Sorting The Value From The Value Traps

Investment trust discounts widened considerably in 2022, finishing the year at an average of 13%, a level that has not been seen on a consistent basis since the global financial crisis of 2007/08. Buying when an asset class has been temporarily marked down is obviously a sensible strategy, although there are plenty of traps to avoid when looking for these value plays.

The broker Numis has recently sought to shed light on this area by highlighting the best opportunities that are available at the moment. Their aim was to pick out examples where there is the potential for discount narrowing to be a tailwind, albeit with the proviso that the underlying NAV performance is usually the biggest driver of returns.

This is a more straightforward process with equity investment trusts that publish daily NAVs than it is for alternative asset classes where valuations are more subjective. When it comes to the latter, they say that value is often reflected as much in the underlying assets and valuation methodology as in the headline discounts.

Equity Investment Trusts

In recent years, style factors have been the major driver of performance, but Numis believe that an environment where interest rates are persistently higher should suit active managers with both growth and value strategies who are able to add value via stock selection. They think that the UK is a potentially attractive market, as it has lagged its global peers significantly in recent years and trades on a relatively cheap valuation.

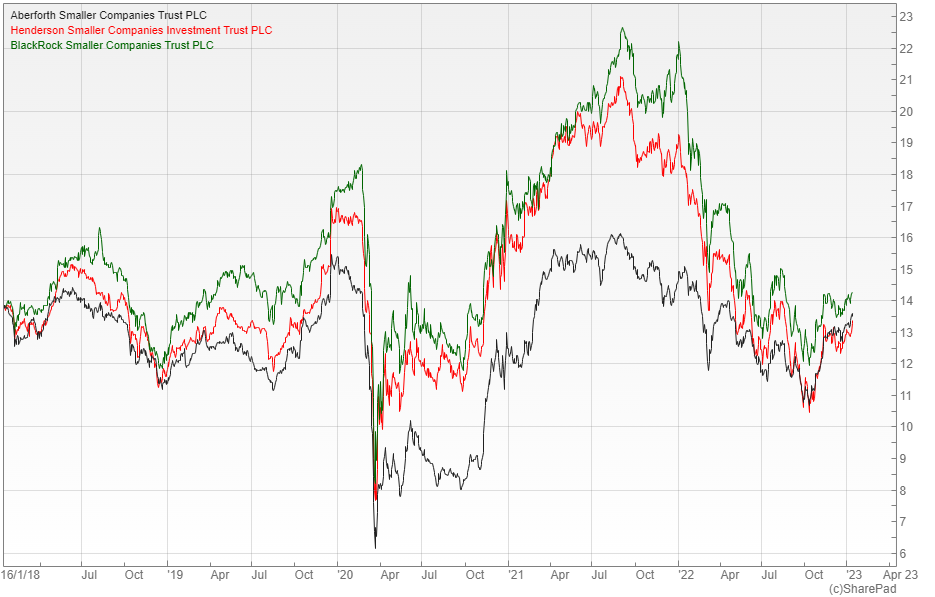

Opportunities in this area include two of the more value-oriented trusts, Temple Bar (LON: TMPL), which is trading five percent below NAV and Fidelity Special Values (LON: FSV) that is available on a seven percent discount. The figures look more enticing further down the market cap spectrum, where valuations have come under sustained pressure, with the smaller companies trusts from Aberforth (LON: ASL), Henderson (LON: HSL) and BlackRock (LON: BRSC) all available at nine percent below NAV.

Elsewhere they highlight RIT Capital (LON: RCP) as a standout opportunity for defensively minded investors. It has a good record of limiting the downside in market declines, while participating in a significant percentage of the market upside, but has sold off sharply after an influential article in the Telegraph and is trading on an 18% discount.

Alternatives

When it comes to the alternatives, Numis particularly like the listed private equity sector, which has a selection of high-quality managers with a record of outperforming equity markets. It offers an attractive valuation opportunity with wide discounts factoring in significant potential NAV declines, whereas they believe the underlying portfolios will be more resilient than investors expect.

One of their highest conviction recommendations in this area is HgCapital Trust (LON: HGT) that is trading on a 15% discount and which focuses on ‘dull tech that seeks to automate business processes and increase efficiency’. Another that they pick out is Oakley Capital (LON: OCI) that has a strong track record and is trading on what Numis describe as an ‘excessive and unwarranted’ discount of 34%.

Elsewhere they like Aquila European Renewables (LON: AERS) that is trading on a 26% discount, the widest of the sector and one that they don’t feel is justified. Another is Cordiant Digital Infrastructure (LON: CORD), which is available on a 21% discount after a disappointing year, although Numis think that an improvement in communication and the potential for crystallising value from part of the portfolio should increase confidence in the valuations.

Comments (0)