserves a mention with an impressive gain of 5.3% helped by the fall in the value of the pound boosting the overseas earnings of its blue chip holdings. Roll on the second half.

Comments (0)